$510 Million in Ethereum Longs at Risk Amid Potential Weekend Volatility – Massive Price Swing Incoming?

Publikováno: 26.4.2024

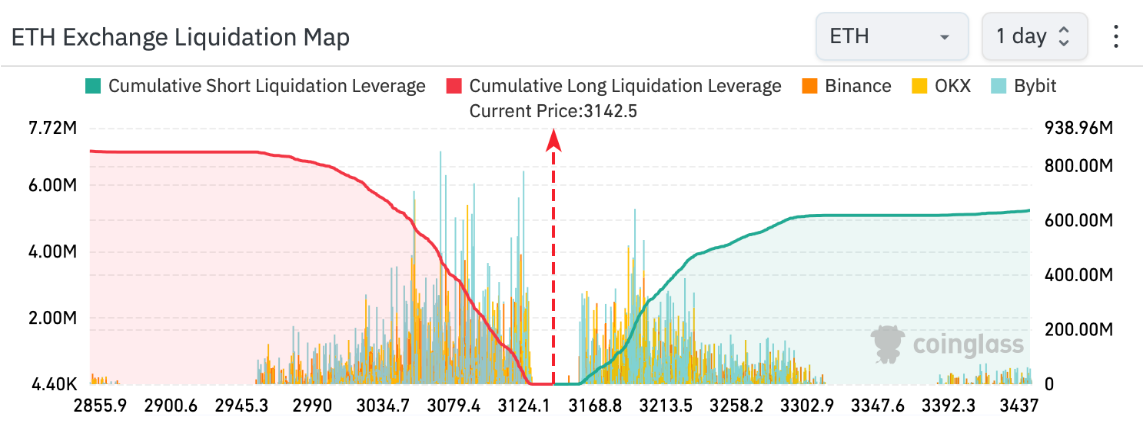

Over $500 million in Ethereum longs could be liquidated if the cryptocurrency experiences another sharp price swing this weekend. Recent volatility highlights the risk, while the SEC's pending decision on spot Ether ETFs adds further uncertainty to the market.

The post $510 Million in Ethereum Longs at Risk Amid Potential Weekend Volatility – Massive Price Swing Incoming? appeared first on Cryptonews.

Over $500 million in Ethereum (ETH) long positions could be liquidated if the price experiences another major drop this weekend. This concern stems from the recent volatility witnessed in the ETH market, with sharp price swings becoming a recurring theme.

Price Swings Threaten Ethereum Longs

Last weekend, the price of ETH plunged by 2.5%, dropping to $3,036, triggering liquidations for some long positions.

An even steeper decline of 9% occurred on April 13, pushing the price down to $2,950 before a rebound.

ETH is currently trading at $3,052, down 0.52% in the last 24 hours.

A similar price swing this coming weekend could lead to a larger wave of liquidations. Based on current market positions, liquidations could potentially exceed $853 million in the event of another 9% decline.

Ethereum Longs at Risk Amid Potential Weekend Volatility

Adding to Ethereum’s price uncertainty is the potential rejection of spot Ethereum ETF applications by the US Securities and Exchange Commission (SEC) in May.

Several US issuers and other firms anticipate that the Securities and Exchange Commission (SEC) will reject the applications.

#Ethereum ETF is likely not approved in May, bit it surely will in August.

— Michaël van de Poppe (@CryptoMichNL) April 26, 2024

The expectation follows a meeting between the four regulators and the concerned parties in the past few weeks. The regulators claimed that all these meetings have been one-sided, and agency staff have not spoken on the proposed products.

Blockchain technology company Consensys has recently filed a lawsuit against the SEC over its stance on potentially classifying ETH as a security.

The combination of potential weekend volatility and the ongoing regulatory uncertainty surrounding spot Ethereum ETFs is creating a tense atmosphere for Ethereum investors. With over half a billion dollars in longs at risk, this weekend could be a major moment for Ethereum investors and the altcoin market.

The post $510 Million in Ethereum Longs at Risk Amid Potential Weekend Volatility – Massive Price Swing Incoming? appeared first on Cryptonews.