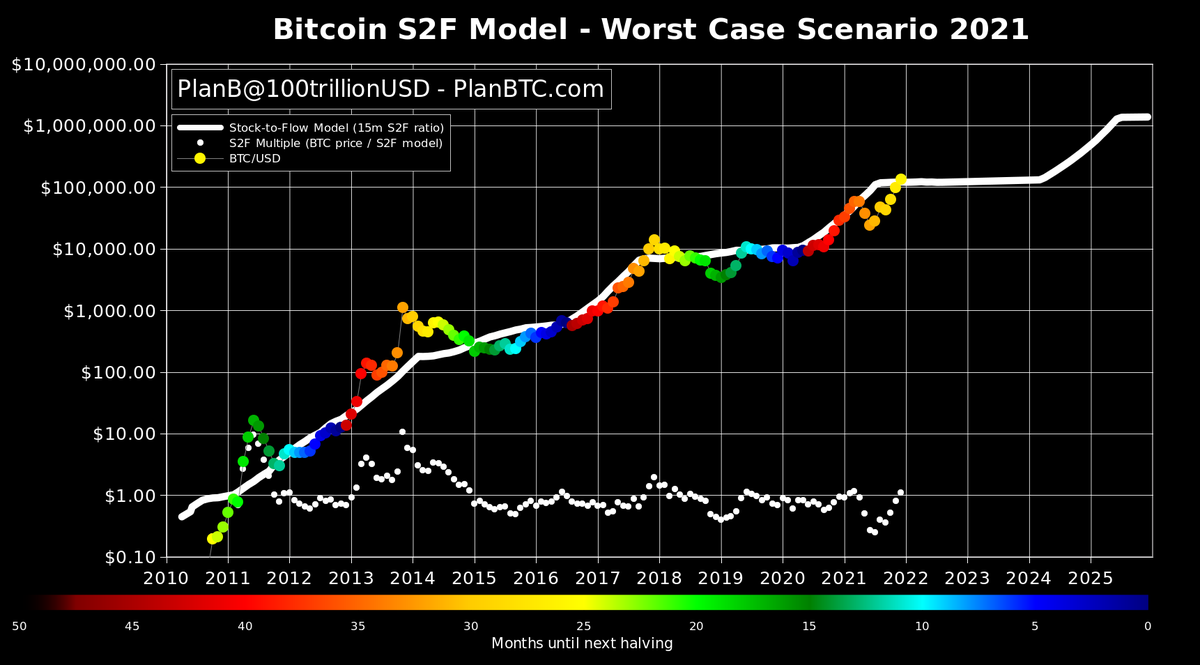

$135K for December: Stock-to-Flow Creator Lays out Bitcoin’s ‘Worst Case Scenario for 2021’

Publikováno: 21.6.2021

The pseudonymous creator of the popular stock-to-flow (S2F) bitcoin price model, Plan B, has published his “worst case scenario for 2021” predictions on social media on Sunday. The analyst says there’s also a “more fundamental reason” to why bitcoin prices have been dropping in June and how the month of July may see “weakness” as […]

The pseudonymous creator of the popular stock-to-flow (S2F) bitcoin price model, Plan B, has published his “worst case scenario for 2021” predictions on social media on Sunday. The analyst says there’s also a “more fundamental reason” to why bitcoin prices have been dropping in June and how the month of July may see “weakness” as […]

The pseudonymous creator of the popular stock-to-flow (S2F) bitcoin price model, Plan B, has published his “worst case scenario for 2021” predictions on social media on Sunday. The analyst says there’s also a “more fundamental reason” to why bitcoin prices have been dropping in June and how the month of July may see “weakness” as well.

Best Case Scenario: $450K Worst Case Scenario: $135K

Five months ago, bitcoin (BTC) prices went parabolic and the value of the leading crypto asset seemingly was following the well known stock-to-flow (S2F) model. At the time, the S2F creator said: “bitcoin stock-to-flow model [is] on track… like clockwork.” The price of bitcoin skyrocketed over $64K per unit but has since lost more than half that value.

At the end of April, Plan B remarked that the downturn was a “mid-way dip” and stressed that “nothing goes up in a straight line.” This past Saturday, Plan B further discussed the infamous death cross pattern in the BTC/USD chart and remained optimistic.

Then on Sunday, Plan B gave an update on his “worst case scenario for 2021.”

“Bitcoin is below $34K, triggered by Elon Musk’s energy FUD and China’s mining crack down,” Plan B tweeted. “There is also a more fundamental reason that we see weakness in June, and possibly July. My worst case scenario for 2021 (price/on-chain based): Aug>47K, Sep>43K, Oct>63K, Nov>98K, Dec>135K,” the analyst added.

Of course, Plan B made sure that people read his tweet carefully when people asked if they should disregard his model. “Please read my tweet more carefully,” Plan B replied. “I said this is a worst case scenario, not a base case, let alone best case. I am still on S2FX track for my base case. I have explained my personal (non)selling strategy in several interviews,” he added. Furthermore, someone asked Plan B: “What’s the more fundamental reason?”

“Great question. I [intend] to publish later this year,” the analyst replied. Additionally, the popular bitcoiner dubbed “Parabolic Trav” said that he likes a bearish Plan B tweet and said “Bullish.” Plan B also responded to Parabolic Trav’s statement and said:

Wait until you [see] my base case and best case scenarios! OK, a hint: best case Dec $450K.

Plan B: ‘Bitcoin Distribution Looks a Lot Healthier Now’

Plan B is a popular analyst and has more than 570,000 Twitter followers. The stock-to-flow price model has also grown in popularity during the last 12 months and it is referenced often in technical analysis. Plan B has been getting a lot more criticism in recent times since bitcoin’s price has been dropping lower. The sell-off, Plan B said this weekend, has led to better bitcoin distribution.

“60% of bitcoins sold in May-June were bought in March-April and sold at a loss,” Plan B wrote. “40% was bought earlier and sold at a profit. Of total 18.7M bitcoins ~2,5M bitcoins are bought at

What do you think about Plan B’s worst case scenarios for 2021? Let us know what you think about this subject in the comments section below.