Best Crypto to Buy Now January 12 – Bitcoin Cash, Sui, Tezos

Publikováno: 12.1.2024

Bitcoin Cash, Sui, and Tezos price resurgences could make them the best cryptos to buy now amid the market retracement. Image by cryptonews.com. Even as the overall crypto market faces selling pressure, impactful developments have lifted SUI to a record 8-month high so far today. Bitcoin Cash (BCH), Sui (SUI), Tezos (XTZ), and ongoing crypto […]

The post Best Crypto to Buy Now January 12 – Bitcoin Cash, Sui, Tezos appeared first on Cryptonews.

Even as the overall crypto market faces selling pressure, impactful developments have lifted SUI to a record 8-month high so far today. Bitcoin Cash (BCH), Sui (SUI), Tezos (XTZ), and ongoing crypto presales like Bitcoin Minetrix and Sponge V2 Token persist as some of the best crypto to buy now options beyond the current market retracement.

Best Crypto to Buy in the News

Bitcoin Cash has displayed robust performance, with its price increasing by 8.40% yesterday to challenge its immediate resistance levels. This uptick comes as the cryptocurrency’s bullish sentiment strengthens, supported by technical indicators pointing to further near-term price volatility.

Sui’s price has jumped significantly as well, hitting an intraday peak of $1.2266 earlier today which is its highest price going back to May 2023. Driving this surge is Sui’s listing on CoinDCX Pro Mode, granting it greater accessibility in the Indian market.

Exciting News!

We're thrilled to announce a strategic partnership and investment from @SuiNetwork!

Together, we're driving innovation and redefining possibilities in #DePIN and digital identity.

Read More

https://t.co/2wXnCziZt6

— Karrier One (@karrier_one) January 11, 2024

Sui has also integrated with Karrier One to deploy decentralized identity and blockchain solutions, showing the project’s technological progress.

Meanwhile, Tezos has registered impressive gains of over 23%, cementing its position among the top performers in today’s volatile market. Propelling its rise is the launch of TezFin, a DeFi lending platform built on Tezos.

ANNOUNCEMENT: TezFin Production Version has launched!

Decentralized Lending/Borrowing on Tezos Blockchain. Visit: (https://t.co/KTSAW00EWH)

– Security Audit by @inference_ag, sponsored by @TezosFoundation#Tezospic.twitter.com/sXlyXvsF68

— TezFin | Tezos DeFi lending (now in beta) (@TezosFinance) January 10, 2024

With strong security audits and seamless integration with the Tezos ecosystem, TezFin signifies a major advancement for decentralized finance on the blockchain.

While these major cryptocurrencies take the spotlight, early-stage crypto projects like Bitcoin Minetrix and Sponge V2 Token offer fresh Bitcoin alternatives for 2024. As crypto presales, their fundamentals and growth potential make them enticing options to consider.

Bitcoin Cash, Sui, and Tezos are among the best cryptos to buy now owing to their positive momentum and ecosystem expansion, along with promising crypto presales Bitcoin Minetrix and Sponge V2 Token, both seeking to disrupt the cryptocurrency space.

Bitcoin Cash’s BCH Price Battles Immediate Resistance Levels: Can Bulls Overcome the Hurdle?

