Bitcoin (BTC), the foremost cryptocurrency, witnessed a notable downturn, dipping below the $42,000 threshold on Friday. This marked its steepest fall since December 2023. The current price of Bitcoin stands at $41,332.95, with a 24-hour trading volume of approximately $26.61 billion.

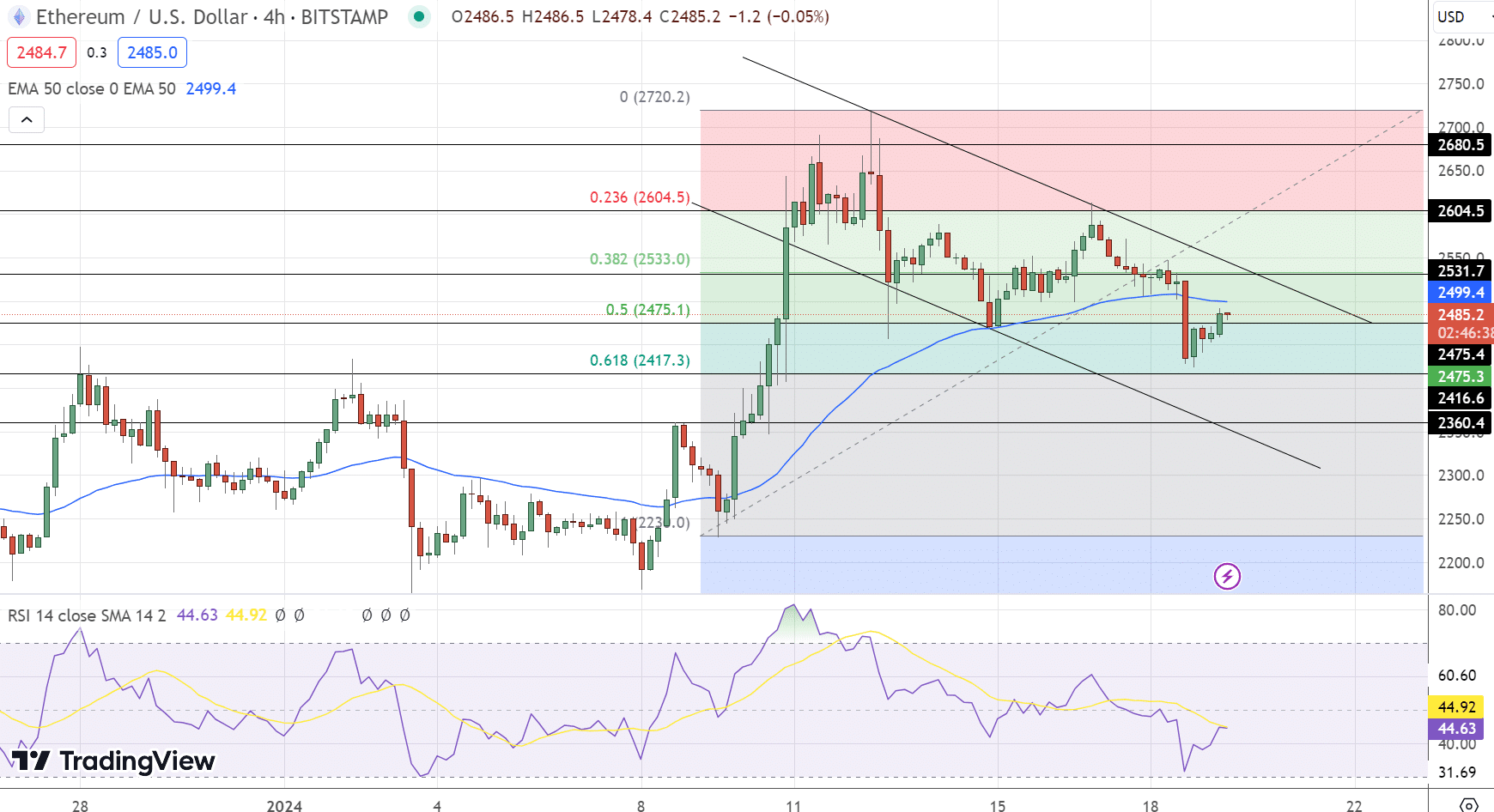

Ethereum (ETH), trailing Bitcoin in market dominance, also encountered declines, with its price now at $2,493.55 and a trading volume of $11.44 billion over the same period. Ethereum’s price has slipped by 0.79% in the last 24 hours.

