Best Crypto to Buy Today January 5 – Celestia, Aptos, Osmosis

Publikováno: 5.1.2024

Celestia, Aptos, Osmosis, Sponge V2, and TG.Casino are top options for the best crypto to buy today. Image by cryptonews.com. With major technical advancements and their prices hitting record levels, Celestia, Aptos, and Osmosis are seeing rising investor interest, driving the cryptocurrencies into the spotlight as some of the best cryptos to buy today. Celestia’s […]

The post Best Crypto to Buy Today January 5 – Celestia, Aptos, Osmosis appeared first on Cryptonews.

With major technical advancements and their prices hitting record levels, Celestia, Aptos, and Osmosis are seeing rising investor interest, driving the cryptocurrencies into the spotlight as some of the best cryptos to buy today.

Celestia’s TIA price continues surging to new all-time highs, while Aptos braces for its major token unlock event.

Additionally, the Osmosis price jumped nearly 40% yesterday, likely fueled by high trading volume and attractive staking rewards for OSMO holders.

Meanwhile, Sponge V2 and the newly launched TG.Casino are positioning themselves as potential Bitcoin alternatives worthy of investor attention and positioning themselves as some of the top presale cryptos to buy today.

Best Crypto to Buy Today in the News

Celestia’s native cryptocurrency TIA has seen impressive growth since its launch in October. The token’s price has increased over 700% from its initial price below $2. Just yesterday, the TIA price saw a spike of nearly 30%.

$tia gang on top.

New airdrops announced.

All time high today.

Life’s good. pic.twitter.com/qXR21nmWsa

— Learn2Earn (@Learn2Earnify) January 5, 2024

The momentum has continued over the past week with a 33% surge that drove the token to reach a new all-time high of $17.2987 earlier today.

After pushing past the $15 mark, the token has captured heightened interest. While technical indicators signal room for growth, a brief correction could occur before further ascent.

Meanwhile, Aptos has captured market attention with its upcoming token unlocks on January 12. The project will release 24.84 million APT tokens, making up 8.08% of the current circulating supply and valued at around $234.76 million.

These unlocks have led to price volatility with previous releases in late 2023. As such, the market will closely watch this impending supply injection of nearly 25 million tokens, which could impact trading behavior and sentiment around Aptos in the short term.

With the network approaching this major token unlock event, participants are bracing for potential effects on the token’s price and stability.

Osmosis’s token, OSMO, has also gained attention as it has seen its price soar to its highest since the previous year, marking over a 650% increase since its 2023 low. The price movement aligns with key technical indicators, and current trends point towards a target of $2.50.

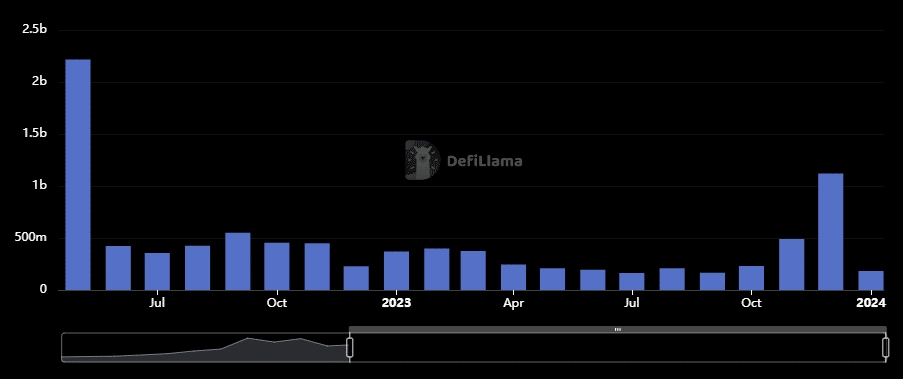

The Osmosis DEX has witnessed increased usage as well, with December 2023’s trading volume crossing $1 billion for the first time in several months. The TVL has also shown notable growth.

While the RSI presents a neutral stance, a bearish divergence hints at a possible trend shift.

Amidst these trending cryptocurrencies, early-stage projects like Sponge V2 and TG.Casino are becoming focal points for growth potential in the cryptocurrency market.

As the crypto market gears up for increased volatility, Celestia, Aptos, Osmosis, Sponge V2, and TG.Casino are at the top of watchlists for traders seeking the best crypto to buy today.