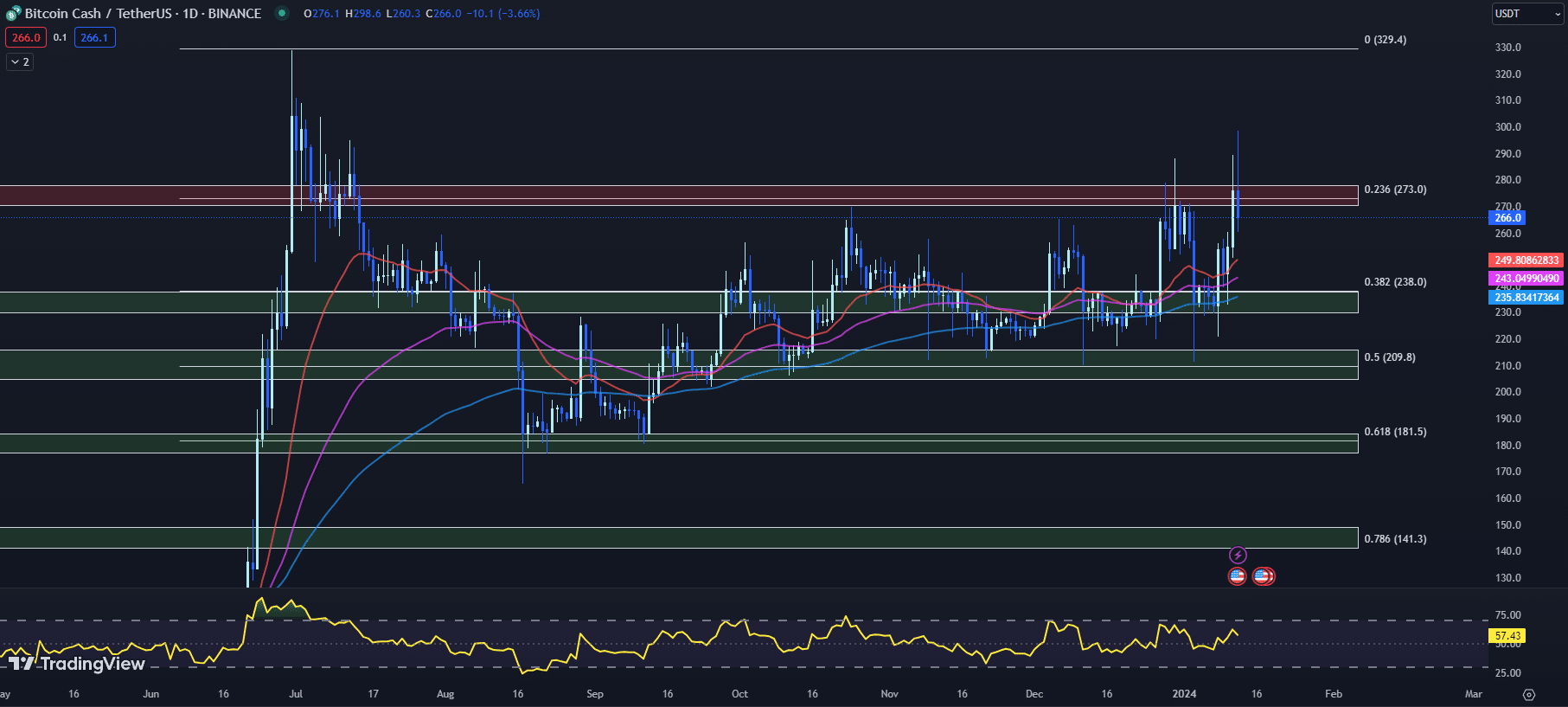

The Bitcoin Cash (BCH) price remains under pressure after failing to sustain momentum above the $270 resistance zone yesterday. BCH currently trades around $266, down nearly 13% from its 6-month high of $298.6 hit earlier today.

BCH’s inability to close decisively above the $270-$278 resistance area, which aligns with the Fib 0.236 level at $273, has left bulls on shaky ground. This region has capped previous rally attempts over the past month. Until BCH can overcome this barrier, substantial near-term gains look unlikely.

The technical indicators reflect the indecision in the marketplace. While the RSI has pulled back from overbought territory to 57, it remains well above the oversold zone below 30. This implies buying interest is still present despite the intraday retreat.

Meanwhile, the MACD histogram has ticked up to 1.95, higher than yesterday’s reading of 1.4. The positive momentum in the oscillator suggests buying interest remains present for now. However, if the MACD fails to post new highs on the next push higher, it could foreshadow fading bullish momentum and possible downside pressure brewing.

On the downside, initial support lies at the 20-day EMA of $249.8. Below that, the 50-day EMA at $243 could come into play. Failure to hold above these key short-term moving averages could open the door for a drop towards the $230 to $238 support zone. This area corresponds with BCH’s 100-day EMA of $235 and the Fib 0.382 level at $238.

In summary, BCH faces a critical inflection point following its failed breakout attempt. While key indicators remain constructive, bulls must reclaim the $270 resistance and 20-day EMA to avoid a deeper correction.

If the $230-$238 support fails, substantial technical damage may unfold. Traders may consider tightening stop losses on long positions while awaiting further directional clues.

