Best Crypto to Buy Now December 4 – ORDI, PEPE, Bitcoin Cash

Publikováno: 4.12.2023

ORDI, PEPE, and Bitcoin Cash rally strongly, signaling their potential as the best crypto to buy now amid renewed market optimism. Image by cryptonews.com. Among considerations around attractive buys and the best crypto to buy now, ORDI has generated interest reaching a new all-time-high in a climate of optimism enabling a 27% surge so far […]

The post Best Crypto to Buy Now December 4 – ORDI, PEPE, Bitcoin Cash appeared first on Cryptonews.

Among considerations around attractive buys and the best crypto to buy now, ORDI has generated interest reaching a new all-time-high in a climate of optimism enabling a 27% surge so far today

PEPE has also capitalized on recovery trends, surging nearly 30% from its established support level.

Meanwhile, Bitcoin Cash is riding a 7% upswing, possibly fueled by MicroStrategy’s recent Bitcoin purchase.

In line with the cryptocurrency market’s positive momentum and restored confidence, ongoing crypto presales such as Bitcoin ETF Token and TG.Casino are similarly attracting speculative investments from investors seeking fresh Bitcoin alternatives.

Best Crypto to Buy Now in the News

Amid a robust market rebound, ORDI has registered a new all-time high of $49.660, echoing Bitcoin’s retest of the $42,000 level.

JUST IN: $42,000 #Bitcoin

pic.twitter.com/AvXeth6SNR

— Bitcoin Magazine (@BitcoinMagazine) December 4, 2023

This surge reflects a broader market rally, with ORDI’s price experiencing a notable 27% increase so far today, and an impressive weekly gain of over 138%.

Year over year, ORDI’s market value has surged by more than 380%. Such strides in performance have shown a strong correlation with Bitcoin’s market dynamics, hinting at the possibility that ORDI could follow Bitcoin’s lead in the market’s bullish phase.

Market analysts maintain a favorable forecast for ORDI, underpinned by heightened activity on the Ordinals protocol, a foundational technology for ORDI.

This protocol is a pivotal part of the Bitcoin network, hosting diverse content, and as transaction fees on Bitcoin have risen, ORDI’s prominence within the network has surged, evidenced by over $46 million in total inscriptions as of writing.

PEPE, another contender for the best crypto to buy now, has been navigating through price fluctuations with a recent rally of over 25% from its support level.

The momentum indicates a potential further surge of 30% to retest its overhead resistance ranging between $0.000001713 and $0.000001770.

Currently trading around $0.000001357, PEPE is up by 12.52% so far today.

The meme coin’s steady performance above the 100-day exponential moving average suggests the token has stable upward momentum.

Bitcoin Cash is also witnessing a positive price movement, with a 7% increase so far today placing it at a trading price of $247.9.

The uptrend in Bitcoin Cash is part of the overall uptick in the cryptocurrency market, spurred by MicroStrategy’s Bitcoin acquisition and the consequent rise in market optimism.

Amidst this dynamic market, the crypto presale space is also attracting attention, with offerings such as Bitcoin ETF Token and TG.Casino presenting new investment opportunities.

As fresh cryptos launch in presale, investors closely track these early-stage opportunities that may become the next big cryptocurrencies to buy.