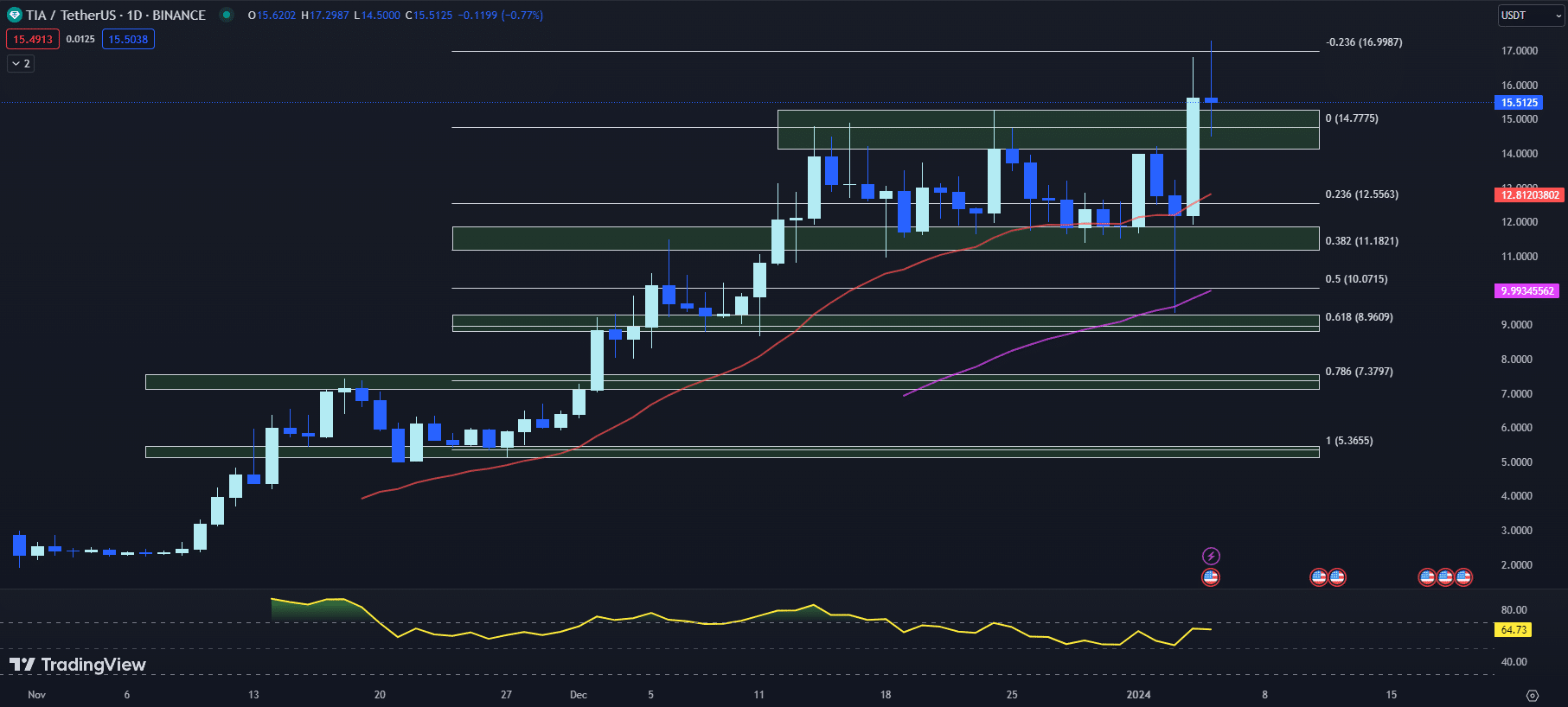

TIA Price Breaks Out of Consolidation, Eyes Psychological Resistance at $20

The TIA price has seen substantial upside, with the cryptocurrency gaining over 28% yesterday to break out of a 3-week consolidation period and hit a new all-time high of $17.2987 earlier today.

However, TIA has since pulled back from its peak and currently trades at $15.5125, down 0.77% so far today. As the TIA price continues testing key support levels, technical indicators offer mixed views on where this nascent uptrend may go next.

The 20-day EMA for TIA stands at $15.5125 while the 50-day EMA is at $12.8120. The bullish alignment between these short and long-term moving averages has been intact for weeks now, affirming sustained upside momentum in the cryptocurrency.

