14 Best Crypto Staking Platforms with Highest APY Yields in 2024

Publikováno: 6.3.2024

Crypto staking platforms enable investors to generate passive income on idle tokens. This will suit investors that wish to benefit from both income and capital growth, through a long-term investment strategy. This comparison guide reviews and ranks the best crypto staking platforms for the highest APY yields, taking into account supported coins, safety, and more. […]

The post 14 Best Crypto Staking Platforms with Highest APY Yields in 2024 appeared first on Cryptonews.

Crypto staking platforms enable investors to generate passive income on idle tokens. This will suit investors that wish to benefit from both income and capital growth, through a long-term investment strategy.

This comparison guide reviews and ranks the best crypto staking platforms for the highest APY yields, taking into account supported coins, safety, and more.

The Best Crypto Staking Platforms with the Highest Rewards

From our research, the best crypto staking platforms on the market right now are listed below:

- Smog – Overall best crypto staking platform with a huge airdrop reward and a 42% staking APY.

- Sponge V2 – Unique P2E game with a Stake-to-Bridge model. Offers a min 40% APY.

- Bitcoin Minetrix – Tokenizes cloud mining and offers a 197% APY on staking. Has a $33M presale target.

- Meme Kombat – Meme crypto with betting options and offers 112% APY during the presale.

- Coinbase – User-friendly platform with up to 5.75% APY. It is regulated and no minimum amount is required.

- Kraken – Has bi-weekly staking payouts. 20% APY on Mina, offers flexible withdrawals and 15 staking coins.

- OKX – Up to 300% APY with hourly payouts. Also has flexible lock-in periods and 340+ crypto tokens.

- Crypto.com – Up to 14.5% APY with low trading fees. It supports stablecoins and has flexible terms.

- DeFi Swap – Up to 75% APY on DEFC. It has cross-chain functionality and supports yield farming.

- MyCointainer – Up to 133% APY with daily rewards. It supports 120+ assets and offers cashback and airdrops.

- Binance – Users can stake 14 coins, offering up to 76% APY with flexible to 180-day terms.

- BlockFi – Up to 7.5% APY with flexible withdrawals and monthly payouts.

- Nexo – Up to 36% APY with daily payouts and higher rates with NEXO tokens.

- Bitstamp – Established exchange with up to 4.12% APY on Ethereum. Also has flexible withdrawals.

Full and comprehensive reviews of the above crypto staking platforms can be found in the sections below.

Reviewing the Top Cryptocurrency Staking Sites

Choosing the best crypto staking platform in 2024 will require investors to focus on core metrics surrounding:

- APYs

- Lock-up terms

- Security and trust

- Supported coins

- Minimum account balances

In the detailed breakdowns below of each of the 14 best crypto staking platforms for 2024, we highlight where platforms perform well in these key metrics.

1. Smog – Overall Best Crypto Staking Platform With a Huge Airdrop Reward And a 42% Staking APY

Smog ($SMOG) is currently the best crypto staking platform on the Solana blockchain that has caught investor attention since its launch on Jupiter DEX. The token’s value has surged massively by over 3,000%, from $0.001419 to $0.047, pushing its market cap from $2 million to over $64 million.

Smog offers a 42% APY for staking, with a 90-day lock-in period to encourage long-term holding. This rate is much higher than other platforms, making it one of the best crypto staking platforms on the market.

Additionally, 10% of the token supply is reserved for future listings on centralized exchanges, increasing its accessibility.

Aiming to recreate and even exceed the success of famous meme coins like Pepe and Bonk, Smog has allocated half its 1.4 billion total supply for marketing.

The “Greatest SOL Airdrop” is a key feature of the token, distributing 490 million tokens to holders who engage with the community and complete quests, earning airdrop points.

Investors looking for a promising crypto staking platform with strong growth potential, active community rewards, and attractive staking rewards may find Smog appealing.

Users can read the Smog whitepaper for more details and updates and connect with its community through the official Telegram channel and X (Twitter) account.

2. Sponge V2 – PoS Crypto With a Unique P2E Game And a Stake-to-Bridge Model, Offers A Minimum APY of 40%

Sponge V2 is a new update to the widely successful $SPONGE meme coin, which achieved massive success in 2023.

Transitioning from a meme-based charm to a more utility-focused asset, SPONGEV2 offers innovative features to increase its market standing and user engagement.

Central to Sponge V2 is the Stake-to-Bridge mechanism. This model allows users to transform their V1 tokens into V2 tokens, enabling an easy transition to the new version.

The staking process is designed for long-term commitment, with V1 tokens being permanently locked, highlighting the project’s strategy for sustained growth and stability.

Sponge V2 offers a high Annual Percentage Yield (APY) of at least 40% over four years, incentivizing users for their loyalty and long-term participation.

Sponge V2 also offers an engaging P2E gaming platform where users can leverage their V2 tokens to play and accumulate more tokens. This gaming aspect adds a dynamic layer of interactivity and user engagement.

The total supply of Sponge V2 tokens stands at 150 billion. A significant allocation (over 51%) is dedicated to staking and P2E gaming rewards, ensuring a high incentive for user participation.

With its focus on organic growth, SPONGEV2 refrains from presale stages and taxes, showing its commitment to genuine user acquisition and market impact.

Sponge V2 aims to capitalize on the charm of the original $SPONGE token. With plans to list on top-tier exchanges, SPONGEV2 can potentially replicate the explosive market performance of its predecessor.

The project leverages a strong community base of over 30,000 members, aiming to expand its reach through targeted marketing campaigns and community-driven initiatives.

Potential investors can read the SPONGEV2 whitepaper and join the Telegram channel. Additionally, following Sponge on platforms like X (Twitter) will provide the latest insights into exchange listings and project developments.

| Presale Started | Dec 2023 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

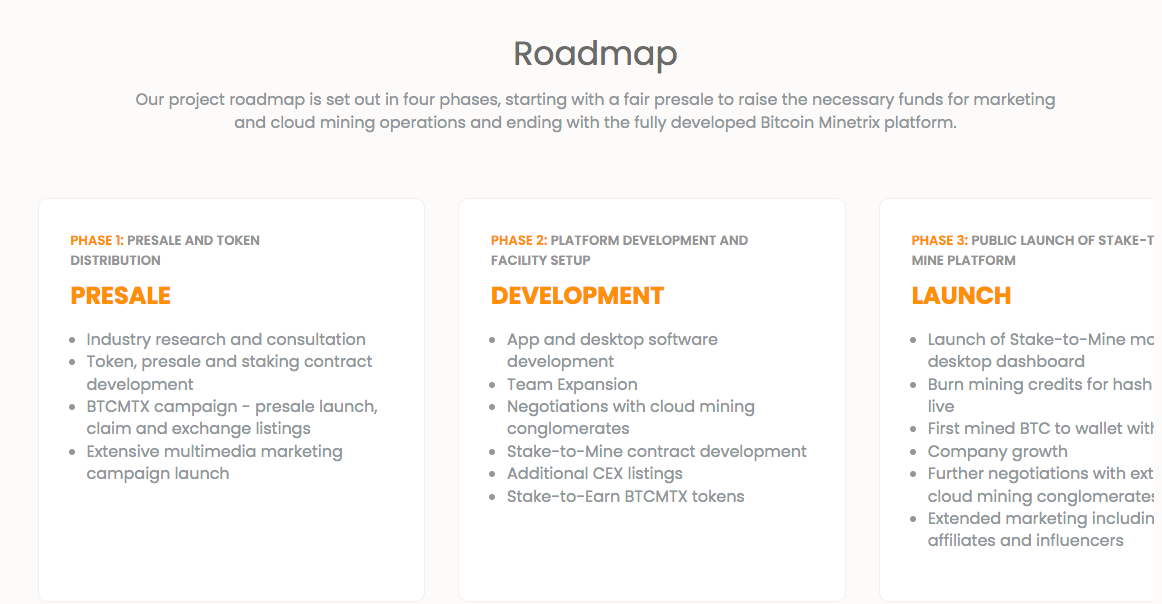

3. Bitcoin Minetrix – Highest APY Crypto Staking with 197% Yield, Newly Launched Presale

The Bitcoin Minetrix staking platform combines token staking with cloud mining. The goal of Bitcoin Minetrix is simple – tokenize cloud mining services by offering credits to token holders that stake the $BTCMTX token.

