Best Crypto to Buy Now December 11 – Bonk, BitTorrent, Injective

Publikováno: 12.12.2023

Bonk, BitTorrent, and Injective surge as the best cryptos to buy now while fresh presales Bitcoin ETF Token and Meme Kombat offer alternatives. Image by cryptonews.com. The cryptocurrency market saw widespread declines with the start of the week. Amid the overall downturn, some cryptocurrencies like Bonk, BitTorrent, and Injective managed to post gains following their […]

The post Best Crypto to Buy Now December 11 – Bonk, BitTorrent, Injective appeared first on Cryptonews.

The cryptocurrency market saw widespread declines with the start of the week. Amid the overall downturn, some cryptocurrencies like Bonk, BitTorrent, and Injective managed to post gains following their listings on major exchanges.

Additionally, there is growing anticipation about an upcoming decision from the Securities and Exchange Commission (SEC) regarding a proposed Bitcoin exchange-traded fund (ETF). If approved, a Bitcoin ETF could potentially help reverse the recent declines across the cryptocurrency market.

In anticipation of the SEC decision and a bullish market, some traders are investing early in new cryptocurrency presales like Bitcoin ETF Token and Meme Kombat. By buying these new cryptocurrencies before they become widely available, early investors hope to benefit if the cryptocurrencies gain popularity after launch.

Best Crypto to Buy Now in the News

The Solana-based meme cryptocurrency Bonk has risen to become the third-largest meme coin by market capitalization, with a huge 320% growth over the past month.

Its market capitalization now stands at roughly $700 million. Listings on major exchanges such as Binance and KuCoin, coupled with a surge in futures trading, have contributed to this growth.

Bonk’s correlation with the Solana coin’s performance and the broader market sentiment is also worth noting, as fluctuations in Solana’s price have recently paralleled those in BONK’s market action.

BitTorrent has also surged by more than 165% in the past week, pushing its monthly gains to 174%. The token’s trading volumes have soared, especially on Binance, where it has been trading a little over $117 million as of writing.

We’ve hit 200 MILLION accounts on the #TRONNetwork!

A massive shoutout to our #TRONICS – this milestone is all because of you!

To celebrate:

1000 USDD up for grabs!

Until 12/14

Join here

https://t.co/qgzNVIfKaK

Let’s celebrate together!

#TRON200M

— TRON DAO (@trondao) December 7, 2023

The Tron network’s milestone of reaching 200 million users has had a positive effect on BTT, which has seen its market cap exceed $1.2 billion. Despite these gains, the Relative Strength Index for BTT indicates that the token might be due for a cooldown.

Injective’s native token INJ set a new YTD high of $24.179 earlier today as it continues to exhibit an overall upward trend. With an annual increase of 1,335% and a rise in market cap, INJ has secured its spot as the 38th largest cryptocurrency.

Helix DEX’s growing market share has improved INJ’s accessibility, while the forthcoming Volan upgrade is expected to enhance the network’s performance.

The platform’s collaboration with Google Cloud is set to facilitate new dApp development and utilize on-chain data for advanced applications.

With a surge in social media activity and analysts predicting new all-time highs, INJ remains a token of interest.

Meanwhile, crypto presales are also offering new avenues for potential market players. Bitcoin ETF Token and Meme Kombat are among the latest to be introduced to the cryptocurrency market.

These projects are at the early stage of development but are already generating interest among market watchers and investors looking for the next significant opportunity within the crypto space.

As the market moves toward the year’s end, investors continue to closely monitor these cryptocurrencies. The best crypto to buy now seems to encompass a diverse selection of tokens, each with unique market dynamics and potential for future growth.