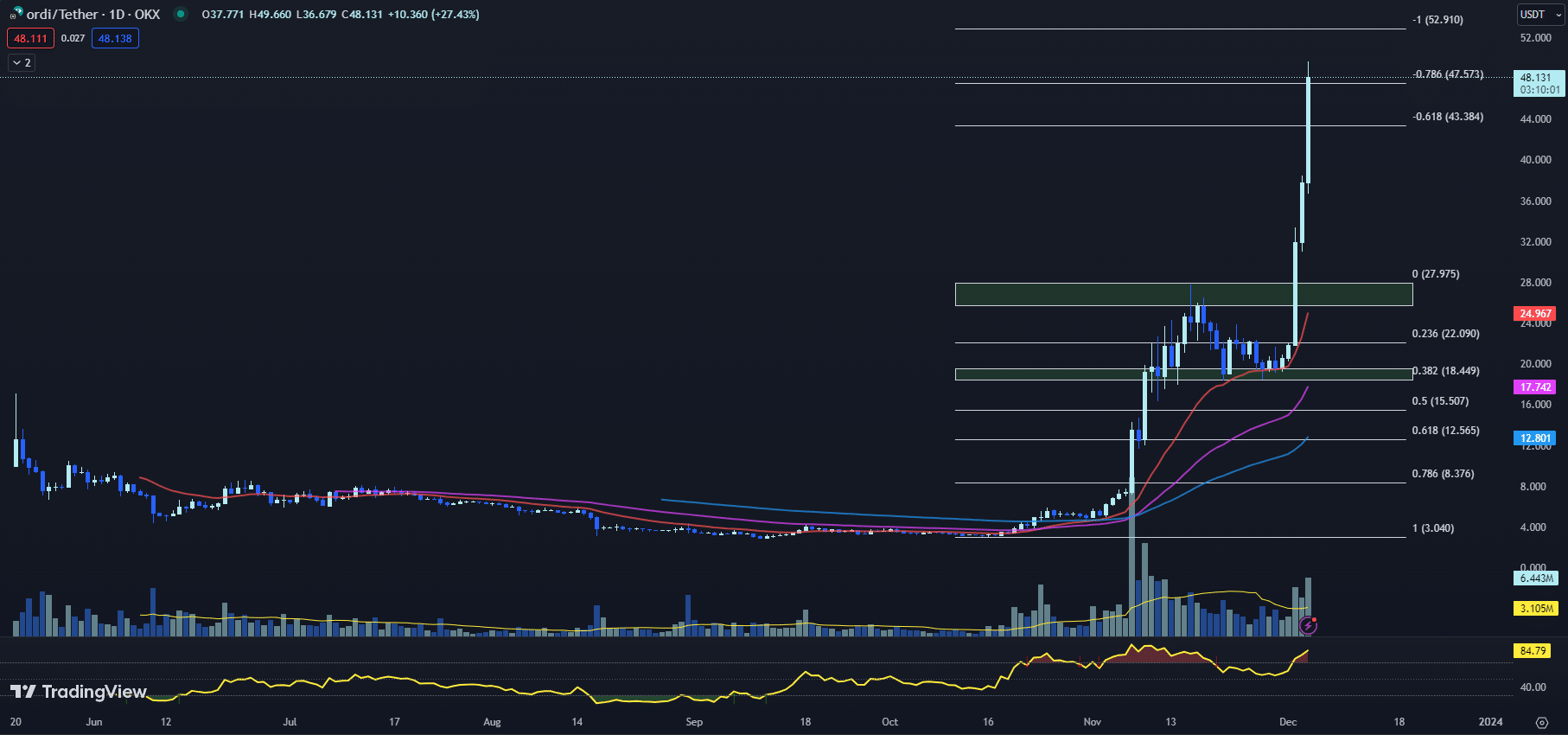

ORDI Price Soars to New Heights in Price Discovery Mode

The ORDI price has been on a tear recently, with a rise of nearly 150% from its support around the Fib 0.382 level of $18.449.

A surge of 27.43% in the current trading day alone has pushed the price to a record $48.131, as ORDI successfully ventured into price discovery mode.

This momentum suggests that the path to least resistance is currently on the upside.

Looking at key technical indicators, we see a compelling story unfolding for ORDI’s immediate future.

The 20-day EMA for the ORDI price is at $24.967, significantly above both the 50-day EMA of $17.742 and the 100-day EMA of $12.801.

This widening gap between the short-term and long-term EMAs indicates a strong bullish momentum in the ORDI price.

The RSI for ORDI, which stands at 84.79, up from yesterday’s 79.34, is well into the overbought territory.

Typically, an RSI above 70 suggests that the asset may be overbought and due for a correction.

However, during strong trends, assets can remain overbought for extended periods.

The sharp rise in the RSI underscores the robust buying sentiment that has propelled the ORDI price to its current highs.

The MACD histogram further accentuates the bullish picture, with a reading of 1.928, a considerable increase from yesterday’s 0.822.

This growing positive value is indicative of the bullish sentiment gaining further momentum, which could boost the ORDI price even more.

