Bitcoin Network Sees a Massive Mining Pool Shift Following the Halving

Publikováno: 14.5.2020

Following the third bitcoin halving on May 11, 2020, there’s been a big shift in mining pool distribution, as far as hashrate is concerned. At the time of publication, there’s around 100-115 exahash per second (EH/s) in search of bitcoin blocks and spectators have seen two relatively unknown mining pools join the top mining pool […]

Following the third bitcoin halving on May 11, 2020, there’s been a big shift in mining pool distribution, as far as hashrate is concerned. At the time of publication, there’s around 100-115 exahash per second (EH/s) in search of bitcoin blocks and spectators have seen two relatively unknown mining pools join the top mining pool […]

The post Bitcoin Network Sees a Massive Mining Pool Shift Following the Halving appeared first on Bitcoin News.

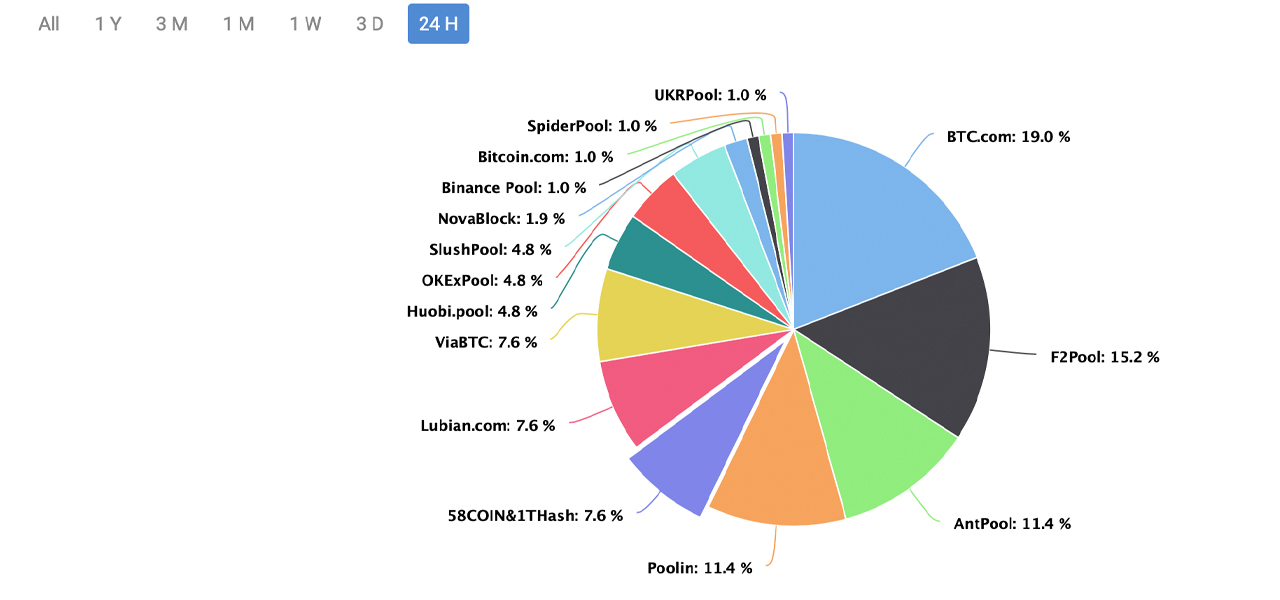