The global crypto market cap is currently valued at $1.62 trillion, experiencing a 3.23% decrease within a day. This bearish trend in the crypto market is largely attributed to escalated liquidations and a strengthening US dollar.

Amidst these market challenges, Bitcoin’s resilience is being tested, particularly in the face of shifting regulatory environments and pivotal market events such as the upcoming Bitcoin halving and the potential launch of a Bitcoin Spot ETF by Hong Kong’s VSFG, which might catalyze a surge in BTC price.

Bitcoin Weathers Market Turbulence and Regulatory Changes

Despite a 3.76% drop in the overall crypto market, Bitcoin (BTC) is holding steady at around $40,900, buoyed by investor interest in the newly approved Bitcoin Spot ETF. Ethereum (ETH) is exhibiting a similar pattern, with its performance under close scrutiny.

Recent comments by JPMorgan Chase CEO Jamie Dimon, who labeled Bitcoin as “worthless,” have introduced near-term uncertainty, impacting market sentiment and contributing to BTC’s losses.

However, the broader outlook for Bitcoin remains cautiously optimistic. This sentiment is in anticipation of a possible Federal Reserve interest rate cut in March and Bitcoin’s halving event in April 2024. Currently, BTC faces resistance at $42,620, while ETH, trading at $2,458, encounters resistance at $2,604.

Bitcoin’s Pre-Halving Impact and Spot ETF Dynamics

The upcoming Bitcoin halving event is poised to potentially trigger a price drop, potentially down to the $36-39K range, presenting a prime buying opportunity. The recent 3.62% decline in Bitcoin’s value, now at $41,144.28, has garnered close attention from investors. Analysts are speculating on a possible pre-halving sell-off, likely influenced by the introduction of the Bitcoin Spot ETF, which could significantly affect institutional investment approaches.

Market enthusiasts are expecting institutions to capitalize on this potential downturn to acquire assets at lower prices ahead of a predicted bullish trend. Industry experts, including Michaël van de Poppe, highlight the strategic advantage of ‘buying the dip’ should prices hit the $36-39K mark.

They recommend focusing on long-term investment strategies, warning against succumbing to FOMO, and stressing the importance of the classic approach of buying low and selling high in the volatile crypto market.

Consequently, the speculation surrounding a potential pre-halving sell-off and the impact of the Bitcoin Spot ETF are contributing to market volatility. Bitcoin’s current price of $41,144.28 may witness significant fluctuations, offering both opportunities and risks for investors.

VSFG’s Bitcoin ETF Launch: A Turning Point for BTC Prices

The Bitcoin (BTC) market may soon receive a boost from Hong Kong-based Venture Smart Financial Holdings (VSFG), which plans to file for a spot Bitcoin ETF. This initiative aims to be the first of its kind in the region, pending approval from Hong Kong’s Securities and Futures Commission. The Commission’s guidelines for spot crypto funds, released last December, pave the way for this development.

Brian Chan, the group head of investment at VSFG, sees considerable market potential and has set an ambitious target of reaching $500 million in assets under management by year-end. This move is part of a wider global trend where institutions are increasingly exploring the introduction of spot Bitcoin ETFs in their markets.

The announcement by VSFG to launch a spot Bitcoin ETF in Hong Kong could significantly influence BTC prices. It underscores growing institutional interest in Bitcoin and may draw substantial investments into the cryptocurrency, potentially marking a pivotal moment for BTC’s market dynamics.

