Bitcoin Hashrate Down 45% – Miners Witness Second-Largest Difficulty Drop in History

Publikováno: 27.3.2020

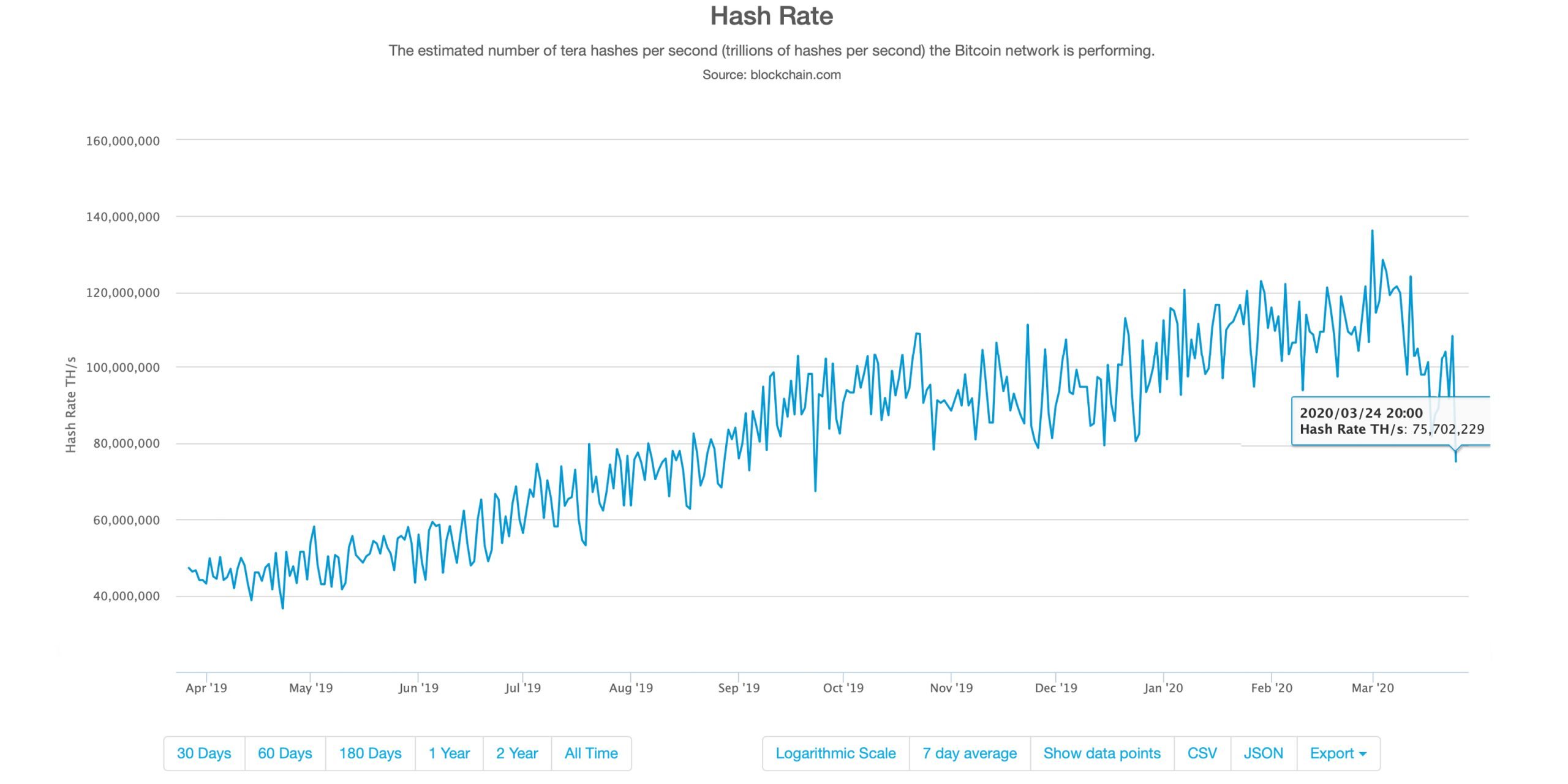

Bitcoin’s hashrate has plummeted 45% since the record-breaking levels it saw on Feb. 29. The hashrate touched an all-time high of 136 exahash per second (EH/s) but has since dropped to 75 EH/s. Moreover, the crypto network has seen the second-largest difficulty drop since October 2011. Also read: While You’re Under Quarantine, Check These Sites […]

Bitcoin’s hashrate has plummeted 45% since the record-breaking levels it saw on Feb. 29. The hashrate touched an all-time high of 136 exahash per second (EH/s) but has since dropped to 75 EH/s. Moreover, the crypto network has seen the second-largest difficulty drop since October 2011. Also read: While You’re Under Quarantine, Check These Sites […]

The post Bitcoin Hashrate Down 45% – Miners Witness Second-Largest Difficulty Drop in History appeared first on Bitcoin News.

Bitcoin’s hashrate has plummeted 45% since the record-breaking levels it saw on Feb. 29. The hashrate touched an all-time high of 136 exahash per second (EH/s) but has since dropped to 75 EH/s. Moreover, the crypto network has seen the second-largest difficulty drop since October 2011.