However, TIA’s failure to hold above the psychologically important $16 level has put its breakout in question.

The RSI for TIA has moderated from yesterday’s 65.39 to 64.73, coming off overbought territory. This suggests buyer exhaustion at current levels, though values above 50 still signify overall bullish control.

The MACD histogram has turned positive at 0.0521, a reversal from yesterday’s -0.0643 reading. This highlights improving short-term momentum that could fuel a retest of TIA’s record high.

With TIA’s market capitalization extending above $850 million, 24-hour trading volumes have spiked to $38 million. This increased investor participation underscores TIA’s breakout credibility. However, failure to take out resistance could lead to a sharp pullback.

On the upside, TIA faces immediate resistance at its all-time high of $17.2987, which aligns with the Fib 0.236 level at $16.9987. Acceptance above this area is needed to open the door to psychological resistance at $20.

On the downside, the TIA price is currently retesting support at $14.1337 to $15.2658, the previous swing high zone. Notably, the 20-day EMA and Fib 0.382 level converge at $15.1250 to add to support. If this area fails to hold, TIA could quickly drop towards the 50-day EMA around $12.80.

With Celestia consolidating below record highs, its short-term outlook remains bullish but caution is warranted. A break above $17 resistance would confirm the uptrend, while a drop under $15 support could lead to a deeper correction.

Traders may look to buy dips given robust technicals, but defined risk practices are key amid volatility.