SUI Price Resilience: Will Support Hold Amid Market Pressures?

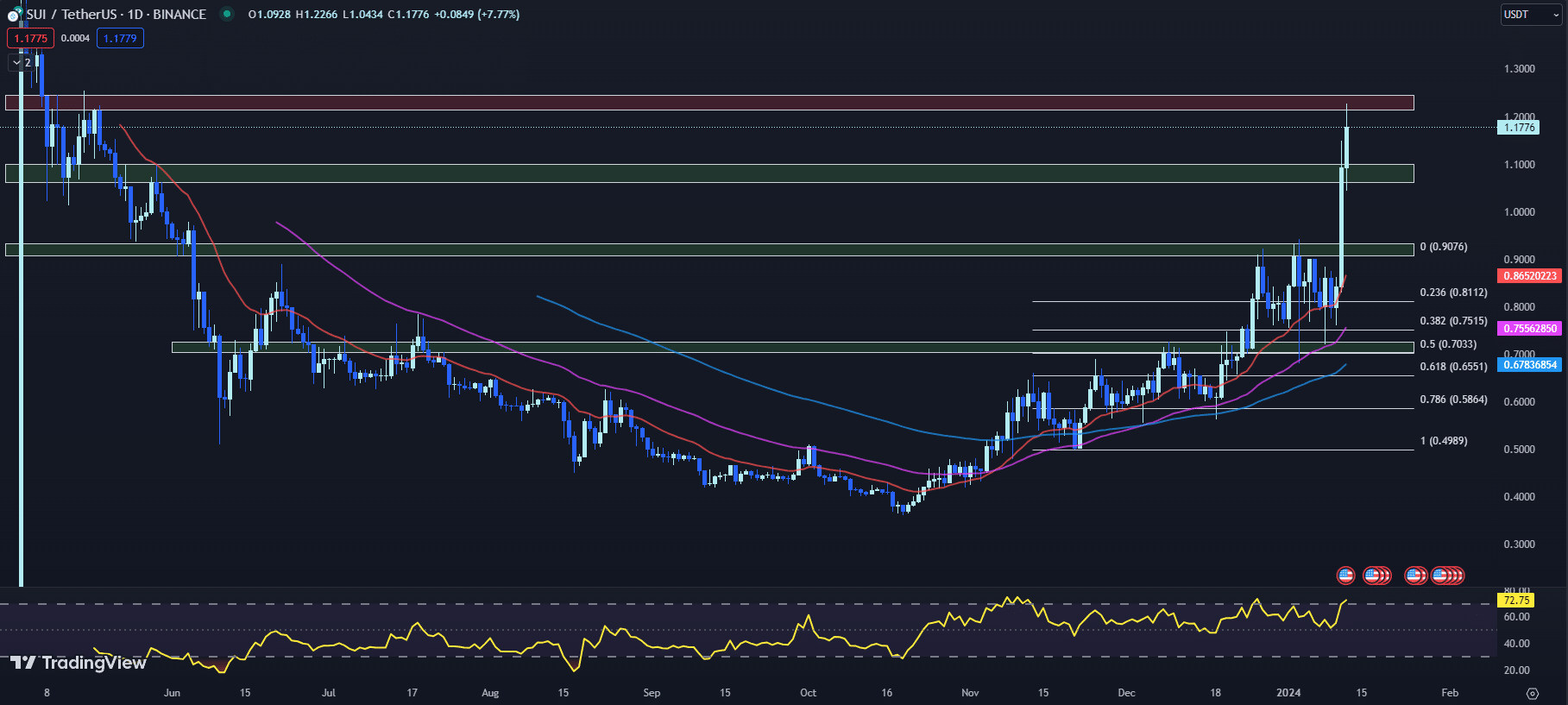

Amidst a generally bearish trend in the cryptocurrency market, the SUI price has been defying gravity, signaling a strong bullish sentiment as it hit an 8-month peak earlier today. This surge has caught the attention of traders and analysts alike, with many keeping a close watch on SUI’s technical indicators for hints of the cryptocurrency’s next move.

The SUI price is currently experiencing a bullish alignment in its moving averages, with the 20-day EMA at $0.8652 standing well above both the 50-day EMA at $0.7556 and the 100-day EMA at $0.6784. Such a configuration is typically interpreted as a strong bullish signal, suggesting a robust uptrend as shorter-term sentiment outpaces longer-term caution.

