Best Crypto to Buy Now November 14 – Frax Share, Polygon, Immutable

Publikováno: 15.11.2023

FXS, MATIC, and IMX log strong gains with crypto presales Bitcoin ETF Token and Bitcoin Minetrix offering potential as the best crypto to buy now. Image by cryptonews.com. Frax Share’s recent market surge has positioned it as one of the best cryptos to buy now with a not insignificant 25.55% price increase so far in […]

The post Best Crypto to Buy Now November 14 – Frax Share, Polygon, Immutable appeared first on Cryptonews.

Frax Share’s recent market surge has positioned it as one of the best cryptos to buy now with a not insignificant 25.55% price increase so far in the month.

Polygon and Immutable are also drawing attention, with Polygon experiencing a 37% surge in the past three weeks and Immutable gaining momentum following its inclusion in Amazon’s ISV Accelerate Program.

Additionally, Bitcoin ETF Token and Bitcoin Minetrix stand out as two potential Bitcoin alternatives gaining traction in the cryptocurrency market with their unique value propositions.

Best Cryptos to Buy Now in The News

Frax Share (FXS) has been one of the standout performers, surging over 25.5% so far in November.

This momentum comes on the heels of Frax recovering its domain names after a potential hacking attempt, as well as the launch of Frax Protocol v3.

The new protocol iteration seeks to improve Frax’s stability across all market conditions by incorporating traditional yield curve dynamics.

It also sets a path towards 100% collateralization primarily through protocol revenues.

With a market capitalization of $534.998 million, Frax Share has gained over 71.54% YTD – outpacing many top 100 cryptocurrencies.

Polygon (MATIC) has also built up substantial momentum, rising over 37% in the past three weeks.

This surge is partially attributed to accumulation by major investors, with around 42.88 million MATIC coins being scooped up by whales – signaling confidence in its immediate trajectory.

@0xPolygonLabs announced the launch of an $85 million grant program with the goal of attracting top Web3 talent to build on its network. #CryptoNewshttps://t.co/0lW0Cf1r6x

— Cryptonews.com (@cryptonews) November 9, 2023

Polygon has trended upward through most of November, consistently gaining price to reach $0.98. Potentially running this run is Polygon Labs’ unveiling of a sizable $85 million grant program to attract web3 developers, as well as hints from co-founder Sandeep Nailwal that key announcements are imminent.

Immutable (IMX) is another standout, having gained significant traction after being added to Amazon’s ISV Accelerate Program.

This provides Immutable with AWS resources to boost security capabilities which is important for securing partnerships with leading gaming studios.

In the aftermath of the Amazon deal, IMX saw its value leap 32.08% in a matter of days. Some analysts predict IMX could reach as high as $1.60 by the end of November given the current momentum.

As of mid-November, Immutable X (IMX) is trading around $1.15 – up 21% week-over-week. IMX’s market cap has also swelled to $1.38 billion, pointing to surging interest among investors.

While major cryptocurrencies grapple with market volatility, investors looking ahead are considering Bitcoin alternatives like Bitcoin ETF Token and Bitcoin Minetrix.

Read on to see why analysts cite FXS, MATIC, IMX, BTCETF, and BTCMTX as some of the best crypto to buy now thanks to their robust fundamentals and/or positive price trajectory.

