Bitcoin Price Prediction as Analyst Says ‘Santa Claus Squeee’ Will Shoot Prices Higher – Time to Buy?

Publikováno: 7.11.2023

Bitcoin’s recent slip below the $35,000 threshold marks a pause in its latest bull run, but the market’s optimism doesn’t seem to wane, as the Fear & Greed Index hovers at a confident 73. This pullback has not dampened the broader positive market mood, with the trajectory for Bitcoin and its digital brethren still pointing north. […]

The post Bitcoin Price Prediction as Analyst Says ‘Santa Claus Squeee’ Will Shoot Prices Higher – Time to Buy? appeared first on Cryptonews.

Bitcoin’s recent slip below the $35,000 threshold marks a pause in its latest bull run, but the market’s optimism doesn’t seem to wane, as the Fear & Greed Index hovers at a confident 73. This pullback has not dampened the broader positive market mood, with the trajectory for Bitcoin and its digital brethren still pointing north.

Amidst these market dynamics, the Bank of England’s move to bring widely-used stablecoins under regulatory oversight, with the Financial Conduct Authority (FCA) helming the crypto industry’s supervision, is a significant stride towards the cryptocurrency sector’s maturation and integration into the established financial system.

BREAKING:

Bank of England proposes allowing crypto stable coins as a payment option for goods and services. pic.twitter.com/E43JGUHijw

— Bitcoin Scoop (@bitcoin_scoop) November 6, 2023

This backdrop sets the stage for the market’s anticipation of the ‘Santa Claus Squeeze,’ a bullish event that analysts believe could propel Bitcoin’s prices to new heights, presenting a potential investment inflection point.

Uptrend Signals: A Crypto Surge on the Horizon?

It’s worth noting that the approaching year-end could potentially trigger a substantial increase in digital assets, as suggested by Markus Thielen, the Head of Crypto Research at Matrixport.

His report indicates that historically, Bitcoin has experienced a 23% surge in the period leading up to Christmas during November and December.

Furthermore, the higher-risk cryptocurrencies have outperformed Bitcoin, hinting at the possibility of a holiday rally.

'Santa Claus squeeze' coming to gift crypto gains this Christmas, analyst says

— Bradicoin (@Bradicoin10) November 7, 2023

Meanwhile, Thielen highlights three significant events indicating a possible end to interest rate peaks, which could encourage an upsurge in risk assets.

- Firstly, the US Treasury’s transition towards shorter-term debt signifies an anticipation of declining interest rates, potentially benefiting tech stocks and cryptocurrencies.

- Secondly, statements from Fed Chair Jerome Powell imply the potential for halting rate cuts, thereby enhancing confidence in risk assets.

- Lastly, a sluggish US job market diminishes the probability of additional rate hikes.

Thielen also highlights past instances when Bitcoin surged post the Fed’s interest rate cycles, hinting at potential advances in 2023 and 2024.

Additionally, Thielen notes past trends where Bitcoin’s value surged following the Federal Reserve’s interest rate cycles, proposing possible gains in 2023 and 2024. The potential approval of a BlackRock spot Bitcoin ETF could catalyze a more extensive crypto rally, akin to the effect of the CME’s Bitcoin futures in 2017. Consequently, Thielen recommends maintaining exposure until a US-listed spot Bitcoin ETF begins trading.

Thus, this information could reinforce Bitcoin’s value, signaling an optimistic future for digital assets. Historical patterns and macroeconomic factors seem to support the notion of a rally during the holiday season.

Taproot Upgrade: A Catalyst for Bitcoin’s Market Value?

Lightning Labs, the developer behind the Lightning Network, recently launched the mainnet alpha version of Taproot Assets on October 19th. This release signifies a big step in allowing the creation of stablecoins and other assets on the Bitcoin network. These assets are managed through Bitcoin’s Script scripting feature and applied via the Lightning Network, marking a potential era of BRC20 tokens on Bitcoin.

Exploring the Multi-Asset Issuance Mechanism of Taproot Assets

By @tmel0211

Read more https://t.co/ydgwPFdASlpic.twitter.com/jUqiZha370

— Wu Blockchain (@WuBlockchain) November 7, 2023

Therefore, the introduction of Taproot Assets and the prospect of BRC20 tokens on Bitcoin have the potential to enhance the utility and adoption of Bitcoin, potentially exerting a positive influence on its long-term price.

