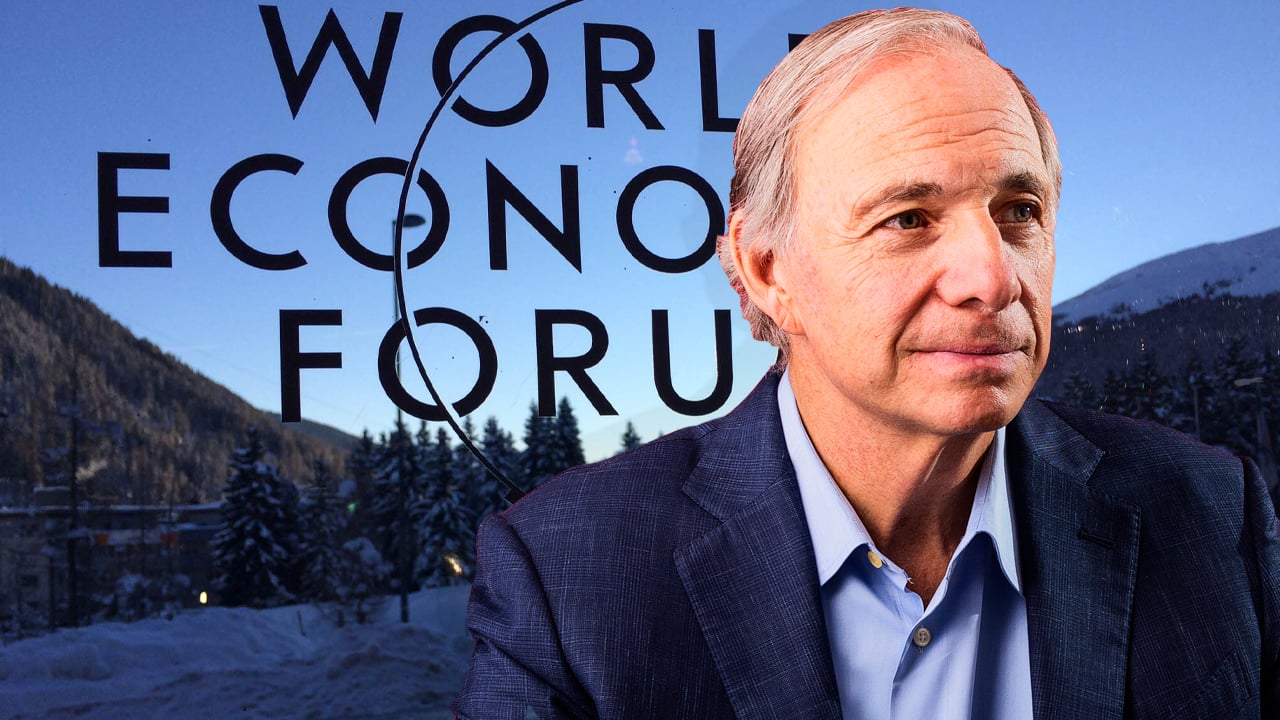

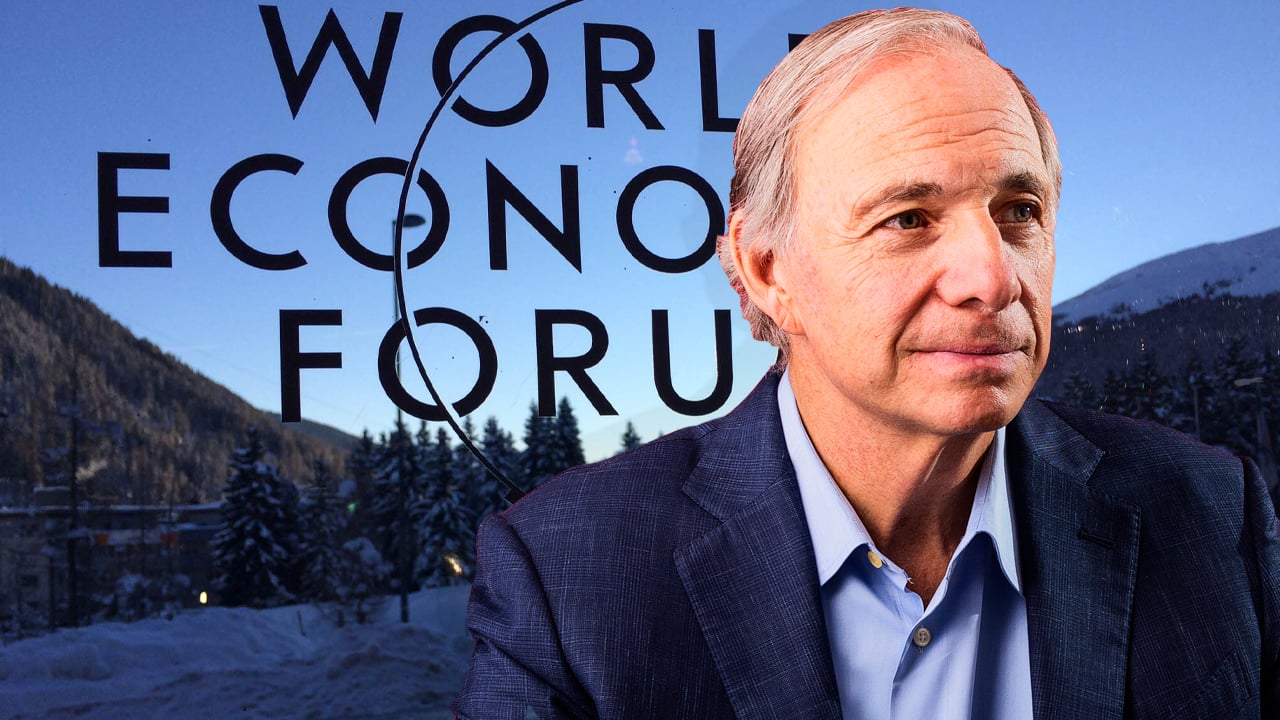

Billionaire Ray Dalio Speaks in Davos — Says ‘Blockchain Is Great, but Let’s Call It Digital Gold’

Publikováno: 24.5.2022

This week the world has been talking about the World Economic Forum (WEF) meeting in Davos, Switzerland, which started on May 22 and ends on May 26. At the event, Bridgewater Associates founder Ray Dalio spoke about today’s economy, the Federal Reserve, cash, and cryptocurrencies. Dalio noted at the WEF conference that he believes blockchain […]

This week the world has been talking about the World Economic Forum (WEF) meeting in Davos, Switzerland, which started on May 22 and ends on May 26. At the event, Bridgewater Associates founder Ray Dalio spoke about today’s economy, the Federal Reserve, cash, and cryptocurrencies. Dalio noted at the WEF conference that he believes blockchain […]

This week the world has been talking about the World Economic Forum (WEF) meeting in Davos, Switzerland, which started on May 22 and ends on May 26. At the event, Bridgewater Associates founder Ray Dalio spoke about today’s economy, the Federal Reserve, cash, and cryptocurrencies. Dalio noted at the WEF conference that he believes blockchain is great, but says “let’s call it a digital gold.”

Billionaire Hedge Fund Manager Ray Dalio Says ‘There’s Going to Be a Supply and Demand Problem That Produces a Squeeze’

During the first week of February, Bitcoin.com News reported on the billionaire Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates. At the time, Dalio spoke about the future of money and the investor said that crypto will be “outlawed, probably by different governments.” Currently, Dalio is in Davos, Switzerland, with the rest of the world’s government officials, economists, and financial big-wigs. The Bridgewater Associates founder spoke in an interview with CNBC’s Andrew Ross Sorkin on the broadcast Squawk Box.

Once again, Dalio spoke on the future of money and the U.S. central bank’s next monetary policies. The hedge fund executive believes the Fed has nothing left to do but sell. “The Federal Reserve is going to sell, individuals are selling, foreigners are selling, and the U.S. government is selling because it has to fund its deficit,” an excerpt from Dalio’s interview notes. “So there’s going to be a supply/demand problem, that means that it produces a squeeze,” he added.

