Best Crypto to Buy Now December 6 – Helium, Celestia, Avalanche

Publikováno: 6.12.2023

HNT, TIA, and AVAX outperform the broader cryptocurrency market as investors hunt for the best crypto to buy now. Image by cryptonews.com. The HNT price is surging over 42% so far today, positioning Helium’s native token as one of the best crypto to buy now amid the network’s launch of Helium Mobile. Celestia and Avalanche […]

The post Best Crypto to Buy Now December 6 – Helium, Celestia, Avalanche appeared first on Cryptonews.

The HNT price is surging over 42% so far today, positioning Helium’s native token as one of the best crypto to buy now amid the network’s launch of Helium Mobile.

Celestia and Avalanche also stand out with their recent price rallies, while fresh bitcoin alternatives like the Bitcoin ETF Token and Bitcoin Minetrix crypto presales offer new opportunities.

Best Crypto to Buy Now in the News

Helium is seeing a substantial intraday gain so far, enabling the cryptocurrency to retest the key $5 level earlier today when it reached a high of $5.014.

At present, Helium is trading at $4.269, up 42.02% so far today. This rise contributes to a 30-day gain of 130%. Helium’s trading volume also spiked to $36.6 million, showing a rise of 1,188%.

IT'S HERE

Our nationwide $20/month Unlimited Phone Plan is now available!The average American spends $157/month on their phone plan, but starting today, anyone in the US can join Helium Mobile & say goodbye to overpriced bills.

Read the news: https://t.co/qXWCpm6zbo

Sign… pic.twitter.com/A2hqPppCMB— Helium Mobile (@helium_mobile) December 5, 2023

This price rally coincides with Helium’s launch of Helium Mobile, a new nationwide phone plan costing $20 per month for unlimited data, texting, and calls. This rate undercuts typical U.S. cell phone bills.

Helium Mobile combines Helium’s decentralized, crowd-sourced network with the nation’s largest 5G carrier.

Helium states this fusion aims to provide reliable nationwide coverage and ensure user data privacy, unlike some traditional cell plans.

Helium promises subscriber data will not be sold to third parties. Subscribers who help map Helium’s network coverage can earn rewards to cover their monthly bill.

Helium has also introduced two new Helium Mobile Hotspots, priced at $499 for an outdoor version and $249 for indoor.

These hotspots allow consumers to operate personal cell towers to boost coverage and reduce dead zones, expanding Helium’s reach.

Celestia’s TIA token also impresses with substantial gains, surging over 66% in the past week.

TIA presently trades at $10.7126, up 5.58% so far today after hitting a new all-time high of $11.50 earlier today.

This performance could signal further interest in Celestia’s capabilities and potential for expansion.

Avalanche’s native token, AVAX, is also shaping up to be a top performer among large-cap cryptocurrencies with a 120% increase over the past month.

Very cool to see this type of experimentation with blockchain (and Avalanche in particular) by financial giants like Apollo and JPMorgan. Basically, they have built out a proof of concept for alternative asset portfolio management construction on top of blockchain and smart… pic.twitter.com/c0b29TgEQG

— Frank Chaparro (@fintechfrank) November 15, 2023

Major financial institutions have tested asset tokenization on the Avalanche network, contributing to its growth.

The blockchain saw its highest weekly traffic, with $2 billion in transactions, and inflows into Avalanche reached $79 million in Q3 and $56 million in Q4 through late November.

AVAX is currently trading at around $27, potentially approaching the $30 mark, although a slight decrease to $25 is also a possibility.

Meanwhile, Bitcoin ETF Token and Bitcoin Minetrix, both early-stage investment opportunities, are also captivating the market’s attention.

These crypto presales offer new Bitcoin alternatives and are becoming a focus for those seeking the best crypto to buy now.

The considerable market advances and activity for Helium, Celestia, Avalanche, Bitcoin ETF Token, and Bitcoin Minetrix suggest these cryptocurrencies might be the best crypto to buy now for those looking to invest.

HNT Price Surge Triggers Overbought Signals, What’s Next?

