Bitcoin Mining Revenue Soared in October, Securing Second-Highest Monthly Earnings of 2023

Publikováno: 4.11.2023

In October, the landscape of bitcoin mining revenue brightened, climbing by $131.45 million over September’s figures. Last month’s surge in BTC prices significantly bolstered revenues, although there was a slight dip in the earnings from fees, which saw a $5.44 million decrease from the previous month. October emerged as the runner-up for the year in […]

In October, the landscape of bitcoin mining revenue brightened, climbing by $131.45 million over September’s figures. Last month’s surge in BTC prices significantly bolstered revenues, although there was a slight dip in the earnings from fees, which saw a $5.44 million decrease from the previous month. October emerged as the runner-up for the year in […]

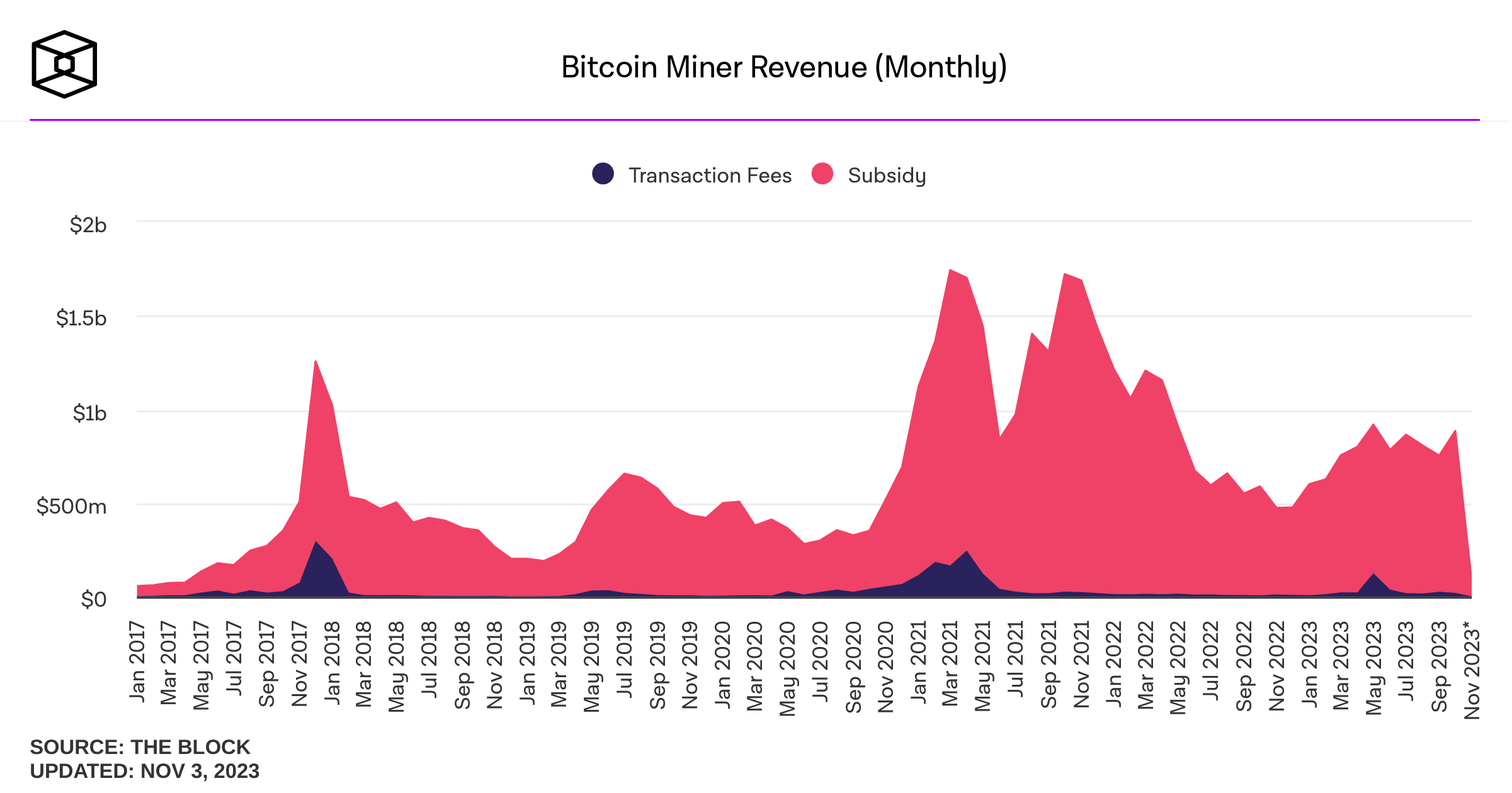

In October, the landscape of bitcoin mining revenue brightened, climbing by $131.45 million over September’s figures. Last month’s surge in BTC prices significantly bolstered revenues, although there was a slight dip in the earnings from fees, which saw a $5.44 million decrease from the previous month. October emerged as the runner-up for the year in terms of monthly revenue generated from BTC block rewards.

Staying Alive — October Marks Near-Record 2023 Earnings for Bitcoin Mining

As of this report, a total of 43 distinct mining pools are channeling SHA256 hashpower toward the Bitcoin blockchain. Collectively, they contribute an impressive 463 exahash per second (EH/s).

In the past month, Foundry USA led the charge, discovering 28% of the block rewards, while Antpool was close behind, securing 27% of the subsidies in October. Not to be overshadowed, both F2pool and Viabtc each claimed about 11%, and Binance Pool rounded out the group by locating 7.23% of the month’s total block finds.

The month of October didn’t just bring about a windfall for miners; it also marked a trio of successive network difficulty increases, culminating with the last 2.35% hike to a record-setting 62.46 trillion difficulty level.

This figure represents the most formidable challenge bitcoin miners have faced throughout the network’s existence. Amid the price surge, Bitcoin miners experienced a revenue increase of $131.45 million in October, surpassing September’s total earnings of $753.6 million.

October’s revenue for bitcoin miners not only topped the $807.01 million total from August but also saw a slight shift in fee collection. Although fees in October topped August’s $17.2 million, they did not reach the heights of September, falling $5.44 million short.

Miners enjoyed $26.4 million in fees in September, but this number dipped to $20.96 million in October. A contributing factor to this fee reduction may be linked to a decrease in Ordinal inscriptions, though there has been a recent uptick in this activity.

In the crypto community, October has been affectionately termed ‘Uptober,’ and fittingly, it delivered the second-highest monthly revenue for miners in the year 2023, only trailing behind May’s impressive $919.22 million haul.

What do you think about bitcoin miner revenue improving in October? Share your thoughts and opinions about this subject in the comments section below.