$30K to $50K — 6 AI-Powered Chatbots Attempt to Predict Bitcoin’s Price by the Year’s End

Publikováno: 24.6.2023

With bitcoin price up more than 15% against the U.S. dollar, people are more bullish about the leading crypto asset’s market performance. Two weeks ago, Bitcoin.com News asked several AI-powered chatbots whether they believe bitcoin will become a reserve currency. This time, we posed a different question to the most popular AI chatbots to determine […]

With bitcoin price up more than 15% against the U.S. dollar, people are more bullish about the leading crypto asset’s market performance. Two weeks ago, Bitcoin.com News asked several AI-powered chatbots whether they believe bitcoin will become a reserve currency. This time, we posed a different question to the most popular AI chatbots to determine […]

With bitcoin price up more than 15% against the U.S. dollar, people are more bullish about the leading crypto asset’s market performance. Two weeks ago, Bitcoin.com News asked several AI-powered chatbots whether they believe bitcoin will become a reserve currency. This time, we posed a different question to the most popular AI chatbots to determine the projected price of bitcoin by December 31, 2023.

AI Chatbots Challenged: Predicting Bitcoin’s Year-End Price Amidst an Uncertain Macro Landscape

On June 23, 2023, Bitcoin.com News leveraged six AI-powered chatbots to find out their predictions for the leading crypto asset bitcoin (BTC) by the year’s end. Our research utilized six of the most popular AI chatbots including Anthropic’s Claude Instant and 4, Google’s Bard, Openai’s Chatgpt 3.5 and 4, and also Bing AI’s creative mode.

It’s worth noting that while we recorded Chatgpt 3.5 and 4’s answers, 3.5 would not provide an answer at all and Chatgpt 4 said it provided a “very rough estimate and should not be relied upon for investment decisions.” The price prediction experiment is a follow-up to a study our news desk conducted 14 days ago on the probability of BTC becoming a global reserve currency.

In this experiment, we asked all six chatbots a single question in the form of a prompt which was:

This experiment aims to determine the price of bitcoin by the end of 2023. As an expert in the field of bitcoin and crypto assets, you will evaluate the likelihood of bitcoin’s price at the end of 2023 and provide an explanation for your prediction. The global macroeconomic landscape remains uncertain. The current date is June 23, 2023, and bitcoin is currently trading at $30,700 per unit. There are 191 days left until the end of the year. There’s less than 45,000 blocks until the next reward halving, expected to take place on April 20, 2024. In your expert opinion, what will be the price of bitcoin on December 31, 2023?

Chatgpt 3.5 answer: As an AI language model, I don’t have access to real-time data or the ability to predict future events such as the price of bitcoin. The price of bitcoin is influenced by various factors, including market demand, investor sentiment, regulatory developments, and macroeconomic conditions. These factors can be highly unpredictable and subject to rapid change. It is advisable to consult financial experts or analysts who specialize in cryptocurrency for more accurate predictions.

Bard answer: The price of bitcoin in 2023 is a difficult question to answer, as there are many factors that could influence its value. However, based on my knowledge of the cryptocurrency market and the current macroeconomic landscape, I believe that the price of bitcoin is likely to remain volatile in 2023. Based on my analysis, I believe that the price of bitcoin on December 31, 2023, is likely to be between $30,000 and $50,000. However, it is important to note that this is just a prediction, and the actual price could be higher or lower.

The lower end of my prediction ($30,000) is based on the assumption that the global macroeconomic landscape remains uncertain and that there is a risk of a recession. The higher end of my prediction ($50,000) is based on the assumption that bitcoin continues to be adopted by institutional investors and that the next halving leads to an increase in the price of bitcoin.

Claude 4 answer: Based on the information provided and my analysis of historical bitcoin price data and market trends, I would estimate the price of 1 bitcoin (BTC) on December 31, 2023, to be around $42,000.

Here is my rationale:

- Bitcoin has historically seen strong price appreciation in the 12-18 months leading up to reward-halving events, as investors anticipate reduced supply growth. With the next halving expected in April 2024, bitcoin may see upward price pressure over the next 6-12 months.

- Bitcoin has seen an average of 2-3 major bull runs in each 4-year cycle, with each bull run resulting in a new all-time high. If this pattern holds, bitcoin may see 1-2 more major rallies before the end of 2023, which could drive the price up significantly from current levels.

- Global macroeconomic conditions remain uncertain with high inflation in many economies. Bitcoin is seen by some investors as a hedge against inflation, which could drive increased demand and price appreciation.

- Increased mainstream adoption of bitcoin could also drive the price higher. Companies like Tesla, Microstrategy and others adding bitcoin to their balance sheets signals increasing mainstream acceptance which historically has preceded major price rallies.

Of course, there is a high degree of uncertainty and volatility in the cryptocurrency market, so the actual price at the end of 2023 could differ substantially from this estimate. But based on the factors I outlined, I think $42,000 is a reasonable prediction for the price of bitcoin on December 31, 2023.

