Biggest Crypto Gainers Today on Uniswap – INJ, PRIME, IMX

Publikováno: 11.12.2023

INJ, PRIME, and IMX stand out as the biggest crypto gainers today on Uniswap, showing bullish momentum that could lead to more upside. Image by Aleksandra Sova, Adobe Stock. While Bitcoin is dropping by more than 5% at the moment, the INJ price is gaining traction, making Injective one of the biggest crypto gainers today […]

The post Biggest Crypto Gainers Today on Uniswap – INJ, PRIME, IMX appeared first on Cryptonews.

While Bitcoin is dropping by more than 5% at the moment, the INJ price is gaining traction, making Injective one of the biggest crypto gainers today on Uniswap.

Recent data indicates BTC’s price decline came as investors took profits after Bitcoin surpassed $40,000 last week.

Bitcoin down as much as 10% since this tweet.

Who says On-chain data is not good as short-term indicator?

On-chain data for the win. @cryptoquant_comhttps://t.co/dubjtZfYqN

— Julio Moreno (@jjcmoreno) December 11, 2023

Julio Moreno, head of research at crypto analytics firm CryptoQuant, noted that the price was overheating following the rally, making a pullback expected as traders cashed out gains. Though not surprising, the drop below $42,000 shows traders remain cautious after the recent peak.

On-chain data from CryptoQuant revealed that mining company Mara Pool distributed some of its Bitcoin holdings after the latest peak, a cautious move hinting that the firm aims to optimize returns while mitigating risks.

Data from analytics provider IntoTheBlock also showed over half of Bitcoin holders were in profit between $35,796 and $48,470, implying many investors were primed to sell around current levels.

The selling pressure pushed Bitcoin down to nearly $40,000 on Monday morning before stabilizing around $41,000 as of writing.

Analysts view the $44,000 level as providing strong resistance, while $40,000 remains an important support area in the short term.

While the outlook remains uncertain in the short run, most experts remain confident in Bitcoin’s long-term prospects heading to the new year.

Despite Bitcoin’s price drop, several altcoins have diverged from the overall market downtrend – notably INJ, PRIME, and IMX, the biggest crypto gainers today on Uniswap.

