10 Best Crypto Leverage Trading Platforms 2023

Publikováno: 7.12.2023

There are many different ways to trade cryptocurrencies with leverage. Some of the most common include crypto futures, options, and tokenized derivatives. In this guide, we review the 1o best crypto leverage trading platforms for 2023. We also explain how crypto leverage works, the best tradable instruments for the job, and what risks to consider […]

The post 10 Best Crypto Leverage Trading Platforms 2023 appeared first on Cryptonews.

There are many different ways to trade cryptocurrencies with leverage. Some of the most common include crypto futures, options, and tokenized derivatives.

In this guide, we review the 1o best crypto leverage trading platforms for 2023. We also explain how crypto leverage works, the best tradable instruments for the job, and what risks to consider before proceeding.

Top 10 Bitcoin Leverage Trading Platforms Listed

Here’s a list of the best crypto leverage trading platforms for 2023

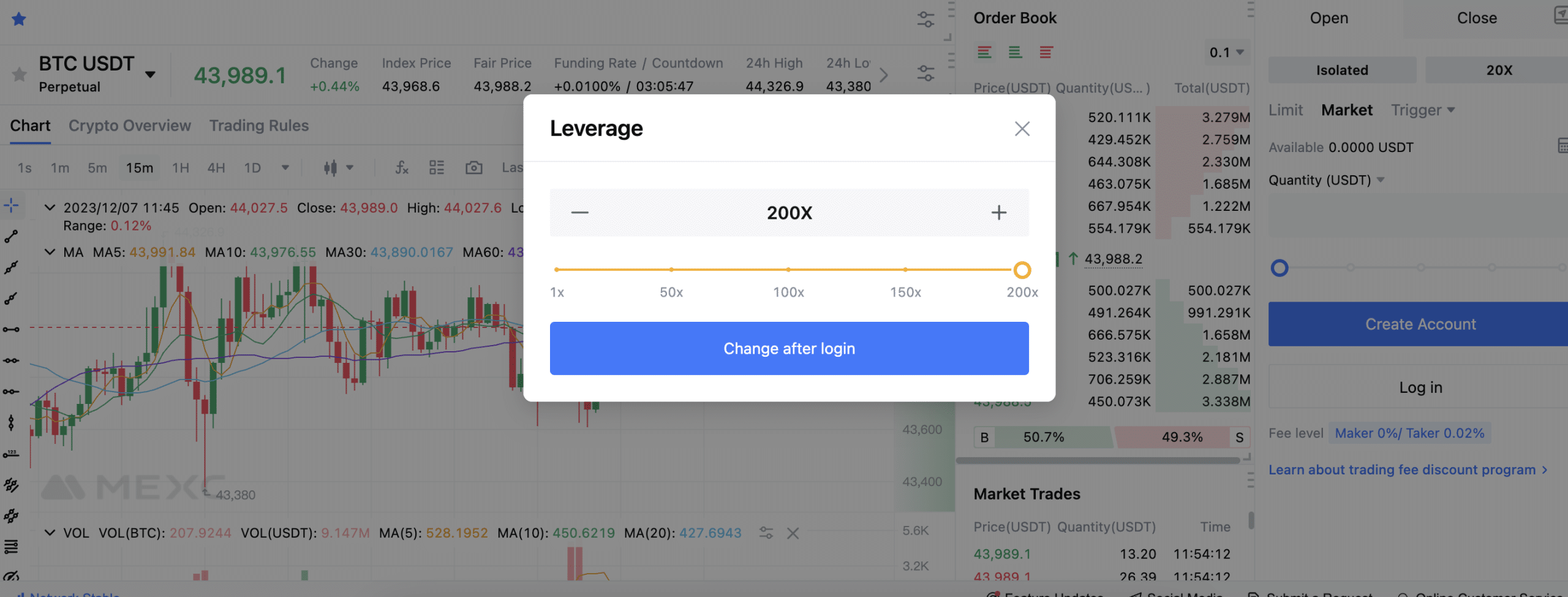

- MEXC: The best trading platform for leveraged products, MEXC offers crypto futures on over 100 markets. Leverage of up to 200x is available at competitive fees; you’ll pay just 0.02% per slide. Leveraged futures are perpetual at MEXC, so they never expire. Unless you’re trading large volumes, MEXC offers KYC-free accounts.

- OKX: Top-rated crypto trading platform offering leveraged options markets. Various strike prices and expiry dates are covered; trading fees cost just 0.03% of the contract value. OKX also offers perpetual futures. The maximum leverage limit is 100x when trading in partial liquidation mode.

- Binance: Offering premium liquidity, advanced trading tools, and low commissions, Binance has a comprehensive range of leveraged products. This includes perpetual and delivery futures, not to mention options and leveraged tokens. The maximum leverage limit is 125x and more than 600 cryptocurrencies are available.

- KuCoin: Trade meme coins like Shiba Inu, Pepe, and FLOKI with leverage of up to 75x. Get 100x on larger cryptocurrencies like Bitcoin and Ethereum. Leveraged markets cover perpetual and inverse futures. Trading commissions of 0.06% apply to all leveraged trades.

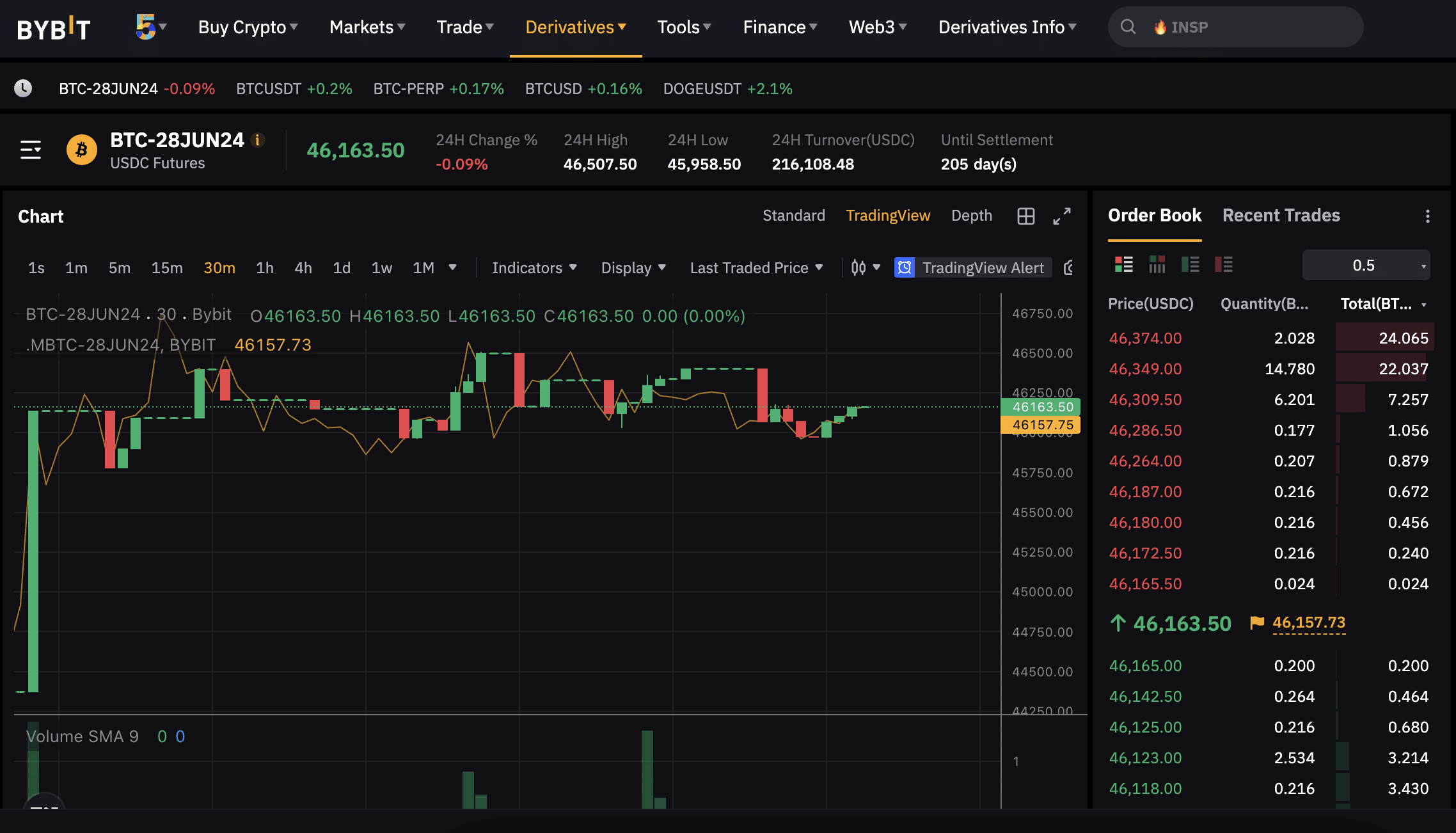

- Bybit: Processing over $20 billion worth of leveraged trades in the prior day, Bybit offers huge liquidity levels. You can trade perpetual, inverse, and delivery futures contracts. Not to mention call and put options. Bybit supports 180 different contracts in total, covering dozens of cryptocurrencies. Leverage is capped at 125x.

