Bitcoin in April: Halving Price Fallout, Network Peaks and ETF Updates

Publikováno: 15.5.2024

In April 2024, Bitcoin faced its sharpest price drop since the FTX collapse, with halving charts in focus, but network activity soared to record highs, driven by new protocols and ETF developments. This report explores and analyzes Bitcoin's ecosystem and the BTC price developments last month.

The post Bitcoin in April: Halving Price Fallout, Network Peaks and ETF Updates appeared first on Cryptonews.

In April 2024, Bitcoin faced its sharpest price drop since the FTX collapse, with halving charts in focus, but network activity soared to record highs, driven by new protocols and ETF developments. This report explores and analyzes Bitcoin’s ecosystem and the BTC price developments last month.

Key takeaways:

- The Bitcoin price dropped following the fourth halving, reaching $57,000 before a quick rebound. This marks the sharpest decline since the FTX collapse.

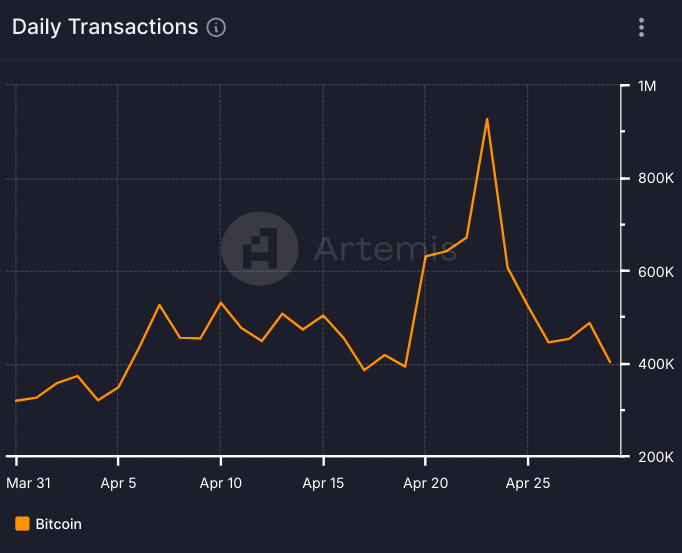

- Despite the price drop, the Bitcoin network saw a surge in activity in April, with daily transactions reaching a record high of 927k on April 23. However, this increase was short-lived, and it dropped again by the end of the month.

- The surge in network activity led to record-high transaction fees in April, peaking at $25.8 million on April 24. This congestion might be linked to the Runes protocol launch.

- Spot Bitcoin ETFs saw $343.5 million withdrawn from the funds in April – the first monthly net outflows since trading began in January.

- While US ETFs faced outflows, Hong Kong launched its first three spot Bitcoin ETFs in April, potentially becoming a hub for Asian crypto investment.

- Bitcoin Ordinals NFTs gained traction, reaching a $2.3 billion valuation, despite Binance ending support due to potential network strain.

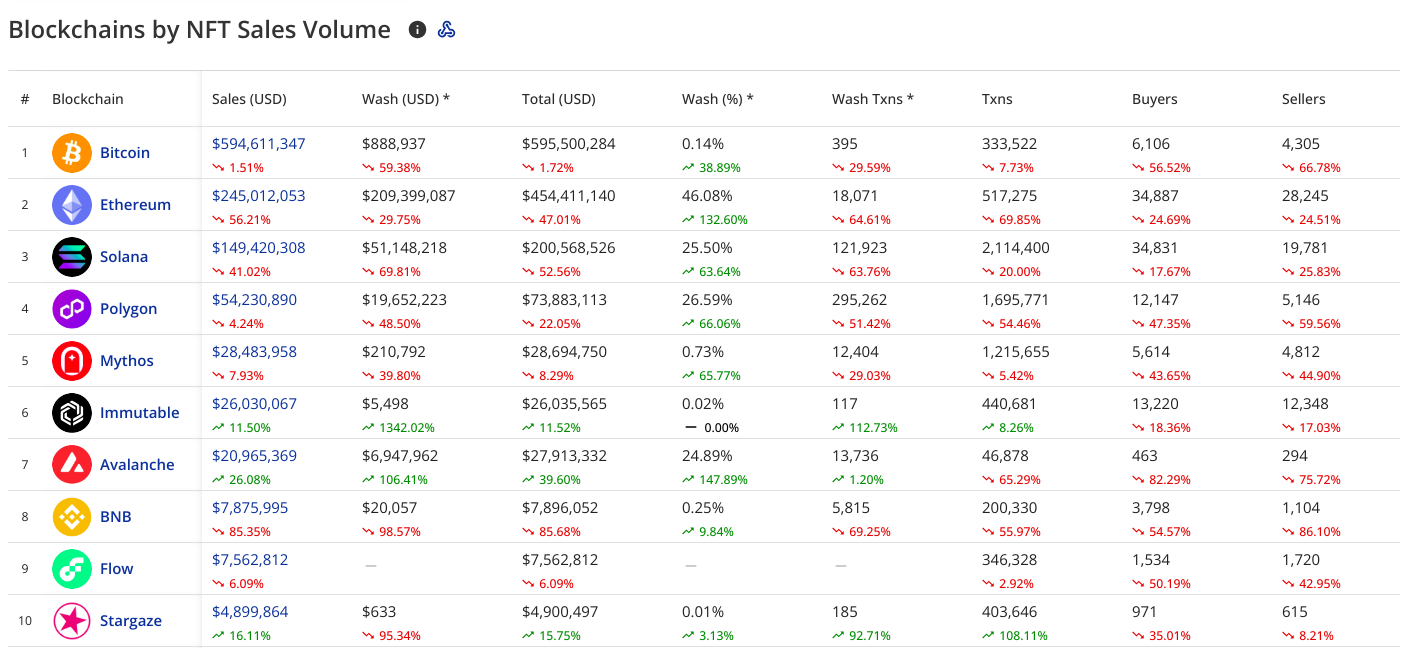

- Bitcoin remained the leader in NFT sales volume in April, generating over $594 million compared to other blockchains.