The immediate resistance for the ORDI price lies at the psychological level of $50, followed by the Extended Fib -1 level of $52.910.

The ability of ORDI to break through these resistance levels could signal a continuation of its upward trend.

However, traders should also keep an eye on potential support levels.

The first immediate support can be found at the Extended Fib -0.786 level of $47.573.

If the ORDI price were to experience a pullback, this could serve as a critical line of defense.

Further down, the Extended Fib -0.618 level of $43.384 could also provide support.

As the ORDI price heads into uncharted territory, traders and investors are advised to monitor these technical indicators closely.

While the current bullish indicators suggest an upward momentum, the high RSI could also point to a potential pullback soon.

Therefore, a balanced approach that considers both the bullish signals and the potential for correction could be the key to navigating the next phase of ORDI’s journey.

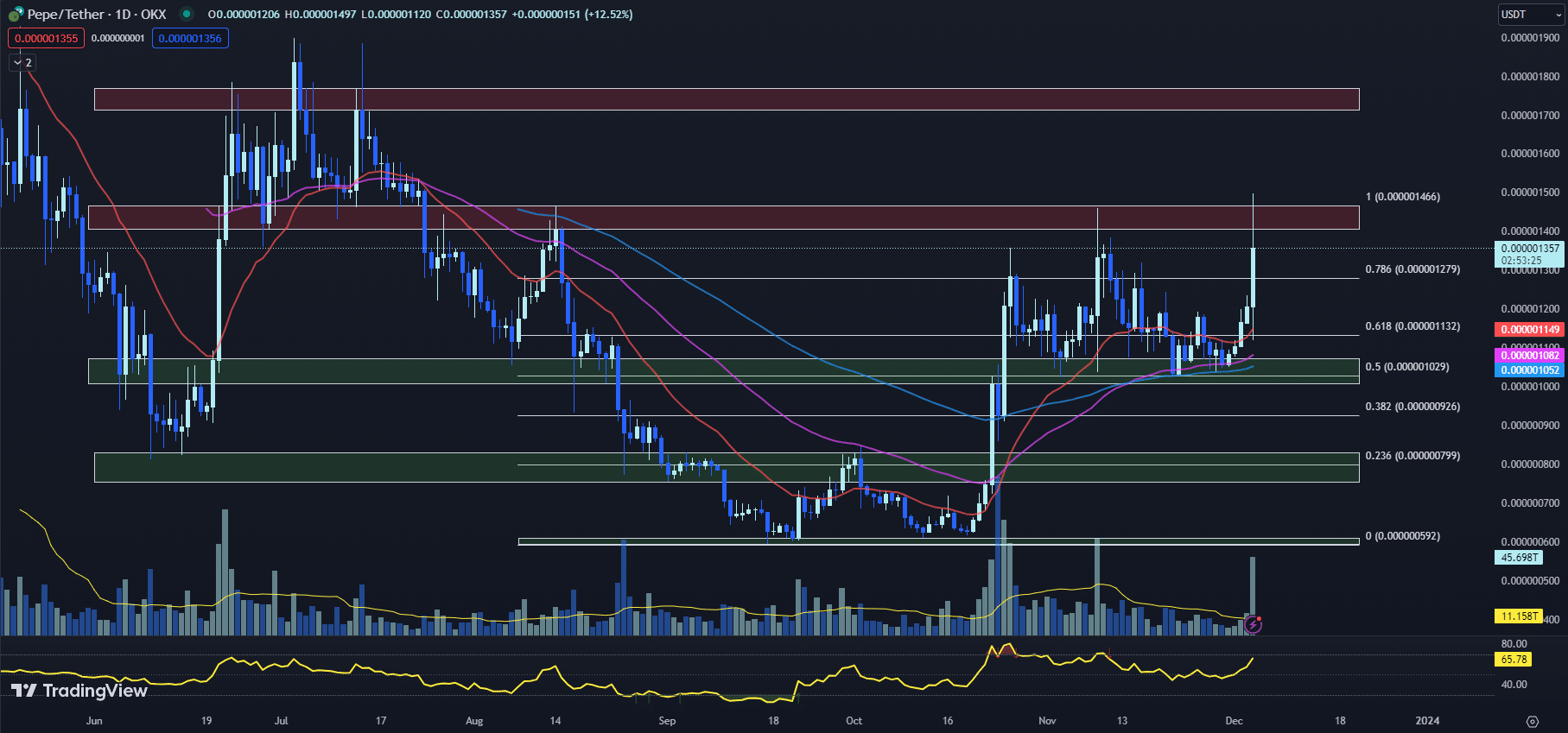

PEPE Price Prediction: RSI Indicates Increasing Buying Momentum

The PEPE price is showing a promising trend after a bounce from its immediate support level, which is around the 50-day EMA and the Fib 0.5 level of $0.000001029.