Further energizing the bullish case for SUI, the RSI has escalated to 72.75, up substantially from the previous day’s reading of 62.15. Traditionally, an RSI above 70 indicates that an asset may be overbought, but in the context of a strong uptrend, it can also reflect a powerful buying momentum that may sustain higher prices.

Confirming this momentum, the MACD histogram’s reading has increased to 1.7 from the previous day’s 1.4, indicating that the bullish trend is gaining strength. The positive histogram values imply that the upward movement in the SUI price is not just a short-lived spike but rather a trend with potential continuity.

The SUI price is currently testing a horizontal resistance zone spanning from $1.2137 to $1.2449. A decisive breakthrough above this resistance could signal further upside potential. However, should the SUI price fail to sustain its climb, the immediate support zone lies between $1.0611 and $1.0998, which could provide a safety net and prevent a more substantial pullback.

Given SUI’s recent performance, investors and traders may want to closely monitor the next price action at the resistance level. A successful breach could pave the way for the continuation of the uptrend. On the flip side, if the SUI price retreats, whether it holds above the support zone could be indicative of the asset’s resilience in the face of broader market pressures.

With the SUI price up by 7.77% so far today, maintaining vigilance on the immediate resistance and support zones is critical. The market’s next move could be pivotal for SUI, with the potential to either fuel the ongoing rally or trigger a consolidation phase that tests the strength of recent gains.

Tezos’ XTZ Price Struggles to Overcome Resistance: What’s Next?

