Binance’s New CEO Teng Commits to More Regulatory Collaboration – Is This a New Chapter for Binance?

Publikováno: 27.11.2023

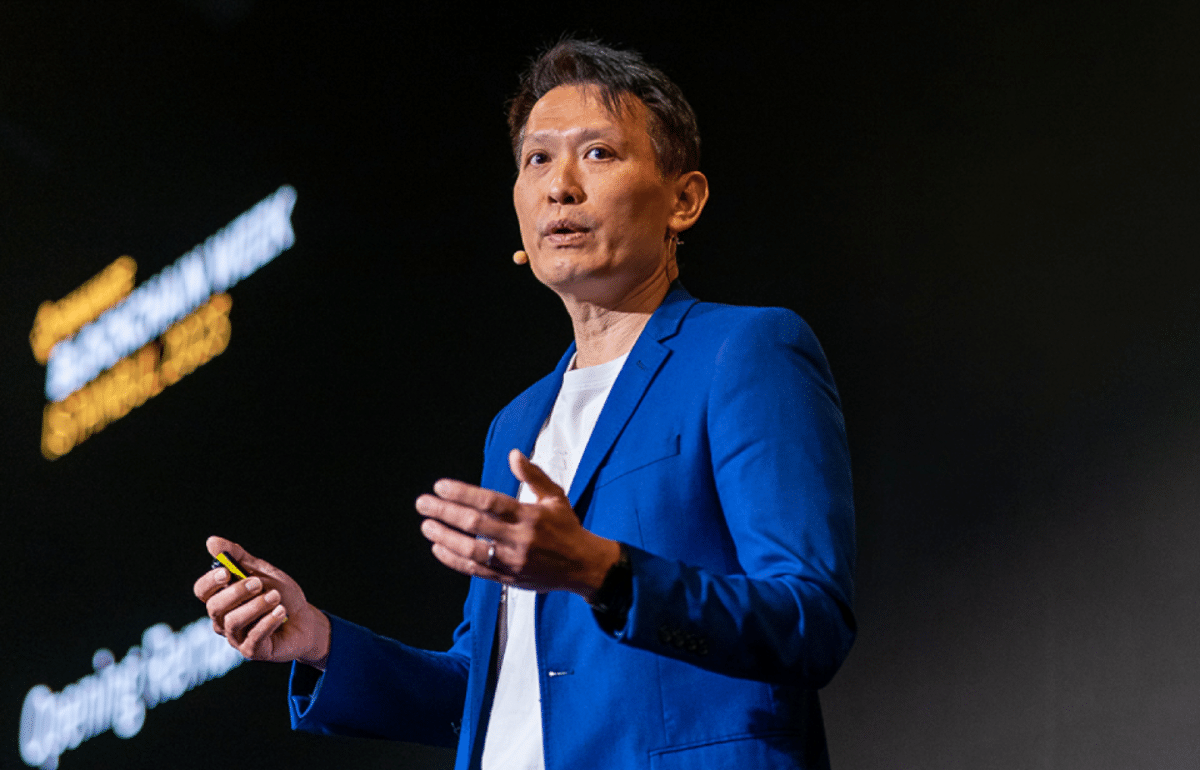

Image Source: Binance Following his appointment as the new CEO of the world’s largest crypto asset exchange on November 22, Richard Teng has outlined his vision for the platform going forward. In his first-ever blog post, Teng revealed that the Binance exchange would be focused on contributing to the development of a globally harmonized regulatory […]

The post Binance’s New CEO Teng Commits to More Regulatory Collaboration – Is This a New Chapter for Binance? appeared first on Cryptonews.

Following his appointment as the new CEO of the world’s largest crypto asset exchange on November 22, Richard Teng has outlined his vision for the platform going forward.

In his first-ever blog post, Teng revealed that the Binance exchange would be focused on contributing to the development of a globally harmonized regulatory framework. This framework will foster innovation within the Web3 ecosystem while directly protecting consumer interests.

Here is my first blog as #Binance CEO.

I want to take this opportunity to share immediate focus areas, discuss our responsibility to users and my view on the future of our industry.https://t.co/c6QMS6Ulmm

— Richard Teng (@_RichardTeng) November 27, 2023

Teng, who formerly served as Binance’s Global Head of Regional Markets, stated that the exchange is now entering an era of “responsible growth” where it would focus on engaging in meaningful discourse with global policymakers.

According to him, this would serve as a form of social contract between the exchange and its 160 million customers, demonstrating a serious commitment to creating a secure environment for digital asset trading.

Before joining Binance, Teng spent 13 years with the Monetary Authority of Singapore (MAS). He also held roles as the Chief Regulatory Officer of the SGX platform and later as the CEO of the Financial Services Regulatory Authority (FSRA) with the Abu Dhabi Global Market.

Teng’s comments come amidst regulatory challenges faced by the Binance exchange in recent months.

Following a multi-year investigation by the US Department of Justice (DoJ), the Commodity Futures Trading Commission (CFTC), and two other US agencies, Binance was found guilty of money laundering, sanctions violations, and various financial breaches.

The crypto asset platform was fined $4.3 billion in penalties.

US DOJ seeking $4B+ from Binance to resolve criminal case.

Do you think CZ will face jail time?

— Dan Held (@danheld) November 20, 2023

However, founder and former CEO Changpeng Zhao (popularly called CZ) was not spared of these blushes.

CZ was required to step down from his role and was fined $50 million in bail given his violation of the US Bank Secrecy Act.

He has since been released after meeting his bail bond and is scheduled for a trial early next year.

The Binance exchange is also currently being investigated by the US Securities and Exchange Commission (SEC) for fraudulent activities, terrorist financing, and 11 other charges.

Proof of Reserves Still Strong, But Outflows Being Recorded

In an effort to reassure investors about the platform’s ongoing commitment to asset security, Teng noted that the exchange takes its role as the custodian of users’ assets seriously.

According to him, each user’s digital assets are backed 1:1. Despite legal challenges, Binance’s proof of reserves, a report of its crypto assets portfolio, remains unquestioned. However, retail outflows are being recorded on a massive scale.

According to blockchain analytics firm CryptoQuant data, Binance’s Bitcoin reserves have since shrunk to 5,000 BTCs in the past week.

In contrast, the US-based Coinbase exchange has seen its figure balloon to 12,000 Bitcoins within the same window.

$BTC moving from Binance to Coinbase

"Coinbase's reserves have since increased by around 12,000 BTC while Binance's have decreased by 5,000 BTC."

by @gaah_im— CryptoQuant.com (@cryptoquant_com) November 23, 2023

Sharing possible reasons for this sharp contrast, CryptoQuant noted that Coinbase’s strong regulatory background and Nasdaq trading experience have served as possible factors for growing confidence in its ability to properly safeguard investors’ assets.

Furthermore, the Coinbase exchange has been earmarked by several spot Bitcoin exchange-traded fund (ETF) applicants like BlackRock, Valkyrie, WisdomTree, Ark Invest, and several others as their Bitcoin custodians.

This has contributed to a positive shift in sentiments toward the 11-year-old exchange.

has contributed to a positive shift in sentiments toward the 11-year-old Bitcoin exchange.

The post Binance’s New CEO Teng Commits to More Regulatory Collaboration – Is This a New Chapter for Binance? appeared first on Cryptonews.