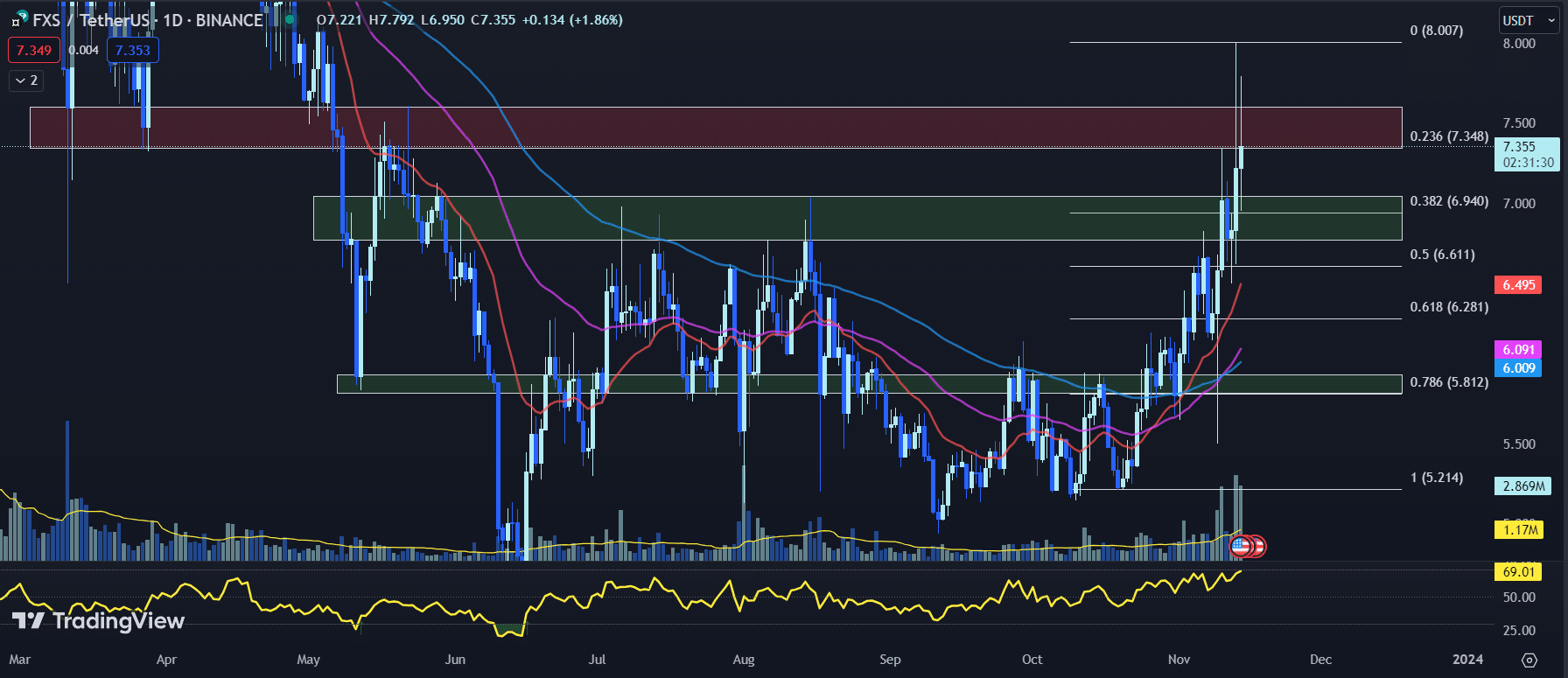

Frax Share FXS Price Prediction: Signs of Exhaustion as Bulls Stumble

After posting three consecutive days of gains, Frax Share (FXS) saw its momentum slow on Tuesday, with prices moving just 1.86% higher amidst declining trading volumes.

While FXS sits near a key resistance level, technical indicators are flashing warning signs that suggest the coin may be due for a pullback in the days ahead.

Frax Share (FXS) Price Prediction and Technical Analysis

The 20-day EMA for the FXS price currently stands at $6.495, crossing above the 50-day EMA of $6.091 just recently. Typically, this golden cross is seen as a bullish indicator.

However, the FXS price is struggling to make headway despite this crossover, signaling potential exhaustion.

The RSI currently reads 69.01, up slightly from 67.48 yesterday. This shows the FXS price is entering overbought territory, which often precedes a selloff as investors take profits.

The MACD histogram sits at 0.085, an increase from the previous day’s 0.072. But the slowing momentum suggests bullish sentiment may be fading for FXS.