Bitcoin Price Prediction

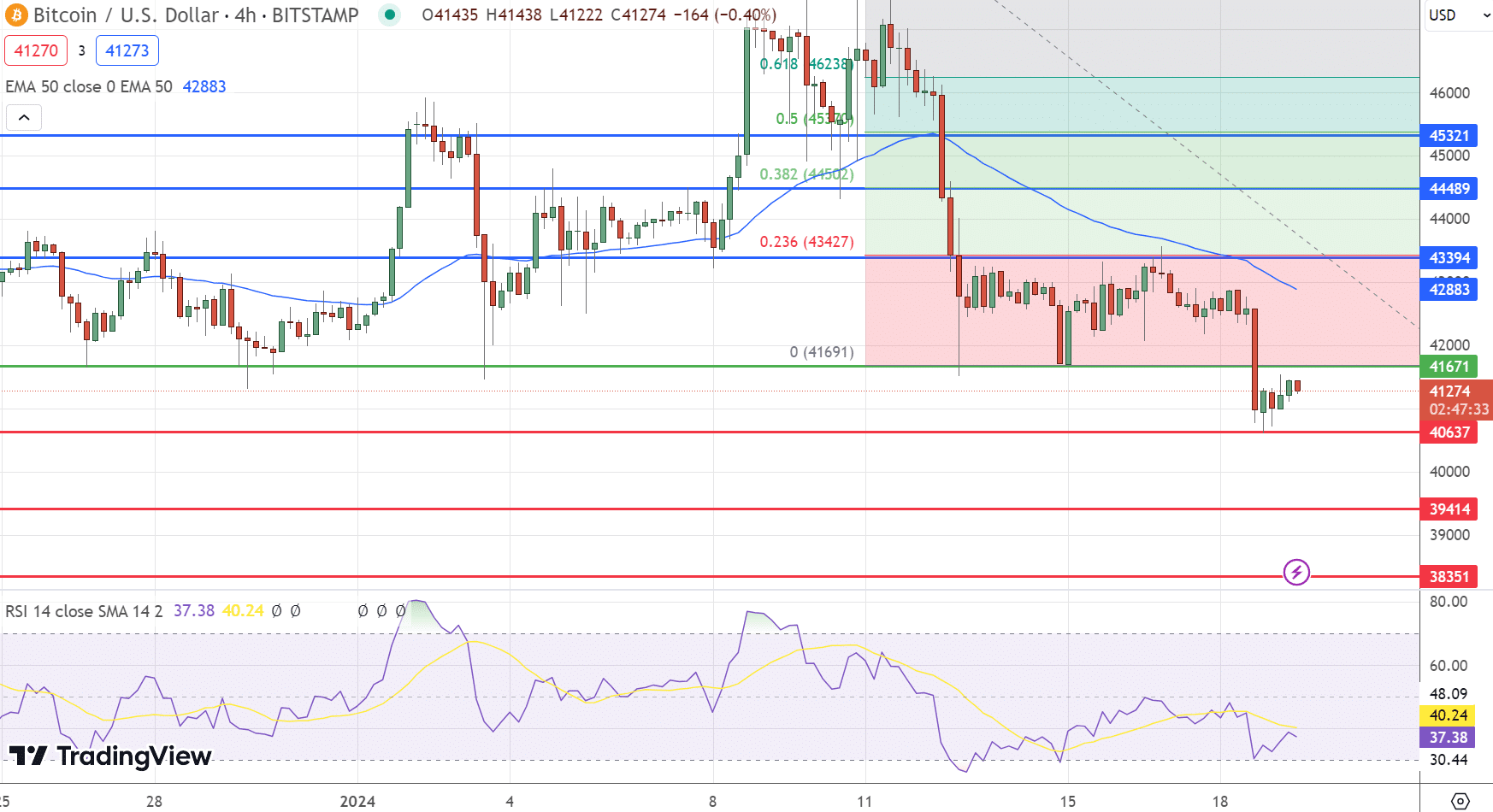

Currently, Bitcoin is trading below the 50 EMA of $42,883, which could have served as a dynamic resistance level. This move down suggests increased selling pressure, and the currency is now facing immediate potential support near the $41,600 level.

YCC (@DU09BTC)

YCC (@DU09BTC)