Berkshire Hathaway’s Charlie Munger Advises Investors to Never Buy Bitcoin or Gold

Publikováno: 26.2.2021

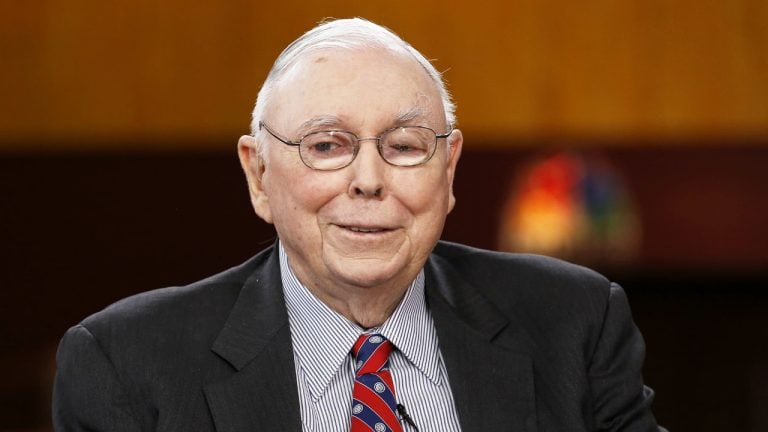

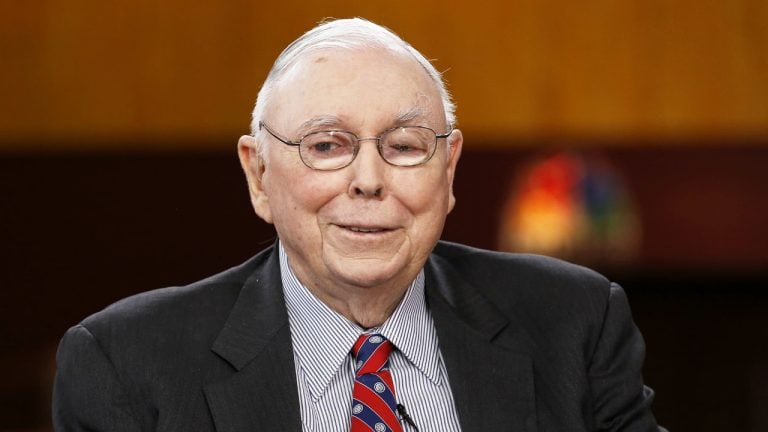

Berkshire Hathaway’s vice chairman and Warren Buffett’s long-time business partner, Charlie Munger, has advised investors not to buy bitcoin or gold. He believes the cryptocurrency is too volatile to serve well as a medium of exchange. Munger also says he doesn’t know which is worse between Elon Musk’s Tesla reaching $1 trillion in market cap […]

Berkshire Hathaway’s vice chairman and Warren Buffett’s long-time business partner, Charlie Munger, has advised investors not to buy bitcoin or gold. He believes the cryptocurrency is too volatile to serve well as a medium of exchange. Munger also says he doesn’t know which is worse between Elon Musk’s Tesla reaching $1 trillion in market cap […]

Berkshire Hathaway’s vice chairman and Warren Buffett’s long-time business partner, Charlie Munger, has advised investors not to buy bitcoin or gold. He believes the cryptocurrency is too volatile to serve well as a medium of exchange. Munger also says he doesn’t know which is worse between Elon Musk’s Tesla reaching $1 trillion in market cap or bitcoin hitting $50,000.

Billionaire Investor Charlie Munger Thinks Bitcoin Is Too Volatile to Be a Good Medium of Exchange

Legendary investor Charlie Munger answered some questions about bitcoin at the annual meeting of shareholders of the Daily Journal Corporation in Los Angeles on Wednesday. The Berkshire Hathaway vice-chairman and Warren Buffett’s long-standing business partner is also chairman of the Daily Journal. He is often known as Warren Buffett’s right-hand man.

The 97-year-old has never been a fan of bitcoin. He previously called bitcoin “rat poison” and likened its trading to “trading turds.” Buffett then called bitcoin “rat poison squared.”

During Wednesday’s meeting, Munger began by explaining why he does not see bitcoin as a future medium of exchange. “I don’t think I know exactly what the future of banking is, and I don’t think I know how the payment system will evolve. I do think that a properly run bank is a great contributor to civilization and that the central banks of the world like controlling their own banking system and their own money supplies,” he described, elaborating:

I don’t think bitcoin is going to end up the medium of exchange for the world. It’s too volatile to serve well as a medium of exchange.

“Bitcoin reminds me of what Oscar Wilde said about fox hunting. He said it’s the pursuit of the uneatable by the unspeakable,” Munger further opined.

Munger Talks About Tesla vs. Bitcoin

When asked about which he thought was crazier, the price of bitcoin hitting $50,000 or Elon Musk’s electric car company, Tesla, reaching $1 trillion in market cap, Munger referenced a quote by famous English writer Samuel Johnson. One of his well-known quotes was “Sir, there is no settling the point of precedency between a louse and a flea.”

Munger replied, “Well I have the same difficulty that Samuel Johnson once had when he got a similar question,” emphasizing:

I can’t decide the order of precedency between a flea and a louse, and I feel the same way about those choices. I don’t know which is worse.

Tesla’s market cap currently stands at $655 billion after its stock fell sharply since last Friday. Bitcoin’s price fell from the all-time high of above $58K on Sunday to $46,073 at the time of writing. Still, the cryptocurrency is up more than 43% since the beginning of the year based on data from markets.Bitcoin.com.

Moreover, some shareholders asked Munger whether his opinion on cryptocurrencies and bitcoin has remained the same and would the Daily Journal consider bitcoin or any other cryptocurrency as an asset on its balance sheet similar to what Tesla recently did. Elon Musk’s electric car company invested $1.5 billion in bitcoin in January, prompting many people to ask which other companies will be following its example and keep some cash reserves in bitcoin.

Responding to this question, Munger affirmed, “No, we will not be following Tesla into bitcoin.”

Munger’s Advice: Don’t Buy Bitcoin or Gold

The Berkshire Hathaway vice chairman proceeded to offer some advice regarding bitcoin and gold investing. He said:

It’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any bitcoin, and I recommend other people follow my practice.

The crypto community was quick to comment on Munger’s remarks about bitcoin. Morgan Creek Digital partner Anthony Pompliano opined: “Charlie Munger and Warren Buffett haven’t beat the S&P 500 in over a decade. Stop asking them about technology.”

Tahinis, the restaurant chain that was among the first companies to convert all of its cash into bitcoin, commented: “Charlie Munger in his latest interview calls bitcoin a gold-like asset. He is wrong again. Bitcoin is rat poison to all fiat-based instruments.”

What do you think about Charlie Munger’s view on bitcoin? Let us know in the comments section below.