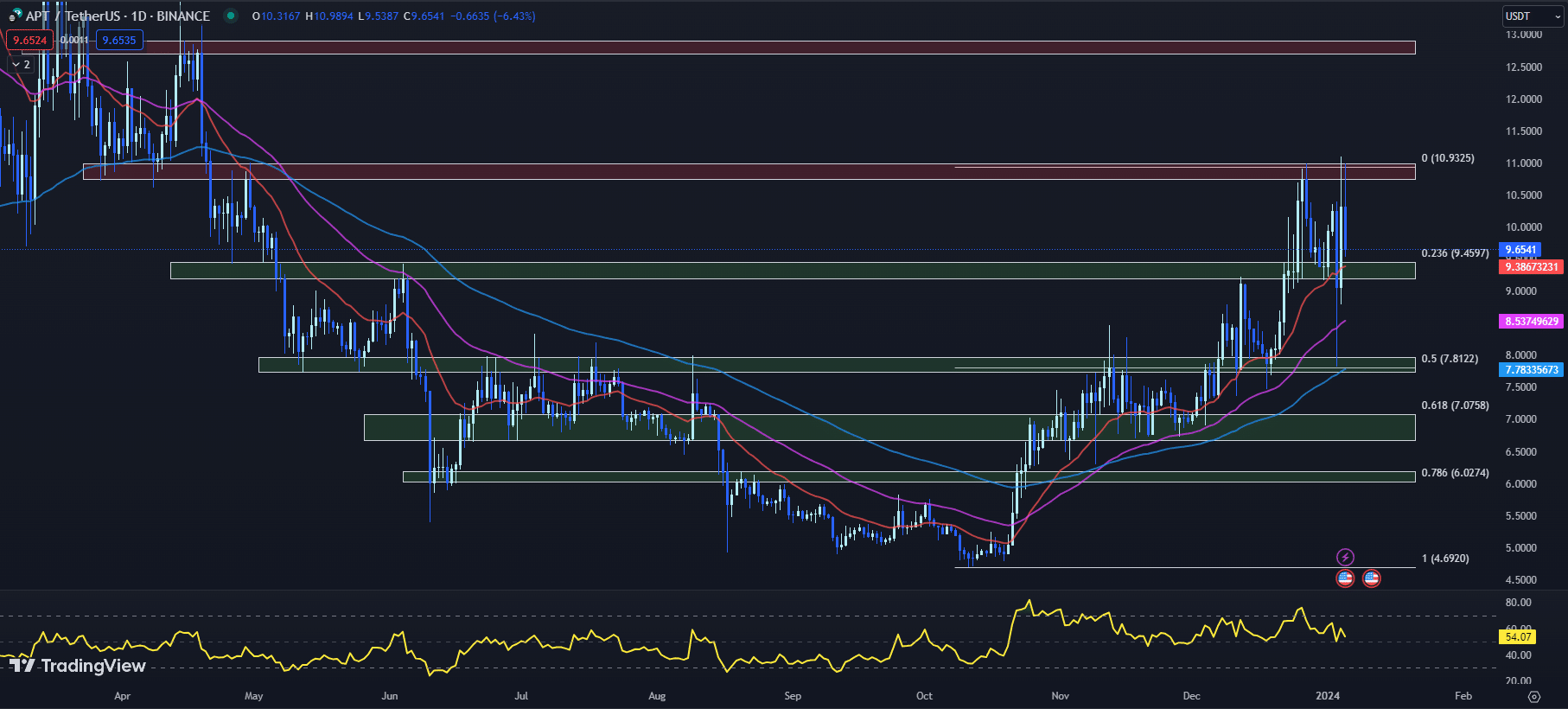

APT Price Struggles to Hold $10 Level: Indecision Looms

The APT price remains stuck in a range, with the cryptocurrency shedding 6.43% today to $9.6542. This comes even after a 13.91% surge yesterday, highlighting APT’s directionless trading.

With technical indicators mixed, the market awaits a potential catalyst from APTOS’ upcoming token unlock event.

With its choppy price action, the 20-day EMA for APT stands at $9.3867 while the 50-day EMA resides at $8.5375. While the bullish EMA alignment remains intact, APT has struggled to hold the $10 level amid its tight trading range. This signals building indecision that could foreshadow a larger move.

The RSI for APT has pulled back from yesterday’s overbought reading of 60.15 to 54.07 today. While still in bullish territory above 50, the moderation highlights fading upside momentum at current levels.

The MACD histogram has turned negative at -0.0442, a deterioration from -0.0201 previously. This reflects a growing bearish momentum that could push APT to retest range support.

With its market capitalization at $2.9 billion, 24-hour trading volumes for APT have declined 6.72% to $535 million. Waning interest during this period of directionless price action poses a downside risk. A decisive breakout or breakdown from its range is needed to spur renewed commitment from investors.

On the upside, APT faces immediate resistance at $10.7452 to $10.9668, the upper boundary of its two-week trading range. Acceptance above this area is needed to open the path to psychological resistance at $12.

To the downside, initial support lies at $9.1925 to $9.4571, with the 20-day EMA and Fib 0.236 level converging at $9.4597. Failure to hold this area could see APT quickly drop towards the 50-day EMA at $8.50. A break below would signal the end of its uptrend.

With APTOS trading sideways ahead of its unlocking, its near-term outlook is neutral leaning bearish. A close below $9 support would confirm downside pressure, while a rally through $11 resistance is needed to reinvigorate bullish momentum.

Caution is warranted amid the uncertainty, with defined risk practices essential.