What You’ll Find in This March Bitcoin Analysis:

What is Bitcoin?

Bitcoin (BTC) is a decentralized cryptocurrency created to function as a digital currency and means of payment that operates independently of any single individual, organization, or authority, eliminating the need for third-party intermediaries in financial transactions.

It is allocated to blockchain miners to validate transactions and can be purchased through various exchanges.Unveiled to the public in 2009 by an enigmatic developer or group known as Satoshi Nakamoto, Bitcoin has become the most widely recognized cryptocurrency in the world. Its success has spurred the creation of numerous other cryptocurrencies.

BTC Price Performance And Halving Charts

While widely anticipated, Bitcoin’s fourth halving on April 20 followed the historical trend of short-term volatility. Bitcoin fell nearly 21% in April alone, dropping below $60,000 on April 19 as investors cashed out of a robust rally that had previously pushed prices above $72,500 (on April 8). Between April 30 and May 1, the Bitcoin price crashed below $57,000, its lowest level since late February.

Interestingly, past halving events also exhibited similar patterns. According to Glassnode data, while the first halving saw an immediate 11% gain, the subsequent two halving events saw price stagnation after two weeks. The 60-day period following halvings often shows choppy sideways movement, and price drops between -5% and -15%.

According to 10x Research CEO and senior analyst Markus Thielen, Bitcoin could further fall to $52,000. The analyst predicts a drop to $52,000, citing a slowdown in the main driver of the rally – inflows into Bitcoin exchange-traded funds (ETFs), which dropped in April.

April 19, 2024: Why #Bitcoin May Fall to $52,000 (https://t.co/G5cig000eI

The primary driver for the recent Bitcoin price rally was the inflow of funds into Bitcoin ETFs, which has now dried up over the past 4-5 weeks. The market internals have become weaker … -> -> pic.twitter.com/0RdkgNO5Q6— Markus Thielen (@thielen10x) April 30, 2024

Fidelity Digital Assets downgraded Bitcoin’s outlook to “neutral” after Q1. Its Q1 2024 Signals Report suggests that Bitcoin is no longer “cheap” and undervalued. The analysts also see potential selling pressure from long-term holders and high overall profitability. According to VanEck, 94% of Bitcoin addresses remain in profit despite a slight decline of 4% over the month.

Analysts at Bitfinex, on the other hand, are more positive and predict Bitcoin will consolidate for 1-2 months after the halving. The experts expect Bitcoin to remain the market leader and believe the economic situation is more stable than in past halvings. This could lead to sideways trading with swings of $10,000, with any price increase from the halving happening later.

Bitcoin’s Network Activity and Fees

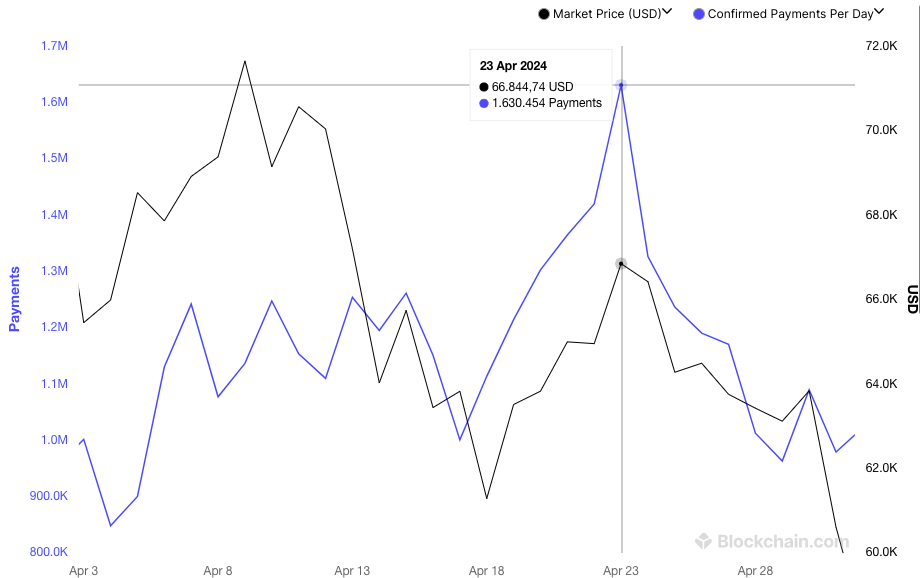

Bitcoin’s price dipped after the halving, but network activity boomed. Daily transactions increased by 135% after the halving, reaching 927k on April 23. However, this recovery was short-lived, and the number of daily transactions dropped again by the end of the month, reaching 403k transactions on April 30.