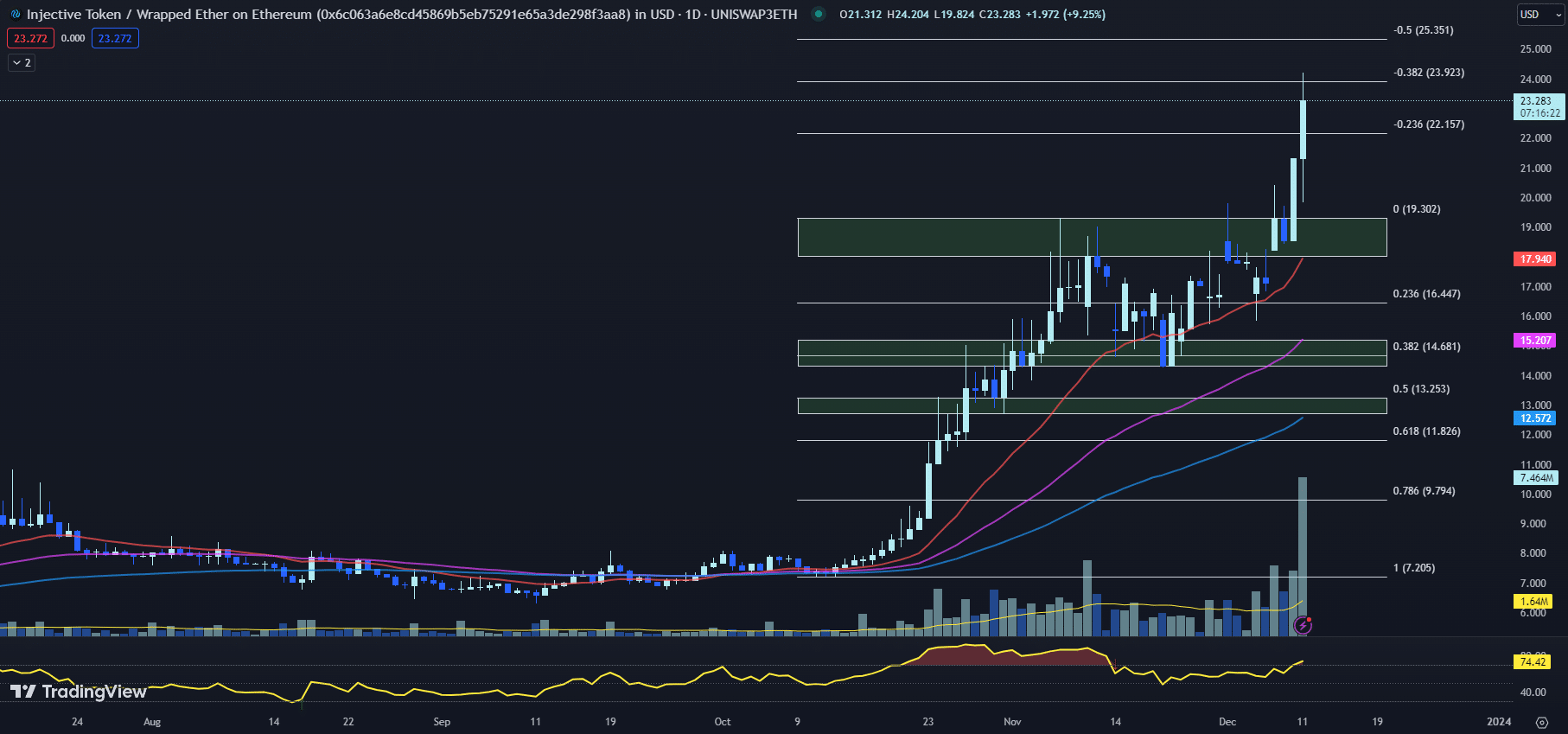

MACD Histogram Supports Bullish Trend as INJ Price Gains Strength

The price of INJ is showing impressive momentum, with the cryptocurrency experiencing substantial gains and indicating a strong upward trend on the charts as one of the biggest crypto gainers today on Uniswap.

As traders and investors closely monitor the INJ price, the technical indicators offer valuable insights into potential future movements.

The EMAs for Injective presents a bullish narrative; the 20-day EMA at $17.940 is well above the 50-day EMA of $15.207, and even further from the 100-day EMA at $12.572.

Traditionally, such alignment signifies continued bullish sentiment, suggesting that the INJ price may have more room to ascend in the short term.

However, the RSI tells a slightly different story. At a high of 74.42, up from the previous day’s 70, the INJ price is delving deeper into overbought territory.

This could be indicative of an upcoming retracement or consolidation, as overbought conditions often precede a pullback when traders decide to take profits.

The MACD histogram further supports the bullish trend with a rise to 0.398 from the prior day’s 0.173. This increase indicates that the bullish momentum is gaining strength, which could propel the INJ price even higher.

Turning to resistance levels, the INJ price is testing the fib -0.382 level at $23.923. A decisive breakout above this level could validate the bullish trend, potentially leading to the next resistance challenge at the fib -0.5 level of $25.351.

Breaking past these resistance levels would require significant buying pressure, which, if sustained, could reinforce the uptrend.

Support levels, on the other hand, suggest a strong safety net for the INJ price. The previous swing high resistance zone now turned support level, ranging from $18.032 to $19.302.

This area could act as a crucial buffer to any downward price correction, giving investors a level to watch for potential entry points if a pullback occurs.

In light of these technical indicators, traders might consider adopting a cautiously optimistic approach. While the INJ price’s current trajectory hints at further upside, the overbought RSI levels suggest that a degree of vigilance is warranted.

A strategy that accommodates potential volatility by setting stop-loss orders just below key support levels could help manage risk while capitalizing on the INJ price’s upward potential.