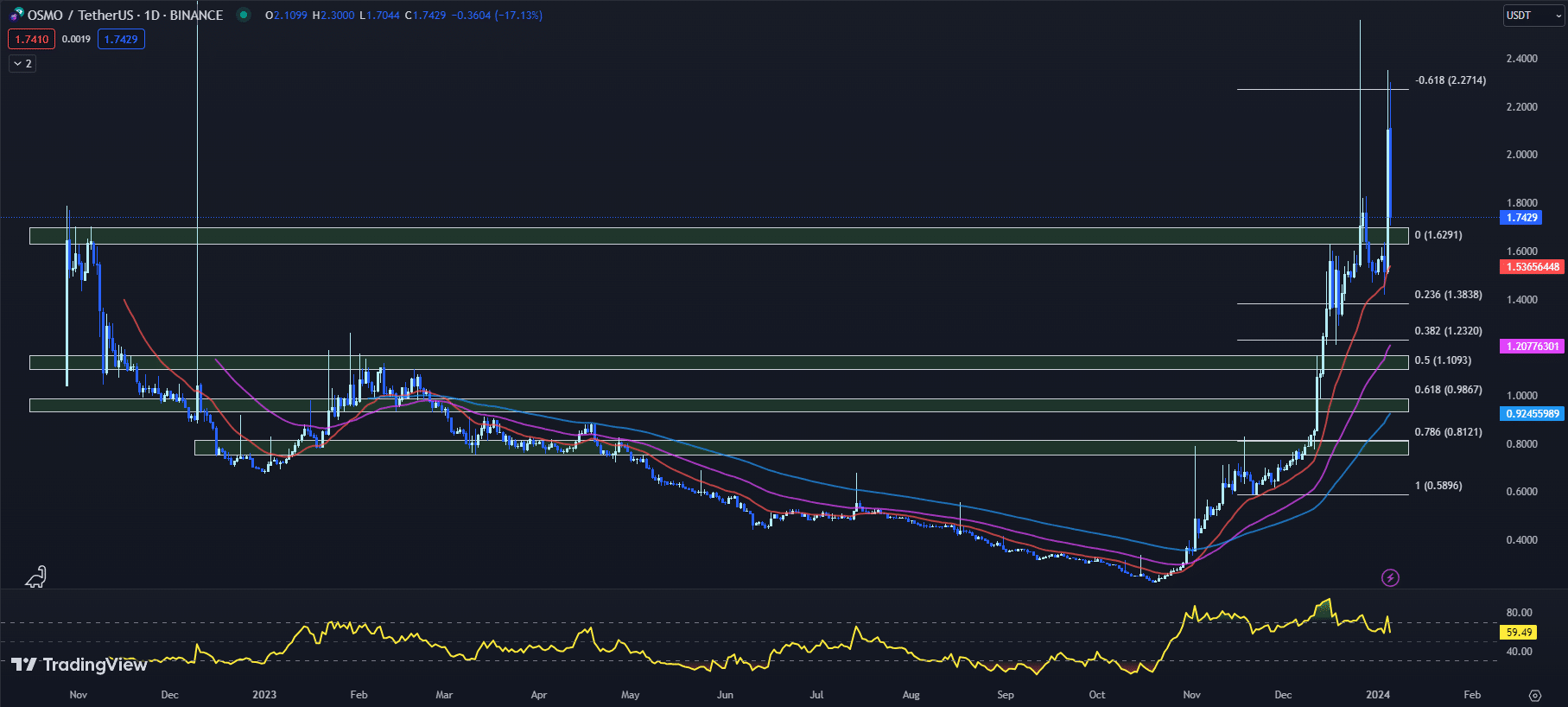

OSMO Price Outlook Weakens: Pullback Challenges Recent Breakout

After surging nearly 40% yesterday, the OSMO price has pulled back sharply, with the cryptocurrency dropping 17.13% so far today to $1.7429. As OSMO retraces from its recent highs, key technical indicators are flashing caution around the sustainability of this nascent uptrend.

The 20-day EMA for OSMO stands at $1.5366, while the 50-day EMA resides at $1.2078. Despite the bullish alignment between these short and long-term moving averages, OSMO has been unable to hold above the $2 level. This highlights potential exhaustion after its parabolic advance.

The RSI indicator has plunged from yesterday’s overbought reading of 75.78 down to 59.49 today. While still in bullish territory, this sharp comedown suggests waning upside momentum in the OSMO price.

Meanwhile, the MACD histogram has turned negative at -0.0027, unable to hold its bullish crossover. This points to building downward pressure.

On the upside, OSMO faces immediate resistance at the extended Fib -0.618 level around $2.2714. Acceptance above this area is needed to confirm bullish continuation.

On the downside, initial support lies between $1.6284 and $1.6993, a previous area of supply turned support. Notably, the 20-day EMA is approaching this zone at around $1.5366.

Failure to hold could see OSMO target the 50-day EMA near $1.20 next.

With its sharp pullback today, Osmosis’ near-term outlook has weakened despite the recent breakout. A daily close below the $1.60 area would raise red flags and shift the bias lower.

Alternatively, a move above the $2.25 resistance would put OSMO back on track.

While the price action, indicators, and outlooks for TIA, APT, and OSMO dominate short-term discussions, the long view shifts to budding cryptos like Sponge V2 and TG.Casino’s $TGC.

Early-bird investors stand to gain handsomely should these projects achieve their ambitious visions.

Diversifying with Bitcoin Alternatives: Tapping Into Overlooked Crypto Opportunities

As we embark on 2024, the crypto market landscape is undergoing a major shift. Investors who previously invested solely in Bitcoin are beginning to explore beyond it and diversify into other cryptocurrencies.

