Bitcoin Miners Feel the Pinch: 10% Value Drop Tanks Hash Price in August

Publikováno: 29.8.2023

August has proved to be a challenging month for bitcoin miners, facing two difficulty spikes and witnessing the currency’s value plummet over 10% in the past 30 days. This decline in value has pulled the network’s hash price to levels reminiscent of late 2022. At present, miners receive roughly $60 daily for every petahash per […]

August has proved to be a challenging month for bitcoin miners, facing two difficulty spikes and witnessing the currency’s value plummet over 10% in the past 30 days. This decline in value has pulled the network’s hash price to levels reminiscent of late 2022. At present, miners receive roughly $60 daily for every petahash per […]

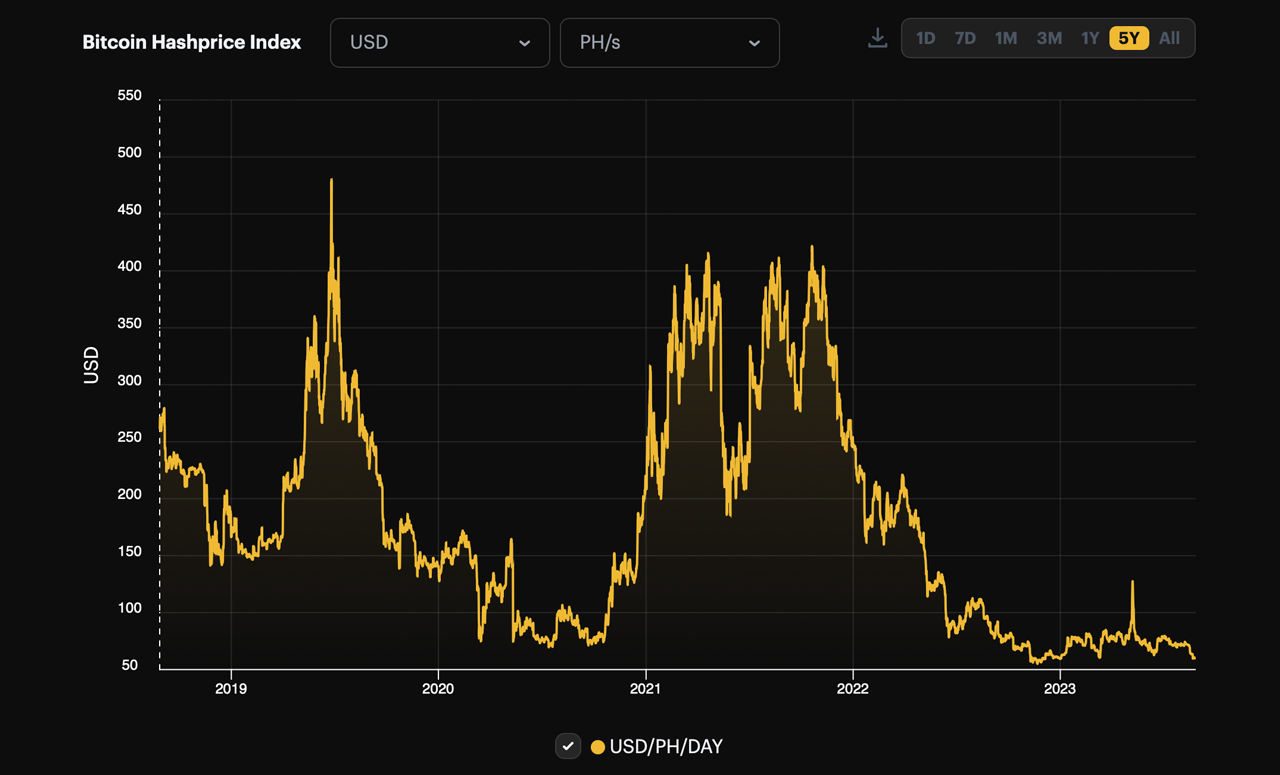

August has proved to be a challenging month for bitcoin miners, facing two difficulty spikes and witnessing the currency’s value plummet over 10% in the past 30 days. This decline in value has pulled the network’s hash price to levels reminiscent of late 2022. At present, miners receive roughly $60 daily for every petahash per second (PH/s) they produce, as indicated by the prevailing hash price.

Bitcoin’s Hash Price Tumbles to Depths Uncharted Since Late 2022

While there’s still two days left of August, data reveals miners have garnered $717.14 million, of which the subsidy accounted for a hefty $702.12 million. Back in July, the total miner earnings stood at $865.26 million, with a significant $846.04 million emerging from newly minted bitcoins.

The dip in earnings this month stems primarily from the BTC price being over 10% less than its previous month’s value. On July 29, 2023, BTC was valued at $29,355 per coin, but fast forward 30 days, and it’s just a tad below the $26K mark.

Currently, miners are churning out a staggering 364.28 exahash per second (EH/s), which translates to 364,280 petahash per second (PH/s). Rewind to July 29, and miners were pocketing just above $71 daily for each PH/s produced; fast-forward 30 days, and this figure has slid to $60.

The Hashrate Index metrics show that the peak hash price for August touched a little over $74 on the 8th. However, the year’s most significant surge was on May 8, 2023, when the hash price soared slightly past $127 per day.

Bitcoin’s hash price trajectory has been on a downward slope since October 2021, witnessing another sharp dip post-March 2022. In fact, you’d have to journey back to the balmy days of summer 2020 to find rates as low as the end of 2022 and today.

Despite August 2023’s softer bitcoin prices, the month wasn’t devoid of action, with the network experiencing two difficulty increases. The second one on August 22, at block height 804,384, leaped by 6.17%.

From July 29, 2023, onward, a total of 4,398 block rewards were discovered by bitcoin miners. Leading the charge was the mining pool Foundry USA with 1,316 discoveries, followed by Antpool with 991, F2pool with 619, Viabtc with 393, and Binance Pool rounding out the list with 335 block rewards discovered.

What do you think about the hash price dropping to fresh lows in August 2023? Share your thoughts and opinions about this subject in the comments section below.