Ark Invest CEO Warns Fed’s Actions Could Lead to 1929-Like Great Depression — Elon Musk Agrees

Publikováno: 14.11.2022

The CEO of investment management firm Ark Invest has warned that if the Federal Reserve does not pivot, the current economic setup will be similar to 1929 when the Great Depression started. Tesla CEO and Twitter chief Elon Musk agreed. The Fed, Inflation, and the Great Depression Ark Invest CEO Cathie Wood, who is also […]

The CEO of investment management firm Ark Invest has warned that if the Federal Reserve does not pivot, the current economic setup will be similar to 1929 when the Great Depression started. Tesla CEO and Twitter chief Elon Musk agreed. The Fed, Inflation, and the Great Depression Ark Invest CEO Cathie Wood, who is also […]

The CEO of investment management firm Ark Invest has warned that if the Federal Reserve does not pivot, the current economic setup will be similar to 1929 when the Great Depression started. Tesla CEO and Twitter chief Elon Musk agreed.

The Fed, Inflation, and the Great Depression

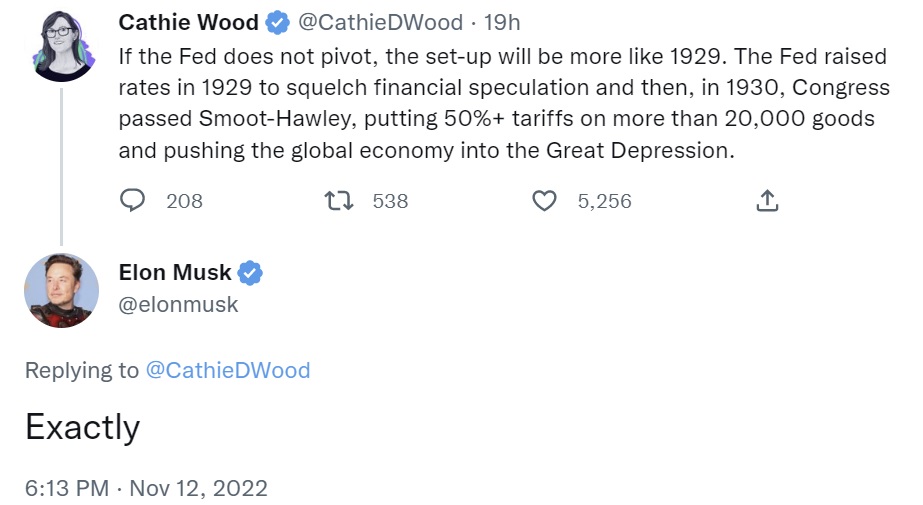

Ark Invest CEO Cathie Wood, who is also the investment management firm’s founder and CIO, shared her thoughts about inflation and how the Federal Reserve could push the global economy into a 1929-like depression in a series of tweets Saturday.

She explained that the Federal Reserve raised interest rates “to squelch financial speculation” in 1929, followed by Congress passing the Smoot-Hawley Tariff Act in 1930, which put more than 50% tariffs on over 20,000 goods and pushed the global economy into the Great Depression. “If the Fed does not pivot, the setup will be more like 1929,” she warned. Tesla, Spacex, and Twitter boss Elon Musk concurred.

Wood pointed out that “If inflation is unwinding, as we believe, then we could be heading back to the future, the Roaring Twenties,” emphasizing:

The setup is remarkably similar!

The Ark Invest executive noted that the world was at war prior to the Roaring Twenties, citing WWI and the Spanish Flu pandemic. Inflation soared during that time, peaking at 24% in June 1920, she continued, adding that the Federal Reserve responded by raising interest rates less than two-fold from 4.6% to 7% in 1919-1920.

Inflation then dropped “precipitously in one year to negative 15% in June 1921,” Wood said, noting that “the Fed lowered interest rates from 7% in May 1921 to 4% in July 1922, tripping the switch for the Roaring Twenties.” The executive additionally shared:

We would not be surprised to see broad-based inflation turn negative in 2023.

“Faced with much lower inflation this time around, the Fed has increased interest rates 16-fold, a serious mistake in our view,” she further opined.

“The University of Michigan’s Consumer Sentiment Survey is at a record low, below levels hit in 2008-09 and 1979-82, a setup for a liquidity trap like that in the Great Depression when massive monetary stimulus failed,” the Ark Invest chief cautioned.

Noting that the Great Depression and the Roaring Twenties are two possible outcomes, Wood described: “Given conflicting data and the stark difference in these outcomes, the Fed should be debating the possible risks associated with its current policy, at the very least, instead of voting unanimously.”

Emphasizing the similarity between today’s economic situation and the one in 1929, she stressed:

Unfortunately, today has some echoes of the same. The Fed is ignoring deflationary signals, and the Chips Act could harm trade perhaps more than we understand.

Do you agree with Ark Invest CEO Cathie Wood and Tesla CEO Elon Musk about the Fed and the risk of a 1929-like depression? Let us know in the comments section below.