While users may directly access cloud mining companies and services, these have been known to scam investors and be unreliable. Bitcoin Minetrix will ensure safety by decentralizing the cloud mining process and also offering passive income.

All $BTCMTX tokens can be staked on the Ethereum-powered staking contract. By staking $BTCMTX, you can earn cloud mining credits. These non-tradable ERC-20 tokens can be burnt on the platform to earn Bitcoin mining power. Thus, this will allow users to earn a share of mining revenues.

Furthermore, users can also generate a hefty APY (Annual Percentage Yield) by staking their tokens. At the time of writing, Bitcoin Minetrix is offering a 190% APY on $BTCMTX. The number is expected to reduce as more tokens are staked on the contract.

$BTCMTX has a low supply of 4 billion tokens. 70% of the tokens will be offered through ten presale rounds. Currently, the token is priced at $0.0114, but will increase by 2.5% at each stage of the 39-stage presale.

According to the Bitcoin Minetrix whitepaper, the project is in its first roadmap phase. The main focus is to undergo a successful presale and reach a hard cap target of $33 million. Afterward, Bitcoin Minetrix will start developing the stake-to-mine project and focus on new CEX and DEX listings.

Stay updated with this new cryptocurrency staking platform by joining the Bitcoin Minetrix Telegram channel.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

4. Meme Kombat – Meme Crypto Offering Wagering Options on a Battle Arena, Get 112% APY During Presale

The next top staking platform on our list is Meme Kombat ($MK). This cryptocurrency combines the popularity of memes with increased utility through its staking mechanism and Battle Arena.

Staked $MK token can be used to in the play-to-earn Battle Arena which allows players to earn tokens and rewards by wagering.

Currently, one can purchase the $MK token on presale for just $0.1667 per token, with tokens automatically staked on Meme Kombat’s ecosystem.

Investors can earn an APY of 112% during the presale through the staking contract, with a minimum lock-up period of only 14 days when the presale ends.

While tokens are staked, a portion can also be allocated for betting purposes. Players can bet on Player vs Player and Player vs Game betting modes. Meme Kombat is expected to release season one of its Battle Arena after the end of the presale. Every new season will feature multiple battle modes, exciting rewards, and online leaderboards.

Meme Kombat has a low supply of just 120 million compared to other meme coins and will offer 30% of the entire token supply as staking and battle rewards. Another 10% will be offered as community rewards.

Half of the 120 million token supply has been allocated for the ongoing presale. By the end of this presale round, Meme Kombat aims to raise a hard cap of $10 million. The remaining 10% of the token supply will be allocated to maintain DEX liquidity. Interested investors can buy Meme Kombat before the presale sells out.

To learn more about this exciting meme cryptocurrency, which has a doxxed and public-facing team, go through the Meme Kombat whitepaper and join the Telegram channel.

| Presale Started | 21 September 2023 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | $5 |

| Max Investment | None |

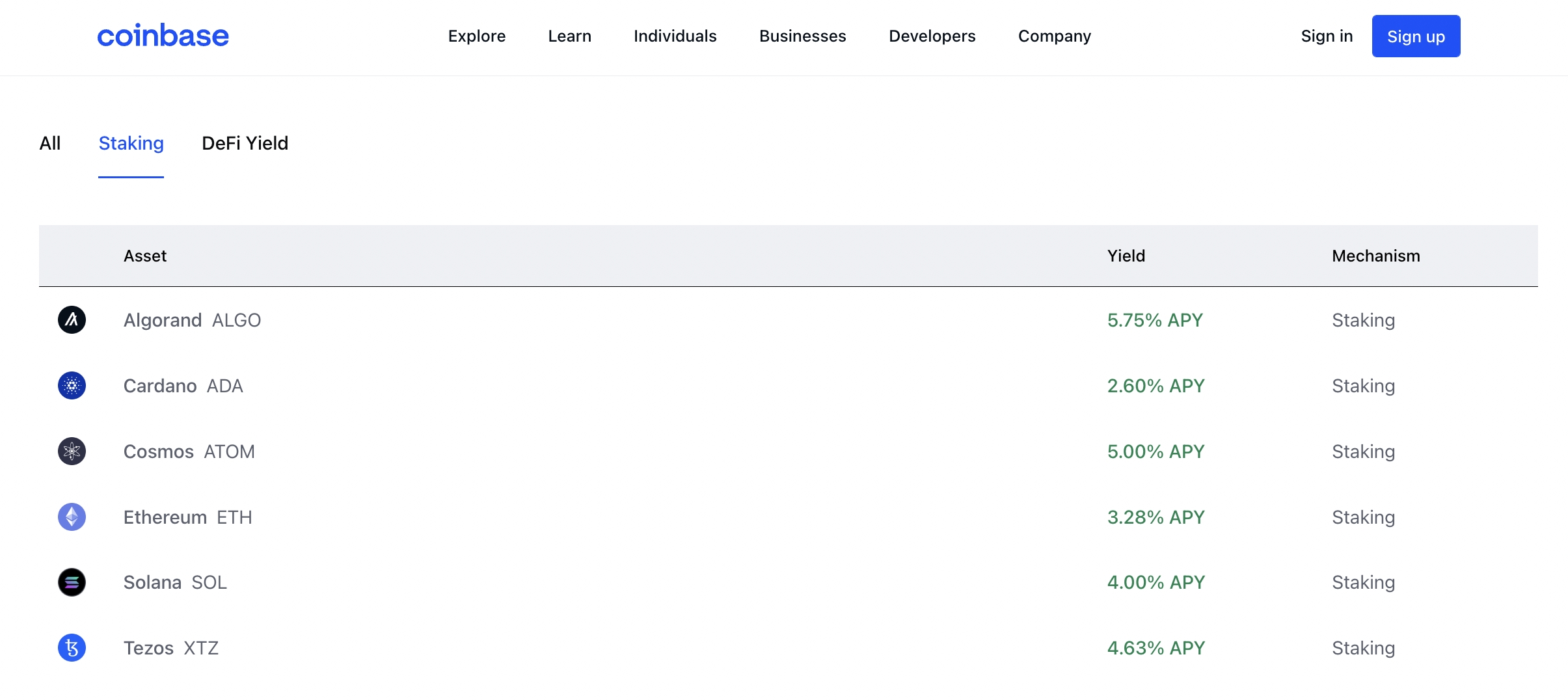

5. Coinbase – Earn up to 5.75% APY via a User-Friendly Staking Platform

Coinbase is a popular crypto exchange and broker that supports 100 coins. It is home to a user-friendly platform that will appeal to beginners. As of writing, Coinbase supports six coins for staking – namely, Algorand, Cardano, Cosmos, Ethereum, Solana, and Tezos. In terms of yields, the best APY on offer is 5.75%, when staking Algorand.