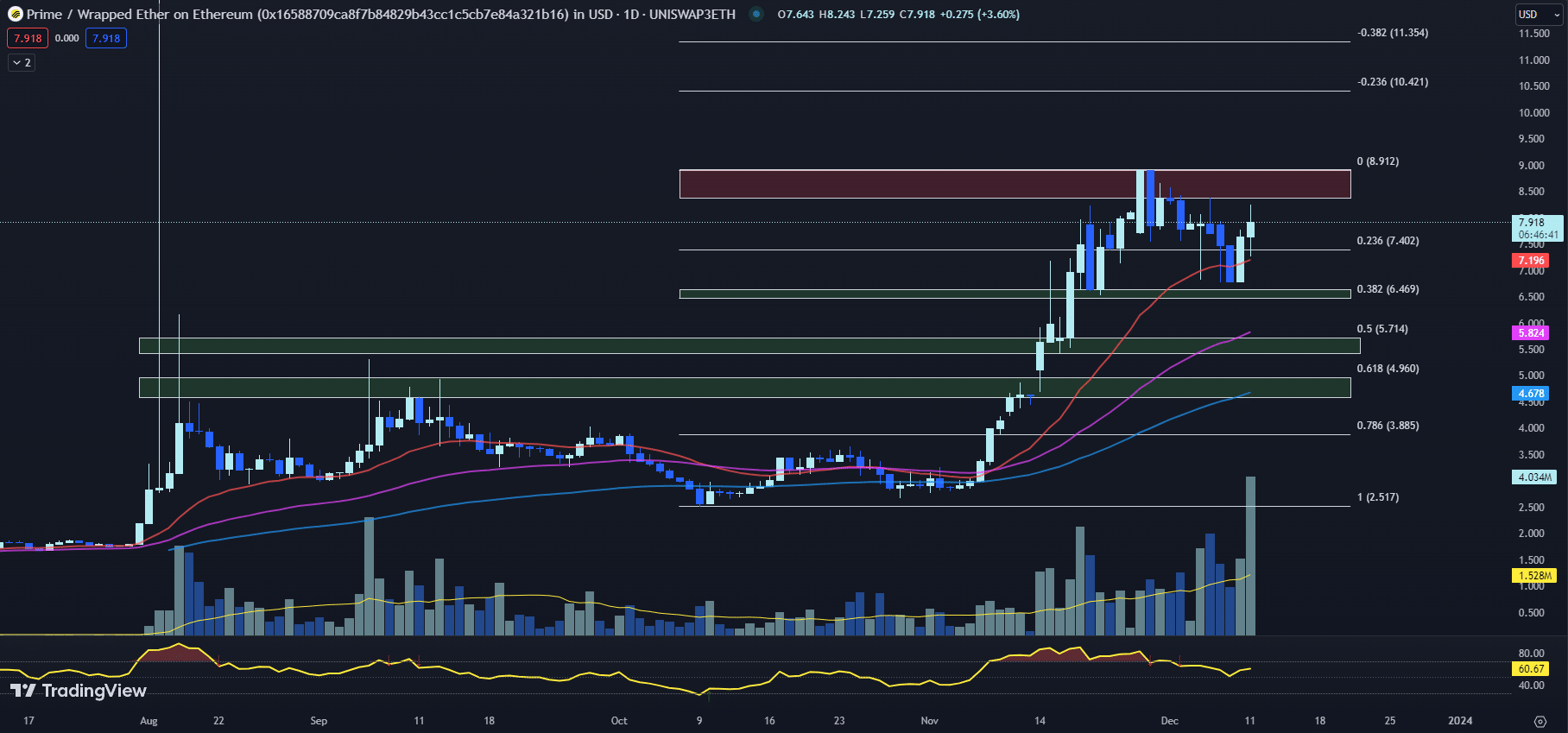

PRIME Price Prediction: One of Today’s Biggest Crypto Gainers With Bullish EMAs and RSI

The momentum for PRIME price continues its climb, as the cryptocurrency has recently broken out of its 20-day EMA and the Fib 0.236 level of $7.402.

Currently trading at $7.918, the PRIME price is recording a 3.60% increase so far today.

The focus is now on the potential retest of its current swing high resistance zone, which lies between $8.374 and $8.915.

Technical indicators for PRIME provide a bullish outlook. The 20-day EMA is positioned at $7.196, well above the 50-day EMA of $5.824, and the 100-day EMA trails at $4.678.

The widening gap between these EMAs underscores a strengthening uptrend. Typically, such a configuration would encourage buyers to sustain the momentum, potentially pushing the PRIME price to higher levels.

The RSI, a measure of momentum, has inched up to 60.67 from yesterday’s 59.62, which is a favorable sign.

An RSI level above 50 but below 70 suggests that the asset is in a bullish phase without being overbought. This leaves room for potential upside before the PRIME price enters a zone where a reversal could be expected.

Conversely, the MACD histogram, which helps to identify the strength and direction of the momentum, has a negative value of -0.175, up from -0.197 the previous day.

