Bitcoin ETFs in Japan: FSA Explains New Rules for Funds Investing in Cryptos

Publikováno: 7.2.2020

Japan’s top financial regulator, the Financial Services Agency (FSA), has explained to news.Bitcoin.com its recently adopted rules regarding the creation and sale of cryptocurrency exchange-traded funds (ETFs). Meanwhile, Japan now has a crypto index, launched by major Japanese companies. Also read: US Government Auctioning off Bitcoins Worth $37 Million in 2 Weeks Crypto-Focused Funds With […]

Japan’s top financial regulator, the Financial Services Agency (FSA), has explained to news.Bitcoin.com its recently adopted rules regarding the creation and sale of cryptocurrency exchange-traded funds (ETFs). Meanwhile, Japan now has a crypto index, launched by major Japanese companies. Also read: US Government Auctioning off Bitcoins Worth $37 Million in 2 Weeks Crypto-Focused Funds With […]

The post Bitcoin ETFs in Japan: FSA Explains New Rules for Funds Investing in Cryptos appeared first on Bitcoin News.

Japan’s top financial regulator, the Financial Services Agency (FSA), has explained to news.Bitcoin.com its recently adopted rules regarding the creation and sale of cryptocurrency exchange-traded funds (ETFs). Meanwhile, Japan now has a crypto index, launched by major Japanese companies.

Also read: US Government Auctioning off Bitcoins Worth $37 Million in 2 Weeks

Crypto-Focused Funds

With the rising interest in cryptocurrencies as an investment option, Japan’s top financial regulator has adopted new guidelines for cryptocurrency ETFs. Japan is often known as one of the most advanced countries when it comes to crypto regulations, having legalized cryptocurrencies as a means of payment back in April 2017.

A spokesperson for the FSA explained to news.Bitcoin.com this week that “In order for an instrument to be treated as an investment fund in Japan, it is necessary that it corresponds to ‘investment trusts’ as per the Act on Investment Trusts and Investment Corporations, at minimum.” Responding to a question about whether cryptocurrency ETFs are allowed under the new law, the regulator confirmed:

As instruments that invest mainly in crypto assets do not correspond to the legal definition of an ‘investment trust,’ such ETFs cannot be created.

The FSA proceeded to tell news.Bitcoin.com that “The Comprehensive Guidelines for Supervision of Financial Instruments Business Operators, etc., adopted on December 27, 2019, stipulate that the formulation or sales of investment funds of assets other than specified assets … is not acceptable.”

Specified assets are securities, real estate property, and other assets that the Cabinet has specified to facilitate investments. “Cryptocurrencies are not defined as specified assets,” the FSA emphasized.

Funds Not Primarily Investing in Crypto Assets

Some investment trusts have a small portion of their funds in crypto assets but not as their primary investment objectives. The agency noted that non-specified assets, which include cryptocurrencies, “have high price fluctuation or liquidity risks,” adding:

It has been pointed out that investment trusts for which the main investment is not a cryptocurrency but are investing in cryptocurrencies are encouraging speculations. The FSA believes that we should carefully respond to the creation and sale of such instruments.

Moreover, the regulator clarified to news.Bitcoin.com how it would judge whether a fund mainly invests in crypto assets. The main investment of a fund “can be considered things which are positioned as core assets under management in the operation of that scheme,” the FSA detailed, but emphasized that the primary investment objective “cannot be judged based on the percentage of the total assets of the fund. “A comprehensive range of various factors” should be considered, “such as, for example, the degree of contributions to earnings and the power to appeal to investors, etc.”

Qualified, Accredited and Institutional Investors

The regulator additionally said that it is not appropriate for qualified, institutional or accredited investors, including pension funds and regional financial institutions, to invest in funds with crypto asset components.

“The creation and sales of products that are capable of harming credibility as an investment trust / system of investment corporation, such as investment trusts which invest in unspecified assets for which it is considered that there is a high probability that the investor will be made to bear the risks of excessive price fluctuations, etc., is not appropriate,” the agency noted.