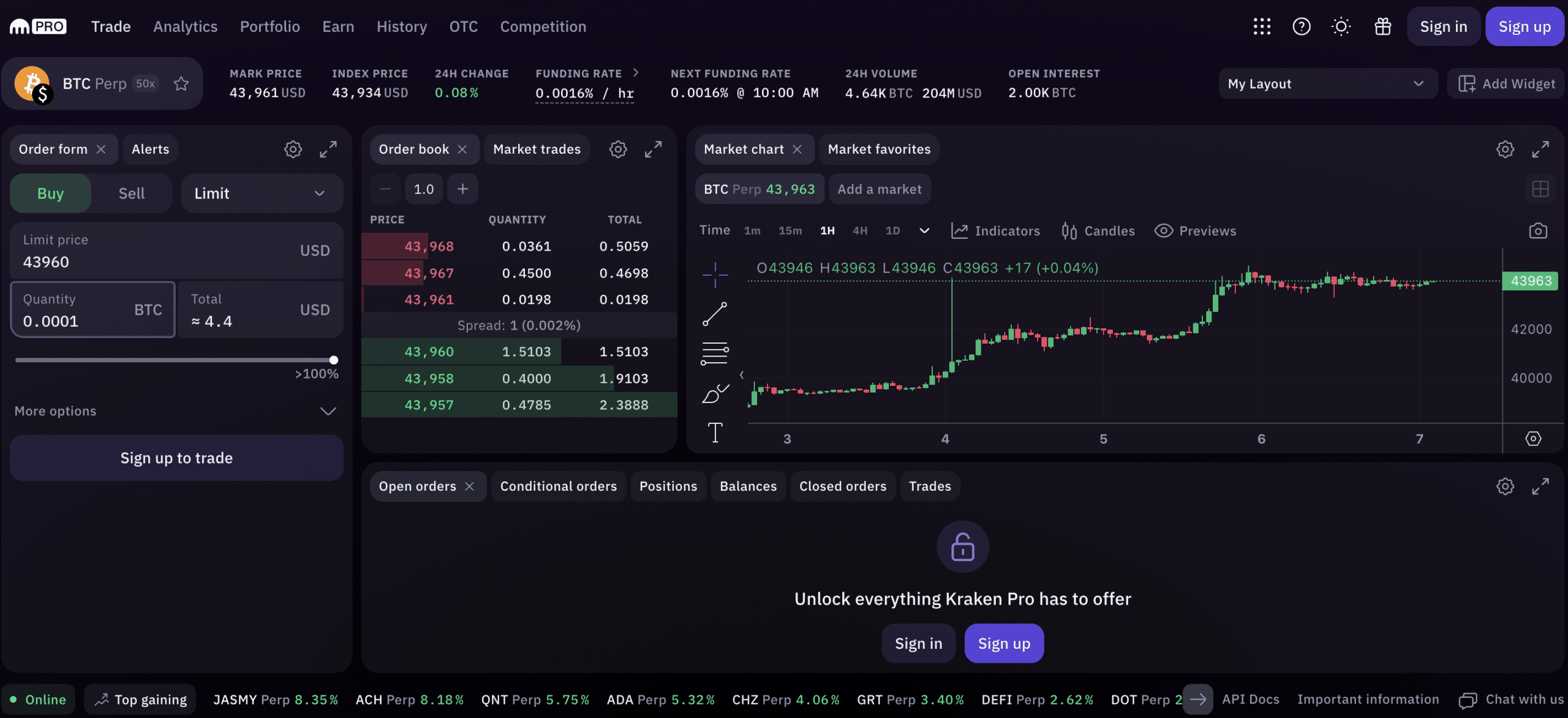

- Kraken Pro: Established crypto trading platform offering margin accounts with a 20% outlay. Kraken Pro also offers futures contracts with leverage of 50x. More than 95 cryptocurrencies are supported and commissions start at 0.05%. Kraken Pro has developed a proprietary trading dashboard that will appeal to technical traders.

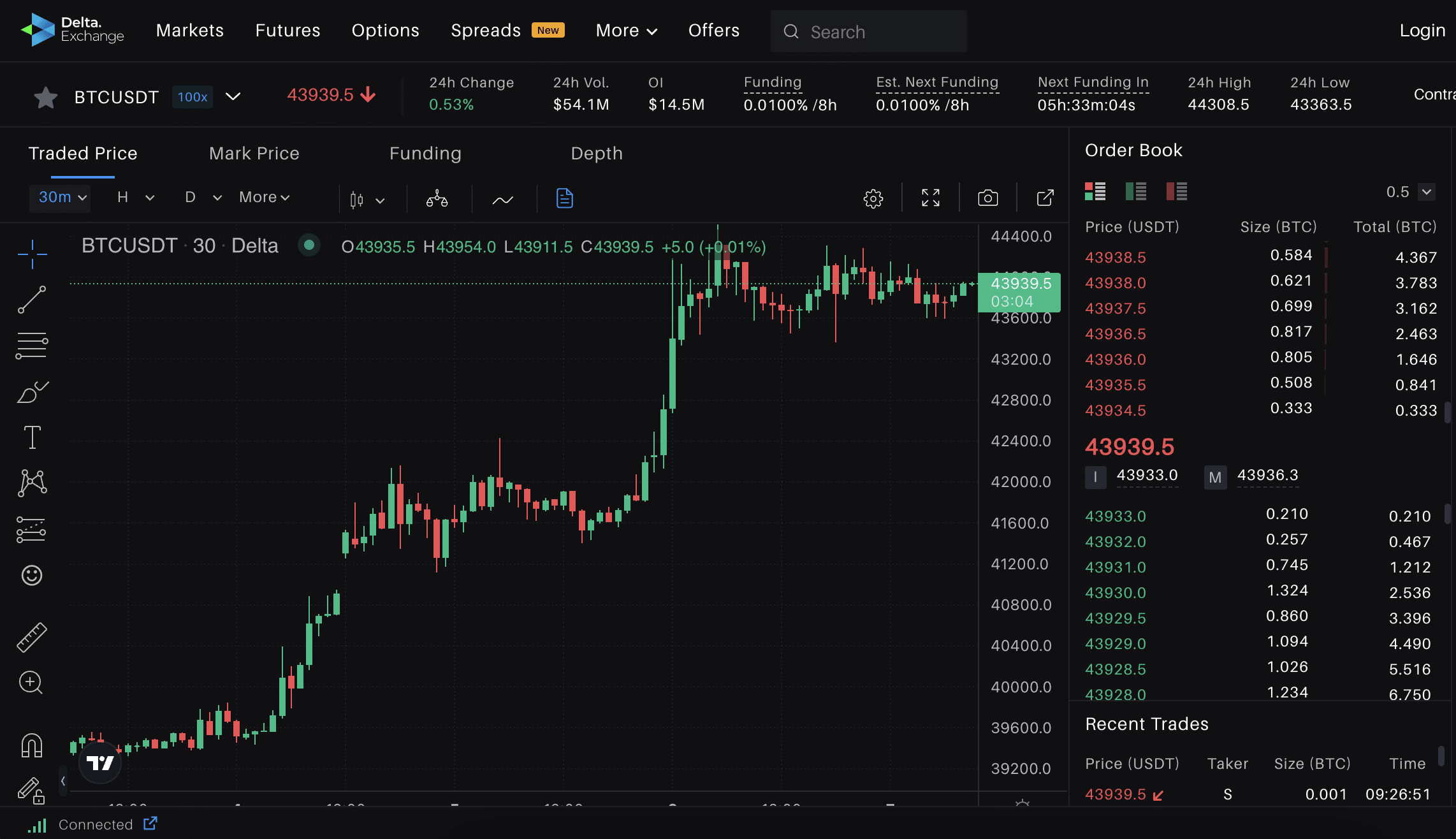

- Delta Exchange: This high-volume trading platform offers perpetual and inverse futures contracts on over 50 cryptocurrencies. Leverage of up to 100x is available and commissions cost 0.05%. Bitcoin and Ethereum options are also supported, with daily and weekly settlements.

- PrimeXTB: High-risk traders will like the 1,000x leverage available on PrimeXTB. This is offered on leveraged CFDs, which aren’t available in all regions. PrimeXTB also offers leveraged futures markets via perpetual swaps. Just 31 cryptocurrencies are supported.

