Best Crypto to Buy Now November 27 – TerraClassicUSD, Terra, Axie Infinity

Publikováno: 28.11.2023

Analyzing USTC, LUNA, and AXS price action – do technical indicators confirm them as the best cryptos to buy now? Image by cryptonews.com. Following TerraClassicUSD’s 220% gains over the past few days, Binance listed USTC in perpetual futures with 50x leverage earlier today, further fueling its uptrend that saw prices surge 80% at one point […]

The post Best Crypto to Buy Now November 27 – TerraClassicUSD, Terra, Axie Infinity appeared first on Cryptonews.

Following TerraClassicUSD’s 220% gains over the past few days, Binance listed USTC in perpetual futures with 50x leverage earlier today, further fueling its uptrend that saw prices surge 80% at one point earlier today–and cementing its position together with LUNA as the best crypto to buy now.

Axie Infinity is also piquing investor interest as crypto presales such as Bitcoin ETF Token and Bitcoin Minetrix also surface as possible Bitcoin alternatives.

Best Crypto to Buy Now in the News

The value of USTC and Luna tokens has been the focus of concerted community efforts, driven by a proposal from community member dfunk, seeking to push the price towards $1.

The USTC price experienced a significant boost when Terra Classic Labs strategically purchased $500,000 worth of USTC tokens at $0.021 each. This move was followed by Binance’s announcement of launching a USTC perpetual contract with up to 50x leverage, leading to an upsurge where prices at one point surged 80% earlier today.

LUNA, another token that is being considered among the best crypto to buy now, has also enjoyed a notable price surge for the past few days posting near 40% gains since November 22. Over the last 30 days, LUNC’s value increased by 63%, prompting investors to monitor the potential of retesting the $1 mark.

In the gaming cryptocurrencies arena, Axie Infinity (AXS) has been showing promising signs. The AXS price broke out from a descending resistance trend line on October 21, indicating a strong bullish trend. AXS set a new multi-month high of $7.51 earlier today, marking the highest point since May 2023.

In just 4 days, Axie Classic weekly active users has hit 100 K

• New game mode: Cursed Coliseum

• In-game tournament with a Mystic Axie prize

• More coming soonDownload it here: https://t.co/98lUueJmcSpic.twitter.com/YWtBrTUSYN

— Axie Infinity (@AxieInfinity) November 27, 2023

Sky Mavis, the team behind Axie Infinity, announced the return of the original Axie Classic game, which drew substantial player interest with weekly users reportedly reaching 100,000 in just four days. Additionally, the launch of the Axie Infinity Merch Store was also announced.

Meanwhile, crypto presales such as Bitcoin ETF Token and Bitcoin Minetrix have also been generating hype as potential Bitcoin alternatives. These early-stage projects hold promise for future development in the cryptocurrency market.

The recent price surges of USTC, LUNA, Axie Infinity, Bitcoin ETF Token, and Bitcoin Minetrix, coupled with their promising performance and notable price movements position these tokens as some of the best crypto to buy now.