With the 24-hour trading volume down 17.63% to $3.2 million, it appears enthusiasm for FXS is declining. This could lead to further consolidation of the FXS price absent a new catalyst.

The FXS price currently faces resistance between $7.348 and $7.6, near the Fib 0.236 level of $7.348. Breaking above this zone could propel FXS higher.

Support lies between $6.769 and the Fib 0.382 level of $6.940. A drop below here risks a steeper correction towards the $5.8 to $6 zone.

While the golden cross suggests upside potential for Frax Share, overbought RSI and falling volumes point to caution. FXS may need to consolidate under resistance before attempting a breakout.

Remaining nimble and watching for a volume spike past $7.60 or drop under $6.75 could set the next major trend.

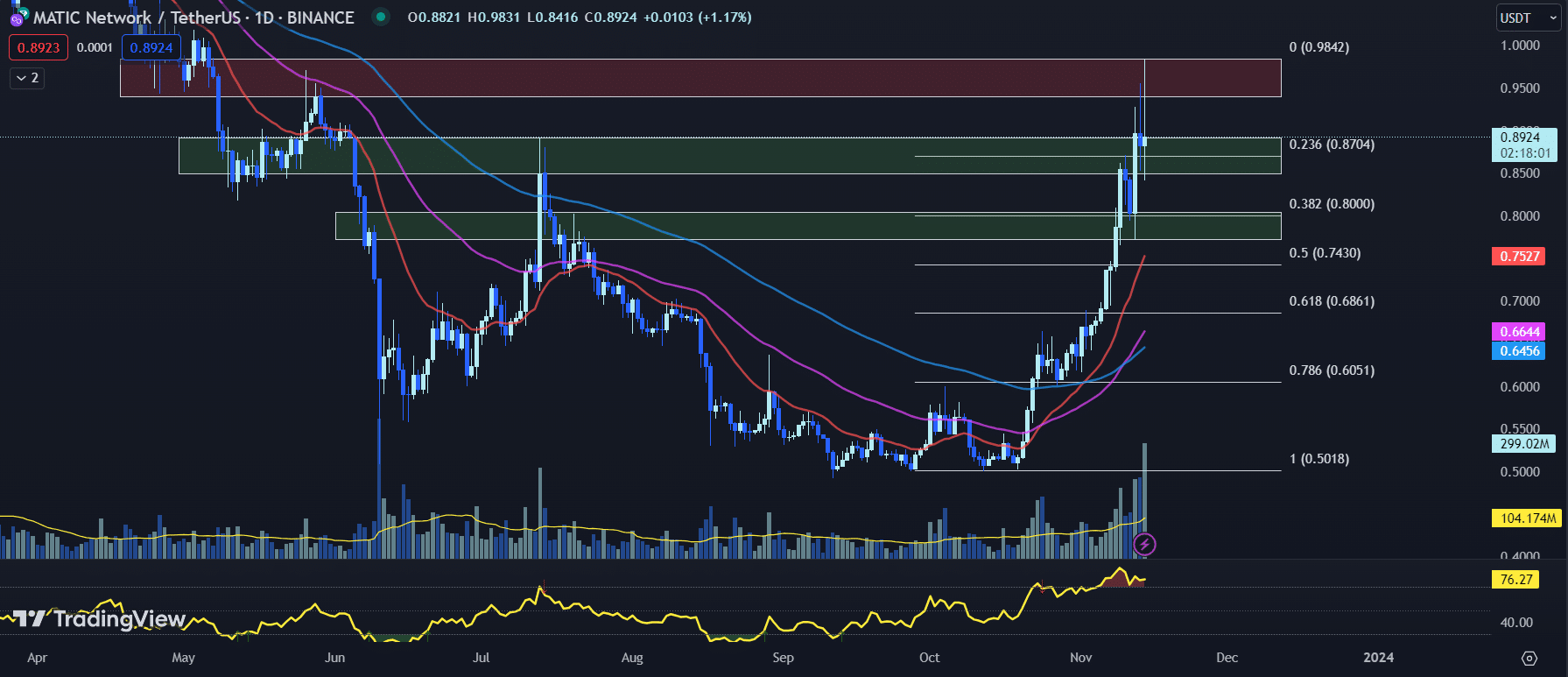

Polygon MATIC Price Prediction: Bulls Take Charge, but Is a Pullback Looming?