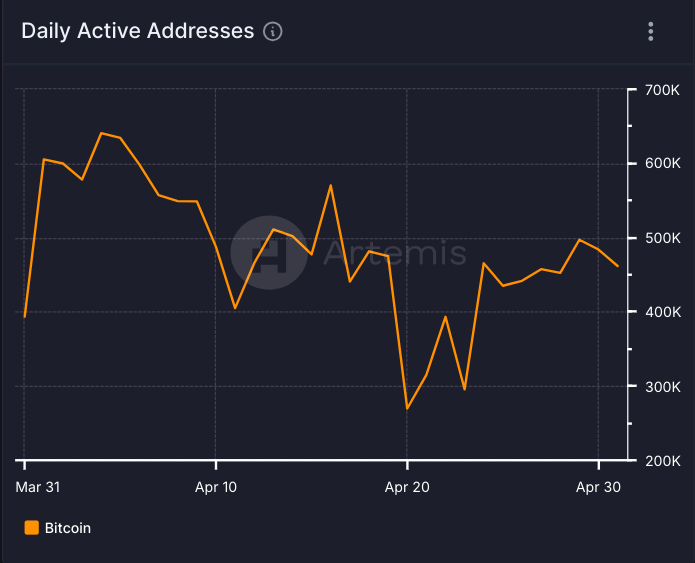

Bitcoin’s daily active addresses saw a rollercoaster ride in April. Starting at 605k on April 1, the number climbed to 640k by April 4. However, it then took a sharp dip to 269k on April 20, the day after the halving. Activity recovered somewhat, reaching 483k by the end of the month.

Average daily transaction fees on Bitcoin surged to a record $25.8 million on April 24 before falling back to $6,15 million on April 30. The average fee in April was $16.77. Similarly, average individual transaction fees on Bitcoin spiked to $40 on April 24 and dropped to $11,92 on April 30.

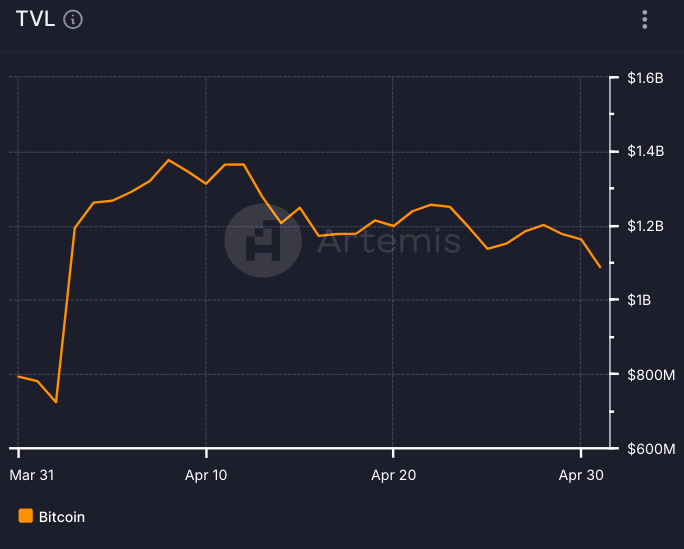

Bitcoin managed to attract more capital in April and reached $1.4 billion in total value locked (TVL), an increase of 94% compared to TVL on April 2 ($724 million).

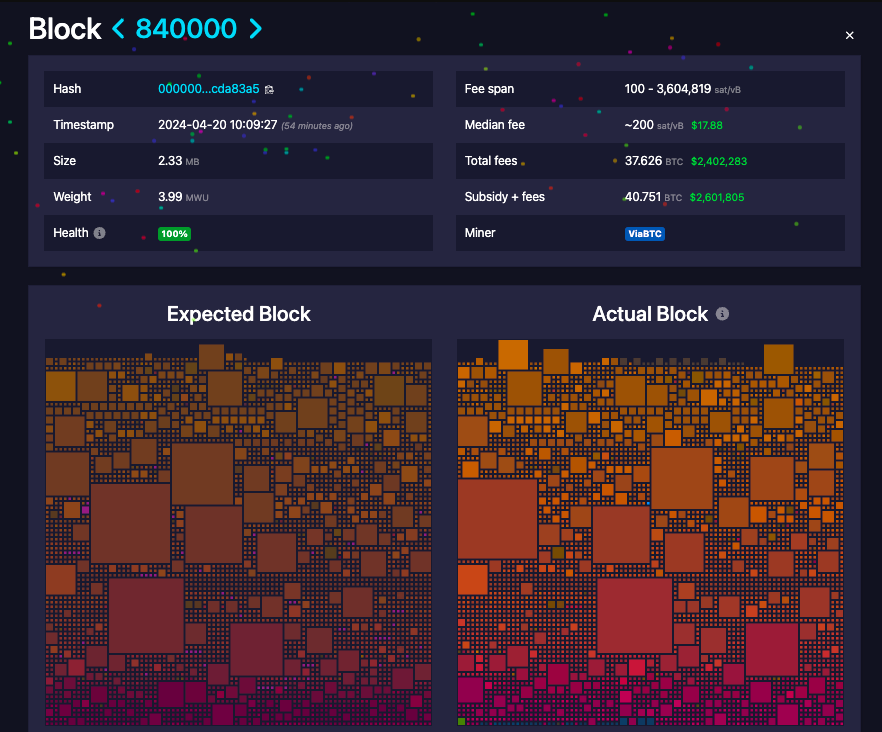

The 2024 halving block has become the most expensive block ever mined in Bitcoin’s history, with users scrambling to inscribe rare assets via the Runes protocol. Users spent a whopping 37.7 Bitcoin (over $2.4 million) to secure a spot, according to data from Bitcoin block explorer Mempool.space.