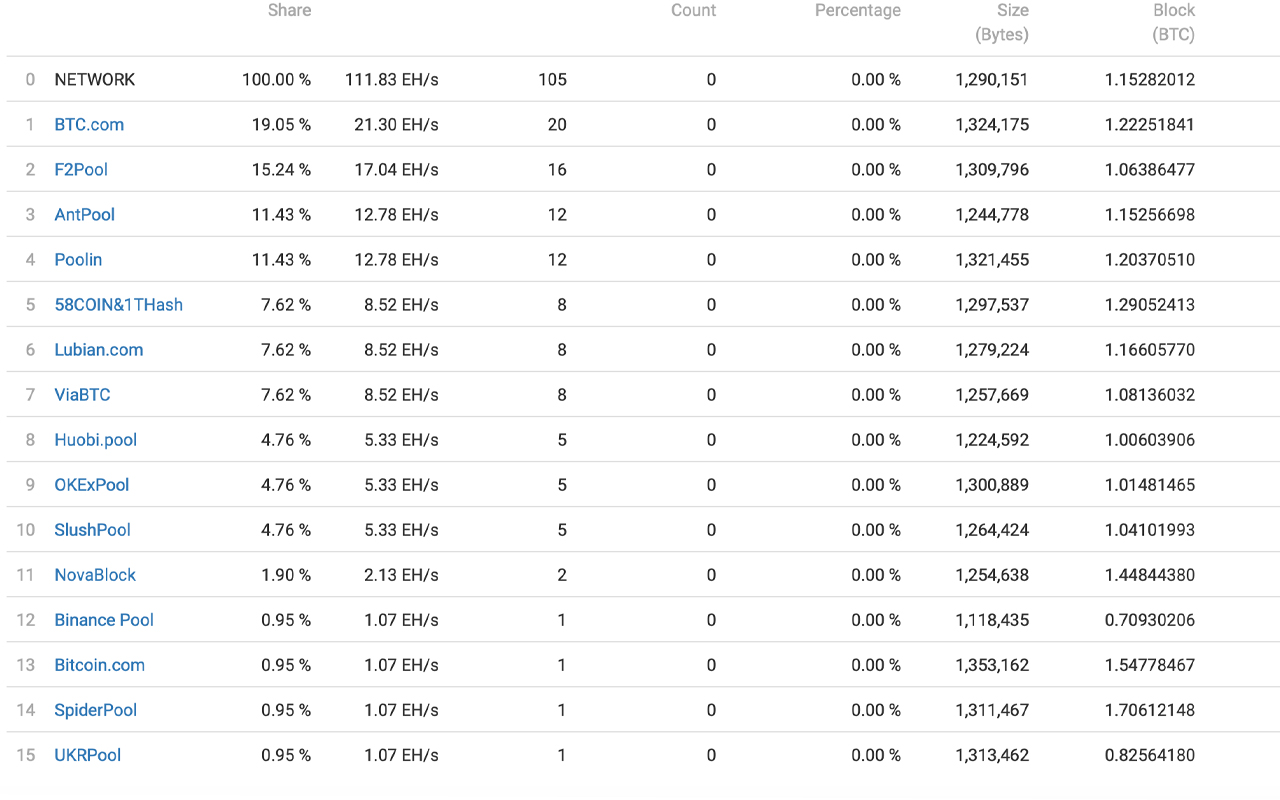

Following the third bitcoin halving on May 11, 2020, there’s been a big shift in mining pool distribution, as far as hashrate is concerned. At the time of publication, there’s around 100-115 exahash per second (EH/s) in search of bitcoin blocks and spectators have seen two relatively unknown mining pools join the top mining pool contenders. Both of these new mining pools capture around 14 EH/s today, and the top operations F2pool and BTC.com have around 34 EH/s between both pools.

The last BTC halving saw a small amount of different network activity and every single mining operation lost 50% of revenue after the halving. A minuscule fraction of hashrate has left since the revenue cut, and BTC transaction (txn) fees have been on the rise. In the last 48 hours, a single BTC txn can cost a user between $2-4 depending on network congestion.