As PEPE sets a new multi-month high at $0.000001497, traders are witnessing selling pressure near the immediate resistance level despite a considerable upswing of 12.52% so far today.

The 20-day EMA for PEPE is currently at $0.000001149, indicating a bullish sign as it is significantly above the 50-day and 100-day EMAs (at $0.000001082 and $0.000001052, respectively).

Given these conditions, it’s plausible that PEPE will continue its upward trajectory, with the 20-day EMA acting as a strong support level for the increasing price.

The RSI (Relative Strength Index) has seen a considerable jump, moving from yesterday’s 57.29 to today’s 65.78, suggesting that buying momentum is increasing.

If the RSI continues to climb and crosses the overbought level of 70, it could indicate a potential price correction in the near term.

However, it is currently in a healthy range, suggesting that PEPE still has room to appreciate before hitting overbought territory.

The MACD histogram has turned positive from yesterday’s neutral reading, marking a bullish MACD crossover.

This is typically seen as a bullish sign and might indicate that the PEPE price could continue its upward trajectory in the short term.

The PEPE price currently faces a horizontal resistance zone between $0.000001406 and $0.000001465.

If PEPE can break through this resistance, it could signal a continuation of the current uptrend.

On the contrary, should selling pressure increase, we might see a pullback to the immediate support level.

The immediate support for the PEPE price lies at the 20-day EMA of $0.000001149, which is closely followed by the Fib 0.618 level of $0.000001132.

If these support levels are breached, it might suggest a short-term bearish trend.

The PEPE price looks to be in a strong position right now, with the MACD suggesting potential upward momentum and the RSI indicating increased buying pressure. However, as always in trading, traders are advised to be aware of the potential for sudden reversals.