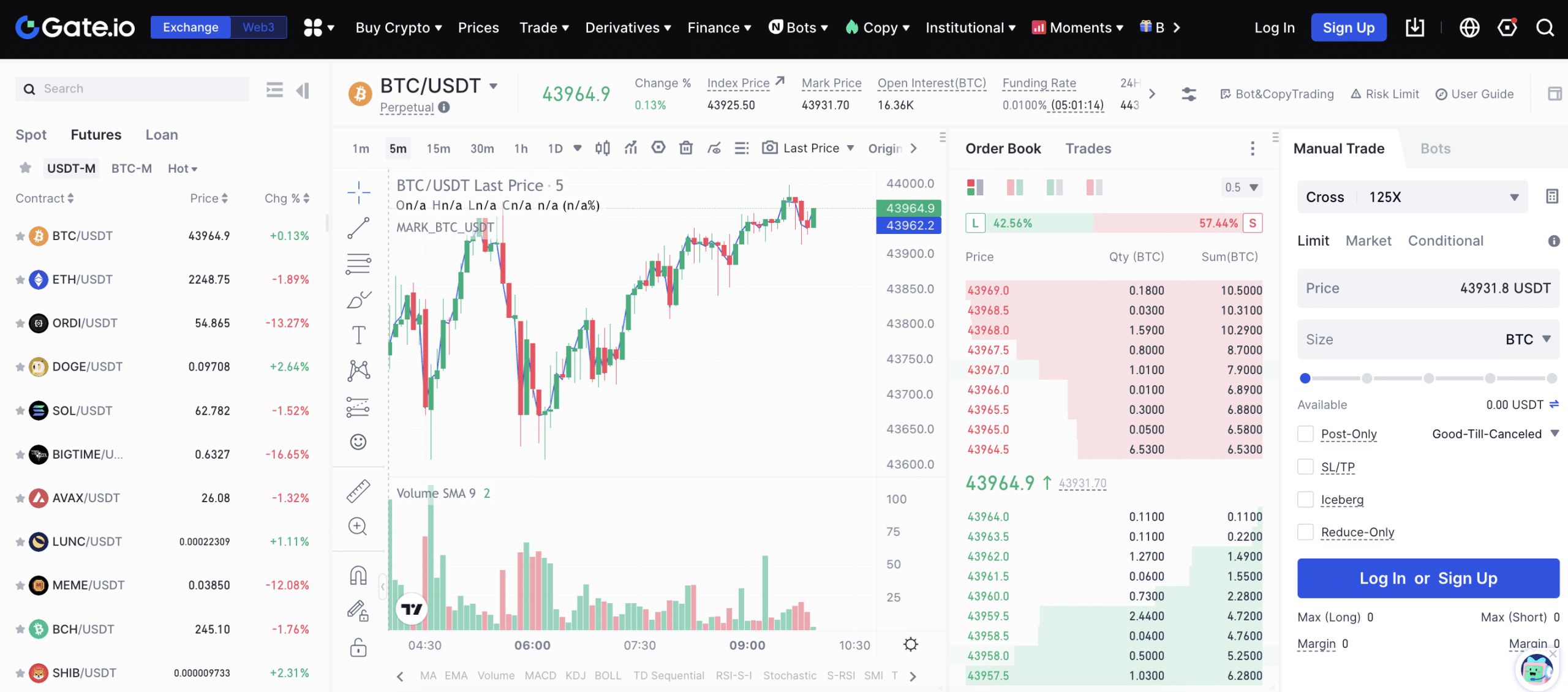

- Gate.io: Popular crypto exchange offering leveraged delivery futures. Choose from weekly or quarterly deliveries with settlement in USDT. Gate.io also offers perpetual swaps and options contracts covering Bitcoin, Ethereum, and Dogecoin. The maximum leverage limit is 100x.

- Deribit: Offers a wealth of tools that can help you make smart leveraged trades. This includes an options wizard, strategy builder, and simulated trading. Deribit offers leverage of up to 100x but only Bitcoin and Ethereum are supported. Futures and options commissions amount to 0.05% and 0.03%, respectively.

Detailed Reviews of the Best Cryptocurrency Leverage Trading Platforms 2023

Read on to discover our comprehensive reviews. We cover everything you need to know about the best leverage trading crypto sites. This includes supported markets, tradeable instruments, fees, leverage limits, payments, and other important metrics.