Do note that Coinbase staking is not accessible to US clients. Moreover, staking rewards are only paid on crypto assets purchased on the Coinbase platform. This could be a sticking point considering that Coinbase charges a trading commission of 1.49%. Furthermore, buying coins directly with a debit card will cost 3.99%.

In addition to staking, Coinbase also supports DeFi yield services. This is supported for both Dai and Tether, albeit, yields will vary depending on market conditions. Staking and DeFi yield rewards can be tracked in real-time via the Coinbase website or mobile app for Android and iOS.

| Staking Rewards on Cryptocurrencies | Up to 5.75% |

| Min & Max Staking Amounts | Not stated |

| Lock-In Period | Flexible withdrawals |

| Security & Regulation Features | Regulated by relevant US licensing bodies |

| Additional Rewards Offered | DeFi yield rewards on Dai and Tether |

| Payout Frequency | Depends on the coin being staked |

Pros

- Top staking platform for beginners

- No minimum staking amount required

- Heavily regulated

Cons

- Debit/credit cards attract a fee of 3.99%

- Better staking yields are available elsewhere

- High trading commissions

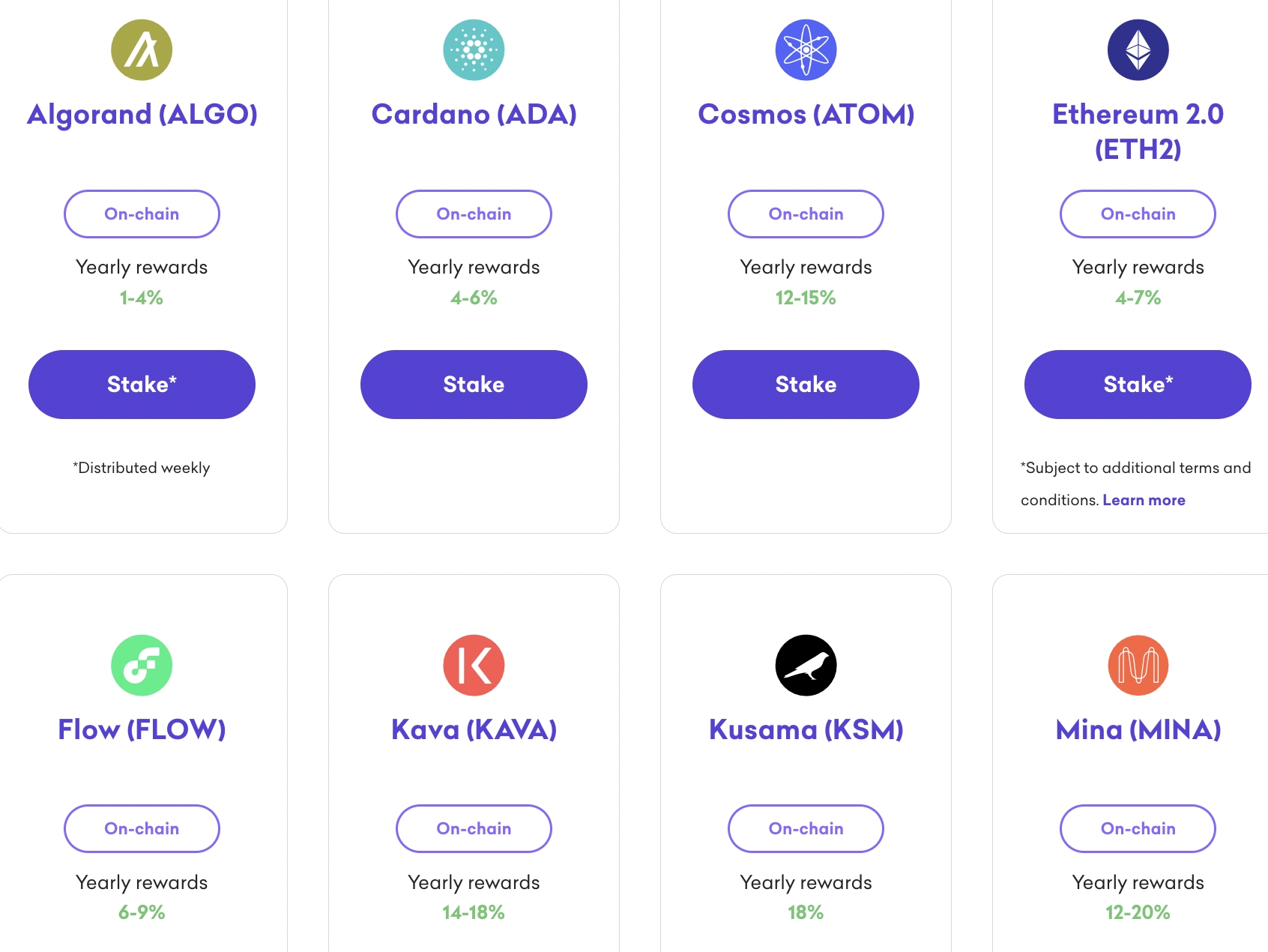

6. Kraken – Staking Rewards Paid Bi-Weekly, Earn 20% APY When Staking Mina

Kraken is one of the best crypto staking platforms for fast reward distributions. This popular exchange pays staking rewards twice per week, which is in addition to competitive yields. In total, 15 digital assets can be staked on the Kraken platform. Apart from Bitcoin, all staking coins on Kraken are initiated on-chain.

Popular coins to stake include Ethereum, Tezos, Tron, Solana, and Polkadot. In terms of APYs, the best rate on offer is 20% and this is available when staking Mina. Kusama and Kava are competitive too, with maximum staking rewards of 18%. All staking agreements on Kraken are offered on flexible terms.

| Staking Rewards on Cryptocurrencies | Up to 20% |

| Min & Max Staking Amounts | Not stated |

| Lock-In Period | Flexible withdrawals |

| Security & Regulation Features | Registered as a money service business in the US |