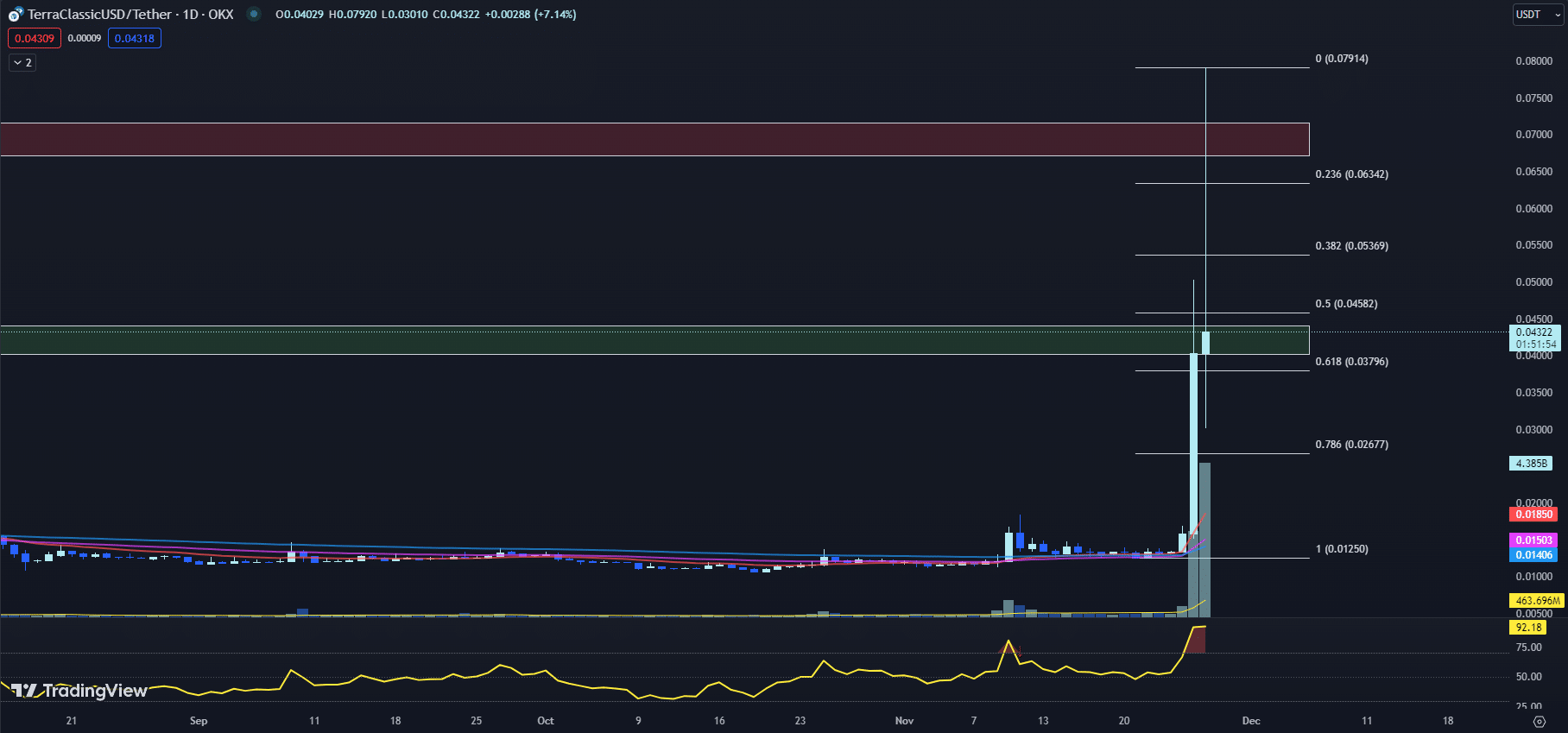

USTC Price Stabilizes Above Key Support Levels: What Lies Ahead?

After posting impressive gains for the past few days, TerraClassicUsd (USTC) price faced a pullback today amidst a broad cryptocurrency market selloff.

With USTC stabilizing above key support levels, technical indicators remain at a crossroads – presenting both risks and opportunities for traders in the days ahead.

The 20-day EMA for the USTC price currently stands at $0.01850, trading above the 50-day EMA of $0.01503 and the 100-day EMA of $0.01406.

The RSI currently stands at 92.18, down from yesterday’s 91.53 but still in overbought territory. This indicates the USTC price may be due for a deeper pullback after its parabolic run.

However, deeply overbought readings can persist in strong uptrends.

The MACD histogram is at 0.00295, an increase from the previous day’s 0.00173. This reflects gathering upside momentum, which could limit the further downside for USTC.

However, MACD divergence with price would highlight a waning bullish conviction.

With the 24-hour trading volume decreasing 35.7% to $22.4 million against USTC’s 80% price jump yesterday, today’s pullback paints a picture of decreased investor enthusiasm at current levels.

This could lead to further consolidation or declines if buying interest continues fading.

The USTC price currently faces horizontal resistance between $0.06713 and $0.07158. Clearing this area could signal the resumption of the uptrend.