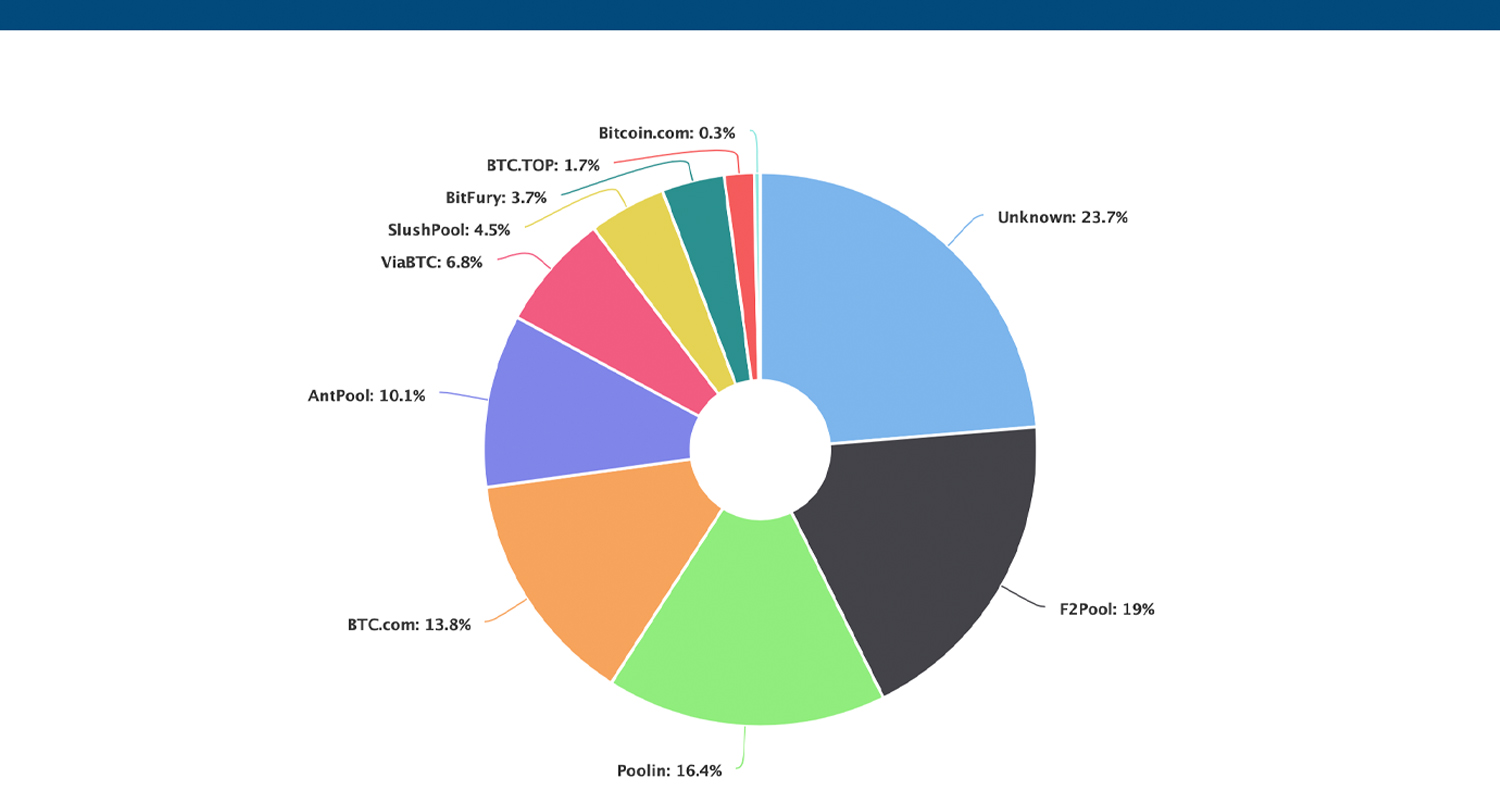

Another noticeable sight is the occurrence of extremely less stealth hash (unknown miners) than weeks ago and two relatively new mining operations. The two mining pools called 1Thash and Lubian.com have gained a lot of hashrate since the halving and both operations have captured around 14 EH/s since then.

1Thash was known for some time now, but the pool had way less hashpower than it does today, as it captures 7.6% of the overall hashrate on May 14, 2020. Hashrate distribution statistics show that the pool Lubian.com mined its first coins at block height 627,441. Similarly to 1Thash, the operation also has 7.6% of today’s SHA256 hashrate on the BTC chain, and both of them control the fifth and sixth largest hashrate distribution positions.

According to the regional reporter Lylian Teng from 8btc, Lubian’s name means “roadside” and the website claims to be the “safest high yielding mining pool.” Teng also said that the local Chinese news outlet Blockbeats were the first to spot Lubian hashing away at the BTC chain, and they gave information to Btc.com for distribution statistics.

Blockchain.com’s pool stat data still says “unknown” for Lubian’s position, but Btc.com statistics has both Lubian and 1Thash recorded. If Btc.com’s pool stats are correct, that would mean there is very little unknown hash stealth mining the BTC chain today. The data indicates that there are 15 known mining pools since the halving still hashing away. Pools include Btc.com, F2pool, Antpool, Poolin, 1Thash, Lubian, Viabtc, Huobi, Okex, Slush, Nova, Binance, Bitcoin.com, Spider, and Ukrpool.

F2pool has also recently commanded the second-largest mining pool position by order of SHA256 hashpower in the race. The Chinese mining operation was also lucky enough to obtain the last 12.5 BTC block reward before the halving. Etched into the Coinbase message F2pool wrote:

NYTimes 09/Apr/2020 With $2.3T Injection, Fed’s Plan Far Exceeds 2008 Rescue.

Since then, news.Bitcoin.com reported on how the total value of block rewards and fees dropped from $17.16 million on May 12 to $8.95 million the very next day. So far, on Thursday three days after the halving, BTC’s price has spiked to the $9,900 region. However, at that point, the value corrected some and the price has been hovering between the $9,500 to $9,750 zone since then.

What do you think about the change in hashrate distribution since the reward halving? Let us know in the comments below.

The post Bitcoin Network Sees a Massive Mining Pool Shift Following the Halving appeared first on Bitcoin News.