This change highlights investors’ eagerness to tap into crypto projects still in their early stages, enticed by their potential for growth. Rather than just diversifying, investors are keen to capitalize on the enthralling possibilities these developing cryptocurrencies present.

Among these options, Sponge V2 stands out as an exciting Bitcoin alternative rapidly gaining traction. As an enhanced version of the original Sponge meme coin, it appeals through its active involvement in the meme coin space and distinct community-driven presence.

Equally enticing is the newly launched $TGC token by TG.Casino, the world’s first fully licensed casino on Telegram.

The debut of $TGC on DEX platforms signifies a notable advancement for the blockchain-based gambling platform.

Throughout 2024, the hunt among investors for the best crypto to buy today is intensifying, as they carefully evaluate the long-term prospects and potential returns of these Bitcoin alternatives.

With the rise of diverse new options like Sponge V2 and TG.Casino, the crypto market is unveiling a wealth of promising investment avenues beyond Bitcoin.

For investors looking to expand their horizons, these pioneering cryptocurrency projects present compelling opportunities worth exploring.

Sponge V2 Token Presale ($SPONGEV2): Bridging From Sponge V1 and Gaining Momentum — Is It the Best Crypto to Buy Today?

The developers behind the popular meme coin Sponge V1 ($SPONGE) have announced a presale event for the upcoming Sponge V2 ($SPONGEV2).

This comes after Sponge V1 gained notable traction last year, rising to a peak market capitalization of $100 million in May 2023.

According to the Sponge V2 website, the new token intends to build on the original’s success by introducing staking rewards and a play-to-earn game.

Sponge V1 holders will be able to stake their tokens to receive Sponge V2 tokens when it launches.

The team says staked Sponge V1 tokens will be locked permanently in exchange for passive rewards in Sponge V2 over four years, starting with a minimum APY of 40%.

The play-to-earn game will allow users to earn additional Sponge V2 tokens by playing. Both free and paid versions will be available.

Sponge V2’s tokenomics allocate 8% to play-to-earn rewards, 43.09% to staking rewards, and 26.93% to bridging from Sponge V1.

Sponge V2’s presale is currently open to participants, with more details available on the meme coin’s website.

As with any cryptocurrency investment, experts advise researching thoroughly and only allocating disposable income.

The Future of Online Gambling: $TGC is the Best Crypto to Buy Today for Gambling Enthusiasts

TG.Casino, a licensed online casino on the popular messaging platform Telegram, recently concluded a successful presale for its native $TGC token.

The presale allowed early investors to acquire $TGC at a discounted $0.16 price ahead of the public listing.

The presale hit its $5 million fundraising target amid strong interest in the promising crypto-gambling project.

TG.Casino moved swiftly, with $TGC already listed on CoinMarketCap shortly after concluding the presale.

$TGC debuted on the decentralized exchange Uniswap earlier today, opening at $0.1886.

TG Casino Latest Numbers

Players: TG Casino has more than 3500 players, a number any one of us can be proud of!

Deposits: Another stunning milestone! Our players' collective deposits have now crossed the $8million mark!

Wagering: Over the past few months and… pic.twitter.com/UwoRsZHqzQ

— TG Casino (@TGCasino_) January 4, 2024

In the first 20 minutes of trading, the price rapidly increased over 50% to $0.28 as trading volumes exceeded $3 million.

The surge highlights the positive sentiment surrounding the TG.Casino platform. $TGC offers utility benefits like staking rewards and casino cashback.

Meanwhile, TG.Casino’s profits provide ongoing funding for $TGC buybacks and burns.

These dynamics have attracted trader attention, with many viewing $TGC as a potential breakout among gambling tokens and possibly one of the best cryptos to buy today.

The crypto gambling space overall has seen immense expansion recently, with leading tokens like RLB and FUN delivering triple-digit gains in 2023.

As an early leader in Telegram-based crypto gambling, TG.Casino is set to ride the surging interest in online casinos.

With plans to grow its features and user base, 2024 could prove a pivotal year as the platform establishes itself.

The successful $TGC presale and listing have kicked off an exciting new chapter for TG.Casino.

Investors are eager to see if $TGC can follow the success of top gambling tokens such as TG.Casino cements itself as a premier destination for crypto gaming.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Best Crypto to Buy Today January 5 – Celestia, Aptos, Osmosis appeared first on Cryptonews.