The negative value indicates bearish momentum, yet the increase toward zero could be viewed as a reduction in bearish pressure.

For investors, this might signal a time of caution until the MACD confirms a stronger bullish trend with positive values.

Looking ahead, if the PRIME price manages to break through the swing high resistance zone ranging from $8.374 to $8.915, it could then target the overhead resistance at the extended fib -0.236 level of $10.421.

Such a breakout would likely attract more buying activity, further fueling the uptrend.

On the downside, immediate support is found at the Fib 0.236 level of $7.402, closely followed by the 20-day EMA at $7.196.

These levels are expected to act as a safety net for the PRIME price, providing a floor in case of short-term pullbacks.

A drop below these support zones could indicate a weakening of the current bullish trend and may lead to a reassessment of the near-term price trajectory.

Investors and traders monitoring the PRIME price should consider these technical indicators as part of their analysis.

With the bullish signals presented by the EMAs and RSI, alongside the cautious optimism suggested by the MACD, market participants may look to capitalize on potential upward movements.

However, pay attention to the immediate support levels to mitigate the risks of a sudden downturn. A strategic approach would involve setting stop-loss orders just below the support levels to protect investments from unexpected market swings.

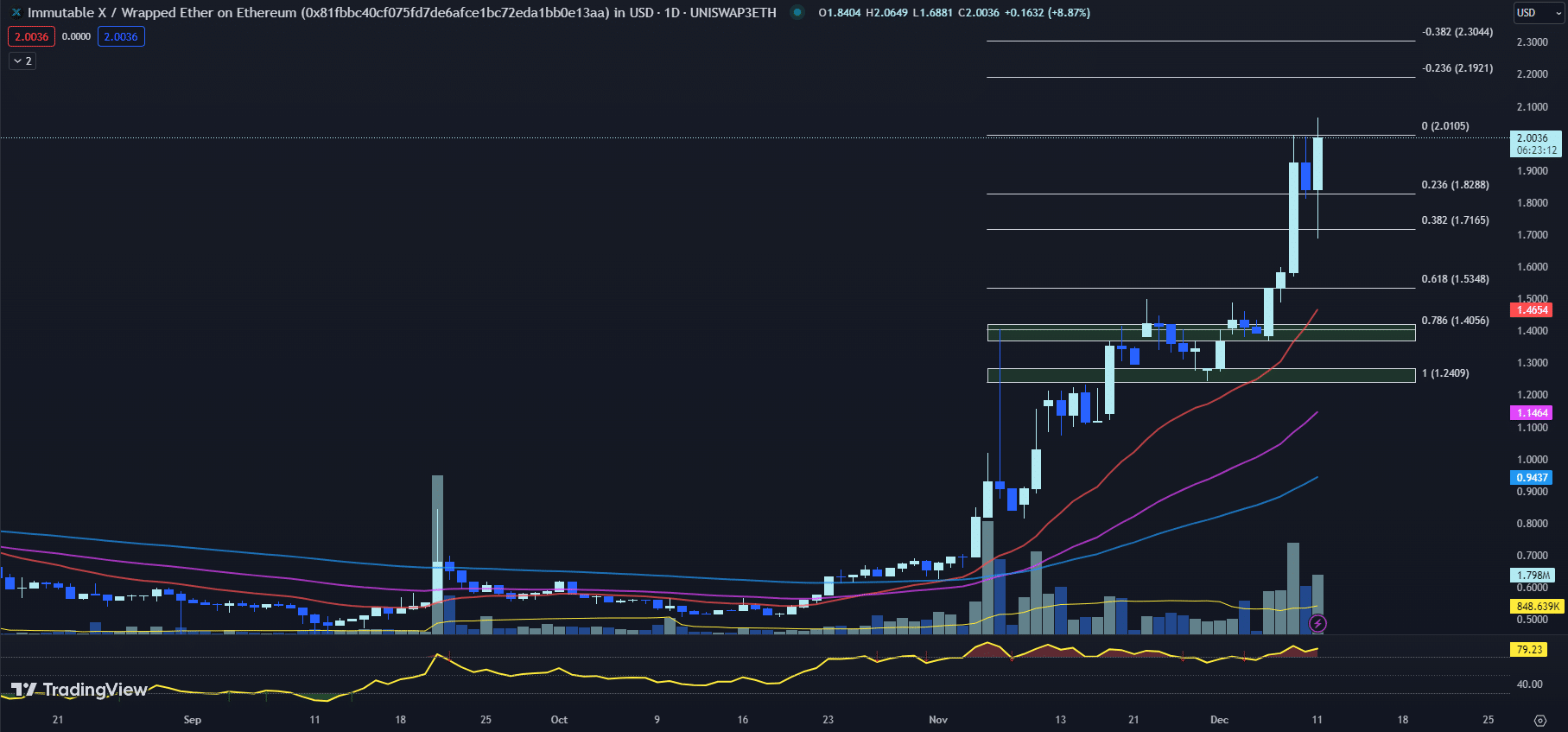

Bullish Sentiment Reinforced: MACD Histogram Supports IMX Price Surge

The recent performance of Immutable (IMX) has captured the attention of the trading community as the IMX price continues to push the boundaries, setting a new year-to-date (YTD) high of $2.0056 earlier today.

This upward trajectory has been nothing short of impressive, with IMX price now up by more than 300% over the past three months, affirming a bullish trend that seems to have robust momentum.

Technical indicators suggest that the IMX price may still have room to grow. The 20-day EMA currently resides at $1.4654, significantly above the 50-day EMA at $1.1464, and the 100-day EMA at $0.9437.

This bullish alignment, with shorter-term EMAs above longer-term ones, typically indicates a strong uptrend is in place. The increasing distance between these EMAs and the current IMX price further solidifies the upward trend.

However, the RSI presents a nuanced picture. At 79.23, up from yesterday’s 75.88, the RSI is deep into overbought territory.

While the trend is clearly up, the elevated RSI suggests that traders should proceed with caution, as the IMX price could experience short-term volatility.

The MACD histogram provides additional context with a reading of 0.0431, up from 0.0317 the previous day. This positive momentum indicates that the bullish sentiment is increasing.