| Additional Rewards Offered | None |

| Payout Frequency | Bi-weekly |

Pros

- Staking rewards are distributed bi-weekly

- Earn up to 20% in staking yields

Cons

- Terms and conditions can vary depending on the coin

- Not transparent on fees

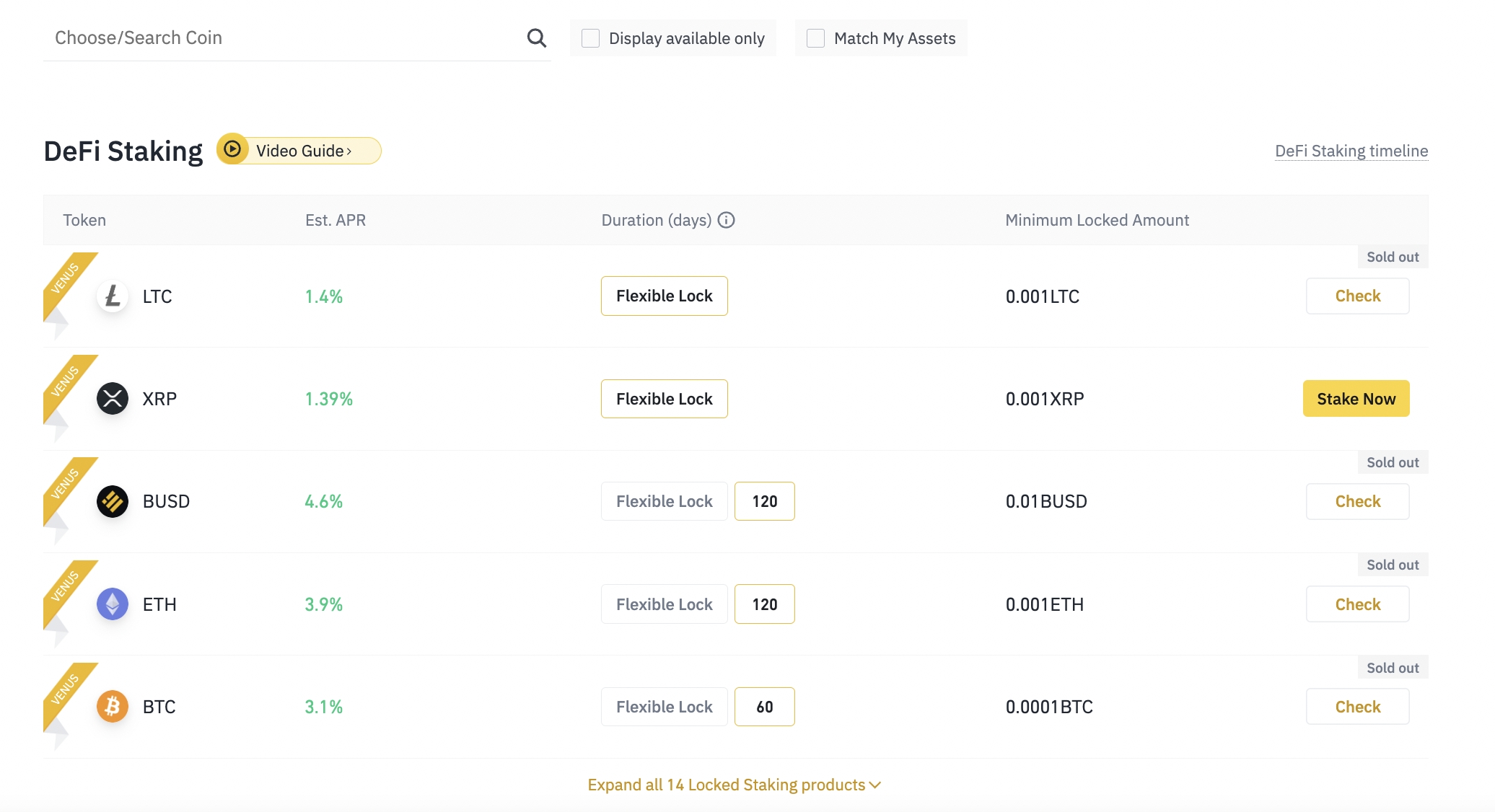

7. OKX – World-Class Crypto Staking Platform Offering up to 300% APY

Another top pick for staking cryptocurrencies in 2024 is OKX. This global crypto exchange offers trading on more than 340 popular cryptocurrencies and gives investors a chance to earn interest on many of them.

OKX’s staking platform is integrated right into the exchange, making it very simple to use. Users can choose from a wide selection of coins to stake, some earning up to 70% APY. Many coins are available to stake with flexible staking periods and there are higher rates available for 15, 30, 60, 90, or 120-day lock-up periods.

In addition to DeFi crypto staking, OKX has crypto savings accounts where investors can earn interest on their tokens. These accounts offer up to 300% APY for certain tokens. Stablecoins like Tether and USD Coin each earn 10% APY, while Bitcoin and Ethereum each earn 5% APY. There are no lock-up periods for tokens in an OKX savings account.

OKX pays out interest every hour, so investors can start compounding their returns right away. OKX is also one of the best yield farming crypto platforms with APYs as high as 6.52% on given crypto crosses.

OKX makes it easy to buy crypto and then stake it. The exchange accepts credit cards, debit cards, bank transfers, and e-wallets to purchase crypto with a minimum trade size of $10. On top of that, the fee to buy crypto on OKX is just 0.10% – among the lowest trading fees in the industry.

| Staking Rewards on Cryptocurrencies | Up to 300% APY |

| Min & Max Staking Amounts | None |

| Lock-In Period | Flexible or 15, 30, 60, 90, 120 days |

| Security & Regulation Features | Regulated in Malta |

| Additional Rewards Offered | None |

| Payout Frequency | Hourly |

Pros

- 20+ million users around the world

- Offers trading on 340+ crypto tokens

- Flexible staking or lock-in periods for higher rewards

- Earn up to 300% APY for specific tokens

- Interest is paid out hourly

Cons

- Doesn’t specify fees for purchasing crypto with a credit card

8. Crypto.com – Earn up to 14.5% APY in Passive Interest

Crypto.com is a leading digital asset exchange that offers the lowest trading commissions in this industry. After recently reducing its fee structure, buying and selling crypto at a commission of just 0.075% is possible. This means that for every $1,000 worth of crypto traded, a commission of just $0.75 will be collected.

Although Crypto.com doesn’t support staking, it does offer crypto interest accounts which, for all intent and purposes, operate in much the same manner. The only difference is that the crypto assets will be used to fund loans. This Crypto.com staking review found that dozens of tokens are supported and investors can choose from flexible withdrawal terms or a 1/3-month lock-up period.

The best interest rates are offered on longer-term agreements. Crypto.com staking rewards offer an APY of up to 14.5% on crypto and up to 8.5% on stablecoins. Moreover, the best APYs require the user to stake CRO tokens, which are native to Crypto.com. Those using the Crypto.com exchange will have access to more than 250 coins. Debit/credit card payments attract a fee of 2.99%.