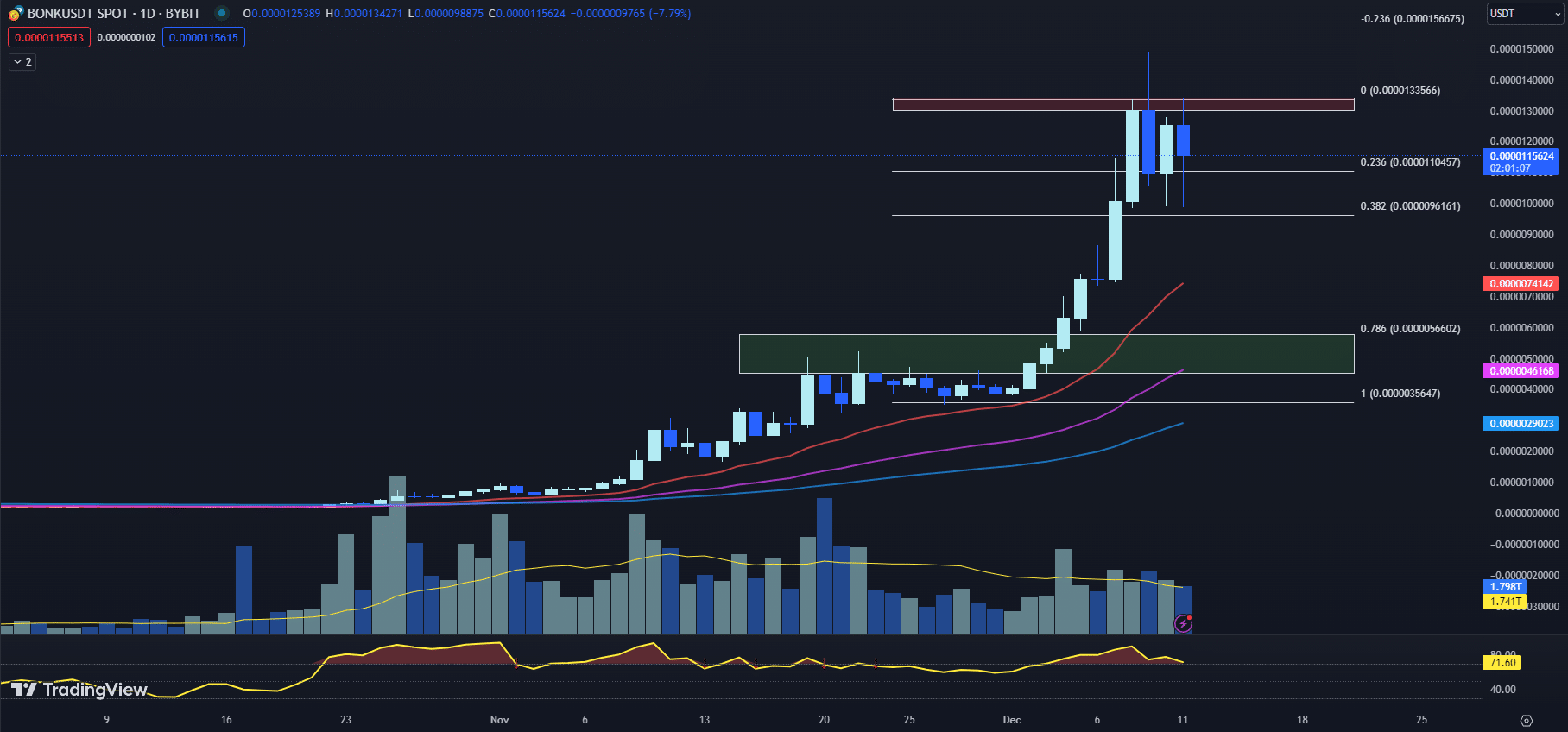

BONK Price Prediction: Testing Support and Resistance Levels

Following a bullish run in the early days of December, BONK has entered a phase of consolidation, oscillating within a narrow band defined by technical levels that are crucial for its short-term trajectory.