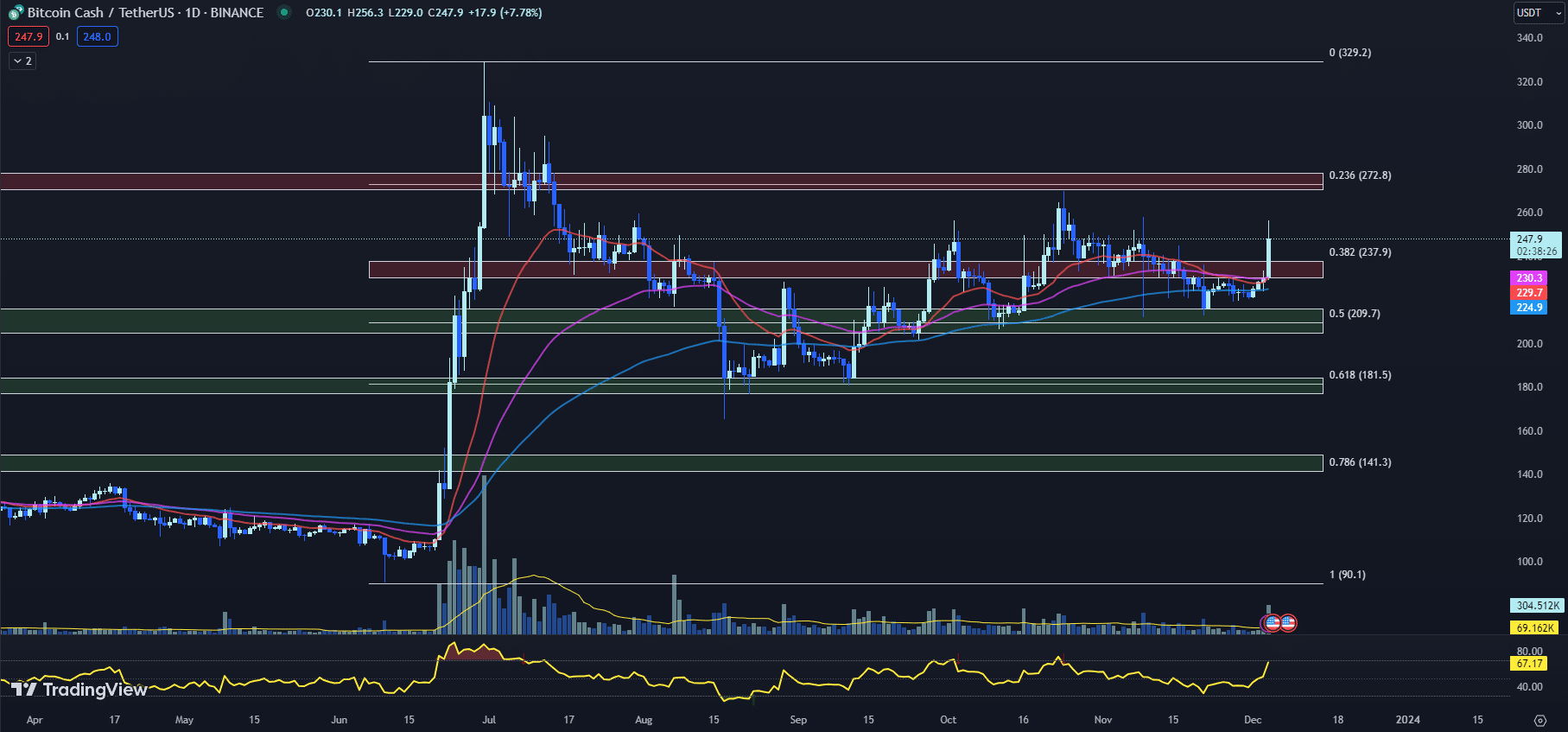

Bitcoin Cash BCH

The BCH price has seen a dramatic turnaround in sentiment over the past few days.

After weeks of lackluster trading and declining volumes, BCH surged over 7% on Monday to break above the $240 level for the first time in over two weeks.

This sharp move appears driven by improving technical indicators and a breakout from a long-term downtrend line.

As the BCH price seeks to continue this bullish momentum, key levels are coming into focus.

On the indicator front, the BCH price rally comes alongside a notable improvement in both oscillators and moving averages.

The RSI has surged from oversold territory below 30 yesterday to 67.17 today.

This rapid climb out of oversold suggests gathering bullish momentum that could propel the BCH price higher.

Additionally, the MACD histogram has crossed into positive territory above 0 for the first time in weeks, printing at 2.0 against yesterday’s 0.6.

This bullish crossover in the MACD highlights accelerating positive momentum.

The BCH price is also seeing its shorter-duration EMAs cross above longer-duration averages.

With the 20-day EMA at $229.7 now trending above the 50-day EMA at $230.3, bullish sentiment appears to be returning to the BCH market.

In terms of key levels, BCH managed to close decisively above the resistance zone between $230 to $237.8.

This area had capped upside progress for over a month. Now turned support, it will be important for the BCH price to hold above this level on any pullbacks.

On the upside, the BCH price is fast approaching the next resistance zone between $270.6 to $278.

This area lines up with the Fib 0.236 level at $272.8, making it a level bulls must conquer to maintain control.

Overall, while technicals have turned decisively bullish, follow-through will be key.

The BCH price needs to hold the breakout over $230 and challenge the upper resistance at $270 to confirm the developing uptrend.

If bearish momentum returns and the BCH price falls back below $230, the rally may be short-lived.

In addition to trading based on technical analysis, research-driven investors look for presales that offer ground-floor entry to the next big cryptocurrencies.

Bitcoin ETF Token and TG.Casino are two such overlooked options.

Overlooked Bitcoin Alternatives With Potential in 2023 and Beyond

While Bitcoin remains the dominant force in crypto, investors are exploring up-and-coming Bitcoin alternatives that lack widespread adoption.

Getting in early on carefully selected new crypto projects provides exposure at a fraction of future valuations.