| Staking Rewards on Cryptocurrencies | Up to 14.5% APY on interest accounts |

| Min & Max Staking Amounts | $1 – $1 million |

| Lock-In Period | Flexible, 1-month, and 3-month accounts |

| Security & Regulation Features | Regulated by CySEC |

| Additional Rewards Offered | When staking CRO tokens |

| Payout Frequency | Weekly |

Pros

- Lowest crypto trading fees in the industry

- Earn up to 14.5% on crypto interest accounts

- Stablecoins are supported too

- Choose from a flexible, 1-month, or 3-month term

- Minimum investment of just $1

Cons

- Debit/credit cards attract a fee of 2.99%

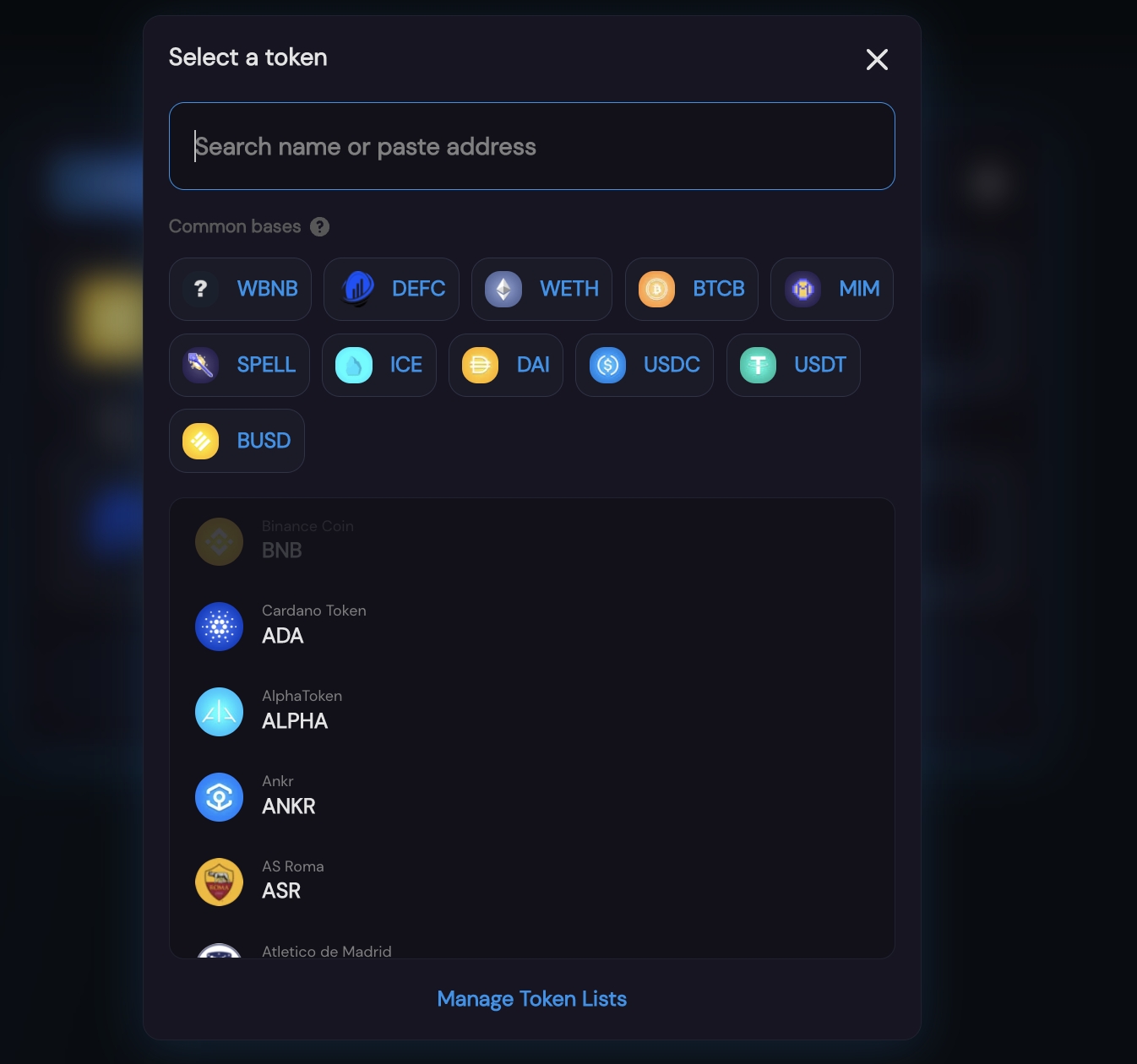

9. DeFi Swap – New Decentralized Exchange With High-Yield Staking Tools, Up to 75% APY on DEFC

DeFi Swap is the best crypto staking platform for investors that prefer using decentralized exchanges. This means that investors will be able to earn staking rewards without using an intermediary. Instead, investors only need to link their crypto wallet to the DeFi Swap exchange, meaning no private information or KYC documents.

DeFi Swap is an up-and-coming exchange in this space that initially, will support staking agreements on tokens operating on the Binance Smart Chain. Further down the line, DeFi Swap will support cross-chain functionality. This means that investors will be able to stake tokens on other blockchain networks – such as Ethereum and Solana.

DeFi Swap also offers decentralized trading services. After connecting a wallet, users can swap one token for another without needing a seller at the other end of the trade. Fees are extremely competitive on DeFi Swap and the platform itself is user-friendly. DeFi Swap also supports yield farming, which is another way to generate passive income in addition to staking.

Another interesting aspect of the DeFi Swap exchange is that the project has its own native digital asset – DeFi Coin (DEFC). This sits at the heart of all DeFi Swap exchange services and subsequently enables investors to gain exposure to its growth. DeFi Coin can be purchased on DeFi Swap, in addition to PancakeSwap.