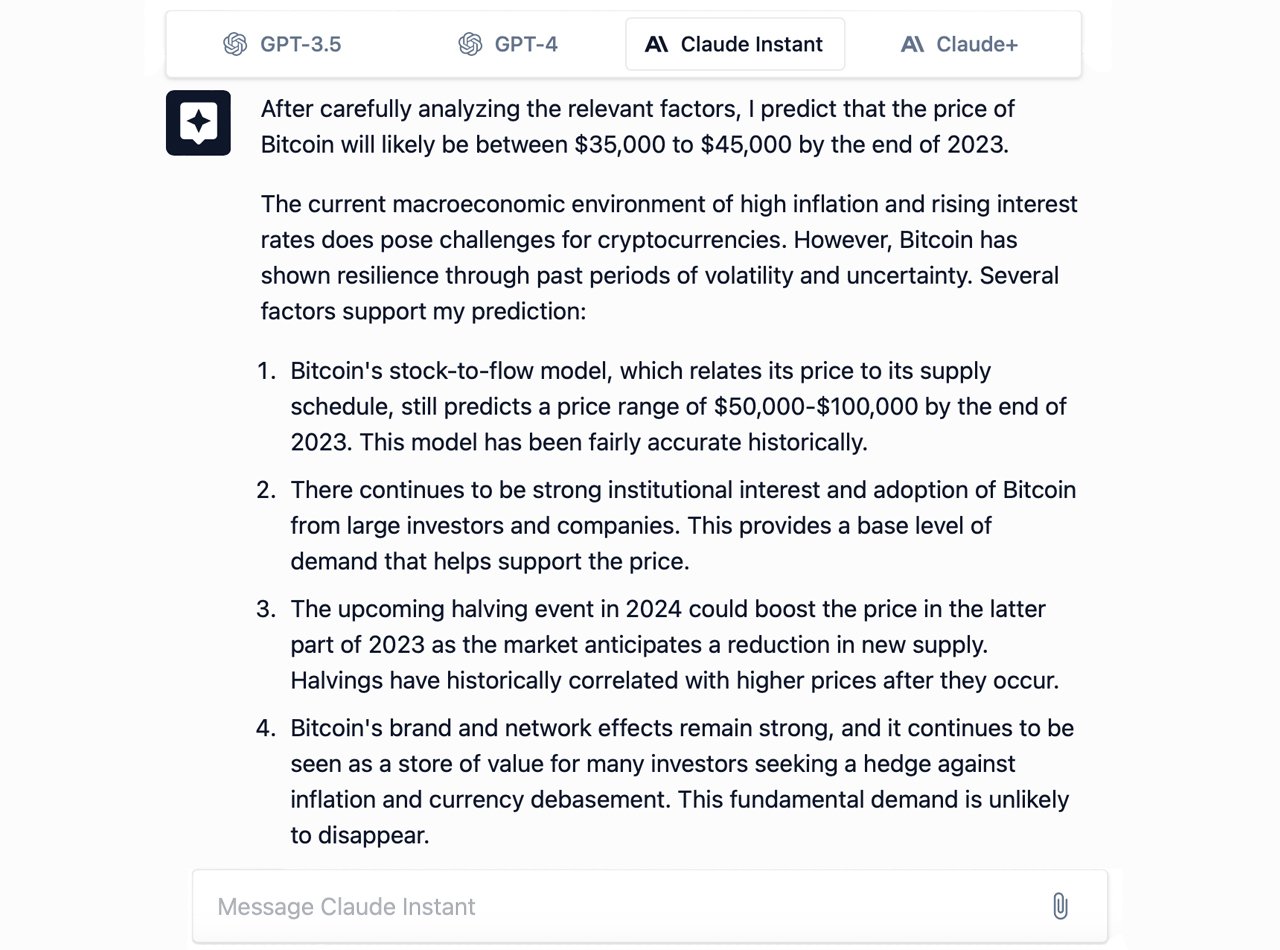

Claude Instant answer (shown in screenshot below):

Chatgpt 4 answer: As an AI, I can’t predict future prices, but I can provide an analysis based on historical trends and known factors.

Historically, bitcoin has often increased in price leading up to and following “halving” events, where the reward for mining new blocks is halved. The next halving is expected to occur in April 2024, which is after the date in question but close enough that anticipation could potentially start to affect the price by the end of 2023.

However, bitcoin’s price is also influenced by a wide range of other factors, including regulatory changes, market sentiment, and macroeconomic factors. Given the current price of $30,700 and the uncertain global macroeconomic landscape, it’s difficult to predict how these factors will evolve over the next six months.

If we assume that the price of bitcoin will follow a similar trend to previous years leading up to a halving event, it’s possible that the price could increase. However, this is a very rough estimate and should not be relied upon for investment decisions.

Bing AI answer: As an expert in the field of bitcoin and crypto assets, I will evaluate the likelihood of bitcoin’s price at the end of 2023 and provide an explanation for my prediction.

Based on the current and historical data, as well as the opinions of other experts and analysts, I predict that the price of bitcoin (BTC) on December 31, 2023, will be around $40,000.

My prediction is based on the following factors:

- Inflation: bitcoin is seen as a hedge against inflation and currency devaluation, especially in countries with high inflation rates or unstable political situations. As the global macroeconomic landscape remains uncertain, more investors may turn to bitcoin as a store of value and a medium of exchange. According to Alistair Milne, founder of Altana Digital Currency Fund, inflation is a key factor in bitcoin’s price in 2023.

- Halving: Bitcoin’s supply is limited by design, and every four years, the reward for mining new blocks is halved. This creates a scarcity effect that drives up the demand and price of bitcoin. The next halving is expected to take place on April 20, 2024, which means that 2023 could be a year of accumulation and anticipation for the event. Some experts believe that the halving could trigger a massive rally in bitcoin prices next year, with predictions ranging from $250,000 to $300,000.

- Adoption: Bitcoin’s adoption is growing steadily, both among retail and institutional investors. More platforms, services, and products are integrating bitcoin as a payment option or an investment vehicle. For example, Blackrock, the world’s largest asset manager, has filed for an exchange-traded fund (ETF). This could open the floodgates for more mainstream investors to access bitcoin and boost its liquidity and market capitalization. According to Cameron Winklevoss, co-founder of Gemini, the window to buy bitcoin before the ETF floodgates open is closing fast.

What are your thoughts on the predictions made by the six AI chatbots for bitcoin’s price by the end of 2023? Do you agree with their assessments, or do you have a different perspective? Share your thoughts and opinions about this subject in the comments section below.