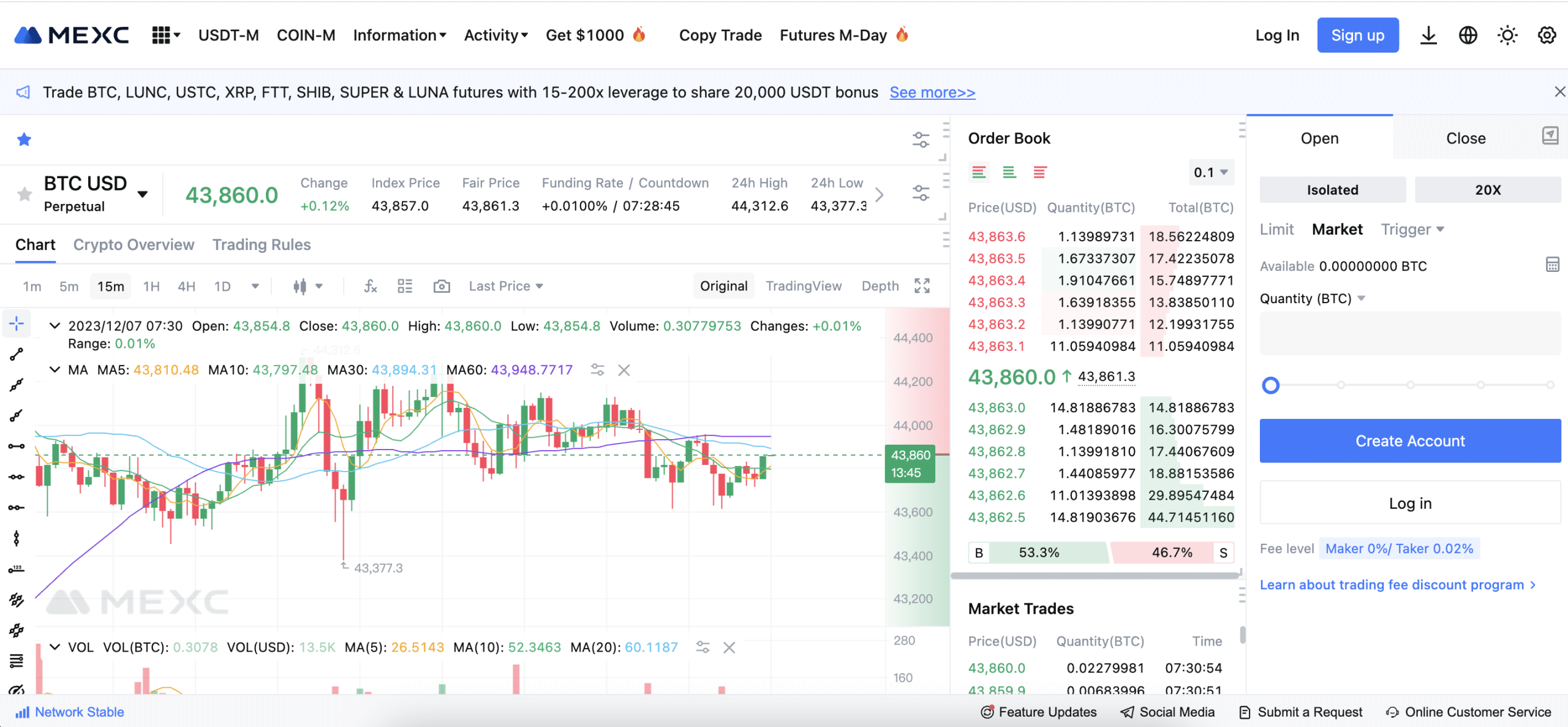

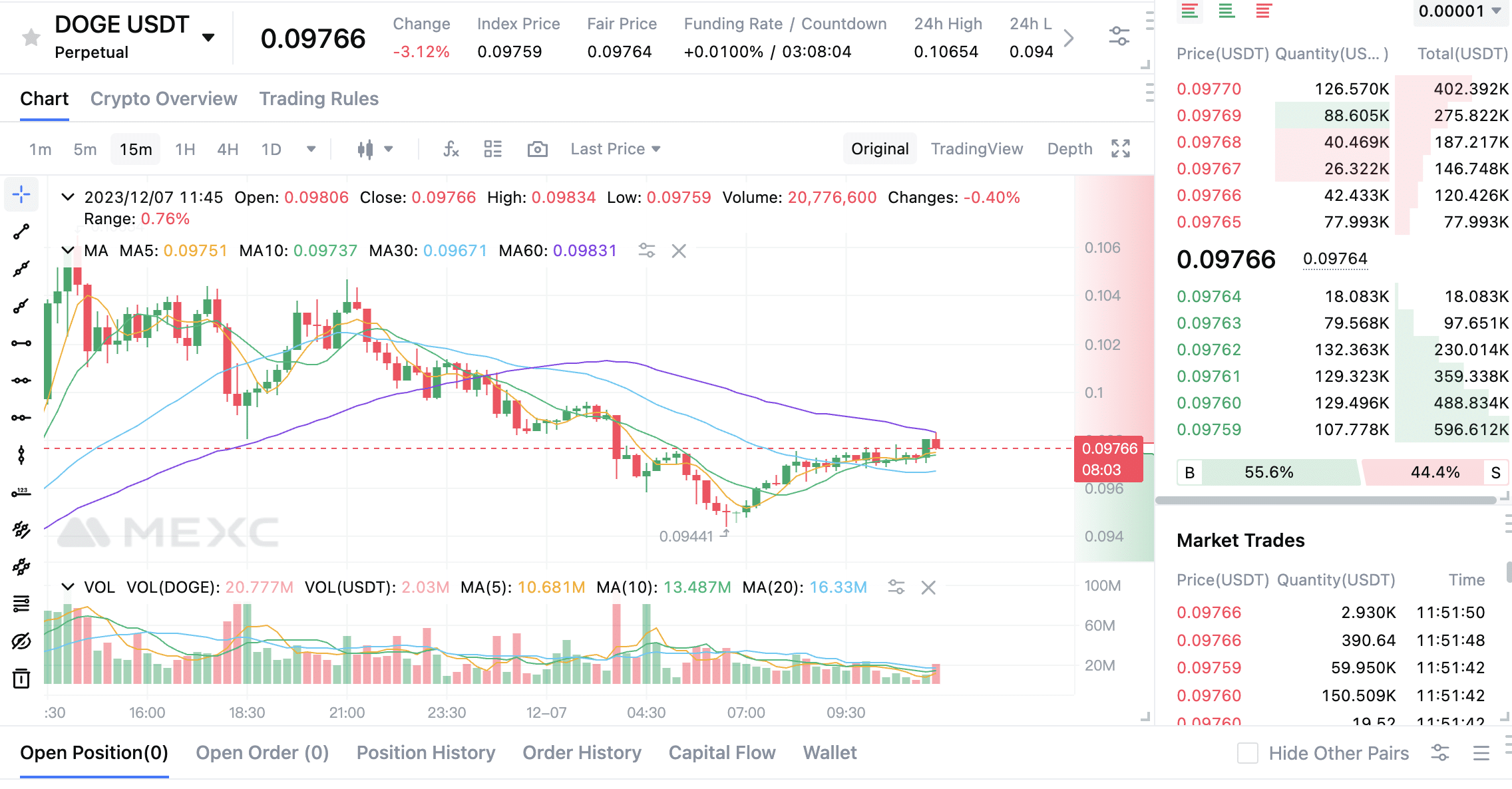

1. MEXC: Get 200x Leverage on 100+ Cryptocurrencies With Low Trading Fees

MEXC is the best Bitcoin leverage trading platform in the market. In fact, not only does MEXC offer leverage on Bitcoin but some of the best altcoins. This includes everything from BNB, Ethereum, and Ripple to Cardano, Cosmos, and Arbitrum. MEXC also offers leverage on meme coins, including Dogecoin, Shiba Inu, Bonk, FLOKI, and Pepe.

The maximum leverage is 200x, although smaller-cap coins come with smaller limits. In terms of tradable instruments, MEXC supports cryptocurrency futures. There are more than 100 perpetual futures, meaning the contracts never expire. You can also trade a selection of Coin-M futures, which use the underlying cryptocurrency as collateral.

MEXC is also one of the best crypto leverage trading platforms for low fees. It charges just 0.02% per slide, which is based on the total value of the leveraged position. For instance, a leveraged trade worth $20,000 would mean a $4 commission. All that being said, one of the main drawbacks of MEXC is that it doesn’t offer options.

Moreover, the MEXC trading platform is more suitable for intermediate to advanced traders. Nonetheless, we like that MEXC allows users to trade anonymously when keeping below KYC limits. Put simply, unless you’re withdrawing more than 30 BTC per day, you won’t need to provide any personal information.

| Maximum Leverage | 200x |

| Supported Cryptocurrencies | 100+ |

| Leveraged Trading Instruments | Perpetual and Coin-M (inverse) futures |

| Fees | 0.02% of the total contract value |

Pros

- Offers perpetual futures with leverage of up to 200x

- More than 100 leveraged cryptocurrencies to choose from

- Pay just 0.02% of the contract value

- No KYC when withdrawing under 30 BTC per day

- Payouts are usually processed in a few minutes

Cons

- Does not accept clients from the US

- Options markets aren’t supported

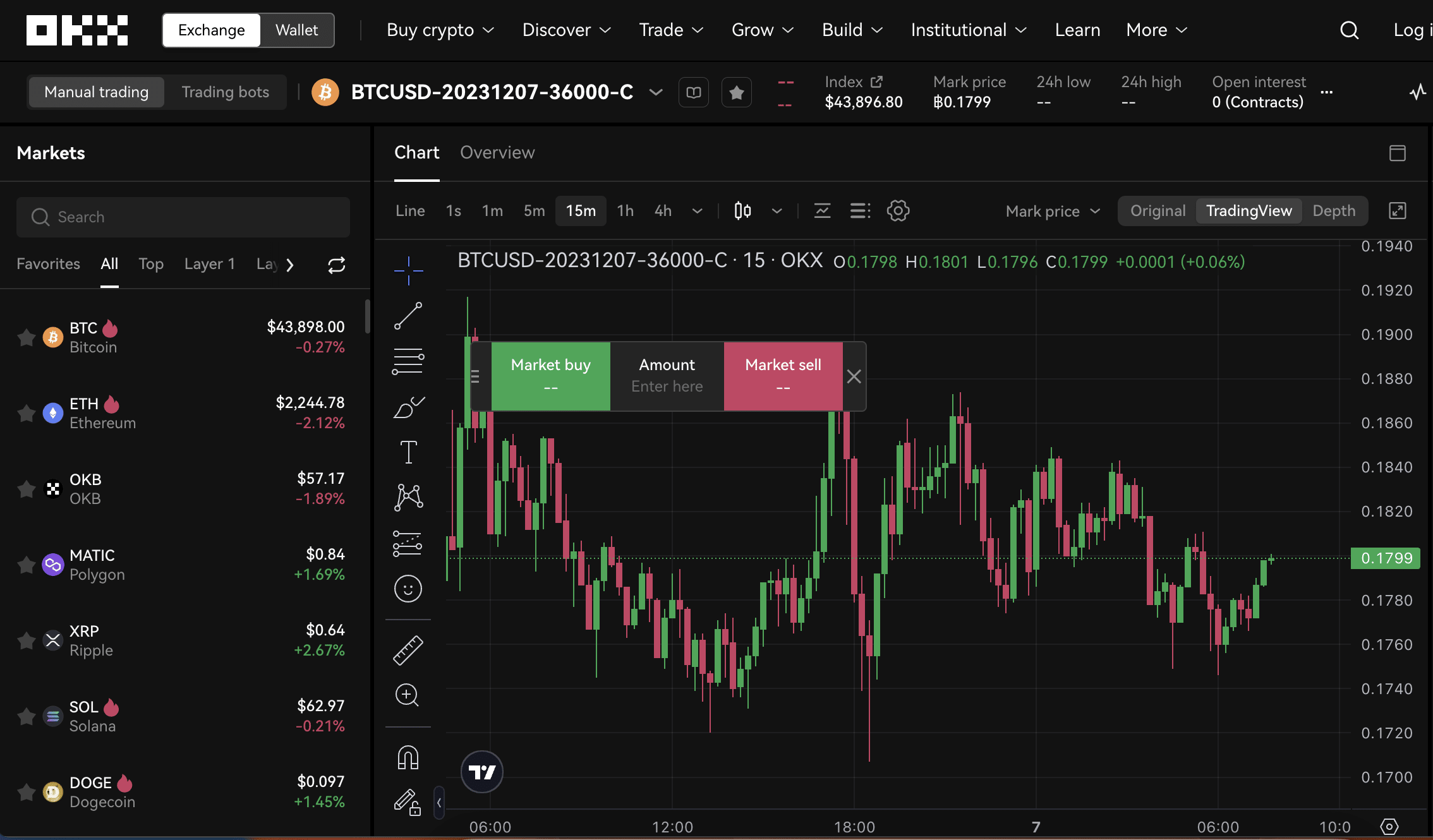

2. OKX: 100x Leverage on Crypto Options Markets With Fees of 0.03%

OKX is a tier-one crypto exchange that offers a huge range of leveraged trading products. In particular, OKX is popular with those who want to trade options. You can go long or short on Bitcoin and Ethereum options, and there are various strike prices and expiry dates to choose from. The maximum leverage limit is 100x when trading in partial liquidation mode.

MEXC charges 0.03% of the options contract value, inclusive of leverage. This needs to be paid when entering and exiting a trade. In addition, OKX also offers perpetual futures on dozens of cryptocurrencies. This includes some of the best utility tokens, such as Ethereum, Polygon, Solana, and Aave.