| Staking Rewards on Cryptocurrencies | 75% on DeFi Coin |

| Min & Max Staking Amounts | None |

| Lock-In Period | 30, 90, 180, 365 days |

| Security & Regulation Features | Decentralized |

| Additional Rewards Offered | Yield farming supported |

| Payout Frequency | At the end of the respective staking term |

Pros

- Decentralized staking in crypto tool

- No account registration or personal information required

- High APYs on BSc tokens

- Cross-chain functionality is a work-in-progress

- Also supports token swaps and yield farming

Cons

- Does not support fiat money payments

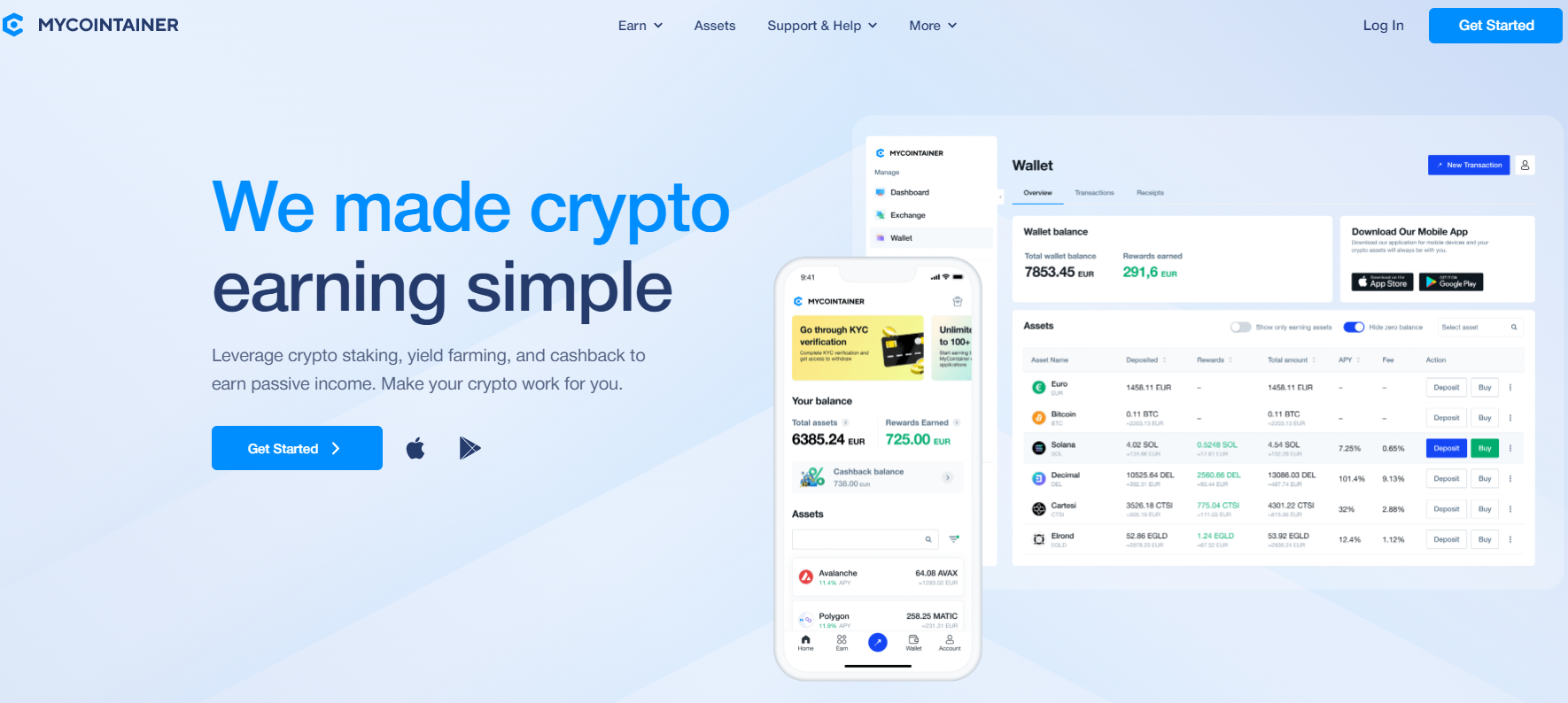

10. MyCointainer – Earn up to 133% APY by Running Nodes

Crypto earning platform MyCointainer allows its users to earn up to 133% APY by running nodes for 122 different assets and collecting rewards in multiple ways: exchange, PoS, masternodes, or cold staking.

Users can track daily returns both in the mobile app (iOS or Android) or in a desktop version.

The platform has been on the market for four years having been launched by Bartosz Pozniak in 2018 – the service operates legally from Estonia with support available worldwide through its mobile app.

MyCointainer also provides users with a wide range of ways to deposit funds into their wallet – from widespread SEPA & SWIFT payments and Visa/Mastercard to less conventional but very fast and convenient payment methods.

As for the additional rewards, the platform offers crypto cashback, airdrops and a referral program. The MyCointainer Crypto Cashback extension sees users get 56% of their money back when shopping online, with the platform partnered with around 300 online stores and services worldwide – including in categories like clothing, education, tourism and entertainment.

MyCointainer provides users with the possibility to take part in multiple airdrops, with seven operating on the platform at the time of writing.

The airdrops can earn from 40 USDT to 1,000,000 USDT, although they are time sensitive so investors should take care they don’t miss such offers.

MyCointainer referral program is versatile and currently offers three different types of referral rewards:

- €15 of free staking tokens for each invite

- 20% from MyCointainer earnings for each of your friend

- 10% of net price for referring MyCointainer’s ‘stake-all’ hosting

On top of that, MyCointainer platform offers a power subscription that helps you avoid reward fees and gives access to various kinds of VIP giveaways.

| Staking Rewards on Cryptocurrencies | Up to 133% APY |

| Min & Max Staking Amounts | Min – 10EUR, Max – None |

| Lock-In Period | None |

| Security & Regulation Features | Regulated in Estonia |

| Additional Rewards Offered | Cashback, airdrops, referrals |

| Payout Frequency | Daily |

Pros

- Daily rewards generation with detailed report

- Fiat currencies are available

- iOS & Android mobile apps

- Unlimited access to 120+ assets

- Beginner-friendly UX

Cons

- Not all coins are available for staking

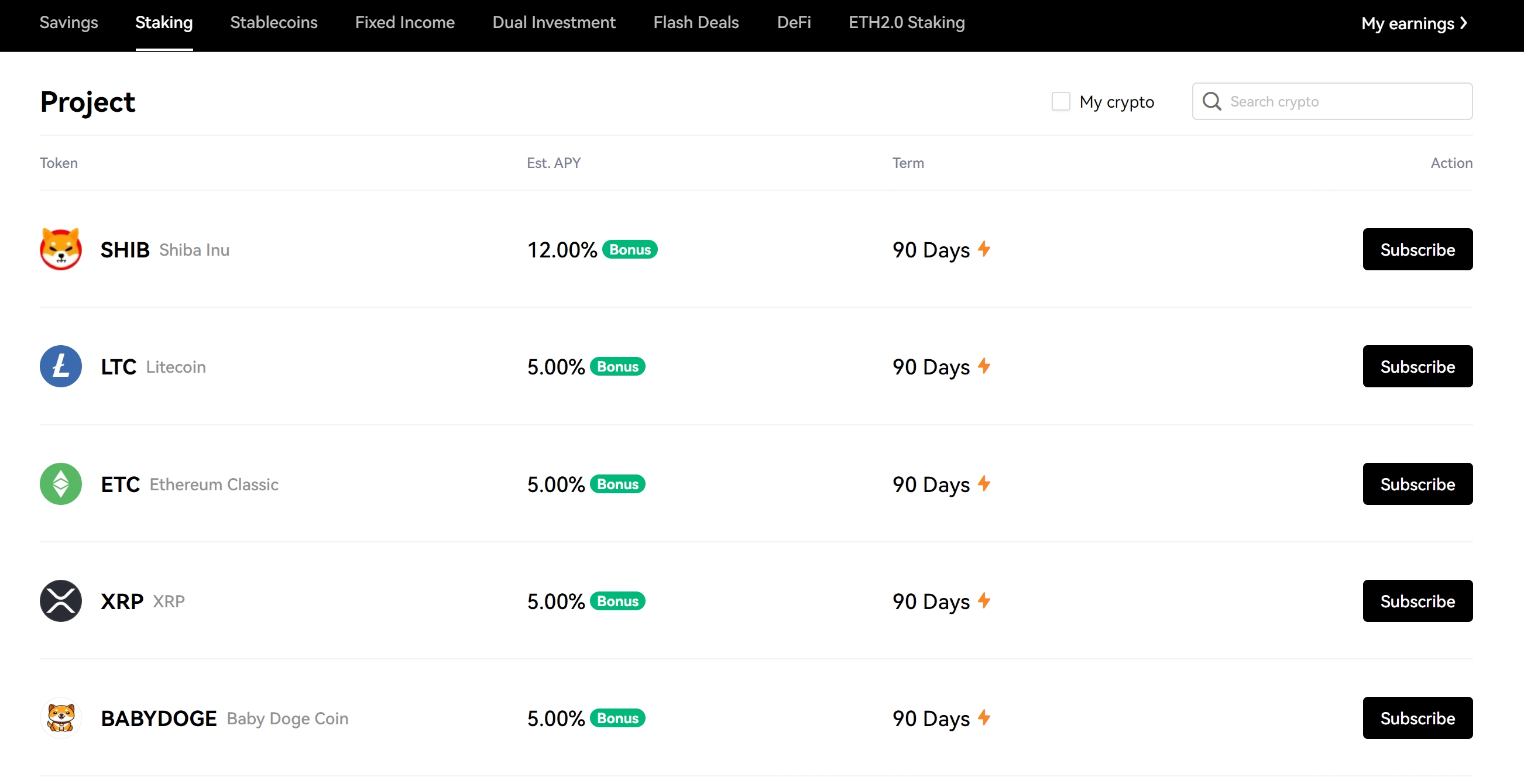

11. Binance – Stake 14 Different Coins for Competitive APYs up to 76%

The Binance ecosystem now consists of the world’s largest crypto exchange for trading volume, a top-5 digital asset by market capitalization, and a fully-fledged facility for earning passive income. As of writing, the Binance staking tool supports 14 coins. This includes everything from BNB, AAVE, and Ethereum to XRP, Litecoin, and Bitcoin.