Simultaneously, USTC is testing support between $0.04026 and $0.04408. Failure to hold above this support zone could see USTC revisit the previous swing low of around $0.03.

With TerraClassicUsd stabilizing above initial support after a parabolic advance, the coin appears at a critical technical juncture.

While overbought RSI allows for deeper pullbacks, holding above $0.04 could maintain the bullish trend.

A decisive break below this support would point to a trend reversal. Trading within defined risk limits is prudent while awaiting confirmation of the next major move.

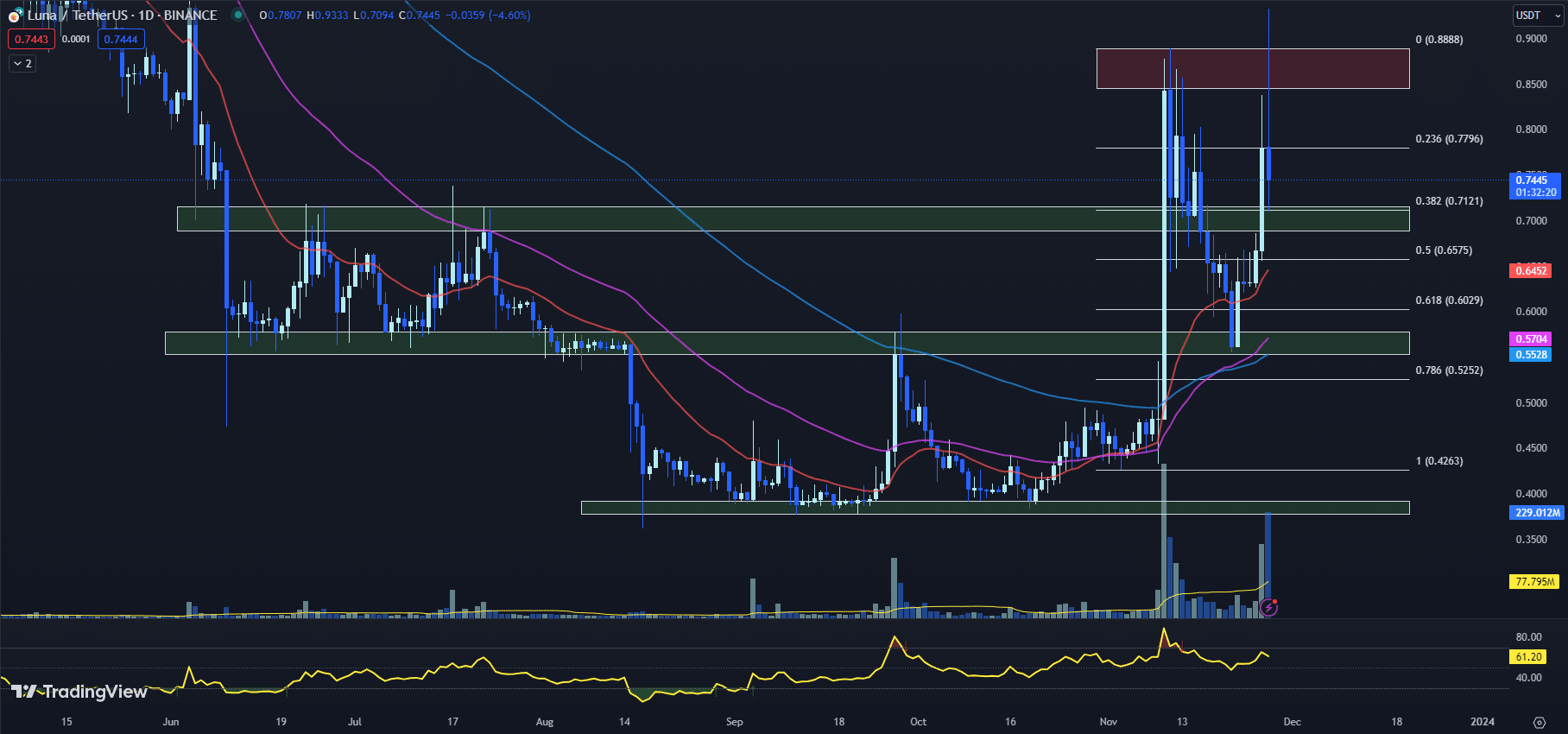

Support Levels Hold Firm for LUNA Amidst Volatile Market

The LUNA price has seen a pullback after reaching a new multi-month high of $0.9333 earlier today amidst the broader cryptocurrency market downturn. LUNA has since retraced and found support around its Fib 0.382 level at $0.7121. Further consolidation may be needed before LUNA’s next potential upswing.

Looking at the key technical indicators, the LUNA price currently stands at $0.7445, down 4.60% so far today. The 20-day EMA is at $0.6452 while the 50-day EMA stands lower at $0.5704.

With the LUNA price remaining above both these EMAs, this signals an established short-term uptrend is still intact for now. However, the pullback today warrants some caution as bears look to gain control.

The RSI for LUNA is at 61.20, down from yesterday’s 65.18 and moving away from overbought territory. This hints that bearish momentum is building. The MACD histogram has formed a bullish crossover to 0.0017 from yesterday’s -0.0013, but its sustainability remains uncertain.

On the upside, LUNA faces immediate resistance at the Fib 0.236 level of $0.7795. Beyond this, the horizontal resistance zone between $0.8452 and $0.8888 that was tested when LUNA hit its earlier high today could act as a barrier.

On the downside, LUNA has found support around the area between $0.6886 and $0.7152. This aligns with the Fib 0.382 support at $0.7121. A break below this could see LUNA test lower support levels.

With the LUNA price stabilizing above key support but technical indicators signaling growing bearish strength, caution may be prudent for traders.

A decisive break past $0.7795 resistance or below $0.7121 support could determine LUNA’s next trend going forward.