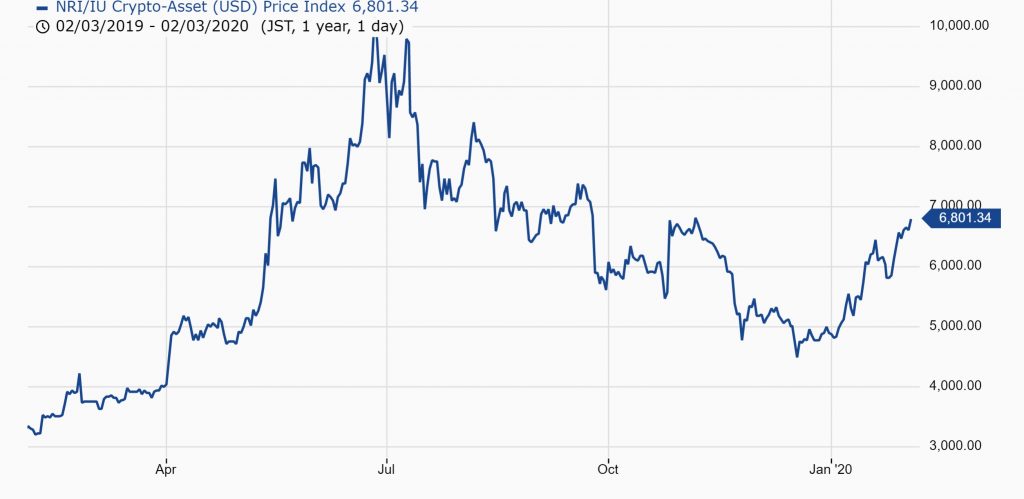

Japanese Crypto Index Launched by Major Companies

Meanwhile, Nomura Research Institute Ltd. (NRI) announced last week that it had started distributing the NRI/IU Crypto-Asset Index to domestic and overseas institutional investors, financial information vendors, and crypto exchanges. The company explained that this index “can be used by institutional investors as a benchmark for objective investment appraisal.” Established in 1965, NRI is the largest Japanese management consulting and economic research firm.

The index was launched in collaboration with Intelligence Unit (IU), a global provider of quantitative research and development for digital asset investment solutions. IU CEO Akihiro Niimi shared his view on the regulatory aspect of this index with news.Bitcoin.com last week. The FSA also chimed in and indicated that this product is not prohibited since it is an index, not a fund.

“The guideline is really complicated,” Niimi began, noting that people misunderstanding the guidelines “would hinder the growth of crypto asset-related business in Japan.” He continued to say that the FSA basically prohibited Japanese mutual fund companies and securities firms from either managing or distributing mutual funds investing in crypto assets directly or indirectly. The CEO added:

However, looking at the Q&A No27, it did not prohibit asset management companies and trust banks to either manage investment advisory business or manage/distribute collective investment schemes.

Based on his interpretation of the guidelines, the FSA prohibited retail businesses from “distributing mutual funds [investing in crypto assets] but had no restriction for institutional business.”

The index is calculated with a platform operated by MV Index Solutions (MVIS), a company registered under the European benchmark regulation, NRI detailed. MVIS is the index business of Vaneck, a U.S.-based investment management firm. Approximately $14.99 billion in assets under management are currently invested in financial products based on MVIS Indices. According to MVIS, the NRI/IU Crypto-Asset Index component as of Jan. 29 was 48.23% BTC, 24.71% ETH, 13.27% XRP, 8.76% BCH, and 5.02% LTC.

What do you think of Japan’s new rules on funds investing in cryptocurrencies and bitcoin ETFs? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock and MVIS.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Bitcoin ETFs in Japan: FSA Explains New Rules for Funds Investing in Cryptos appeared first on Bitcoin News.