Alternatively, you can also trade delivery futures. These are settled every three months and only Bitcoin is covered. OKX charges 0.05% per slide when trading perpetual and delivery futures, which aligns with the industry average. OKX accepts many payment methods, including debit/credit cards. It also offers peer-to-peer funding.

| Maximum Leverage | 100x |

| Supported Cryptocurrencies | 100+ |

| Leveraged Trading Instruments | Options, delivery futures, and perpetual futures |

| Fees | Options (0.03%), futures (0.05%) |

Pros

- Trade Bitcoin and Ethereum options with leverage of 100x

- Also supports perpetual and delivery futures

- Over 100+ cryptocurrencies can be traded with leverage

- Maximum leverage limits of 100x

- Accepts fiat money payments

Cons

- Leverage is reduced to 20x when trading in full liquidation mode

- US clients are not accepted

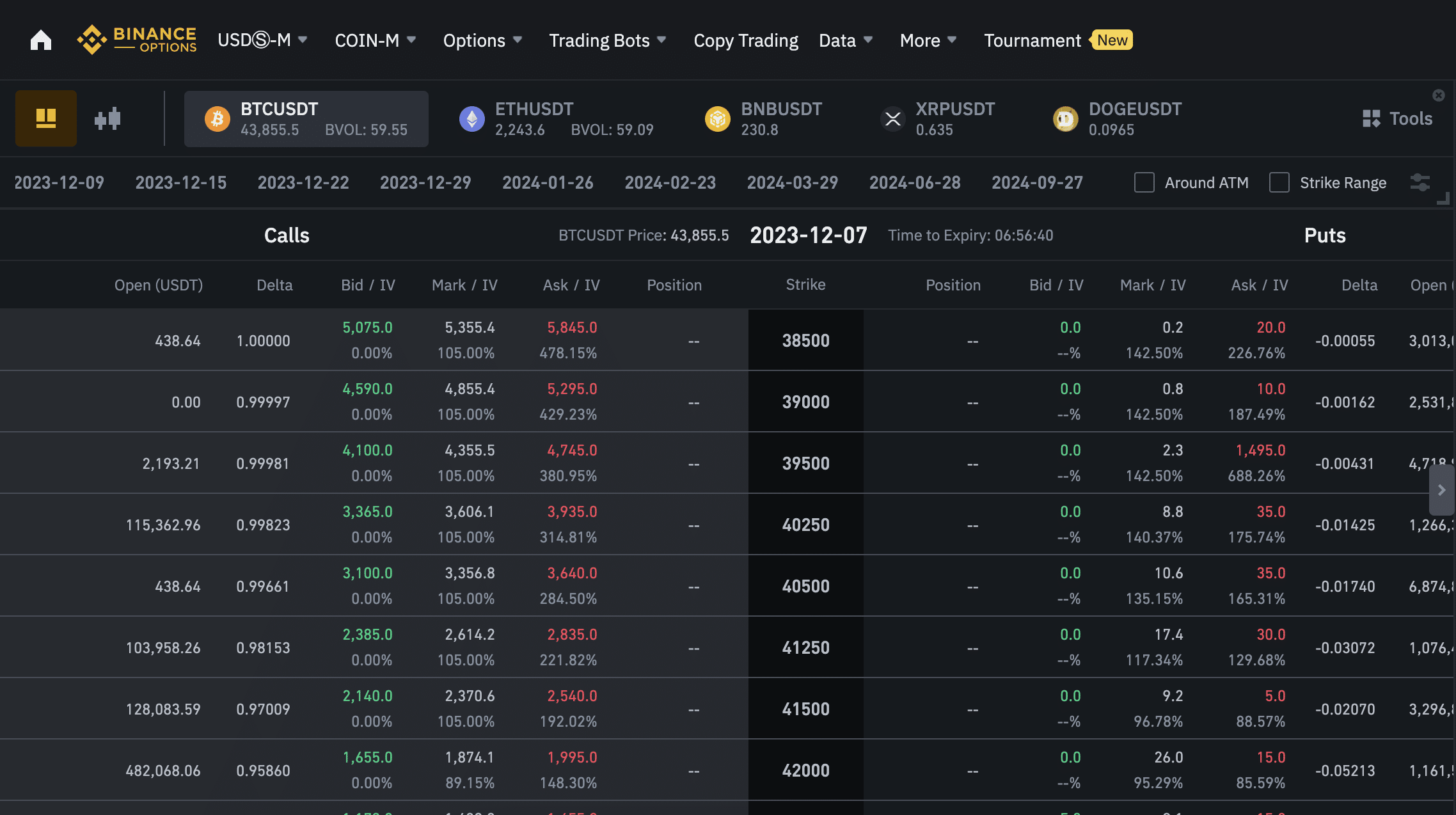

3. Binance: Wide Range of Crypto Leverage Products Including Futures, Options, and Multiplier Tokens

Binance is one of the most popular trading platforms for leveraged markets. It offers many different tradeable instruments, including multiplier tokens. For instance, suppose you buy ‘ETH/USDT 5x’ contracts. If Ethereum increases by 10%, your position will rise by 50%. Multiplier tokens don’t come with liquidation risks.

Alternatively, you can also trade crypto futures. There are two options here, perpetual or inverse contracts. The latter is settled in the underlying cryptocurrency. Binance charges 0.05% on multiplier tokens and futures contracts. It supports more than 600 cryptocurrencies, so you’ll never be short of opportunities.

We also like that Binance supports crypto options. You’ll find a fully-fledged options chain with lengthy expiry dates. There are many different strike prices too. Binance charges 0.03% on crypto options and the only risk is the premium you pay to enter the market. Finally, Binance is the world’s largest crypto exchange, so you’ll benefit from premium liquidity 24/7.

| Maximum Leverage | 125x |

| Supported Cryptocurrencies | 600+ |

| Leveraged Trading Instruments | Options, delivery futures, perpetual futures, multiplier tokens |

| Fees | Options (0.03%), futures/multiplier tokens (0.05%) |

Pros

- Leverage is available on over 600 cryptocurrencies

- Supports options, futures, and multiplier tokens

- High leverage limits of up to 125x

- Largest exchange for trading volume

- Advanced trading tools for technical analysis

Cons

- Recently admitted money laundering charges brought by the DoJ

- Fiat payment facilities for some currencies are not always available

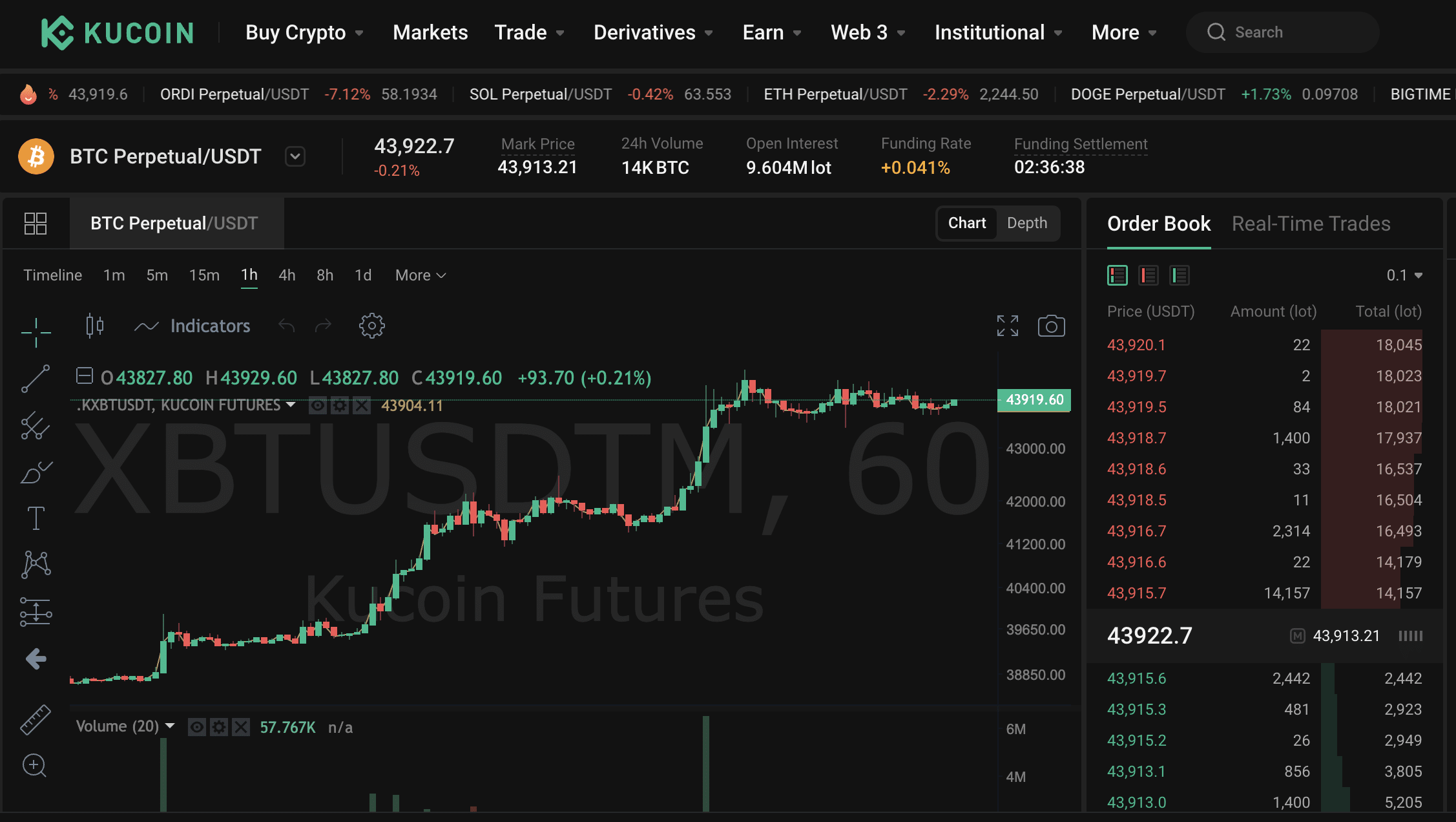

4. KuCoin: Trade Meme Coins With High Leverage Limits and Fair Commissions

If you’re looking to trade the best meme coins with leverage, KuCoin is a great option. It offers high leverage limits of 75x on FLOKI, Bonk, Pepe, Dogecoin, and Shiba Inu. These popular meme coins can be traded via perpetual futures, so you can go long or short without worrying about expiry dates.