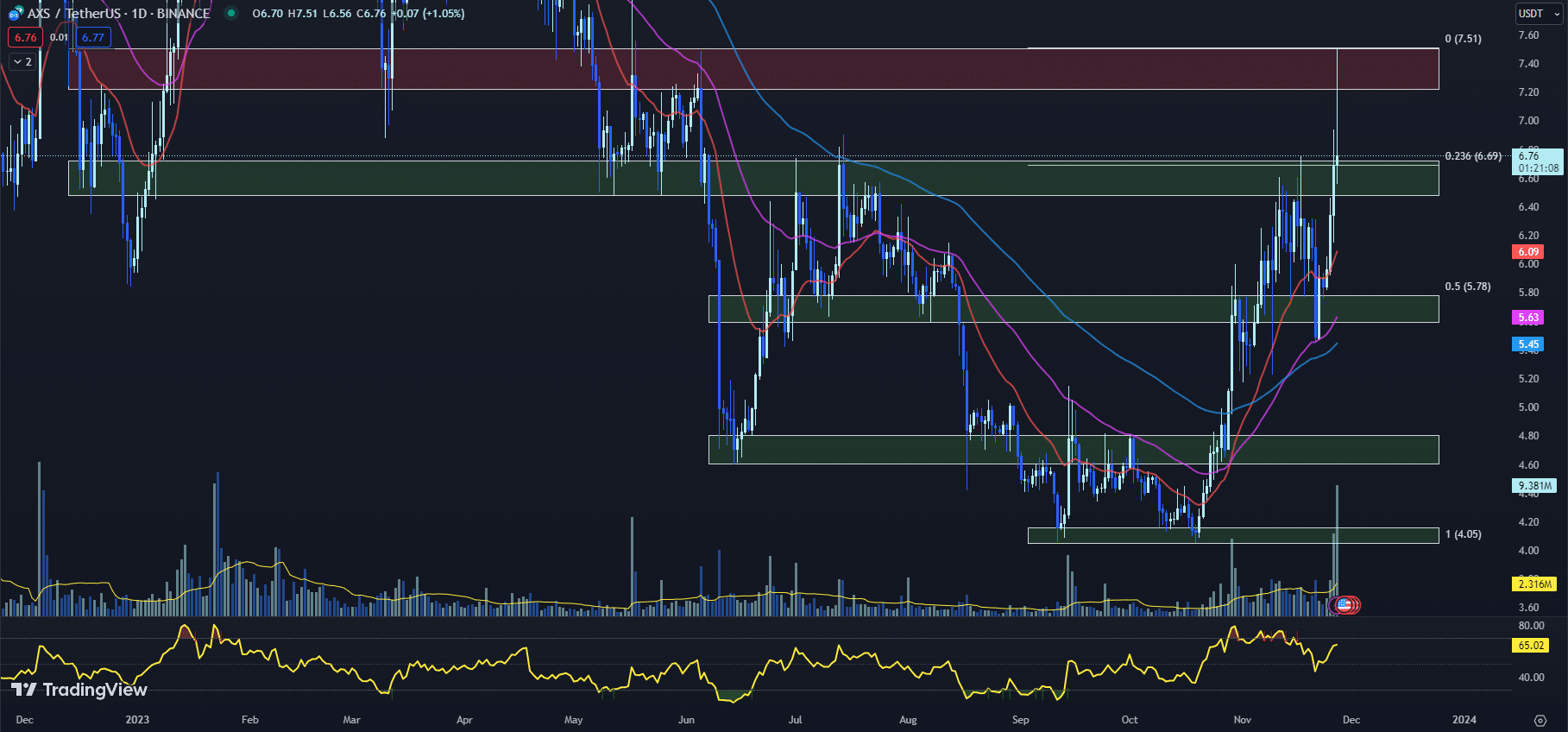

Bullish Momentum Building for AXS: Key Levels to Watch

The AXS price continues to show strength, hitting a multi-month high of $7.51 earlier today before retreating to stabilize around the Fib 0.236 support level of $6.69.

With AXS up over 8% in the past week, technical indicators suggest the rally may have further room to run if key levels hold.

The 20-day EMA for the AXS price currently stands at $6.09 while the 50-day EMA sits at $5.63. With the faster-moving short-term EMA well above the longer-term EMA, this bullish crossover pattern reflects building positive momentum.

The RSI jumped to 65.02 from yesterday’s 64.14 reading. While no longer overbought, the RSI remaining firmly in bullish territory signals lingering buyer dominance. However, the RSI is extended and due for a pullback, meaning caution is still warranted at these altitudes.

The MACD histogram is at 0.01, crossing over into positive territory from yesterday’s -0.02 value. This bullish crossover suggests upsideConviction is accelerating. However, like the elevated RSI, the histogram’s rise means pullbacks remain likely.

With the AXS price stabilizing above the support zone between $6.48 to $6.72 after its rapid surge, the path of least resistance appears higher. However, overextended technical readings mean volatility, and two-sided trade is expected.

To maintain the uptrend, the AXS price will need to hold above support at around $6.69. A decisive break below this area would signal weakness. To the upside, the horizontal resistance zone of $7.22 to $7.50 remains the next target.

While USTC, LUNA, and AXS take the spotlight based on their recent price movements, new blockchain initiatives like Bitcoin ETF Token and Bitcoin Minetrix are seeking to make their mark through ongoing presale opportunities.

Diversifying Your Crypto Portfolio with Bitcoin Alternatives

As Bitcoin continues to lead the crypto market, savvy investors are actively seeking lesser-known Bitcoin alternatives that have yet to capture widespread attention.

One effective strategy is to focus on cryptocurrencies that are currently offering presales of their native tokens.

Participating in crypto presales can be a smart move, allowing investors to buy new tokens at prices lower than what they might be when they hit the market.

Although this approach comes with its own set of risks, it does offer investors an early entry into potentially successful cryptocurrencies before they become mainstream.

The key to success in this endeavor is identifying projects that offer practical solutions to existing problems or fulfill current market demands.

Two such promising Bitcoin alternatives currently in the presale phase are Bitcoin ETF Token and Bitcoin Minetrix.