Yields vary depending on the coin, albeit, the highest interest rate as of writing is being paid on DYDX at 8.7%. Some staking coins come with flexible withdrawal terms, while others require a lock-up period of up to 120 days. It is possible to earn an even higher yield by opting for a Binance interest account. Axie Infinity, for example, on a 90-day term yields an APY of 76%.

In addition to offering interest-bearing products, Binance is one of the cheapest crypto exchanges in this space. Buying and selling crypto will cost just 0.1% per slide here. Binance supports more than 1,000 markets, which includes many of the best meme coins for speculative investors. Binance also lists a range of fast-growing cryptocurrencies from the BSc network.

| Staking Rewards on Cryptocurrencies | Up to 8.7% |

| Min & Max Staking Amounts | Depends on the coin |

| Lock-In Period | From flexible to 180 days |

| Security & Regulation Features | Regulated digital asset service provider in several jurisdictions |

| Additional Rewards Offered | Yield farming and interest accounts supported |

| Payout Frequency | At the end of the respective staking term |

Pros

- 14 assets can be staked

- Various terms and yields on offer

- Also supports yield farming and interest accounts

- Hosts some of the best crypto giveaways

Cons

- Some staking pools sell out quickly

12. BlockFi – Lend Out Crypto to generate Interest Payments, Earn up to 7.5% APY

BlockFi is a leading crypto lending platform that supports interest accounts and loans. While BlockFi does not support staking tools per se, it does enable investors to deposit coins for the purpose of generating passive income. The coins deposited by investors will subsequently be used to fund third-party loans that are secured by crypto.

BlockFi supports interest accounts on 15 crypto assets, which includes a selection of stablecoins. Interest rates will vary depending on the coin and the amount that has been invested. For example, investors can earn an APY of 3.5% on Bitcoin, up to the first 0.1 BTC. For deposits above this amount, interest of 2% is paid.

The best rates, however, are actually offered on stablecoins – which will appeal to investors that wish to earn passive income without witnessing volatility. BUSD and USDC, for example, yield 7.5%.

| Staking Rewards on Cryptocurrencies | Up to 7.5% |

| Min & Max Staking Amounts | Not stated |

| Lock-In Period | Flexible withdrawals |

| Security & Regulation Features | Licensed by the Bermuda Monetary Authority |

| Additional Rewards Offered | Credit card cashback rewards |

| Payout Frequency | Monthly |

Pros

- Earn up to 7.5% on stablecoins

- Flexible withdrawals

Cons

- Small limits on the highest rates offered

- APYs change at a moment’s notice

13. Nexo – Top Earning Platform for High Yields, up to 36% APY

Nexo is a direct competitor to BlockFi, as the platform specializes in crypto lending services. Investors can deposit tokens into Nexo to earn a high rate of interest, with the likes of Axie Infinity yielding up to 36%. Bitcoin and Ethereum are competitive too, with yields of up to 7% and 8% on offer, respectively.

However, in order to get the best rates possible on Nexo, investors will need to meet certain terms. This typically includes meeting a minimum lock-up term of one month and receiving interest payments in NEXO tokens. Nonetheless, Nexo is popular for fast payouts, with rewards distributed on a daily basis. Nexo does not collect any fees from the APYs advertised.

| Staking Rewards on Cryptocurrencies | Up to 36% |

| Min & Max Staking Amounts | Not stated |

| Lock-In Period | Flexible withdrawals, but the highest rate kicks in after one month of holding |

| Security & Regulation Features | Licensed in various jurisdictions |

| Additional Rewards Offered | Higher rates when electing to receive rewards in NEXO |

| Payout Frequency | Daily |

Pros

- One of the best crypto staking rewards for high yields

- APYs of up to 36%

Cons

- Need to hold tokens for at least one month to get the best rates

- Best rates require users to receive rewards in NEXO

14. Bitstamp – Established Crypto Exchange Offering Staking, up to 4.12% APY

Bitstamp is an established crypto exchange that was founded in 2013. The platform is primarily used by traders that seek low commissions and access to a diversified range of markets. Trading volumes of under $1,000, for example, have access to 0% commissions when buying and selling crypto.

Although Bitstamp also offers staking services, only two crypto assets are supported at this moment in time. This includes Ethereum, which offers an APY of 4.12%. The other crypto asset supported is Algorand, which offers an APY of just 1.6%. The minimum staking amount on Ethereum is 0.1 ETH. There is no minimum when staking Algorand.

| Staking Rewards on Cryptocurrencies | Up to 4.12% |

| Min & Max Staking Amounts | 0.1 ETH, no minimum on ALGO |

| Lock-In Period | Flexible withdrawals |

| Security & Regulation Features | Regulated in Luxembourg |

| Additional Rewards Offered | None |

| Payout Frequency | ETH is monthly, ALGO is typically quarterly |

Pros

- Established and trusted crypto exchange founded in 2011

- No minimum staking investment on Algorand

Cons

- Ethereum staking requires a minimum of 0.1 ETH

- Yields are low

- Just two coins supported for staking

Best Crypto Staking Platforms Compared

The comparison table below offers a recap of the highest APY crypto staking platforms reviewed in the sections above:

| Staking Platforms | Staking Rewards on Cryptocurrencies | Min & Max Staking Amounts | Lock-In Period | Security & Regulation Features | Additional Rewards Offered | Payout Frequency |

| Smog | 42% | None | Yes | Decentralized | Community rewards | N/A |

| Sponge V2 | Min 40% | None | Yes | Decentralized | Community rewards | NA |

| Bitcoin Minetrix | Up to 190% APY | None | 14 days | Decentralized | Community rewards | N/A |

| Meme Kombat | Up to 112% APY | None | 14 days | Project is doxxed | Free tokens on ecosystem through wagering | N/A |

| OKX | Up to 300% APY | None | Flexible or 15, 30, 60, 90, 120 days | Regulated in Malta | None | Hourly |

| Crypto.com | Up to 14.5% APY on interest accounts | $1 – $1 million | Flexible, 1-month, and 3-month accounts | Regulated by CySEC | Higher rates when staking CRO tokens | Weekly |

| DeFi Swap | 75% on DeFi Coin | None | 30, 90, 180, 365 days | Decentralized | Yield farming supported | At the end of the respective staking term |

| Binance | Up to 8.7% | It depends on the coin | From flexible to 180 days | Regulated digital asset service provider in several jurisdictions | Yield farming and interest accounts supported | At the end of the respective staking term |

| Coinbase | Up to 5.75% | Not stated | Flexible withdrawals | Regulated by relevant US licensing bodies | DeFi yield rewards on Dai and Tether | It depends on the coin being staked |

| Blockfi | Up to 7.5% | Not stated | Flexible withdrawals | Licensed by the Bermuda Monetary Authority | Credit card cashback rewards | Monthly |

| Nexo | Up to 36% | Not stated | Flexible withdrawals, but the highest rate kicks in after one month of holding | Licensed in various jurisdictions | Higher rates when electing to receive rewards in NEXO | Daily |

| Kraken | Up to 20% | Not stated | Flexible withdrawals | Registered as a money service business in the US | None | Bi-weekly |

| BitStamp | Up to 4.12% | 0.1 ETH, no minimum on ALGO | Flexible withdrawals | Regulated in Luxembourg | None | ETH is monthly, ALGO is typically quarterly |

Our Methodology – How We Rated the Best Crypto Staking Platforms

The best crypto staking platform for you has to align with your goals, preferences, and risk tolerance. These were the key factors that the platforms we assessed had to have to make the cut, along with the weighting that each factor had on the ranking.