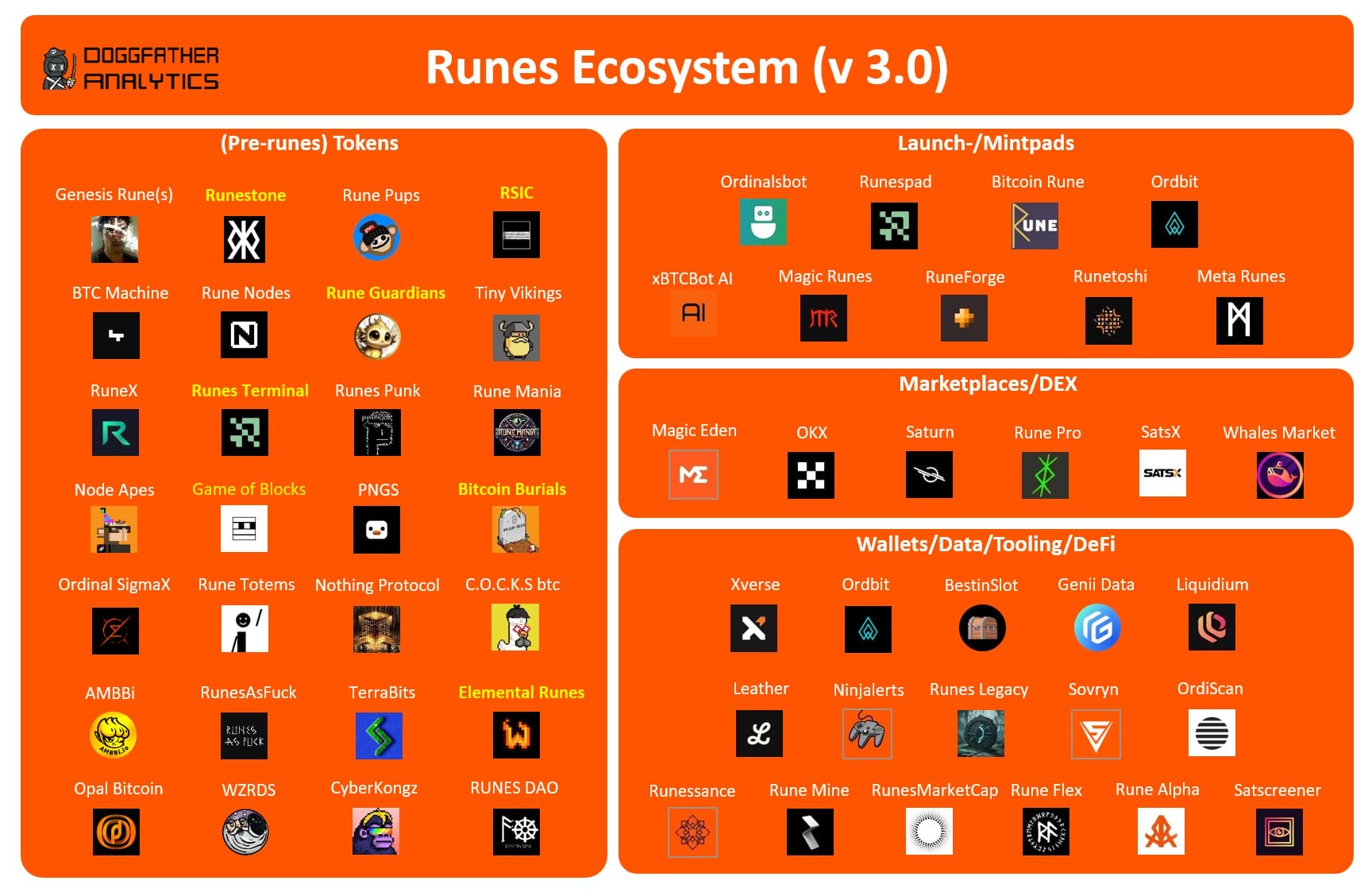

High fees on the Bitcoin halving block were fueled by a surge in demand for rare digital inscriptions and new token creation. This frenzy was driven by the launch of Casey Rodarmor’s Runes protocol, which allows users to create tokens directly on the Bitcoin network, coinciding with the halving event.

Runes offers an alternative to existing methods like the BRC-20 token standard – an Ordinals-based method for creating Bitcoin-based tokens. Both leverage Bitcoin’s network, but Runes utilizes a more efficient Unspent Transaction Output (UTXO) model, unlike the “inscription” method of BRC-20s.

Amid increasing Bitcoin use for day-to-day purchases, the Bitcoin network recorded the highest number – 1.63 million – of confirmed payments on April 23.

This massive spike was also driven by the launch of the Runes protocol. According to Dune Analytics data, Runes accounted for a whopping 81.3% of all Bitcoin transactions that day. However, Bitcoin is making a comeback, reclaiming 82,6% of transactions by April 30. Other protocols like Ordinals (2,6%) and BRC-20 (0,7%) comprise a smaller portion of the network activity.

Spot Bitcoin ETFs

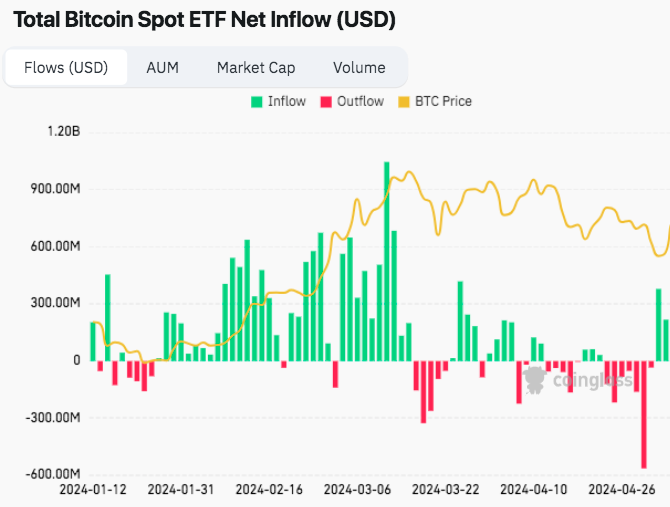

April 2024 was a whirlwind for spot Bitcoin ETFs. After a period of immense enthusiasm and record inflows in Q1 2024—attracting $1.5 billion, $6 billion, and $4.6 billion in January, February, and March, respectively—April saw a significant shift in sentiment, with outflows surpassing inflows for the first time since the Bitcoin ETFs launched in January.