Dalio’s outlook is gloomy and he’s not the only one in Davos at the WEF meeting that believes the global economy faces multiple threats. Reporting from the WEF multi-day conference, Reuters reporter Dan Burns highlighted that specific threats like the Ukraine-Russia war, food shortages, and the recent Covid-19 lockdowns in China have “no clear end” and “have compounded the gloom.” Germany’s vice-chancellor Robert Habeck agrees and said:

We have at least four crises, which are interwoven. We have high inflation … we have an energy crisis… we have food poverty, and we have a climate crisis. And we can’t solve the problems if we concentrate on only one of the crises.

Dalio Discusses Bitcoin’s ‘Little Spot Relative to Gold’

The Bridgewater Associates founder explained at the WEF event that right now cash is trash. “Of course, cash is still trash,” Dalio told the CNBC reporter. “I’m asking you, do you know how fast you’re losing buying power in cash?” the hedge fund executive asked. Dalio further elaborated by explaining what he means by saying cash is trash.

“When I say cash is trash, what I mean is all currencies in [relation] to the euro, in relationship to the yen,” Dalio stressed. “All of those currencies like in the 1930s will be currencies that will go down in [relation] to goods and services.” In addition to speaking about currencies and cash in Davos, Dalio talked about cryptocurriences being a form of digital gold.

“Cryptocurrencies in particular – I think blockchain’s great,” Dalio said to the host of CNBC’s broadcast Squawk Box. “But let’s call it a digital gold. I think a digital gold, which would be a bitcoin kind of thing, is something that—probably in the interest of diversification of finding an alternative to gold—has a little spot relative to gold and then relative to other assets.”

While its been known since May 2021 that Dalio had personally invested in bitcoin (BTC), four sources explained to the crypto reporters Danny Nelson and Ian Allison in March 2021, that Bridgewater Associates would use a “small slug of their fund deployed directly into digital assets.” That same month, the billionaire investor and hedge fund manager told the world that he thinks governments may apply taxes to cryptocurrencies that “could be more shocking than expected.”

What do you think about Ray Dalio’s opinions from Davos? What do you think about the hedge fund manager’s thoughts about cryptocurrencies? Let us know what you think about this subject in the comments section below.