Two such overlooked presales offering potential upside are Bitcoin ETF Token and TG.Casino.

These fresh blockchain-based concepts are seeking to disrupt established finance and gambling sectors respectively.

Investing in these under-the-radar presales early presents upside potential before wider recognition kicks in.

Rather than sticking with predictable crypto giants, these presales offer ground-floor entry to pioneering Bitcoin alternatives and disruptive new crypto projects.

Pinpointing and investing in platforms on the cusp of addressing unmet needs before mass awareness can yield substantial returns.

The key is identifying the next big breakthroughs in crypto before the crowd catches on.

Bitcoin Breaks $40K, Highlighting the Potential of the Bitcoin ETF Token Presale as a Best Crypto to Buy Now

The pending SEC approval of a Bitcoin exchange-traded fund (ETF) has sparked interest in a new token seeking to provide exposure to the event.

The Bitcoin ETF Token (BTCETF) has raised over $2.47 million so far in its presale, showing why some investors see it as one of the best crypto to buy now in anticipation of the SEC’s decision.

The presale utilizes unique tokenomics to tie the token’s price to milestones in the SEC approval process.

#Bitcoin soared to $41,448, boosted by #ETF hopes and a $70 million liquidation from short traders.

With #SEC meetings boosting optimism, $BTC now ranks among the top 10 global assets by market cap, trailing just behind #Meta.

Which #Altcoin gains caught your eye the most… pic.twitter.com/Iz8bpAI1vQ

— BTCETF_Token (@BTCETF_Token) December 4, 2023

Specifically, the total supply of 100 billion BTCETF tokens will be decreased by 5% every time a predetermined SEC approval milestone is reached.

These milestones are enshrined in smart contracts to trigger automatic supply burns.

In addition, a 5% tax on all BTCETF transactions is implemented during the presale, which will decrease by 1% for each milestone achieved.

This tax is intended to discourage flipping and incentivize longer-term holds.

The presale price for each BTCETF token currently stands at $0.0062. However, as predetermined SEC approval milestones are met, the automatic token burns enacted will rapidly decrease the circulating supply.

With lessening token availability, BTCETF could foreseeably trade at a premium.

The presale mirrors the countdown to the SEC’s ETF decision, which some analysts predict could arrive as soon as January 10, 2024.

For cryptocurrency investors, BTCETF provides an opportunity to anticipate how the market may respond to a major event that is expected to increase mainstream adoption of cryptocurrencies.

The token has attracted investors seeking targeted exposure along with the presale incentives.

Crypto-Based TG.Casino Gains Steam Amid Booming Online Gambling Industry – Is It the Best Crypto to Buy Now?

TG.Casino, a new blockchain-based online gambling platform accessible via Telegram has seen rapid early growth with over 2,000 users joining its Telegram community to date and betting a total of $20 million on the platform’s casino games, live events, and sportsbook offerings.

The platform’s rising popularity comes as the online gambling industry expands rapidly.

Valued at $262 billion in 2021, the market is increasingly incorporating crypto features like provably fair games and instant payouts.

It's the natural thing to do.

Play with $TGC

pic.twitter.com/Px24tTexXS

— TG Casino (@TGCasino_) December 4, 2023

TG.Casino intends to capture market share in this high-growth sector by tailoring to crypto users.

The platform operates without KYC, requiring just a Telegram account and crypto wallet to play.

TG.Casino’s ongoing presale for its native token TGC is currently at $0.175, with the price scheduled to increase in less than three days.

Demand has been high, with less than 40% of the supply remaining.

TGC holders will gain access to staking rewards up to 194% APY, NFT rewards for big buyers, and other benefits.

The majority of tokens purchased have already been staked.

TGC also fuels a buyback system designed to boost its value over time.

With the presale nearing completion, the run rate has accelerated as buyers purchase TGC at the lowest possible price.

Major crypto influencers have promoted TG.Casino to their hundreds of thousands of followers. The platform is fully licensed and audited for security.

As crypto continues its march into the mainstream, the convergence of blockchain technology and online gambling at platforms like TG.Casino seems destined to pay off for early adopters.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Best Crypto to Buy Now December 4 – ORDI, PEPE, Bitcoin Cash appeared first on Cryptonews.