In April, spot Bitcoin ETFs saw $343.5 million withdrawn from the funds, ending their three-month inflow streak. The initial inflows surge slowed significantly after peaking at $1.05 billion daily in mid-March. This coincided with a drop in Bitcoin’s price, which fell 18% from its all-time high by the end of April.

Grayscale’s GBTC fund saw the most significant outflows at $2.5 billion. ARK Invest’s ARKB and Valkyrie’s BRRR also experienced minor outflows.BlackRock’s IBIT initially attracted the most inflows in April ($1.5 billion), followed by Fidelity’s FBTC and Bitwise’s BITB. However, IBIT’s impressive 71-day inflow streak ended on April 23 and has seen zero flows for five consecutive days since. The trend continued on April 30. ARKB was the only ETF with inflows ($3.6 million), while outflows from GBTC, FBTC and BITB resulted in a net outflow of $161.6 million for the day.

Bitcoin ETFs’ trading activity also slowed significantly during the last month. After hitting a record daily volume of $9.9 billion on March 5 (coinciding with Bitcoin surpassing its previous cycle high), trading volume fell to $2.9 billion on April 30.

BlackRock updated its Bitcoin ETF

On April 5, BlackRock, a leading asset manager, updated their Bitcoin ETF prospectus, adding five new authorized participants: ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs, and UBS Securities. This move adds to the existing roster of authorized participants, including JPMorgan, Jane Street Capital, Macquarie Capital, and Virtu Americas. By incorporating these big Wall Street players, BlackRock could increase liquidity and attract more institutional interest in their Bitcoin ETFs.

Hong Kong launched Asia’s first Bitcoin ETFs

While US spot Bitcoin ETFs have dominated headlines recently, April marked a significant shift. The Hong Kong Stock Exchange (HKEX) debuted three new spot Bitcoin ETFs on April 30, offering investors exposure to these leading cryptocurrency-based products. These include Bosera HashKey Bitcoin ETF (3008.HK), ChinaAMC Bitcoin ETF (3042.HK), and Harvest Bitcoin Spot ETF (3439.HK). This launch positions Hong Kong as a potential hub for Asian cryptocurrency investment.

However, the inflows from the launched spot Bitcoin ETFs in Hong Kong were not enough to cover the outflows from the 11 US-based spot Bitcoin ETFs.

meanwhile, Hong Kong has seen US$217m on inflows this week pic.twitter.com/mLZVLzDQFy

— James Butterfill (@jbutterfill) May 2, 2024

DTCC rules out collateral for Bitcoin-linked ETFs

On April 26, the Depository Trust and Clearing Corporation (DTCC), a key player in financial settlements, dealt a blow to Bitcoin ETFs. DTCC announced it will not consider Bitcoin or other cryptocurrencies as collateral for loans or credit facilities. This change takes effect in late April, meaning these ETFs will have zero collateral value within the DTCC system.

This decision could limit the attractiveness of Bitcoin ETFs for some institutional investors who rely on collateral for borrowing and managing risk. However, in an X post, cryptocurrency enthusiast K.O. Kryptowaluty clarified that this would only apply to inter-entity settlement within the line of credit system. The use of cryptocurrency ETFs for lending and as collateral in brokerage activities will continue unaffected, depending on the risk tolerance of individual brokers.

The DTC system, or Depository Trust Company, is a key component of the financial infrastructure of the United States, acting as the central securities depository. DTC is part of a larger organization called the Depository Trust & Clearing Corporation (DTCC)

what you write…

— K.O Kryptowaluty (@KO_Kryptowaluty) April 27, 2024

Morgan Stanley and UBS want to offer Bitcoin ETFs

Financial giants Morgan Stanley and UBS, boasting a combined $2.36 trillion in assets under management, are reportedly gearing up to offer spot Bitcoin ETFs on their platforms. This move could be a major tipping point for institutional adoption of Bitcoin, bringing mainstream legitimacy and potentially driving broader investor interest.

Australia’s top exchange expected to approve Bitcoin ETFs in 2024

Australia’s leading stock exchange, the ASX, is expected to list its first spot Bitcoin ETFs by the end of 2024. Bloomberg quoted sources familiar with the matter saying several companies have already filed applications for these ETFs. These include established players like VanEck and local Australian firms BetaShares and DigitalX. With a domestic market capitalization of $2.7 trillion as of March 2024, the ASX is a major player in Australian finance, and the arrival of Bitcoin ETFs could further diversify investment options on the platform.