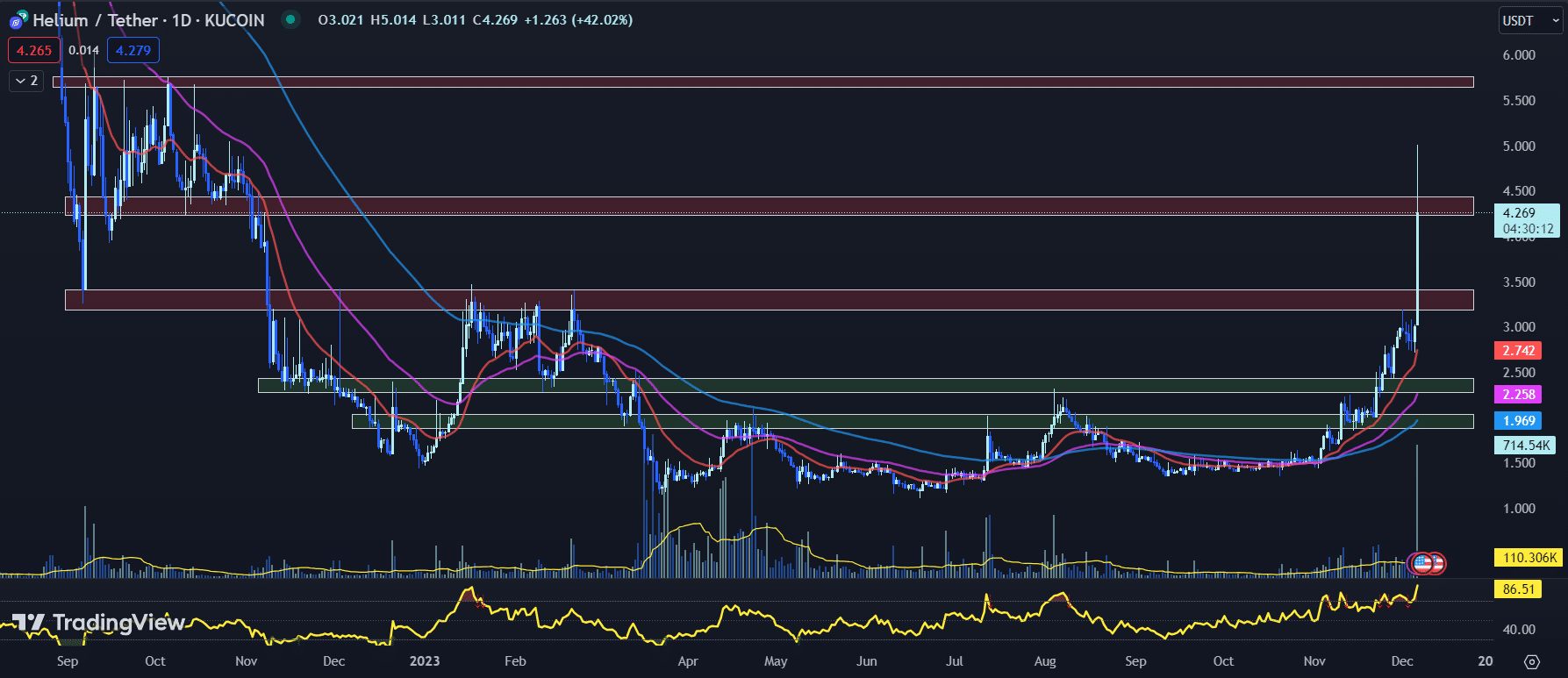

The HNT price has recently seen a remarkable climb, with a rise of 41.02% in just one day, and is currently trading at $4.269.

This surge accompanies the recent release of the platform’s Helium Mobile.

HNT’s 20-day EMA currently stands at $2.742, significantly below the current HNT price.

This is a bullish sign, indicating that the recent price increase is not a temporary spike but rather a potential new upward trend.

The 50-day and 100-day EMAs, standing at $2.258 and $1.969 respectively, also support this bullish outlook, being well below the current price.

Turning to the RSI, it has surged to 86.51 from yesterday’s 72.58.

Typically, an RSI above 70 signals that an asset is potentially overbought, suggesting that the HNT price may be due for a correction or consolidation in the short term.

However, extreme RSI values can also be an indication of strong momentum, which seems to be the case given the recent price action.

The MACD histogram, another momentum indicator, is currently at 0.095, lower than yesterday’s 0.20.

Although this marks a decrease, the MACD histogram remains in positive territory, indicating that the bullish sentiment still holds some strength.

As for key price levels, the HNT price has already broken through its immediate horizontal resistance zone between $3.188 to $3.409.

The price is now dealing with resistance in the $4.234 to $4.435 range.

If the HNT price manages to close above this level, it could turn the former resistance into potential support, providing a foundation for further upward movement.

On the downside, the immediate support is at the 20-day EMA of $2.742. Should the HNT price pull back, this level could provide a bounce point.

However, with the price well above this level and the recent momentum, it appears less likely that this level will be tested in the immediate future.

While the technical indicators suggest that the HNT price has entered the overbought territory, the strong momentum may carry the price further upward in the short term.

Investors should be cautious, however, as a pullback or consolidation phase could follow this sharp rise.

