Bitcoin Miners Not Showing Capitulation Signs, Says CryptoQuant CEO

Publikováno: 30.4.2024

The CEO of CryptoQuant, Ki Young Ju, described the predicament that Bitcoin miners are in after the halving on April 30. The investigator claims that miners are currently faced with a decision: they may either accept the state of the market or hold out for a possible rise in the price of bitcoin.

The post Bitcoin Miners Not Showing Capitulation Signs, Says CryptoQuant CEO appeared first on Cryptonews.

CryptoQuant CEO Ki Young Ju explained on April 30 the dilemma facing Bitcoin miners post-halving. According to the researcher, miners are now at a crossroad – they can either capitulate to current market conditions or await a potential BTC price increase.

Bitcoin Miners May Fall to Halving Event Pressure

Ju expressed his concerns on X that Bitcoin miners were holding onto their crypto holdings despite plummeting revenues. Revenues have dropped to 2023 levels due to the just concluded Bitcoin Halving, which slashed block rewards from 6.25 BTC to 3.125 BTC.

#Bitcoin miners' revenue has dropped to levels seen in early 2023 following the halving.

Now they have two options: 1. Capitulation, or 2. Waiting for a rise in $BTC price.

There are no signs of capitulation for now. pic.twitter.com/8GrYk7zcN1

— Ki Young Ju (@ki_young_ju) April 30, 2024

While the miners saw temporary higher revenue of over $100 million on the halving day, it has since reduced, with Ju indicating that “there are no signs of capitulation for now.”

Bitcoin miners capitulate when the price drops and the less-efficient miners are forced off the network because the Bitcoin they earn is not worth the cost to mine. This can lead them to sell the reserve Bitcoin, resulting in further price drops.

On the other hand, if miners wait for a price increase, they are essentially hoping that Bitcoin will rise in the future, making it more profitable for them to continue mining.

The #Bitcoin miners I know is a group of humam beings who have the strongest faith on bitcoion and cryptos, so capitulation is never an option. Me either. https://t.co/FfAF6FAbeb

— fat_bear@okx (@okx_fat_bear) April 30, 2024

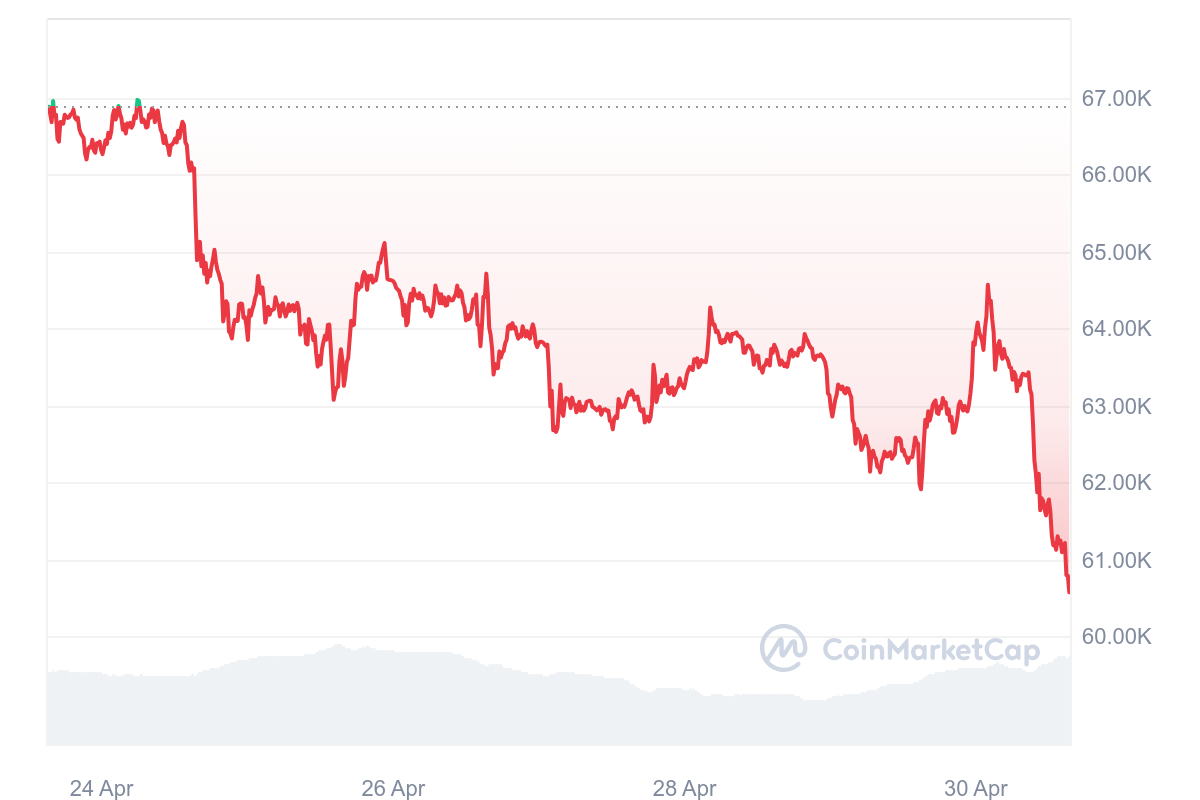

BTC trades at $60K at press time, down 4.46% in the last 24 hours, 9.47% in the past seven days, and 17.1% since hitting its all-time high price of $73,750 on March 14, 2024.

Meanwhile, Bitcoin’s prices have historically shown fluctuations around halving events, often leading to expectations of a possible rally following the increased scarcity of the asset.

The latest Bitcoin halving took a new path as BTC had already reached a new all-time high before the halving, leading enthusiasts and global crypto communities to suggest that the market dynamics have shifted compared to previous halving cycles.

Analysts Forecast Selloffs & Price Increases for Bitcoin Miners

Industry experts have made price predictions for Bitcoin post-halving, with some expecting a price increase due to the change in the rate at which new coins are created.

10x Research published a cautionary forecast suggesting that Bitcoin miners could liquidate up to $5 billion following the halving. Markus Thielen, Head of Research at 10x Research, indicated that the crypto markets might not see any major upward movement until October 2024.

In contrast, Coincodex projected an optimistic market sentiment leading up to and after the Bitcoin halving, with predictions indicating that Bitcoin could experience a minor retracement about a month after the event. However, this retracement would be followed by a 14-month-long rally, culminating in a new all-time high of approximately $179,000 in August 2025.

The post Bitcoin Miners Not Showing Capitulation Signs, Says CryptoQuant CEO appeared first on Cryptonews.