Security – 20%

Each platform had to have robust security measures in place, such as two-factor authentication (2FA), encryption, and cold storage for funds.

Staking Rewards – 20%

Different platforms offer different staking rewards. While the highest staking rewards are very appealing, they naturally come with higher risks as well. We listed a mix of platforms for investors with both high and low-risk appetites.

Staking Options – 20%

We listed crypto staking options that supported different coins for the convenience of as broad a base of users as possible. We also took into account whether the platforms support both proof-of-stake (PoS) and delegated proof-of-stake (DPoS) consensus mechanisms, as this can affect staking rewards and participation.

User Interface and Experience – 10%

The best DeFi staking platforms should be built to be as user-friendly as possible, so our top picks have intuitive interfaces and easy navigation. If they offer detailed stats and information about users’ staking activities, it’s a plus.

Fees – 10%

We evaluated the fee structure of the high yield crypto staking platforms, including staking fees, withdrawal fees, and any other associated costs. The platforms we recommended were upfront about their fees, but it’s never a bad idea to read the terms and conditions carefully to make sure that everything is fully transparent.

Customer Support – 10%

We recommended the best crypto exchanges for staking that provided responsive customer support to address our concerns and instantly troubleshot any problems we came across.

Backup and Recovery Options – 10%

Most of the platforms that we recommended offer backup and recovery options in case of unexpected events. It’s not enough to have the highest staking rewards – your staked assets also need to be protected.

The Basics of Staking Crypto

Staking enables investors to earn interest on tokens that would other remain idle in a crypto wallet. It is, however, important to have a firm grasp of how crypto staking works before proceeding.

The purpose of this section is, therefore, to explain the basics of staking cryptos.

How Does Cryptocurrency Staking Work?

In its most basic form, staking requires the investor to deposit tokens into the respective blockchain network. This helps keep the network safe and decentralized. Miners – who verify blockchain transactions are rewarded for their efforts with the staked tokens.

In turn, the investor that staked the tokens will be paid interest. This will be the case for as long as the investor staked the token. Yields will vary depending on the coin and underlying blockchain network. Nonetheless, staking offers a passive way to generate crypto rewards.

Another factor to remember about staking is that oftentimes, there will be a minimum lock-up period. This refers to the number of days that the tokens will remain locked in the respective blockchain network. During this time, the investor will not be able to withdraw their tokens.

Crypto Mining vs Staking

Both crypto mining and staking go hand in hand. However, the two terms refer to different processes.

Regarding mining, this refers to the process of verifying blockchain transactions to ensure the network remains decentralized and secure.

In most cases, anyone can be a miner simply by connecting specialist hardware to a device. This offers a passive way to earn free crypto, albeit, certain costs remain present – such as the consumption of electricity.

Staking, on the other hand, refers to the process of locking crypto tokens for a minimum number of days. The tokens are used to reward miners for their efforts. Staking is a lot more cost-effective when compared to mining, albeit, yields are often less competitive. For more details on crypto mining readers can explore our article on the best crypto mining platforms in 2024.

On-Chain & Off-Chain Staking

Investors will often have the option of staking tokens on-chain or off-chain.

On-chain staking refers to the process of depositing tokens directly into the respective blockchain protocol. This is often considered the safest option of the two, but a lot more complex. Moreover, minimum staking requirements can be high when opting for an on-chain agreement.

Off-chain staking enables investors to generate passive income via a third-party platform – such as Crypto.com. This typically offers a less attractive yield, but off-chain staking is more user-friendly. Furthermore, off-chain staking often requires a much lower capital outlay.

Why Stake Crypto?

Long-term investors with an interest in crypto would be wise to consider staking. The reason is that upon buying crypto, the tokens will sit idle in an exchange or wallet without generating any income. This is like buying an investment property and not renting it out to tenants.

In comparison, by instead staking the purchased crypto, investors will earn passive income. Those who engage in staking will still own the respective crypto assets outright, so any capital gains that the tokens generate will still be realized.

- For example, let’s say that an investor owns 2 ETH and decides to stake at an APY of 5%.

- After 12 months of staking, the investor will have generated an additional 0.1% ETH in rewards.

- As such, they now own 2.1 ETH. If the value of ETH has since increased in the open market, this will amplify the investor’s capital gains.

The only downside to staking is if the investor opts for an agreement that requires a minimum lock-up period. While the tokens are locked, the investor will not be able to request a withdrawal. During this timeframe, an opportunity cost might arise.

Crypto Staking Taxes

Crypto taxes in general will vary depending on the location of the investor. With that said, in many jurisdictions, crypto staking is taxed in a similar nature to income.

This is in stark contrast to crypto capital gains, which in most cases are only payable once the tokens have been sold.

Taxes on staking will often be determined by the value of the rewards when they were received.

This can make it challenging to know exactly how much tax is due, considering the volatile nature of the crypto space.

Investors are strongly advised to consult with a tax specialist to assess their crypto staking obligations.

Is Staking Crypto Safe?

There will always be an element of risk when staking crypto.

First and foremost, while the investor might generate income from their staking endeavors, the process can still result in a loss if the value of the respective token declines in the open market.

Moreover, when staking off-chain, investors need to consider the risk of the platform itself. After all, if the staking platform runs into financial issues, it might not be able to return the tokens that have been deposited by investors.

There is also risk associated with on-chain staking. After all, if the network is hacked, this could result in the staked tokens being stolen.

Conclusion – Finding the Best Bitcoin Staking Platforms

This guide has compared and contrasted the best staking crypto platforms on the market today. We have covered a blend of on-chain and off-chain options, across a variety of yields and supported coins.

We recommend the new Smog token as the highest APY crypto staking platform. It is a hot new Solana-powered meme token with massive airdrop rewards and a staking APY of 42%.

Highest APY Crypto Staking Platforms FAQs

What is crypto staking?

Crypto staking is a passive investment strategy. It requires investors to deposit their crypto assets into a blockchain protocol to help keep the network safe and operational. Investors will then be paid a rate of interest on the tokens for as long as they are staked.

One of the best crypto for staking right now is Ethereum, which recently transitioned to proof-of-stake. As such, Ethereum is now considered the best proof-of-stake coin to buy and hold long-term. This will also make Ethereum one of the most energy-efficient cryptocurrencies on the market. BTC20 is another excellent coin for staking, though the APY is not yet known.

Is crypto staking worth it?

Yes, it goes without saying that crypto staking is worth it. Otherwise, the respective tokens will remain in a crypto wallet without generating any income. Staking enables the investor to earn passive income for as long as the tokens are held.

What is the best crypto staking platform?

One of the top crypto staking platforms is Smog. It offers a high minimum staking return of 42% for early stakers.

How can I stake cryptocurrency?

The easiest way to stake crypto is to opt for a third-party platform that offers off-chain staking. The process typically requires the investor to open an account with the platform before depositing their tokens into the staking pool. Interest on the tokens will be generated thereon.

Can you get rich from staking crypto?

Some crypto assets attract highly lucrative staking rewards – which can be as high as double or even triple-digit APYs. However, there is no guarantee that the investor will make a financial return when staking. After all, if the value of the token declines in the open market by more than is being generated in staking rewards, the investor will make a loss.

The post 14 Best Crypto Staking Platforms with Highest APY Yields in 2024 appeared first on Cryptonews.