The Matic price has been on a run over the past several weeks, with the cryptocurrency gaining 70% in the last month alone.

After consolidating between $0.50 and $0.60 for much of mid-August to late October, Matic staged a breakout in early November that propelled it to its highest levels since last May.

Matic is currently trading around $0.89, up 1.17% so far today. The MATIC price hit an intraday high of $0.9831 earlier today before pulling back. This test of resistance appears to have brought in profit-taking from short-term bulls.

Looking at technical indicators, Matic’s 20-day EMA stands at $0.7527, crossing above its 50-day EMA at $0.6644. This bullish crossover of the short and long-term moving averages reflects the positive momentum behind Matic over the past month.

The RSI is currently at 76.27, up slightly from 75.55 yesterday and approaching overbought territory. This warns of waning upside potential in the near term.

At the same time, the MACD histogram sits at 0.0161, down from 0.0173 yesterday. The declining histogram suggests slowing bullish momentum after the sharp surge higher.

With Matic stabilizing following its test of resistance, the coin may need to consolidate recent gains before attempting another push higher. Initial support lies between $0.8496 and $0.8920, with the Fib 0.236 level at $0.8704 offering additional support.

A breakback below this area could open the door for a larger pullback. On the upside, Matic will need to decisively break resistance at $0.9404-$0.9842 to resume its uptrend. Traders may look to buy a confirmed breakout or add to longs on a retest of support.