You can increase your leverage limits when trading larger-cap cryptocurrencies like Bitcoin and Ethereum. In addition to perpetual swaps, KuCoin also supports inverse futures. Although KuCoin doesn’t offer options, it does support leveraged tokens. You can get up to 3x on multiple cryptocurrencies and there are no liquidation risks.

KuCoin offers competitive trading fees; you’ll pay just 0.06% when trading leveraged markets. Funding a KuCoin account is simple. The platform accepts debit/credit cards, e-wallets, bank transfers, and local payment methods via peer-to-peer deposits. KuCoin also offers competitive yields on crypto savings accounts, dual investments, and staking.

| Maximum Leverage | 100x |

| Supported Cryptocurrencies | 100+ |

| Leveraged Trading Instruments | Perpetual futures, inverse futures, and leveraged tokens |

| Fees | 0.06% |

Pros

- Trade perpetual or inverse futures with leverage of 100x

- Also offers leveraged tokens without liquidation risks

- Premium analysis tools including real-time order books

- Accepts a wide range of fiat payment methods

Cons

- Leveraged tokens are capped at 3x

- No longer allows anonymous accounts

5. Bybit: Bitcoin and Ethereum Delivery Futures Settled in USDC

Bybit is the best crypto leverage trading platform for delivery futures. It offers various settlement dates, ranging from a few weeks to six months. Delivery futures are settled in USDC and cover Bitcoin and Ethereum. Bybit also offers perpetual futures on a much larger range of cryptocurrencies.

This includes everything from ApeCoin, Cosmos, and Near Protocol to the Graph, Solana, and Cardano. Bybit is also a great option for trading leveraged options. There’s a full options chain for Bitcoin and Ethereum, and expiry dates range from one to six months. Bybit also stands out for its huge liquidity levels.

In the prior 24 hours, Bybit processed more than $20 billion worth of leveraged trades. What’s more, Bybit offers competitive fees. Options can be traded at just 0.02% of the contract value, which is lower than most leverage platforms. Futures commissions start from 0.055% but can be reduced when trading larger amounts. Finally, the maximum leverage on Bybit is 125x.

| Maximum Leverage | 125x |

| Supported Cryptocurrencies | 180 contracts covering dozens of cryptocurrencies |

| Leveraged Trading Instruments | Perpetual futures, inverse futures, delivery futures, and options |

| Fees | Options (0.02%), futures (from 0.055%) |

Pros

- Low options trading fees of just 0.02%

- Supports perpetual, inverse, and delivery futures

- Dozens of leveraged cryptocurrencies are available

- Maximum leverage limits of 125x

Cons

- Options are restricted to Bitcoin and Ethereum

- Isn’t regulated by any reputable financial bodies

6. Kraken Pro: Advanced Trading Platform With USD-Settled Crypto Futures

Kraken Pro is one of the best crypto leverage trading platforms for advanced traders. Its native trading dashboard offers everything needed to perform technical analysis. This includes drawing tools, custom pricing charts, and dozens of technical indicators. Kraken Pro also offers bespoke order types, so you can enter and exit the market with full flexibility.

Kraken Pro supports leveraged futures on over 95 cryptocurrencies. This includes Bitcoin, Dogecoin, Litecoin, Algorand, ApeCoin, Ethereum, and Cardano. Futures are traded via perpetual swaps and both long and short positions are supported. We like that futures contracts are settled in USD, rather than stablecoins like USDT or USDC.

Kraken Pro offers leverage of up to 50x, although this is lower than other providers. Additionally, Kraken Pro also offers margin accounts without liquidation risks. This requires an upfront margin of 20%, meaning leverage is capped at 5x. Kraken Pro charges 0.05% when trading futures. Rolling fees of 0.02% are charged every four hours on margin accounts.

| Maximum Leverage | 50x |

| Supported Cryptocurrencies | 95 (futures), 100+ (margin accounts) |

| Leveraged Trading Instruments | Perpetual futures (USD-settled), margin accounts |

| Fees | From 0.055% |

Pros

- Trade perpetual futures that are settled in USD

- Also supports margin accounts

- Advanced trading dashboard with technical indicators

- Minimum deposit requirement of just $10

Cons

- Maximum leverage of 50x

- Doesn’t support delivery futures

7. Delta Exchange: Perpetual Futures and Options on 50+ Cryptocurrencies

Delta Exchange specializes in cryptocurrency derivatives, with leverage of up to 100x available. You can trade perpetual futures contracts on over 50 cryptocurrencies. This includes everything from Bitcoin, Polygon, and Dogecoin to Ripple, Cosmos, and Chainlink.

Delta Exchange also offers inverse futures. Contracts can be settled in Bitcoin, Ethereum, and USDT. Futures commissions amount to 0.05% for market takers. This is charged on both ends of the trade. In addition, Delta Exchange is one of the best crypto leverage trading platforms for options.

You can trade Bitcoin and Ethereum options with daily and weekly settlements. Options positions are charged 0.03% of the contract value, which aligns with the industry average. Delta Exchange offers an advanced trading suite that can be customized. Drawing tools, order books, and technical indicators are also available.

| Maximum Leverage | 50x |

| Supported Cryptocurrencies | 50+ |

| Leveraged Trading Instruments | Perpetual futures, inverse futures, and options |

| Fees | Options (0.03%), futures (0.05%) |

Pros

- Supports perpetual and inverse futures on 50+ cryptocurrencies

- Trade with leverage of up to 100x

- Contracts can be settled in Bitcoin, Ethereum, or USDT

- Bank wire deposits and withdrawals are available

Cons

- Advanced trading platform won’t be suitable for beginners

- Doesn’t offer monthly or quarterly options contracts

8. PrimeXTB: Crypto Leverage of up to 1,000x on Contracts-for-Differences

PrimeXTB is the best crypto leverage trading platform for high limits; you’ll get leverage of up to 1,000x when trading contracts-for-differences (CFDs). This means a $10 account balance would secure $10,000 worth of trading capital. However, do note that CFDs are regulated financial instruments in many countries, so leverage limits might be restricted.

For example, according to ESMA, EU clients can only trade crypto CFDs with leverage of up to 2x. XTB also offers isolated and cross-margin futures on some of the best cryptocurrencies to trade. This includes Bitcoin, Dogecoin, Ripple, Solana, Litecoin, and Ethereum.

When it comes to fees, PrimeXTB is very competitive. For example, it charges just 0.05% on leveraged CFDs. Futures commissions are even lower at just 0.02%. We also like that PrimeXTB doesn’t have a minimum deposit requirement. PrimeXTB is available on desktop browsers and its native app for Android and iOS.

| Maximum Leverage | 1,000x |

| Supported Cryptocurrencies | 31 |

| Leveraged Trading Instruments | Perpetual futures and CFDs |

| Fees | Futures (0.02%), CFDs (0.05%) |

Pros

- Get leverage of up to 1,000x on crypto CFDs

- Also offers perpetual futures with 200x leverage

- Low futures commissions of just 0.02% per slide

- Supports other leveraged products like indices and commodities

Cons

- Supports just 31 cryptocurrencies

- PrimeXTB’s Android app is rated just 4/5

9. Gate.io: Trade Weekly and Quarterly Futures With Leverage of 100x

One of the best crypto exchanges, Gate.io, offers a huge range of leverage markets. This includes delivery futures with weekly and quarterly expiry dates, settled in USDT. Gate.io also offers perpetual futures, should you wish to keep your position open long-term. Either way, you’ll get leverage of up to 100x when trading futures.

Gate.io is also ideal for trading options. It supports Bitcoin, Ethereum, and Dogecoin options with multiple settlement dates. This ranges from one to nine months and covers many options strategies. Another option is leveraged tokens. These come with leverage of up to 5x and no initial margin is required.