The EMAs for BONK have been revealing in terms of the coin’s momentum. The 20-day EMA, at $0.0000074068, has surged above both the 50-day and the 100-day EMAs, positioned at $0.0000046137 and $0.00000029008 respectively.

This alignment typically suggests that the upward momentum has been strong in the recent past, which often leads to bullish sentiment among investors. However, the BONK price’s recent drop of 7.79% in a single day warrants a closer examination.

The RSI for the BONK price has receded to 71.60 from the previous day’s 77.58, although still residing in the territory that indicates overbought conditions. This could imply that the BONK price may be ripe for a correction, as an RSI above 70 often suggests that an asset might be overvalued and could see a pullback as traders look to capture profits.

Concurrently, the MACD histogram, which has tapered slightly to 0.0000006593 from 0.0000007425, still indicates positive momentum, albeit with a decrease. This slowdown could suggest that while the overall trend remains bullish, the bullish pressure is waning, and caution is advised as the MACD is a lagging indicator and might not fully capture swift market shifts.

The BONK price’s present stance near $0.0000115624, down significantly on the day, is testing the immediate support at the Fib 0.236 level of $0.0000110457.

Should this level fail to hold, the BONK price could retreat toward the next Fib retracement level at 0.382, marked at $0.0000096161, which might serve as the subsequent line of defense for the bulls.

The resistance to beat for BONK bulls lies in the current swing high zone stretching from $0.0000130001 to $0.0000134277. A decisive closure above this zone could instigate a fresh rally, potentially inviting more buyers to the market.

Given the current market dynamics and technical indicator readings, traders might consider adopting a cautious approach, balancing the potential for both a pullback due to the overbought RSI and the possibility of a continued uptrend as suggested by the bullish crossover of EMAs.

The BONK price is at a critical juncture, and the market’s next move could be contingent on how these technical levels are respected in the immediate future.