A rising MACD histogram in the context of an uptrend is a reinforcing signal for bulls, suggesting that the upward price movement has strong backing in terms of market sentiment.

At the time of writing, the IMX price is trading at $2.0036, having surged by 8.87% so far today. The asset is testing the waters around the psychologically significant $2 level, which could act as a resistance or pivot point.

The current YTD high of $2.0056 is now the resistance to watch, with further resistance anticipated at the extended Fib -0.236 level of $2.1921 and the Fib -0.382 level of $2.3044.

On the flip side, the IMX price has found consistent support at the Fib 0.236 level of $1.8288, where it has hovered for the past three days. This support level is critical for maintaining the current bullish structure.

A sustained drop below this could signal a potential shift in market sentiment, possibly leading to a deeper correction.

While the strength in IMX price is evident, traders should be mindful of the overextended RSI and prepare for potential volatility.

The key will be whether IMX price can consolidate gains above the $2 mark and establish new support, setting the stage for a continued rally.

As INJ, PRIME, and IMX exhibit bullish momentum as some of the biggest crypto gainers today on Uniswap, it illustrates how overlooked assets can suddenly gain traction.

This brings up an interesting option – investing in new crypto presales. Presales allow you to buy tokens early before the crypto launches on major crypto exchanges.

Overlooked Cryptocurrencies with Upside Potential

While high-profile cryptocurrencies grab most of the headlines, there are lesser-known cryptocurrencies that could generate significant returns.

One strategy to find promising yet overlooked cryptocurrencies is to identify early-stage projects before they gain widespread notoriety.

Projects in the presale and launch phases often have tokens trading at low prices, providing an opportunity to get in on the ground floor.

As the project gains traction and builds out its technology, the value of its native token tends to rise.

Evaluating presale and newly launched cryptos requires deep due diligence.

The technology, team, roadmap, and tokenomics all need to be thoroughly assessed.

Analysts at cryptonews.com spend countless hours analyzing fresh cryptocurrency projects to find the ones that show the most potential based on these factors.

Below we showcase 19 of the most intriguing lesser-known cryptocurrencies that could have a significant impact in the months ahead.

While risks exist with any new crypto asset, these new cryptocurrency projects have several positive attributes that make them worth keeping on your radar.

19 New Cryptocurrency to Buy in 2024

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. By using this website, you agree to our terms and conditions. We may utilise affiliate links within our content, and receive commission.

The post Biggest Crypto Gainers Today on Uniswap – INJ, PRIME, IMX appeared first on Cryptonews.