Commissions on Gate.io start from 0.05%. It rewards active traders with lower commissions, but you’ll need to trade at least $60,000 per month. In addition to leveraged derivatives, Gate.io also offers spot trading on hundreds of cryptocurrencies. You’ll also find crypto loans, savings accounts, and auto-investing tools.

| Maximum Leverage | 100x |

| Supported Cryptocurrencies | 100+ |

| Leveraged Trading Instruments | Perpetual futures, delivery futures, and options |

| Fees | From 0.05% |

Pros

- Trade weekly and monthly delivery futures

- Also supports Bitcoin, Ethereum, and Dogecoin options

- Get leverage of up to 100x

- Accepts instant payment methods – including Visa and MasterCard

Cons

- Reduced trading commissions require $60,000+ volume every month

- Gate.io is rated just 2.3/5 on TrustPilot

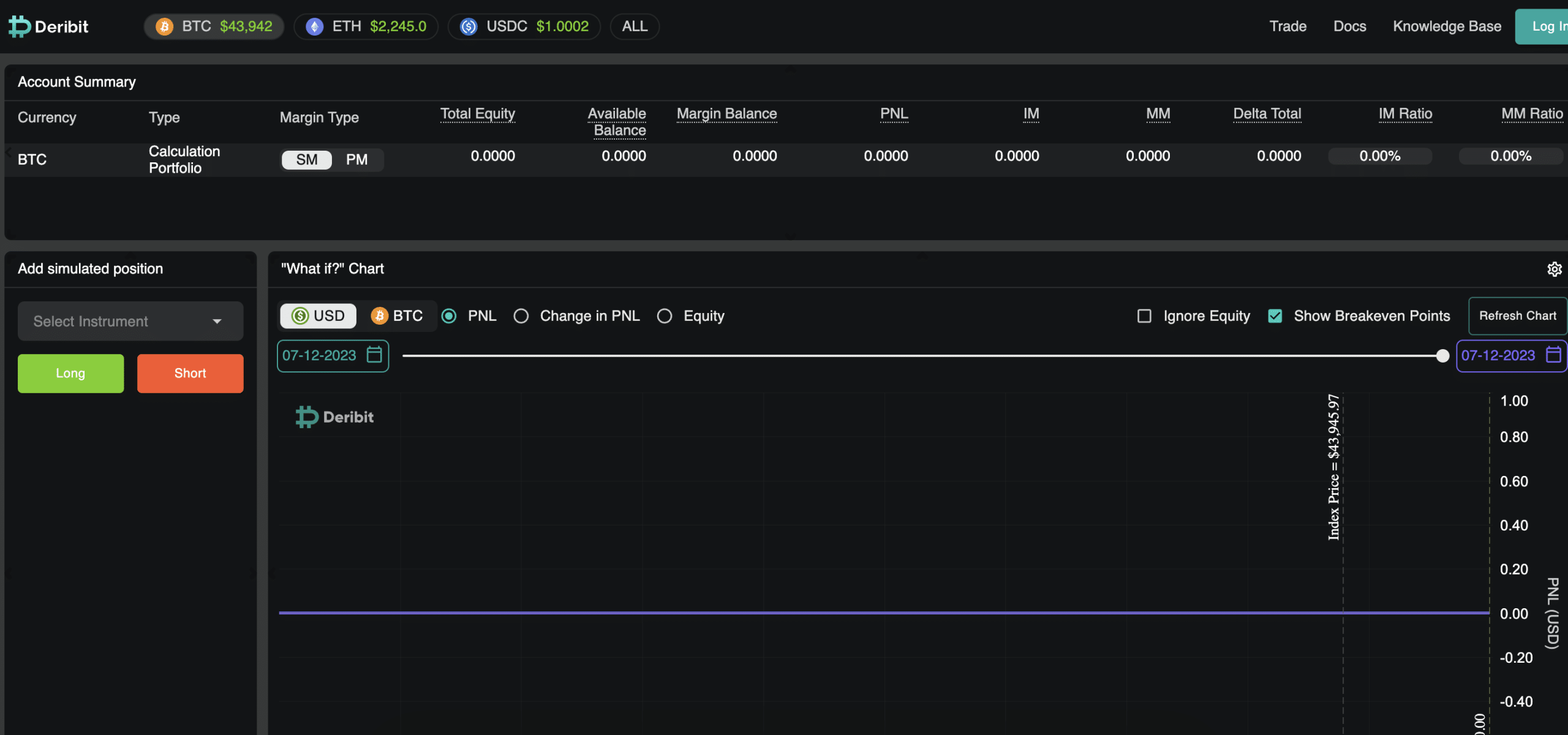

10. Deribit: Create the Ultimate Leverage Trading Strategy With Simulated Position Builders

Deribit is a crypto derivative platform that offers leverage of up to 100x. Only two cryptocurrencies are supported, Bitcoin and Ethereum. That said, you can choose from perpetual/delivery futures or options, and both long and short trades are permitted. One of the best tools on Deribit is its ‘Position Builder’.

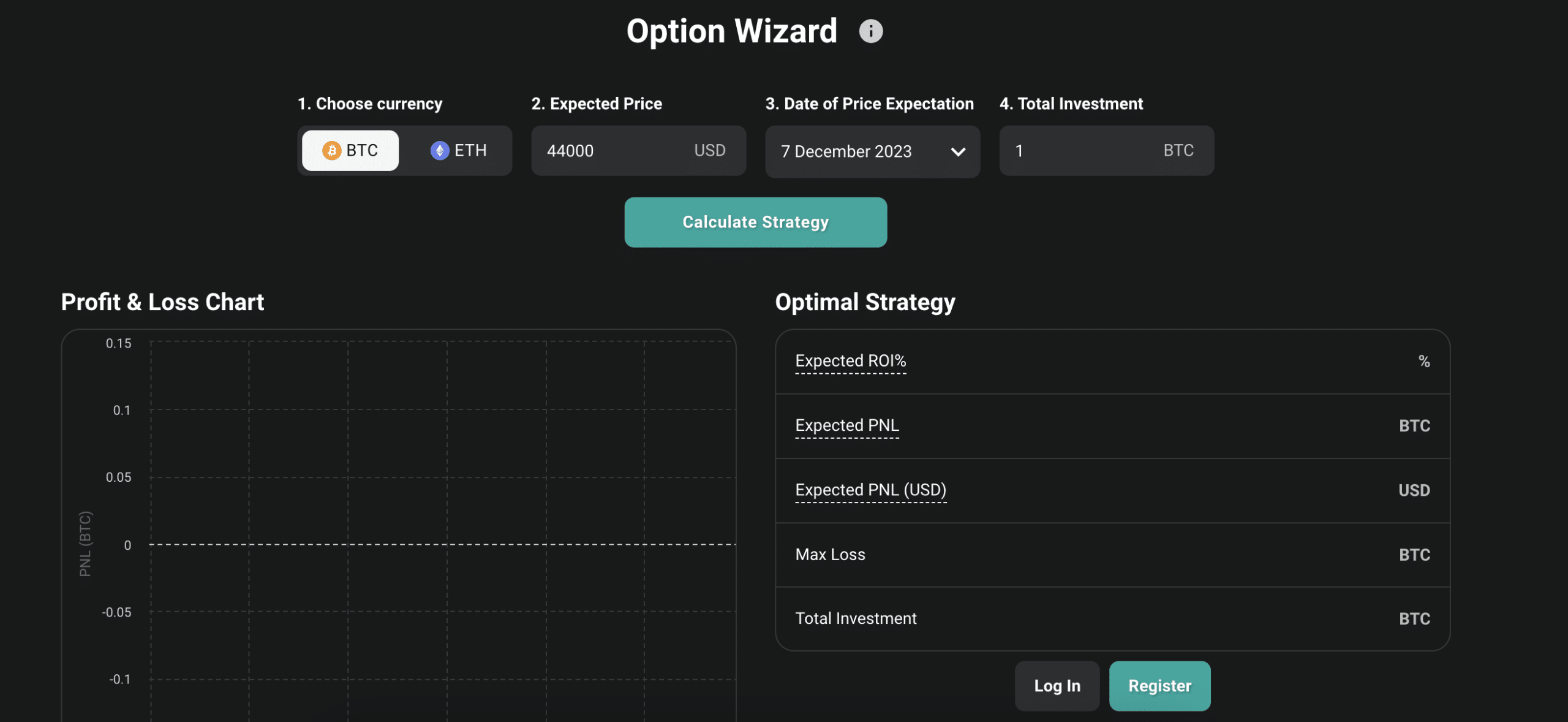

This enables you to create, modify, and backtest different strategies in simulated conditions. You can also trade in live market conditions with demo funds. This will enable you to test whether the strategy is working, or it needs to be tweaked further. We also like that Deribit offers an ‘Option Wizard’.

After inputting your Bitcoin or Ethereum price prediction, Deribit will suggest the ideal options contract. When it comes to fees, Deribit charges 0.05% on futures contracts. Like many platforms, lower commissions are available when meeting minimum monthly volumes. Deribit charges 0.03% when trading leveraged options.

| Maximum Leverage | 100x |

| Supported Cryptocurrencies | Bitcoin and Ethereum |

| Leveraged Trading Instruments | Perpetual futures and options |

| Fees | Options (0.03%), futures (0.05%) |

Pros

- Build, modify, and test trading strategies in simulated conditions

- Find the ideal contract via the Options Wizard tool

- Supports perpetual and delivery futures

- High liquidity levels available around the clock

Cons

- Just two cryptocurrencies are supported

- Doesn’t offer discounted fees when trading large volumes

How Does Crypto Leverage Trading Work?

In a nutshell, leverage allows traders to ‘amplify’ their positions, meaning you can trade with more than you have in your account balance. For example, suppose you trade $500 worth of Ethereum with 20x leverage. Your $500 trade is now valued at $10,000. Leverage appeals to traders who want to boost their trading profits without depositing higher amounts.

However, leverage will also increase your losses when things don’t go to plan. In most cases, the trade will be liquidated when it declines by the initial margin. This means the crypto trading platform will close the trade and you’ll lose your stake. For instance, suppose you stake $1,000 with 5x leverage – increasing the position to $5,000.

You’re putting up 20% worth of margin ($5,000/$1,000), so if the trade declines by 20%, it will be closed. In this instance, you’ve just lost $1,000. Therefore, you must consider the risks of leverage trading before proceeding. In terms of markets, leverage can be accessed in many different ways.