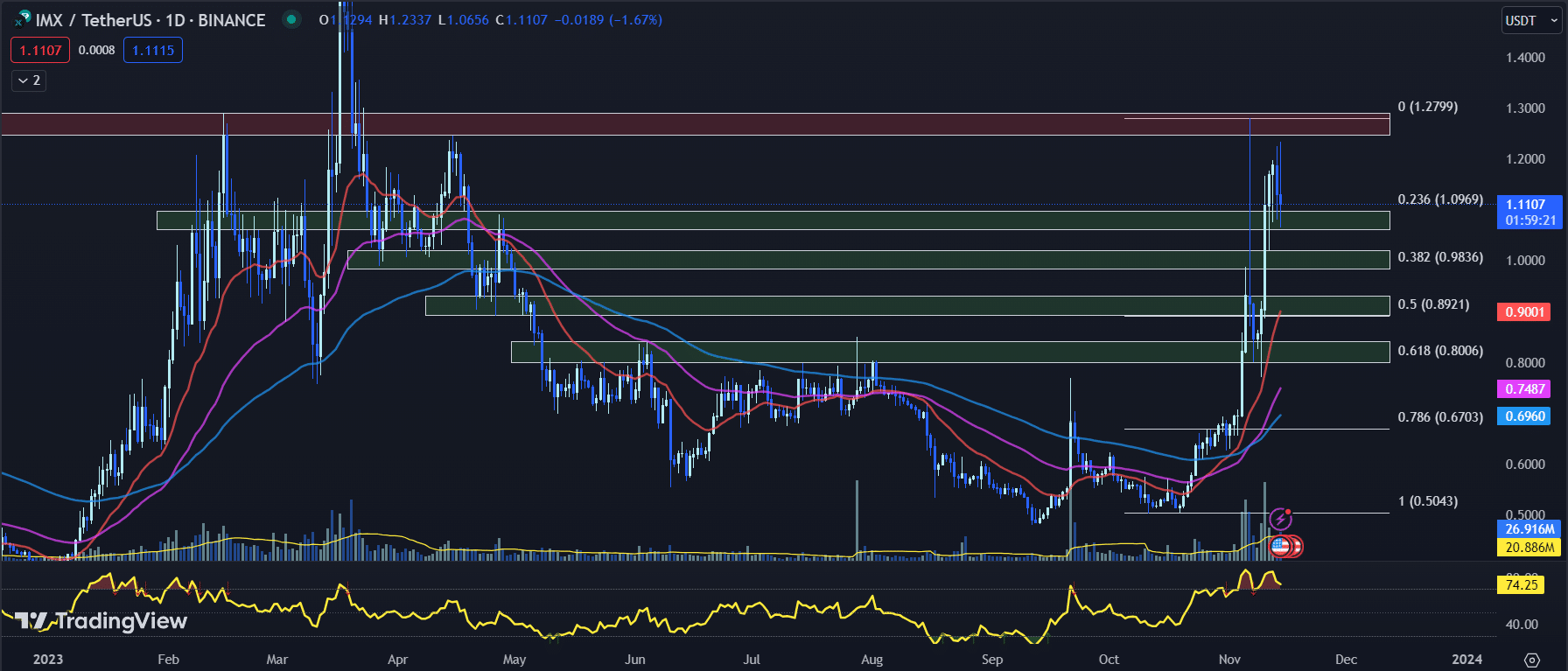

Immutable IMX Price Prediction: Will Support Hold or Deeper Pullback Ahead?

The IMX price has been facing downward pressure over the last two days, declining 1.67% so far today.

IMX is currently hovering around the key support level of $1.0969, which aligns with the Fib 0.236 level.

This support zone between $1.0606 and $1.0975 will be crucial for IMX to hold above to avoid further losses.

Looking at technical indicators, the 20-day EMA sits at $0.9001 while the 50-day EMA is at $0.7487.

With the short-term EMA above the longer-term EMA, this signals a bullish trend.

However, with the IMX price pulling back from recent highs, caution should be exercised relying solely on EMAs.

The relative strength index (RSI) for IMX is 74.25, down from yesterday’s 76.60 reading.

While still in bullish territory, the RSI is drifting lower suggesting waning upside momentum.

The MACD histogram has also tightened to 0.0322 from 0.0390, highlighting slowing bullish momentum.

On the upside, IMX faces horizontal resistance between $1.2477 and $1.2894. A break above this could open the door to further gains.

To the downside, losing the $1.0606 to $1.0975 support zone could see IMX target the next support at $0.9841 to $1.0210.

Overall, while IMX remains in an uptrend, its price is taking a breather after a strong run higher.

Bulls will want to see the $1.0969 support level hold firm to keep the rally intact.

Otherwise, a deeper pullback towards the $0.9841 to $1.0210 zone may materialize before IMX can regain its upside momentum.

Maintaining prudent risk management will be key amid the consolidation.

As FXS, MATIC, and IMX search for a definitive direction, crypto presales also offer opportunities.

The upcoming launches of Bitcoin ETF token and Bitcoin Minetrix presales provide interesting prospects.

Uncovering Promising Bitcoin Alternatives in Crypto Presales

As the crypto market matures, Bitcoin is no longer the only viable cryptocurrency for investors.

Although it continues to be the most dominant cryptocurrency, Bitcoin’s steadfast status as the best crypto to buy may slowly decline moving forward.

Speculators are digging into neglected segments of the crypto market, seeking cryptocurrencies that could rapidly increase in value before drawing investor attention.

Crypto presale offerings allow access to new Bitcoin alternatives before exchange listings.

Unlike an IPO in stocks, a crypto presale allows you to buy tokens early at a discount compared to the eventual listing price.

The project raises capital while letting investors get skin in the game.

Two crypto presale projects aspiring to one day reach Bitcoin alternative status are Bitcoin ETF Token and Bitcoin Minetrix.

Though risky, investing in crypto presales allows you to buy the best crypto to buy now before the masses take notice.