Bitcoin Mining Updates

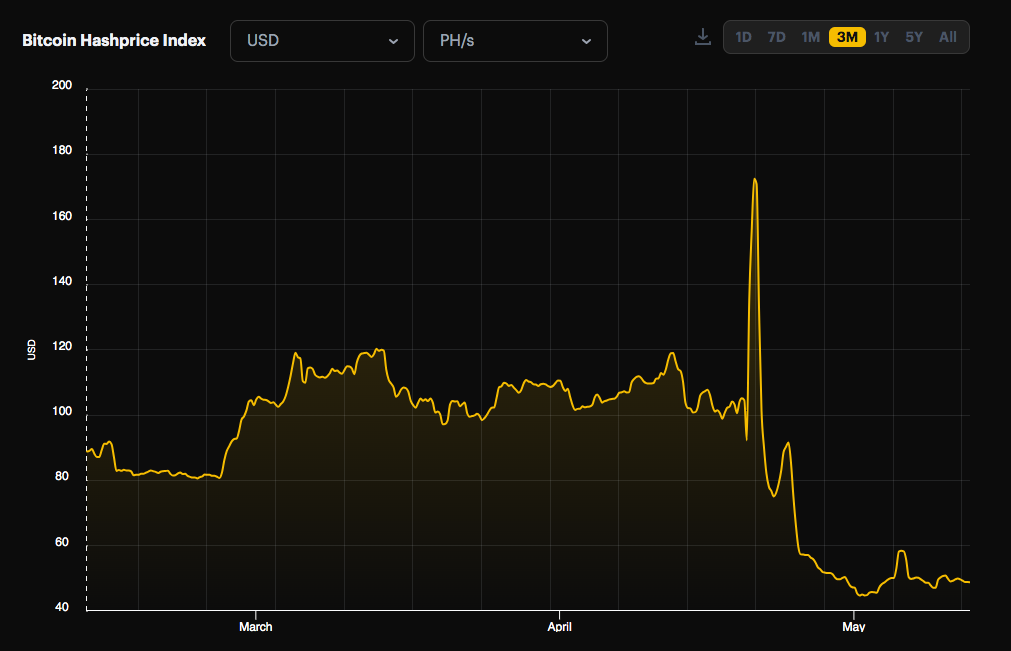

Bitcoin miners feel the pinch after the halving cut their earnings (from 6.25 BTC to 3.125 BTC). According to data from Hashrate Index, the hash price fell below $45 per PH/s per day on May 2, despite a brief pop in revenue for miners post-halving amid the Runes frenzy transaction fee windfall (172 per PH/s on April 20).

According to crypto analytics firm CryptoQuant, the hash price for miners dropped from nearly $0.12 in early April to $0.07 post-halving, following a $0.19 peak on halving day.

Despite a high network hashrate maintaining pressure, hashprice has dropped, challenging miner profitability.

The initial halving benefits through increased fees quickly dissipated, setting a new norm for lower daily revenues.

With the network hashrate holding steady at 617… pic.twitter.com/yH2xP3qt7w

— CryptoQuant.com (@cryptoquant_com) April 25, 2024

Despite the reduction in rewards, miners are still hashing, suggesting that BTC mining is still profitable at Bitcoin’s current prices. According to Ki Young Ju, CEO of CryptoQuant, there’s no sign of miners dumping their Bitcoin capitulation – for now. But, if Bitcoin prices keep dropping, large miners may be forced to sell some Bitcoin liquidate to stay afloat.

#Bitcoin miners' revenue has dropped to levels seen in early 2023 following the halving.

Now they have two options: 1. Capitulation, or 2. Waiting for a rise in $BTC price.

There are no signs of capitulation for now. pic.twitter.com/8GrYk7zcN1

— Ki Young Ju (@ki_young_ju) April 30, 2024

While Bitcoin’s mining network appears stable in the short term, the long-term effects of halving the hash rate (processing power) and overall miner activity remain unclear. Historically, periods following halving events have witnessed some miners exiting the market due to increased operational costs. The future of Bitcoin mining will likely depend on factors like Bitcoin price fluctuations and changes in electricity costs.

There are also some new April updates related to Bitcoin mining:

Block develops its own Bitcoin mining system

Payments company Block, formerly known as Square, announced the development of a new Bitcoin mining system. This follows the completion of a 3-nanometer application-specific integrated circuit (ASIC) chip designed specifically for Bitcoin mining. Block plans to offer both standalone mining chips and complete mining systems.

Waste heat from Bitcoin mining warms Finnish homes

Finland is exploring utilizing waste heat from Bitcoin mining for residential heating. A new project by Hashlabs Mining integrates heat generation from specialized Bitcoin mining equipment (WhatsMiner M63S) with the existing district heating system. This system transfers heat from a central source (in this case, Bitcoin mining) through insulated pipes to multiple buildings. This initiative could provide a sustainable heating solution for Finnish households, particularly during cold winters.

Norway tightens regulations for data centers, potentially impacting Bitcoin miners

In April, Norway enacted new legislation requiring all data centers to formally register with the government. This registration process will involve disclosing ownership, leadership, and the types of digital services offered. Terje Aasland, Norway’s Minister of Energy, stated that the government hopes this increased transparency will allow local authorities to make more informed decisions regarding data center operations, particularly their potential impact on Bitcoin mining activities.

Bitcoin Ecosystem News

April saw some important developments in the Bitcoin ecosystem, showing how companies innovate on multiple fronts.

MicroStrategy unveils a decentralized identity solution on Bitcoin

MicroStrategy, known for its massive Bitcoin holdings, is venturing beyond simple investment. At their “Bitcoin For Corporations” conference on May 1, the company announced “MicroStrategy Orange,” a decentralized identity solution built on the Bitcoin network. This system will leverage Ordinal inscriptions to store data directly on the Bitcoin blockchain. This could revolutionize online identity management by offering a secure, tamper-proof and user-controlled alternative to traditional systems.

Moreover, in April, MicroStrategy purchased $7.8 million worth of Bitcoin, bringing its total holdings to 214,400 BTC.

Ankr brings Bitcoin liquidity to Talus’ AI-powered blockchain

Starting May 1, Ankr, an infrastructure provider for decentralized blockchains, brought Bitcoin liquidity to Talus, a blockchain-focused on artificial intelligence (AI). This collaboration unlocks new possibilities for Talus’ smart agents and AI assistants, allowing Talus users to leverage the security and value of Bitcoin while participating in DeFi activities on the Talus network.