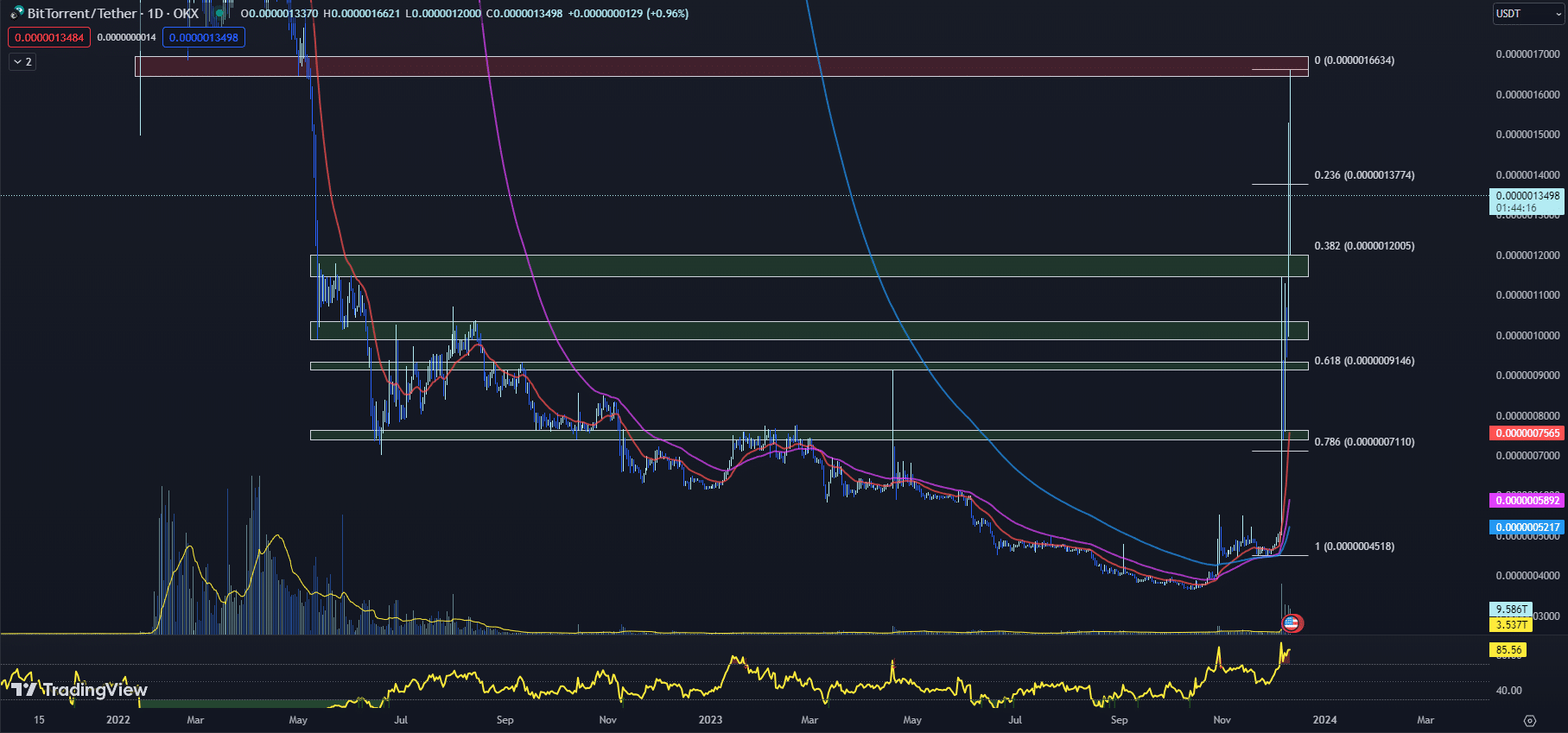

MACD Histogram Signals Potential Correction for the BTT Price

The BTT price has recently drawn attention from the trading community, building on the previous day’s notable 32.13% rally. Early in today’s trading session, BTT achieved a new year-to-date high, touching $0.0000016621, before retracting to the current level of $0.0000013498.

Despite this pullback, the BTT price maintains an uptrend, with a modest 0.96% increase today. The resilience of BTT, despite overbought conditions persisting for six days, suggests an underlying strength; however, traders are beginning to speculate on the likelihood of an impending correction.

Technical indicators present a compelling narrative for BTT. The 20-day EMA at $0.0000007565 is significantly above both the 50-day and 100-day EMAs, which are $0.0000005892 and $0.0000005217, respectively.

This divergence typically indicates that BTT has been gaining momentum, as the price is supported by the shorter-term moving average well above the longer-term averages.

However, the current BTT price is considerably higher than these EMAs, which may indicate that the price has moved ahead of the market’s average valuations and could be due to a retracement toward these averages.

The overbought nature of BTT is further confirmed by the RSI, which has edged higher to 85.56 from 85.37 the previous day. An RSI reading above 70 often points to an overextended market, and values as high as BTT’s suggest that a correction is not just possible, but probable.

Investors and traders should be vigilant for signs of a potential price pullback as the market seeks to normalize from these heightened levels.

Additionally, the MACD histogram’s slight decrease from 0.0000000920 to 0.0000000822, though still positive, signals a deceleration in the bullish momentum. It’s a nuanced hint that buying pressure could be waning, with the BTT price potentially at the cusp of a reversal.

Key price levels are now in sharp focus. BTT’s immediate resistance level is the Fib 0.236 at $0.0000013774, which was approached earlier in the day when BTT set a new high.

This level is succeeded by a more formidable overhead resistance zone ranging from $0.0000016456 to $0.0000016956, which could prove challenging for bulls to breach should another upward move be attempted.

On the downside, BTT’s price is currently cushioned by a horizontal support zone between $0.0000011468 and $0.0000012006. This zone aligns closely with the Fib 0.382 level of $0.0000012005, offering a confluence of support that may absorb selling pressure.