Also read: While You’re Under Quarantine, Check These Sites for Remote Crypto Jobs

Bitcoin Hashrate Declines 45% Since All-Time High

The latest cryptoconomy price shift has capitulated a number of small mining operations and BTC’s overall hashrate has dropped 45% in 30 days. The price drop stemmed from the looming economic crisis scaring the entire world and BTC is hovering between $6,600-6,850 per coin. On Feb. 29, the network’s hashrate spiked to the highest level ever captured, reaching 136 EH/s. But during the last 30 days and especially since the infamous “Black Thursday” on March 12, BTC’s hashrate dropped to a low of 75 EH/s. Statistics show that miners paying above $0.05 per kilowatt-hour (kWh) are not seeing the best profits. Naturally, this has caused some operations to shut off miners, as they hope to re-enter when the price gets better.

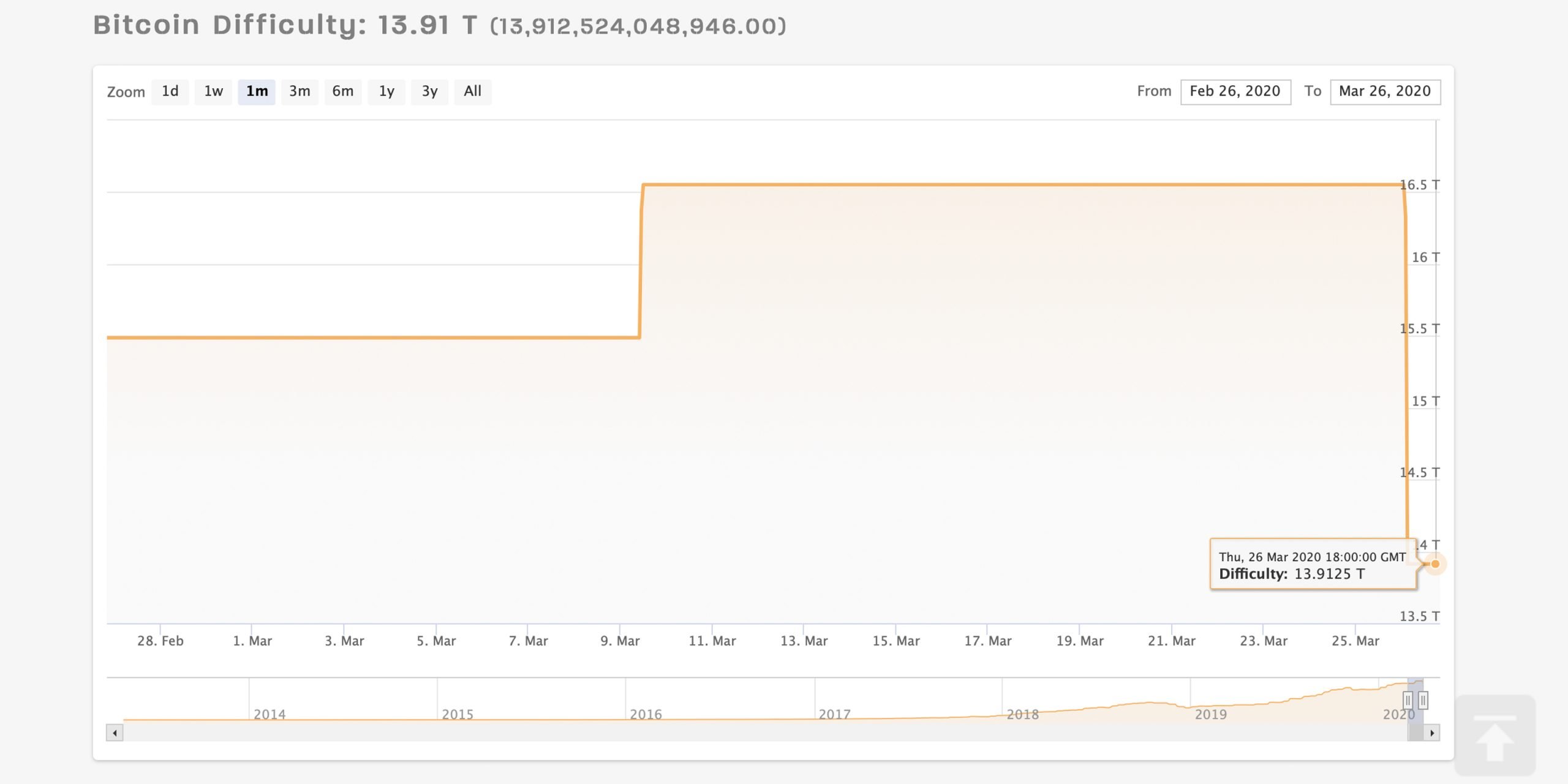

Second-Largest BTC Difficulty Drop

Miners leaving the system and the hashrate dropping 45% have caused the second largest BTC network difficulty drop since 2011. Basically, the network’s difficulty is a measure of how hard it is to find the hash beneath a specified target. The drop was around 15.5% after the difficulty went from 16.5 trillion to 13.9 trillion on Thursday. BTC’s difficulty is based on a two-week interval or 2,016 blocks, but it’s also affected a great deal when a large number of mining operations stop mining.

The last times BTC saw such a drastic difficulty dip were in December 2018 (15%) and October 2011 (around 18%). The price drop BTC experienced last week was the worst in years and it wasn’t nice for miners hoping for a bull run. Meanwhile, with the difficulty so low, a few crypto observers have noticed a lot more miners bouncing back and forth between the BCH and BTC networks. Both blockchains will see a block reward reduction during the next month and a half, as BCH will halve in 12 days on or around April 8. BTC will see its block subsidy chopped in half around 48 days from now on or around May 13.

What do you think about BTC’s hashrate dip and the plummeting network difficulty? Let us know in the comments section below.

The post Bitcoin Hashrate Down 45% – Miners Witness Second-Largest Difficulty Drop in History appeared first on Bitcoin News.