The key is picking quality projects with long-term upside past the hype.

Bitcoin ETF Token May Be the Best Crypto to Buy Now As Bitcoin ETF Excitement Boosts Presale to Over $600,000

The possibility of SEC approval for a spot bitcoin exchange-traded fund (ETF) has created excitement in the cryptocurrency market.

This positive sentiment has attracted significant interest in the presale for Bitcoin ETF Token (BTCETF), a cryptocurrency designed to benefit from Bitcoin ETF milestones.

The Bitcoin ETF Token presale has reeled in over $600,000 so far. The presale pricing will rise in less than two days, incentivizing traders to buy now before it increases.

What is the purpose of the $BTCETF#Token?

The #BitcoinETF token is an ERC-20 token that has been created to celebrate the expected arrival of #Bitcoin ETFs in the U.S. financial markets. pic.twitter.com/KUalGAFD5a

— BTCETF_Token (@BTCETF_Token) November 14, 2023

A spot bitcoin ETF would provide mainstream investors with an easier way to gain exposure to bitcoin.

Financial advisors currently restricted from cryptocurrencies could invest client funds into a Bitcoin ETF.

Many anticipate an ETF could result in billions of dollars flowing into bitcoin.

BTCETF implements deflationary token burns based on ETF-related milestones.

For example, when the trading volume reaches $100 million, the tax drops from 5% to 4%.

As real ETFs get closer to launching, BTCETF adjusts to capture that value.

BTCETF holders can also stake their tokens to earn rewards of up to 423% APY paid out over five years. Over 66.2 million tokens have already been staked.

While the market awaits the SEC’s decision, traders clearly want exposure to the ETF narrative. Bitcoin ETF Token offers a way to buy into the story before it potentially takes off.

Bitcoin Minetrix: The Best Crypto to Buy Now for Bitcoin Mining Enthusiasts

With Bitcoin stabilizing above $35,000, interest in Bitcoin mining is surging.

However, this growth has led to increased centralization, with the top two mining pools controlling over 55% of the network hash rate. This makes profitable mining difficult for regular investors.

Bitcoin Minetrix seeks to open up Bitcoin mining rewards to the masses through decentralized cloud mining, a pioneering crypto mining model that is driving the project’s successful $BTCMTX presale, which has raised nearly $4 million so far.

Discovering the groundbreaking stake-to-mine idea, reigniting excitement for everyday #Crypto lovers to participate in #Bitcoin mining.

Users of #BitcoinMinetrix only need an Ethereum-compatible wallet such as #MetaMask, making the process simple and accessible. pic.twitter.com/kEPQyA21YP

— Bitcoinminetrix (@bitcoinminetrix) November 14, 2023

Industry experts cite mining centralization as fueling interest in Minetrix’s solution.

Marathon Digital, the world’s top Bitcoin miner, reported a Q3 2023 average hash rate of 14.2 EH/s, around 4% of total network hash.

Meanwhile, Riot Platforms hit 10.9 EH/s.

Bitcoin Minetrix lets users stake $BTCMTX tokens to earn mining credits, which are redeemed for Bitcoin cloud mining time slots.

This helps decentralize Bitcoin mining again, restoring accessibility for smaller investors.

As a Bitcoin alternative, $BTCMTX also provides an affordable way to capitalize on the resurgence of the Bitcoin mining industry.

With a fractional total supply and minuscule starting market cap, major growth is expected as demand rises.

Bitcoin’s 120% YTD performance signals a robust demand for cryptocurrencies connected to crypto mining.

$BTCMTX offers similar exposure but with greater upside potential from its extremely low market cap basis.

With presale momentum growing and Bitcoin mining demand persistent, $BTCMTX holds strong upside potential – positioning it as a leading contender for the best crypto to buy now.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital

The post Best Crypto to Buy Now November 14 – Frax Share, Polygon, Immutable appeared first on Cryptonews.