Should the BTT price break below this zone, it might trigger a sharper decline as the bullish case weakens.

In the immediate future, traders should monitor the BTT price for signs of stability within these technical levels. A decisive move beyond either the immediate resistance or support could signal the market’s next direction.

Given the overbought RSI levels, a conservative approach would be advisable, with traders considering taking profits or setting tight stop-loss orders to protect against a potential downturn.

Conversely, should the BTT price consolidate above support levels, it may provide a stable platform for a potential resumption of the bullish trend.

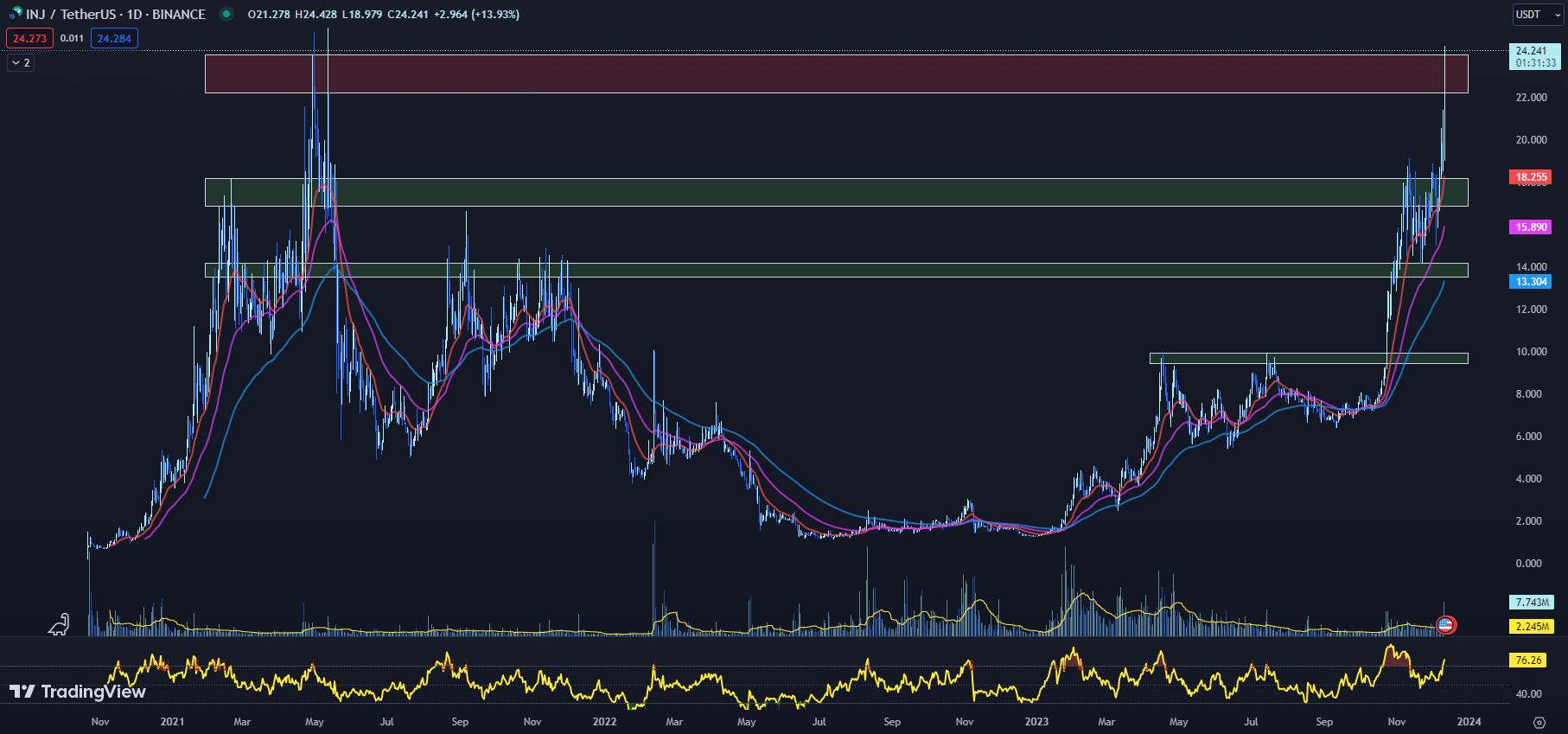

INJ Price Prediction: Nearing All-Time High Amidst Market Downtrend

Amidst the pervasive bearish sentiment gripping the cryptocurrency market, the INJ price has charted its course, rallying by an impressive 13.93% so far today to trade at $24.241.

This surge has placed INJ within striking distance of its all-time high, breaking away from the broader market downtrend and edging closer to critical resistance levels.

The technical indicators for Injective (INJ) have painted a bullish picture. The 20-day EMA stands at $18.255, well above the 50-day and 100-day EMAs, which are positioned at $15.890 and $13.304, respectively.

This alignment of EMAs typically exemplifies a strong bullish trend, with the INJ price showing sustained momentum above these key averages.

However, the RSI presents a cautionary signal, having ascended to 76.26 from 69.60 just the day prior.

While this underscores the current bullish momentum, it also flirts with overbought territory — a region where assets often face potential pullbacks as traders lock in profits from the heightened levels.

The MACD histogram’s jump to 0.501 from 0.225 is yet another testament to the prevailing bullishness in the INJ price. The widening gap indicates an increase in upward momentum, which, if sustained, could support further price increases in the short term.

The INJ price now confronts a resistance zone stretching from $22.224 to $24.001. This area has served as a tough barrier in the past, but the recent push through it suggests that the bulls are in control.

A definitive breach could pave the way for INJ to test its all-time high of $25.306 set in May 2021.