This includes perpetual futures, inverse futures, delivery futures, and options. Some platforms also offer ‘leveraged tokens’. These simply track the spot trading price of a cryptocurrency and multiply profits and losses. Another feature of leverage trading is that you can go long or short. This means you can look for trading opportunities in both bullish and bearish markets.

What is the Best Way to Short-Sell When Crypto Trading with Leverage?

- There are several different ways to short cryptocurrencies with leverage.

- One of the easiest is to sell crypto futures on MEXC. You’ll have access to leverage of up to 200x and short-selling commissions are just 0.2%.

- Another method is to purchase put options on OKX. You’ll need to select a strike price and pay an upfront premium. If your options trade doesn’t go to plan, only the premium will be lost.

Our Research Methods When Selecting the Best Bitcoin Leverage Trading Platform

We followed strict criteria when reviewing the best crypto leverage trading platforms. Having selected the top 10 providers for 2023, here’s what we focused on:

Safety and Security

Many crypto leverage platforms operate without a license, even though they handle billions of dollars in daily trading volume. This is because, in most countries, leveraged cryptocurrencies are unregulated financial products. Nonetheless, you should tread carefully when selecting a platform, especially if it’s located offshore.

- Explore when the platform was founded and how many people actively use it.

- Check out CoinMarketCap to get an idea of trading volume and proof of reserves.

- You can also research consumer reviews and browse Reddit for additional feedback.

We’d also advise seeing what security controls the platform offers. For instance, what safeguards are in place to prevent a remote hacking attempt?

Platforms like MEXC and OKX keep the majority of client funds in cold storage, meaning the cryptocurrencies are always offline. These platforms also have strong and audited proof of reserves, meaning they can cover 100% of client balances.

Supported Leverage Markets

Once you’re satisfied with safety, the next step is to research what leverage markets are available. For example, MEXC offers perpetual futures, which are very popular with crypto traders. Just like futures, perpetuals support leverage and short-selling. However, perpetual futures don’t come with a delivery date, meaning they’re always active.

If you’re looking to trade delivery futures, then check out OKX. It offers many different delivery time frames and strike prices. Alternatively, you might also consider leveraged options markets. Although options come with huge upside potential, they’re considered low risk. This is because you can only lose the premium.

Another popular method is leveraged tokens. These amplify profits and losses like futures and options. However, there is no requirement to put up a margin, meaning you won’t be liquidated. Ultimately, make sure you choose a leverage platform that offers your preferred trading instrument.

Listed Cryptocurrencies

If you’re looking to trade Bitcoin, Ethereum, and other top-10 cryptocurrencies; you’ll have no issues finding a leverage platform. But if you’re more interested in meme coins or DeFi tokens, you’ll need to do a bit of research.

- For instance, the best crypto leverage trading platform for smaller-cap cryptocurrencies is MEXC.

- It supports more than 100 altcoins, including Gala, Pepe, and Internet Computer.

- KuCoin is a great option for leveraged meme coins, including FLOKI, Bonk, and Shiba Inu.

We found that perpetual futures are the best option for trading less popular cryptocurrencies. In contrast, most crypto option chains only support Bitcoin and Ethereum.

Maximum Leverage Limits

Depending on your risk tolerance, you might want to trade cryptocurrencies with very high leverage limits. The highest limits that we found were 1,000x, available on PrimeXTB. However, this is offered via crypto CFDs, which aren’t available in the US or the UK. Moreover, although European and Australian retail clients can trade crypto CFDs, they’re capped at 2x.

Therefore, the best platform for getting much higher limits is MEXC. It offers leverage of up to 200x and there’s no KYC process when withdrawing under 30 BTC per day. Binance and Bybit also offer high leverage limits at 125x. That said, you’ll only get 50x when trading on Kraken Pro.

Leverage Trading Fees

Fees will vary depending on the leverage trading platform and the type of instrument being traded. On average, you’ll pay 0.05% per slide to trade leveraged futures. This is reduced to 0.02% on MEXC and PrimeXTB. Leveraged options average 0.03% of the total contract amount.

How do Leveraged Options Fees Work?

- When you trade options with leverage, you’ll need to pay a commission. However, the commission is based on the total trade value, including leverage.

- For example, suppose you trade $500 worth of options at leverage of 50x.

- You’ll pay 0.2% of the $25,000 ($500 x 50x) position, so that’s $50.

Some crypto leverage trading platforms also charge financing fees. This will be charged each day the position remains open. On Kraken Pro, financing fees are charged every four hours.

Analysis Tools

We also explored what analysis tools were available when ranking crypto leverage platforms. For instance, Deribit offers an ‘Options Wizard’ tool. First, Deribit will ask for your prediction. For example, you might believe that Bitcoin will be trading at $100,000 in April 2024. Deribit will then suggest the best options contract for this hypothesis.

If you’re more interested in leveraged futures, MEXC offers a wide range of analysis tools. This includes technical indicators like the MACD, Bollinger Bands, and RSI. It also offers custom chart patterns, multiple time frames, and drawing tools. Binance and Kraken Pro are also great options for advanced technical analysis.

Payment Methods

Payments are also important when choosing a crypto leverage platform.

For instance:

- What deposit and withdrawal methods are accepted? Most traders prefer funding their accounts with fiat money. On MEXC and OKX, you can deposit funds with a debit/credit card or bank wire.

- What is the minimum deposit requirement? Most platforms allow you to get started with a few dollars.

- How long does the platform take to process withdrawals? You should prioritize platforms that offer same-day payouts – including weekends and public holidays.

Don’t forget to check what payment fees apply too. Debit/credit cards, for example, can cost as much as 5% when using a crypto leverage platform.

Customer Service

Customer service levels can vary widely from one platform to the next. For example, although Kraken Pro offers a live chat box, it’s very cumbersome. You first need to get past the ‘Bot’ that you’re connected with. After requesting a human agent, we were told waiting times would be at least three hours.

Therefore, you should never assume that live chat offers instant assistance; so it’s worth testing out. Additionally, make sure the customer service department operates 24 hours per day. If it doesn’t, its operating hours should align with your local time zone.

Is it Legal to Trade Cryptocurrencies With Leverage?

Most countries do not place restrictions on leverage trading; not only for cryptocurrencies but other assets like stocks and ETFs. This means traders can access high leverage limits of 100x and more. However, some countries have installed leverage restrictions for retail clients.

- For example, UK retail clients can’t legally access leveraged crypto projects, including CFDs, futures, options, and anything in between. These crypto leverage restrictions were implemented by the FCA in January 2021 to protect reckless trading.

- Although Europeans can trade cryptocurrencies with leverage, ESMA restricts retail clients to just 2x.

- Similar to the UK, Canadian retail clients are unable to trade leveraged cryptocurrencies. This is unless Canadian traders are classed as ‘Permitted Clients’, which requires at least $5 million in net assets.

- US clients can legally trade cryptocurrencies with leverage, but only with regulated and approved providers. For instance, Coinbase recently secured approval from the National Futures Association to offer crypto futures.

Although regulation is crucial when exploring crypto leverage trading, the industry still operates in a gray area. Many platforms offer anonymous accounts, meaning nationalities are not collected. As such, many traders in the US, Canada, the UK, and other restricted countries simply use a VPN.

The Verdict

In summary, leverage is increasingly becoming popular with crypto traders, so there are many providers to choose from. We’ve explored the markets extensively and found that MEXC is the best crypto leverage platform.

MEXC offers 200x leverage on perpetual crypto futures. Long and short positions are supported and you’ll pay just 0.02% per slide. What’s more, MEXC supports a huge range of leveraged markets, including Bitcoin, Dogecoin, Shiba Inu, and Ethereum.

References

- https://www.wsj.com/articles/binance-became-the-biggest-cryptocurrency-exchange-without-licenses-or-headquarters-thats-coming-to-an-end-11636640029

- https://www.justice.gov/opa/pr/binance-and-ceo-plead-guilty-federal-charges-4b-resolution

- https://www.esma.europa.eu/press-news/esma-news/esma-renew-restrictions-cfds-further-three-months-1-may-2019

- https://www.fca.org.uk/news/press-releases/fca-bans-sale-crypto-derivatives-retail-consumers

- https://ca.practicallaw.thomsonreuters.com/0-606-9007?transitionType=Default&contextData=(sc.Default)&firstPage=true

- https://asic.gov.au/about-asic/news-centre/find-a-media-release/2022-releases/22-082mr-asic-s-cfd-product-intervention-order-extended-for-five-years/

FAQs

What is the best crypto leverage trading platform in 2023?

MEXC is a popular trading platform for crypto leverage; you’ll get up to 200x on perpetual futures.

Can you get 1,000x leverage on crypto?

PrimeXTB offers 1,000x leverage on crypto via CFDs. However, crypto CFDs are not available to US, UK, or Hong Kong residents.

Does Binance offer leverage trading?

Yes, Binance offers leverage of up to 125x on perpetual futures and options.

Can you leverage trade on Bybit without KYC?

Yes, Bybit allows crypto leverage trading without KYC, but you’ll be limited to daily withdrawals of 20,000 USDT.

The post 10 Best Crypto Leverage Trading Platforms 2023 appeared first on Cryptonews.