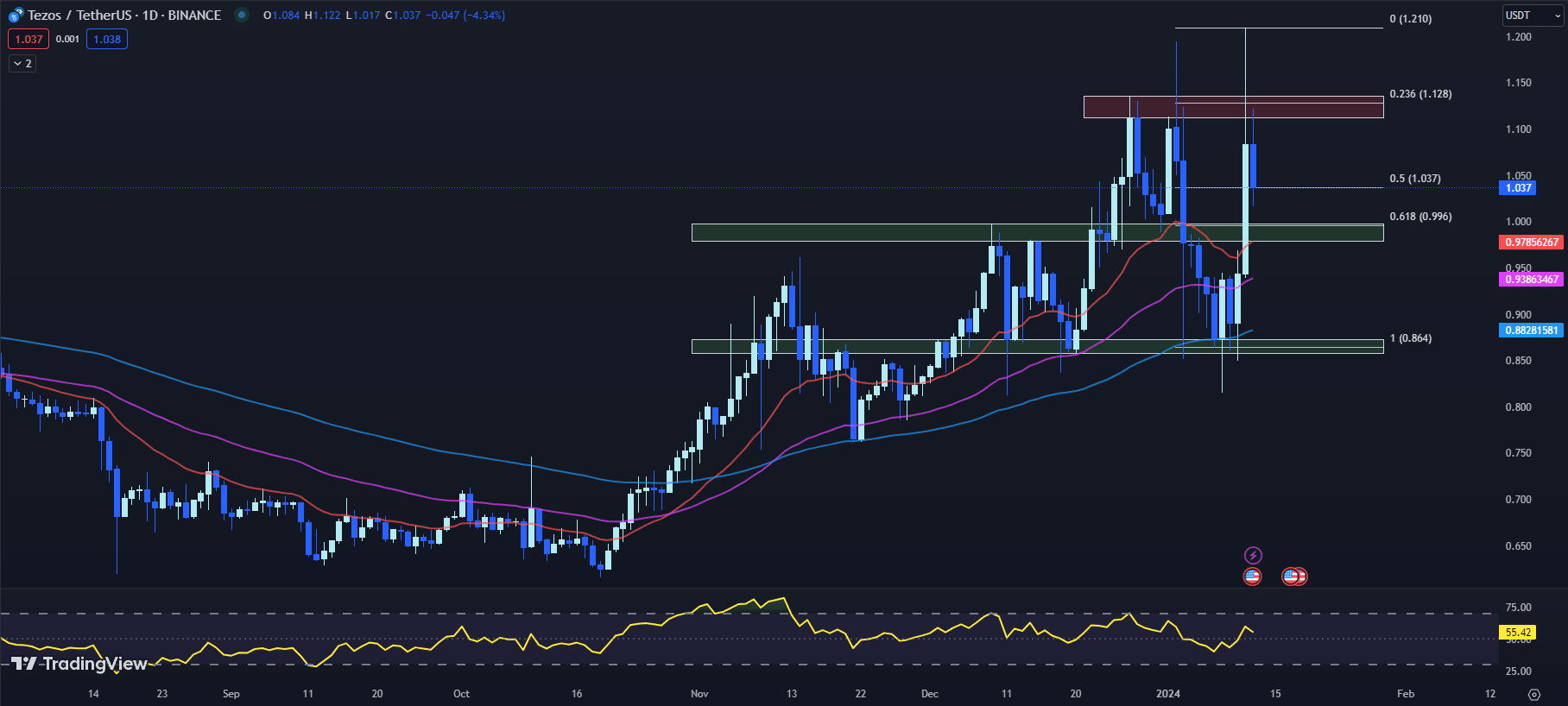

Tezos (XTZ) surged yesterday achieving its highest level since March 2023, with an intraday high of $1.210. Despite this upward momentum, the XTZ price failed to hold its gains and retreated to close at $0.939, undercutting its peak yet still posting a notable 14.83% rise from the previous close.

This price action has prompted investors to scrutinize the current technical indicators for clues on the immediate future of XTZ.

The XTZ price is currently retesting the Fib 0.5 level at $1.037, seeking support after a decline of 4.34% so far today. The layered support levels provided by the 20-day EMA ($0.9786), the 50-day EMA ($0.9386), and the 100-day EMA ($0.8828) suggest that multiple thresholds could potentially cushion further drops in the XTZ price, should it continue to falter.

The Relative Strength Index (RSI) stands at 55.42, down from the previous day’s 59.72, indicating that the recent buying pressure is waning, albeit still within a moderate range. This decrease in the RSI may signal a period of consolidation or a minor pullback following the recent price spike.

Offering a beacon of hope to bullish traders, the MACD histogram is currently at -0.000, inching up from yesterday’s -0.005, and is on the cusp of a potential bullish MACD crossover. Such a crossover could be indicative of a shift in momentum that may favor the XTZ price in the upcoming days.

Resistance remains a key obstacle for XTZ, with a formidable horizontal zone lying between $1.113 to $1.136. This resistance is reinforced by the proximity to the Fib 0.236 level of $1.128, an area that XTZ has struggled to surpass with conviction. Overcoming this resistance is critical for XTZ to signal a potential bullish trend reversal.

Should the XTZ price break below the Fib 0.5 support level at $1.037, it may find itself in a precarious situation, with the next support zone situated between $0.979 to $0.998. This zone coincides with the Fib 0.618 level of $0.996 and is underpinned by the 20-day EMA, offering a confluence of support that could be pivotal in preventing further price erosion.

Traders are advised to closely watch these technical indicators and key price levels. The XTZ price is at a pivotal point where its ability to rebound from support or break through resistance will likely set the tone for its short-term trajectory.

While BCH, SUI, and XTZ chart their courses, fresh concepts arise through presales like decentralized mining trailblazer Bitcoin Minetrix and community-focused meme coin Sponge V2 Token.

Hidden Gems: Overlooked Bitcoin Alternatives Worth Uncovering

As we enter 2024, the cryptocurrency spotlight is expanding beyond Bitcoin. Investors are eager to explore promising Bitcoin alternatives that could fuel the next surge of growth for the industry. The pursuit is on to find uncharted, profitable opportunities among cutting-edge cryptocurrencies.

Several potential Bitcoin alternatives have come to prominence, gaining interest among investors searching for the best crypto to buy now. Bitcoin Minetrix and Sponge V2 Token in particular are attracting attention for their growth potential.

Forward-thinking investors are noticing these new cryptos as strategic additions to diversify their portfolios beyond Bitcoin. While Bitcoin still holds an important position, intrigue is building around these rising stars in the crypto space.

Expanding beyond Bitcoin by investing early in compelling alternatives like Bitcoin Minetrix and Sponge V2 Token provides new avenues for portfolio growth. Identifying and investing in what could become the next high flyers in crypto presents an opportunity to ride their ascent potentially.