On the flip side, the immediate support zone for the INJ price lies between $16.882 and $18.164. This zone is bolstered by the 20-day EMA, creating a robust confluence of support that could mitigate any potential sell-offs and provide a springboard for further upward movements.

Given the bullish indicators coupled with INJ’s defiance of the broader market malaise, traders might be well-advised to monitor the current resistance levels closely.

A successful consolidation above these levels could signal continued bullishness, while a failure to maintain current gains might see INJ price retreating to test the robustness of its support zones.

As INJ joins market movers like BONK and BTT, lesser-known cryptos are also vying for investor attention via presale. Bitcoin ETF Token and Meme Kombat offer discounted entry to these fresh bitcoin alternatives before their launch.

Finding Overlooked Bitcoin Alternatives Before Widespread Adoption

While Bitcoin remains the biggest name in crypto, investors seeking the next major disruptive project can explore Bitcoin alternatives flying under the mainstream radar.

Buying into promising blockchain projects at the presale stage yields discounts and first-mover advantage, granting maximum exposure to upside optionality.

Looking past Bitcoin, Bitcoin ETF Token seeks to capitalize on the hype surrounding a potential Bitcoin ETF approval in 2024 while Meme Kombat pioneers play-to-earn gaming with memes.

Cryptocurrency presales enable early entry into these lesser-known assets at discount prices ahead of exchange listings and broad awareness. Investing in the presale phase opens the door to asymmetric returns compared to later-stage investments.

Although major cryptocurrencies like bitcoin offer a solid base, complementing core holdings with select bitcoin alternatives provides portfolio diversification. The presale window offers the earliest opportunity to invest in pioneering crypto projects.

While outcomes are always speculative, investing in Bitcoin alternatives approaching mainstream adoption can provide a sizable upside.

By identifying and researching overlooked cryptocurrencies before widespread popularity, the next disruptive project could be building right now.

Bitcoin ETF Token Presale Builds Momentum Ahead of SEC Decisions – Is It the Best Crypto to Buy Now?