Coinbase integrates Lightning Network for Bitcoin transactions

Coinbase is now offering users more flexibility when sending Bitcoin. The cryptocurrency exchange integrated the Lightning Network, a Layer 2 technology that enables quicker and cheaper transactions compared to the traditional Bitcoin blockchain. To use the Lightning Network, the intended recipient sends an invoice consisting of a lengthy string of characters that Coinbase recognizes as the transfer amount.

For this integration, Coinbase chose Lightspark, a provider of Lightning payments solutions, as its partner.

Animoca Brands enters Bitcoin with Opal Foundation

Hong Kong-based game software company Animoca Brands announced its foray into the Bitcoin industry on April 30. The firm aims to become the “largest Web3 ecosystem” for gaming, education and culture built on Bitcoin. This move involves backing the Opal Foundation, a new protocol within the Bitcoin ecosystem. The foundation will focus on the Opal Protocol and its associated token, BLIF (potentially referring to “Opal Protocol Runes”). BLIF is initiated by collaborating with Animoca Brands and the metaverse technology platform Darewise.

Animoca Brands is coming to #Bitcoin!

Bitcoin is ready for Web3. OPAL Protocol (@OpalBTC), powered by $BLIF and initiated by @darewise & @animocabrands, is slated to become the largest #Web3 ecosystem of #gaming, entertainment, #Defi, education, and culture, built on Bitcoin.

A… pic.twitter.com/WcJ65vMHfB— Animoca Brands (@animocabrands) April 30, 2024

Bitcoin DeFi Updates

The emergence of Ordinals has reinvigorated the Bitcoin decentralized application (DApp) ecosystem by demonstrating the potential for novel protocols on the network. One such protocol is the Runes protocol, launched on April 20.

Runes is a new standard for creating tokens on the Bitcoin blockchain. It allows users to represent real-world assets such as real estate, stocks, commodities or even other cryptocurrencies (including stablecoins) using tokens on the Bitcoin network.

The growing interest in Runes could drive more activity to Layer 2 networks and increase the adoption of Bitcoin-native DApps, as we can see from recent developments.

Stacks active accounts reach record-high

Data from Bitcoin data provider Signal 21 showed that Stacks, a Layer 2 network for Bitcoin, reached a new all-time high of 122,497 active accounts in April. Active accounts are defined as addresses with at least one transaction.

Active Accounts on @Stacks reached a new all time high of 122,497 for the month of April $STXpic.twitter.com/lcE8tAj9rz

— Signal21 (@signal21btc) May 2, 2024

Orders DEX unveils roadmap

Bitcoin decentralized exchange (DEX) Orders Exchange announced its 2024 roadmap on April 29. Plans include integrating with major Web3 wallets and building a Bitcoin nonfungible token (NFT) marketplace.

Previously, Orders Exchange integrated with the Runes protocol to enable fungible token issuance and built a bridge with sidechain MicroVisionChain for BRC-20 token swaps.

The 2024 roadmap for https://t.co/p5980u1jCI has just been released!

Our team continues to work tirelessly to bring you the best experience.

Stay tuned for more updates!#Bitcoin$BTC$RDEX#DeFi#BRC20#Ordinlas#Runespic.twitter.com/FZEGXvPhBX

— Orders.Exchange (@orders_exchange) April 29, 2024

BEVM gains traction

Launched in March 2024, BEVM, a Layer 2 scaling solution for Bitcoin, attracted over 700,000 user addresses and 30+ ecosystem projects during April 2024. Built on Taproot consensus, BEVM utilizes BTC for gas fees and boasts a current valuation of $200 million.

BEVM also announced an investment from Bitmain, the world’s leading manufacturer of cryptocurrency mining servers. The exact amount of the investment was not disclosed.

Bitcoin Ordinals NFTs

The Bitcoin Ordinals market has reached a valuation of $2.3 billion at publication, even amid a broader market downturn. Ordinals are the first iteration of NFTs on Bitcoin. Ordinals live solely on the Bitcoin blockchain, unlike most of today’s popular NFT collections that host their metadata on centralized servers, creating additional points of vulnerability.

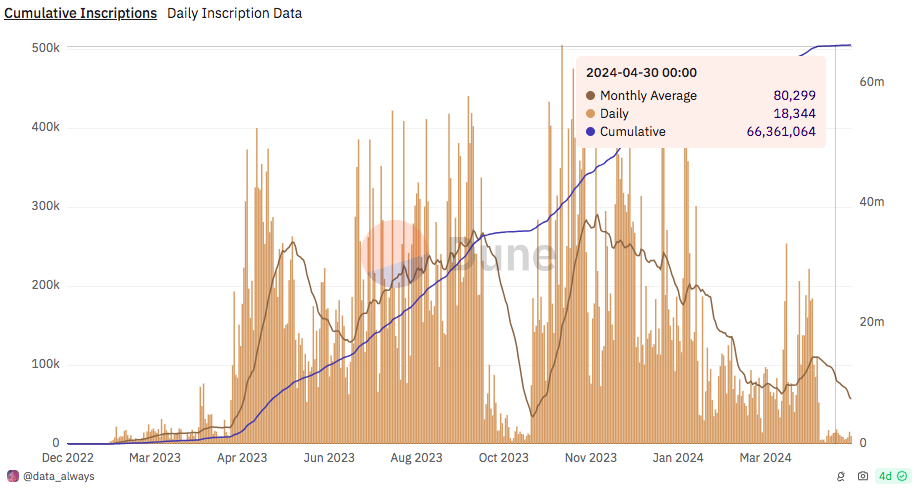

According to data from Dune Analytics, the network has over 66,3 million inscriptions to date and generated over $267 million in transaction fees.