Celestia (TIA) Price Discovery Phase Continues with No Signs of Slowdown

The TIA price has been on a strong upward trajectory, extending its gains for a potential third consecutive day and hitting an all-time high of $11.5000 earlier today, indicating a robust bullish sentiment among investors.

The cryptocurrency is currently in a price discovery phase, with no immediate signs of a slowdown.

The 20-day EMA for the TIA price currently stands at $7.0496, considerably below the present price level. Typically, when the price trades significantly above the EMA, it may be indicative of overbought conditions.

In this case, however, the TIA price has maintained its position above the EMA, sustaining its bullish momentum.

TIA’s RSI currently reads at 79.12, up from yesterday’s 77.49. An RSI above 70 typically signals overbought conditions, suggesting that the TIA price might be ripe for a pullback.

However, the continued uptrend could indicate the presence of strong buying pressure, which might delay any potential reversal.

The MACD histogram registers at 0.3168, an increase from yesterday’s 0.2587. This rise in the MACD histogram suggests that the bullish momentum is still growing, potentially propelling further upward movement in the TIA price.

On the upside, the TIA price faces resistance at its current all-time high of $11.5000. Beyond this, the next significant resistance lies at the extended Fib -0.236 level of $12.9977, which notably aligns with the psychological level of $13. Breaking these resistance levels could see the TIA price soar further to new highs.

Conversely, immediate support for the TIA price is found at the Fib 0.236 level of $9.9895. This level could serve as a potential bounce point should the price initiate a pullback.

As the TIA price continues its ascent, investors should approach with caution. The overbought conditions indicated by the RSI may hint at a potential pullback, but strong buying pressure and increasing bullish momentum as shown by the rising MACD may delay such a reversal.

Investors should closely monitor the aforementioned resistance and support levels. A breakout past the $13 resistance could indicate a continuation of the bullish trend, while a pullback to the $9.9895 support could trigger a potential price correction.

While the TIA price is currently demonstrating strong bullish momentum, market participants should stay vigilant and watch for any signs of a potential reversal or continuation of the current trend.

AVAX Price Continues to Soar, Surpassing Immediate Resistance Levels

The AVAX price continues to impress with its ongoing uptrend, currently trading at $26.93, an increase of 9.74% so far today.

The cryptocurrency has risen by over 117% the past month, attempting to break out from its immediate resistance levels.

The 20-day EMA for the AVAX price is currently at $21.39, well below the current price. This indicates a strong upward momentum in the AVAX price, as it is significantly trading above the short-term EMA.

The 50-day EMA and 100-day EMA stand at $17.78 and $15.19 respectively, further corroborating the bullish trend.

However, such a substantial deviation from the EMAs could also suggest the price is now hovering in overbought territory.

The RSI for the AVAX price reads at 78.39, up from yesterday’s 73.25, suggesting that the asset is potentially overbought. Typically, an RSI above 70 signals overbought conditions, hinting at a potential pullback.

However, the AVAX price is still climbing, indicating strong buying pressure that can delay any potential reversal.

Meanwhile, the MACD histogram has turned positive, recording at 0.17 from yesterday’s -0.04. This newly formed bullish MACD crossover indicates that buying pressure is increasing, which could propel the AVAX price further.

On the upside, the immediate resistance for the AVAX price is the horizontal zone between $25.01 to $25.83. However, given the robust price action today, this level could potentially turn into a support level in the coming days.

The next level of significant resistance lies between $29.37 to $30.22, which coincides with the psychological level of $30. Overcoming these resistance levels could signal a continuation of the bullish trend.

On the downside, immediate support for the AVAX price lies between $21.36 to $22.82, which aligns with the 20-day EMA of $21.39. This level could serve as a potential bounce point if the AVAX price initiates a pullback.

Despite the AVAX price’s ongoing ascent, investors should approach with caution. The overbought conditions suggested by the RSI may hint at a potential pullback.

However, the strong buying pressure and a positive MACD crossover indicate that the bullish momentum may continue.

Investors should closely watch the resistance and support levels. A breakout past the $30 resistance could hint at a continuation of the bullish trend, while a pullback to the $21.36 support could trigger a potential price correction.

AVAX’s current bullish momentum necessitates vigilance from market participants. While signs point towards ongoing ascendance, caution is key as the market sentiment can rapidly change.

While names like AVAX, TIA and HNT surge, the next crypto winner could be quietly fundraising today.

Bitcoin ETF Token and Bitcoin Minetrix are two presales set to benefit from coming shifts in ETF and mining adoption.

The Search for Promising Bitcoin Alternatives

Despite Bitcoin’s dominance, investors are actively seeking out compelling Bitcoin alternatives yet to hit the mainstream.