As the cryptocurrency community awaits determinations on several proposed Bitcoin exchange-traded funds (ETFs), one project is generating significant presale interest.

Bitcoin ETF Token (BTCETF) has raised over $3.4 million so far in its effort to create a platform for traders to access real-time Bitcoin ETF news and alerts.

The awaited debut of a spot #Bitcoin#ETF by @BlackRock might reshape the #Crypto landscape, ushering in institutional funds and igniting a fresh market phase.

How do you anticipate this type of #ETF impacting the dynamics of the broader #CryptoCurrency market? pic.twitter.com/VHRocGm5Uh

— BTCETF_Token (@BTCETF_Token) December 11, 2023

The ERC-20 token is currently selling for $0.0066 in its presale, up from an initial price of $0.005. The incremental price increases reflect strong investor demand for the project’s unique value proposition.

Once fully operational, BTCETF will employ monitoring bots to continuously scan media and regulatory filings for the latest Bitcoin ETF developments.

This real-time news feed will inform traders immediately when new ETF proposals get filed, delayed, or approved.

According to BTCETF’s developers, no other cryptocurrency platforms currently provide this degree of up-to-the-minute coverage focused squarely on the long-awaited spot Bitcoin ETF product.

In addition to its utility for ETF traders, BTCETF also boasts compelling tokenomics. The project plans to execute multiple token burns amounting to 30% of the total supply based on key ETF approval milestones.

This deflationary mechanism helps ensure scarcity for early adopters. BTCETF also taxes each buy/sell transaction at 5% to permanently remove tokens from circulation – a tax that decreases over time to reward long-term holders.

As the presale momentum continues to accelerate, BTCETF seeks to be the go-to information platform for cryptocurrency traders when the SEC finally issues its verdicts on a spot Bitcoin ETF.

The project’s unique combination of real-time alerts and deflationary tokenomics looks well-positioned to drive further presale success as one of the best crypto to buy now.

Why $MK is the Best Crypto to Buy Now for Meme Coin Enthusiasts

Meme Kombat, a new player-versus-player crypto gaming platform, has raised over $2.8 million so far in its $MK token presale. This has fueled speculation that it could follow the success of other popular meme coins like Dogecoin.

The presale allows early investors to purchase $MK, Meme Kombat’s native token, at a discounted price before the full launch later next year. With demand running high, the presale’s 60 million token supply could soon be sold out.

We are getting so close memers!

pic.twitter.com/P7yFQnHdO1

— Meme Kombat (@Meme_Kombat) December 11, 2023

The funds raised will allow the Meme Kombat team to fully deliver their vision of an immersive battle arena where meme coin characters fight for rewards.

The game allows players to bet on popular meme coins like Doge, Shiba Inu, and Pepe using $MK tokens. These meme fighters can then battle in AI-powered duels, with unpredictable match outcomes to keep things exciting.

Participants can also wager $MK tokens on match results. Successful bets allow players to earn more $MK tokens and other prizes. Users can cheer for their favorite meme fighter while earning crypto rewards at the same time.

Additionally, players can stake their $MK tokens to earn staking rewards of up to 298% APY. Higher staking amounts yield greater rewards.

After the presale ends, Meme Kombat tokens are tradeable on decentralized exchanges, potentially increasing adoption and valuations.

The gaming platform is scheduled to launch once the presale concludes, with new features and fighters planned for future seasons.

Meme Kombat is designed as a long-term platform focused on community rewards and engagement. User participation shapes future development phases and features.

While risks remain, Meme Kombat’s one-of-a-kind crypto gaming approach has drawn comparisons to 2021’s breakout meme coin Hit Dogecoin.

For speculators seeking overlooked cryptos with upside potential, Meme Kombat’s $MK could be the best crypto to buy now.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Best Crypto to Buy Now December 11 – Bonk, BitTorrent, Injective appeared first on Cryptonews.

…

…