It’s no surprise that asset manager Franklin Templeton recognized Bitcoin Ordinals as a driving force behind the “renaissance” of activity on the Bitcoin network. Similarly, OKX Ventures, the investment arm of crypto exchange OKX, highlighted in its “2024 Bitcoin Outlook” report that Bitcoin Ordinals will play a “pivotal role” this year.

However, the significant increase in NFT transactions has periodically congested the Bitcoin network since its inception, resulting in increased fees and slower processing times due to increased on-chain transaction validation. This circumstance may have influenced Binance’s decision on April 4 to discontinue support for Bitcoin Ordinals. As a result, users are no longer allowed to buy, sell or deposit Bitcoin Ordinals on the Binance NFT marketplace.

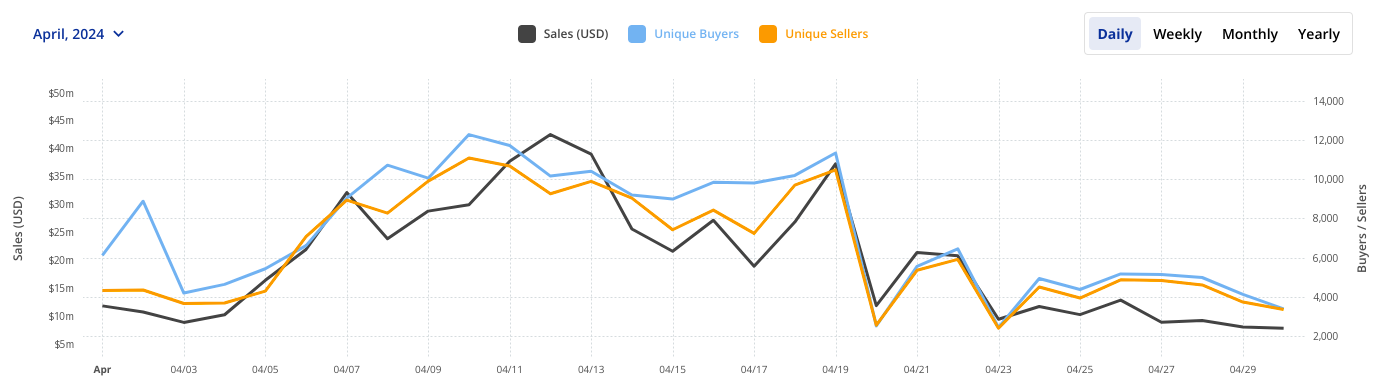

Bitcoin NFTs lead the market

Among the 24 blockchain networks minting NFTs, Bitcoin emerged as the leader in April, with sales reaching $594 million.

According to CryptoSlam data, the sales volume of Bitcoin-based NFTs reached 602 million in April (only 3% less than in March and 93% more than in February). The data further revealed that the Bitcoin network attracted around 113k buyers and 98k sellers of NFTs during April. The number of NFT transactions on Bitcoin Ordinals reached more than 340k.

Uncategorized Ordinals, NFTs not associated with specific collections, led sales with $316.9 million in volume from 219k transactions. NodeMonkes came in second in sales volume, reaching $32.7 million in April.

Runestone ($RUNE) NFT collection gained significant popularity during the month, attracting $798.4k in April (10836% more than in March). $PUPs, another NFT collection on Bitcoin using BRC-20 protocol, reached a trading volume of $72.7 million (up 2087% from last month).

Notable NFT launches in April:

- Ordinal SigmaX (April 2 – April 9) is a digital collectibles project that features 5,555 unique, fully animated pixel-art profile pictures (PFPs).

- The Rune Guardians (April 12 – April 19) is a collection of 10,000 PFP NFTs built on the Bitcoin blockchain. The project began with an airdrop of “Rune” NFTs to members of over 20 Ordinals communities (Ordinals are a type of NFT on Bitcoin).

- Rune Mining Pups (April 20 – April 27) is a collection of 10,000 unique 2D pixel art NFTs on the Bitcoin blockchain. The project integrates functionalities associated with DAOs and offers potential benefits to holders. The collection’s theme revolves around characters who discover digital assets.

Looking ahead – Can the Bitcoin Halving Charts be Inversed?

The April 2024 halving triggered the expected short-term volatility in the Bitcoin market. Despite a price drop of nearly 21%, the network experienced a surge in activity, with record-breaking daily transactions and a significant rise in fees. This activity spike was partly fueled by the launch of the Runes protocol.

Looking ahead, several factors will shape Bitcoin’s future trajectory:

- Institutional investment: The entry of major financial institutions like Morgan Stanley and UBS into the spot Bitcoin ETF market signifies growing mainstream recognition and could drive broader investor interest. However, the DTCC’s decision not to consider Bitcoin as collateral for loan purposes might limit its appeal for some institutional investors.

- Regulation: Regulatory developments like Norway’s data center registration requirement could impact Bitcoin mining operations. How other countries approach Bitcoin regulations will be crucial in shaping its future adoption.

- Bitcoin DeFi: The emergence of the Runes protocol has revitalized the Bitcoin DApp ecosystem, showcasing the potential for novel use cases on the network. Continued innovation in this space could drive more activity to Layer 2 solutions.

While the post-halving period witnessed a price correction, the Bitcoin market continues to buzz with innovation. The influx of institutional interest, ongoing advancements in mining technology and the burgeoning DeFi space all point toward a dynamic future for Bitcoin. How these factors will interplay and ultimately shape Bitcoin’s trajectory remains to be seen.

The post Bitcoin in April: Halving Price Fallout, Network Peaks and ETF Updates appeared first on Cryptonews.