Their presale offerings provide an opportunity for investors to get in early on what could be the next significant players in the crypto market, at a price much lower than their future potential.

For investors searching for the best crypto to buy now, keeping an eye on these Bitcoin alternatives could be a wise decision as they prepare for their introduction to the broader cryptocurrency market.

Bitcoin ETF Token Presale Nears $2 Million, Positioning Itself as One of the Best Crypto to Buy Now

The cryptocurrency market has seen mixed performance over the past week, with Bitcoin struggling to break past resistance at $38,500. Bitcoin hit a YTD peak of $38,400 on Nov 24, but has since pulled back nearly 4% and is currently trading around $37,000, based on data from TradingView.

Meanwhile, the newer crypto project Bitcoin ETF Token has continued to gain traction, raising over $1.8 million in its ongoing BTCETF token presale. The project seeks to capitalize on investor excitement around a potential Bitcoin Exchange Traded Fund (ETF).

#BitcoinETF Stage 5 is wrapping up in just 1 day!

Stay alert!

pic.twitter.com/6eRzXfrSs7

— BTCETF_Token (@BTCETF_Token) November 27, 2023

Bitcoin ETF Token utilizes deflationary tokenomics, with 5% of the total supply burned at major Bitcoin ETF milestones. The project also imposes a 5% burn tax on each transaction, reducing circulating supply over time. Holders can earn up to 138% APY by staking the token.

The presale, which allows early participants to purchase the token at $0.0058, has proven popular thus far. However, the initial price will increase after hitting specific fundraising targets.

The crypto market has been volatile after a major crash in 2022. Bitcoin is up 125% year-to-date but down from its all-time high near $69,000 in Nov 2021. Some analysts predict Bitcoin could rally to new highs in 2024 after the next halving event which will reduce the supply of new Bitcoin being mined.

Regulatory approval of a spot Bitcoin ETF in the U.S. has been viewed as a potential catalyst for renewed retail and institutional investment. ProShares’ Bitcoin futures ETF was approved in 2021 but a spot ETF has yet to be approved. The SEC has rejected numerous spot Bitcoin ETF applications to date.

While the broader crypto market faces ongoing volatility, Bitcoin ETF Token’s accelerating presale momentum positions the speculative token as one of the more intriguing crypto bets for investors seeking leveraged exposure to a potential Bitcoin ETF approval.

Low-Cost Bitcoin Mining is Here: Bitcoin Minetrix May Be the Best Crypto to Buy Now

A new cryptocurrency project called Bitcoin Minetrix has launched a presale for its native token, BTCMTX, with the goal of providing an alternative to expensive hardware-based Bitcoin mining.

The core concept behind Bitcoin Minetrix is a stake-to-mine system that will enable BTCMTX token holders to earn cloud mining credits by staking their tokens. These credits can then be redeemed for either Bitcoin cloud mining time or a share of the project’s mining rewards.

#BTCMTX provides a reliable cloud mining option for everyone.

Previous worries regarding pricey hardware and deceptive cloud mining schemes have discouraged entry into this realm.

This decentralized approach guarantees transparency and a safe mining experience.

pic.twitter.com/r3613htyCp

— Bitcoinminetrix (@bitcoinminetrix) November 27, 2023

According to information provided on the Bitcoin Minetrix website, 42.5% of all tokens will fund the project’s mining operations. The remainder will go towards covering staking rewards, marketing, development costs, and other expenses.

In an effort to incentivize early participation, staking BTCMTX currently offers staking rewards of up to 133% APY. The project roadmap indicates plans to launch the platform itself sometime in 2024, followed by exchange listings and expanded marketing campaigns later in the year.

The presale has raised nearly $5 million so far, reflecting significant early-stage interest in the project. As Bitcoin Minetrix’s presale continues, the door is open for all to access tokenized mining rigs and take part in reshaping the Bitcoin mining sector.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Best Crypto to Buy Now November 27 – TerraClassicUSD, Terra, Axie Infinity appeared first on Cryptonews.