Entering early into carefully researched new crypto ventures gives you a chance to gain a foothold for a fraction of their potential future worth.

Bitcoin ETF Token and Bitcoin Minetrix are two current fundraising Bitcoin alternatives that warrant a closer look.

These new blockchain concepts seek to shake up the traditional finance and bitcoin mining industries through their platform’s pioneering approaches.

Investing in the presales of these lesser-known cryptos presents a potential upside before wider market awareness sets in.

Rather than limiting investments to major cryptos like Bitcoin, these presales allow early entry into cutting-edge cryptocurrency projects and business models.

While Bitcoin will likely remain dominant, slipping some alternative cryptos into a portfolio provides diversification and speculative upside.

The next surge of wealth creation may come from an unassuming Bitcoin alternative quietly building behind the scenes today.

BTCETF: The Best Crypto to Buy Now as SEC Nears Bitcoin ETF Approval

Capitalizing on renewed optimism for Bitcoin ETF approval by the SEC in 2024, crypto project Bitcoin ETF Token (BTCETF) has commenced a presale fundraising round for its native token BTCETF.

BTCETF is an ERC-20 token built around the impending launch of the first regulated, SEC-sanctioned Bitcoin ETFs.

It has already attracted over $2.5 million in presale purchases, with its token price increasing from an initial $0.005 to the current $0.0062 per BTCETF.

#BitcoinETF Stage 8 has begun!

pic.twitter.com/Zxp6tAPVpB

— BTCETF_Token (@BTCETF_Token) December 6, 2023

The presale comes amid building optimism that the SEC will finally approve Bitcoin ETF applications during a pivotal regulatory window between January 5-10, 2024.

Popular analyst channel Altcoin Daily recently explained to its 1.4 million X followers how an approved Bitcoin ETF could mirror the gold ETF watershed moment in 2004. They noted gold prices never returned to pre-ETF levels afterward.

Altcoin Daily also highlighted how Bitcoin’s capped supply would intensify any demand spikes post-ETF approval compared to commodities like gold.

BTCETF seeks to benefit from the expected flood of capital into Bitcoin if SEC-approved ETFs launch.

It will burn 25% of its total token supply in five milestones based on the ETF approval process.

In addition to its deflationary design, BTCETF will also implement a transaction tax that starts at 5% and gradually declines to zero when certain milestones are achieved.

This tax system will further reduce the token’s circulating supply over time.

By tying its very tokenomics to the impending adoption of Bitcoin ETFs, BTCETF offers traders indirect exposure and upside to this macroeconomic shift.

As the crypto industry matures towards greater mainstream adoption and regulation, investors have an expanding array of derivative opportunities to benefit from the growth.

BTCMTX Could Be the Best Crypto to Buy Now for Exposure to Bitcoin Mining

Bitcoin Minetrix, a cryptocurrency project with a one-of-a-kind stake-to-mine system, has raised over $4.8 million and counting in its ongoing BTCMTX token presale.

The presale allows participants to gain priority access to BTCMTX, the native token underpinning the Bitcoin Minetrix ecosystem.

The presale has already completed 11 out of 39 stages, with the price per BTCMTX token increasing incrementally with each new stage in a model designed to incentivize investors to buy early to secure the lowest price possible.

#BitcoinMinetrix Stage 11 is ending in just 1 day!

How do you see #Blockchain impacting data security in the next 5 years?

#DataProtection#BlockchainFuturepic.twitter.com/Ao30t6hdJ5

— Bitcoinminetrix (@bitcoinminetrix) December 6, 2023

BTCMTX tokens entitle holders to earn mining credits by staking their holdings on the Bitcoin Minetrix platform.

These credits can then be redeemed for Bitcoin, allowing a hands-off way to gain exposure to Bitcoin mining rewards.

The project represents a departure from conventional, hardware-driven Bitcoin mining operations requiring intensive use of resources.

Bitcoin Minetrix seeks to open up mining to more users through its tokenized approach.

According to the Bitcoin Minetrix website, the total presale supply is limited, which has created an urgency to buy tokens early.

The project has already raised over a third of its $15 million soft cap with the latest stage nearing completion.

While Bitcoin mining has faced criticism over sustainability concerns, Bitcoin Minetrix promotes a greener solution with its cloud-based setup requiring less energy.

With its stake-to-mine model, strong presale momentum, and greener approach to mining, Bitcoin Minetrix makes a compelling case as perhaps the best crypto to buy now while still early.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Best Crypto to Buy Now December 6 – Helium, Celestia, Avalanche appeared first on Cryptonews.