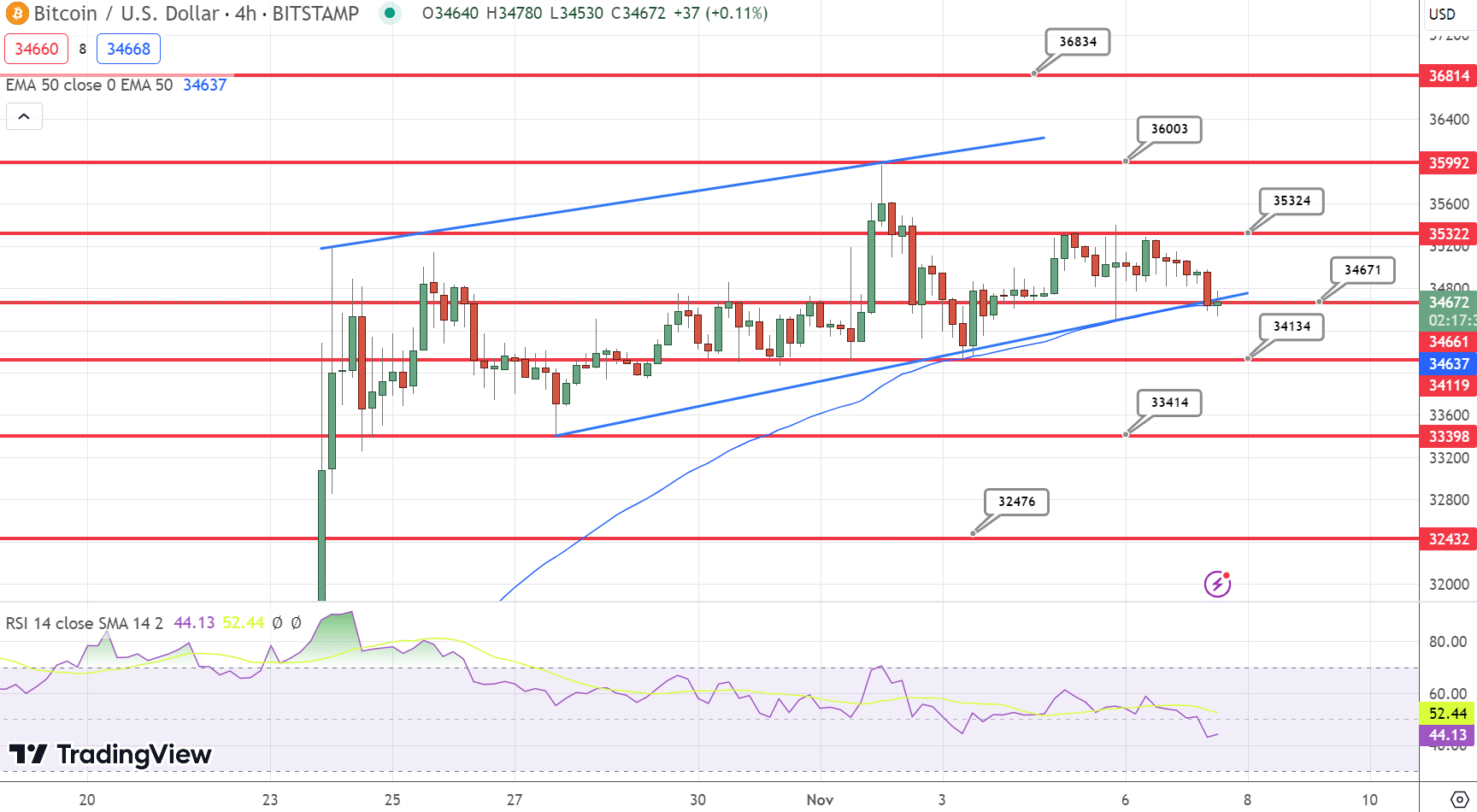

Bitcoin Price Prediction

As of the latest market trends, Bitcoin’s price action seems to be in a consolidation phase, with a pivotal level established around $34,990, which is of particular interest to day traders. It’s facing immediate resistance at approximately $35,360, which has been a bottleneck in recent trading activity.

If it successfully surpasses this level, traders might set their sights on successive resistance levels at $36,051, followed by $37,018.

On the flip side, the first line of support is positioned at around $34,693. Should bearish momentum take hold, subsequent support levels could come into play at $33,281 and then at $32,481.

The Relative Strength Index (RSI) stands at 57, leaning toward a bullish sentiment without veering into overbought territory.

With the 50-Day Exponential Moving Average (EMA) currently at $34,390, just below Bitcoin’s present value, it indicates a slight bullish bias in the short term.

Looking ahead in the short term: Bitcoin’s price may approach the resistance of $35,360 if it can maintain the current support. Conversely, a drop below the support of $34,693 could precipitate further losses, underscoring the importance of setting stop-loss orders amidst the current market volatility.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction as Analyst Says ‘Santa Claus Squeee’ Will Shoot Prices Higher – Time to Buy? appeared first on Cryptonews.