Rather than limiting investments to Bitcoin, diversifying into new cryptocurrencies with unique value is a savvy move. It allows investors to capitalize on the next major boom in the dynamic crypto space.

Bitcoin Minetrix: Shaking Up the Mining Industry with the Best Crypto to Buy Now

Bitcoin Minetrix, a new protocol for decentralized cloud mining, has raised over $8.3 million so far in its ongoing token presale. The presale allows participants to purchase BTCMTX, an ERC-20 utility token.

#CryptoCommunity, your queries, our responses…

'What advantages does #Bitcoin mining provide over purchasing #Bitcoin?'

Directly fuel network growth.

Heightened autonomy in acquisition.

Develop a profound grasp of technology mechanisms. pic.twitter.com/ygjRceQxNp

— Bitcoinminetrix (@bitcoinminetrix) January 12, 2024

BTCMTX can be staked to earn mining credits which provide access to Bitcoin mining power on the Bitcoin Minetrix platform. This enables users to mine Bitcoin without requiring specialized hardware or expertise.

During the presale, purchased tokens are automatically staked, currently providing a 78% APY. However, this yield will decrease as the staking pool grows.

Bitcoin Minetrix seeks to make Bitcoin mining more accessible by utilizing a platform built on the Ethereum network. This could potentially open Bitcoin mining to a wider audience and contribute to network decentralization and security.

The BTCMTX token has a total supply of 4 billion based on information on the Bitcoin Minetrix website. Of that, 42.5% is allocated to mining, 35% to marketing, 12.5% to staking rewards, and 10% to the community.

The project is currently running a marketing campaign called the “Minedrop” which distributes $30K worth of BTCMTX tokens to competition winners.

With its pioneering model for decentralized Bitcoin mining and focus on ease of use, Bitcoin Minetrix has quickly generated significant buzz in crypto communities. Many contend it could be one of the best crypto to buy now before its fast-approaching public launch.

Interested participants looking to gain exposure to this emergent protocol would be wise to conduct thorough due diligence and act with urgency, as the next presale price hike is happening in less than four days.

Sponge V2: The Best Crypto to Buy Now to Join the Meme Coin Craze

The presale for the new Sponge V2 meme coin comes on the heels of immense hype surrounding meme cryptos like Dogecoin and Shiba Inu. Sponge V2 follows the viral success of Sponge V1, an homage to SpongeBob SquarePants which reached a $100 million market cap at its peak in 2023.

Transitioning from Sponge V1 to V2 is a breeze!

Visit our website and follow our simple steps to bridge your tokens and join the future of #SpongeV2.

#Crypto#AltSeason#CryptoMemespic.twitter.com/sPbreu1JLS

— $SPONGE (@spongeoneth) January 12, 2024

The Sponge V2 presale stands out from typical cryptocurrency offerings due to its one-of-a-kind stake-to-bridge process. This model requires interested investors to first purchase and stake Sponge V1 tokens, which then provides a pathway to acquire Sponge V2 tokens when they are minted.

By incentivizing longer-term positions in V1, this approach seeks to cultivate loyal community involvement leading up to the V2 presale.

Beyond the unique staking-to-bridge mechanism, Sponge V2 is also launching an integrated play-to-earn game. Adding this gaming component not only provides real-world utility for the token but also enables engaging experiences that can attract fresh investors.

The presale is further distinguished by Sponge V2’s total supply of 150 billion tokens, with allocations designated for staking rewards, exchange liquidity, and funding development of the play-to-earn functionality.

By building on the Ethereum blockchain and utilizing the widely adopted ERC-20 token standard, Sponge V2 will be compatible with major cryptocurrency wallets and exchanges right from its launch. This should assist with accessibility and trading activity.

For investors evaluating the dynamic cryptocurrency market in search of the best crypto to buy now, Sponge V2 deserves a closer look given its strategic presale approach and creative concepts around staking, crypto gaming, and building community commitment.

With its creative approach and focus on cultivating an engaged community, the ongoing Sponge V2 token presale offers a compelling opportunity for investors looking to get in early on an ambitious new meme coin project.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Best Crypto to Buy Now January 12 – Bitcoin Cash, Sui, Tezos appeared first on Cryptonews.