Bitcoin Price Prediction as BTC Pulls Back From $42,000 – When is the Next Leg Up?

Publikováno: 5.12.2023

Bitcoin, currently standing as the premier cryptocurrency, has witnessed a remarkable surge, pushing its price to a striking $41,765. Accompanied by a substantial 24-hour trading volume of $27 billion, Bitcoin has experienced an impressive upswing of nearly 6% in the last day alone. This notable ascent solidifies its position at the top of CoinMarketCap rankings, […]

The post Bitcoin Price Prediction as BTC Pulls Back From $42,000 – When is the Next Leg Up? appeared first on Cryptonews.

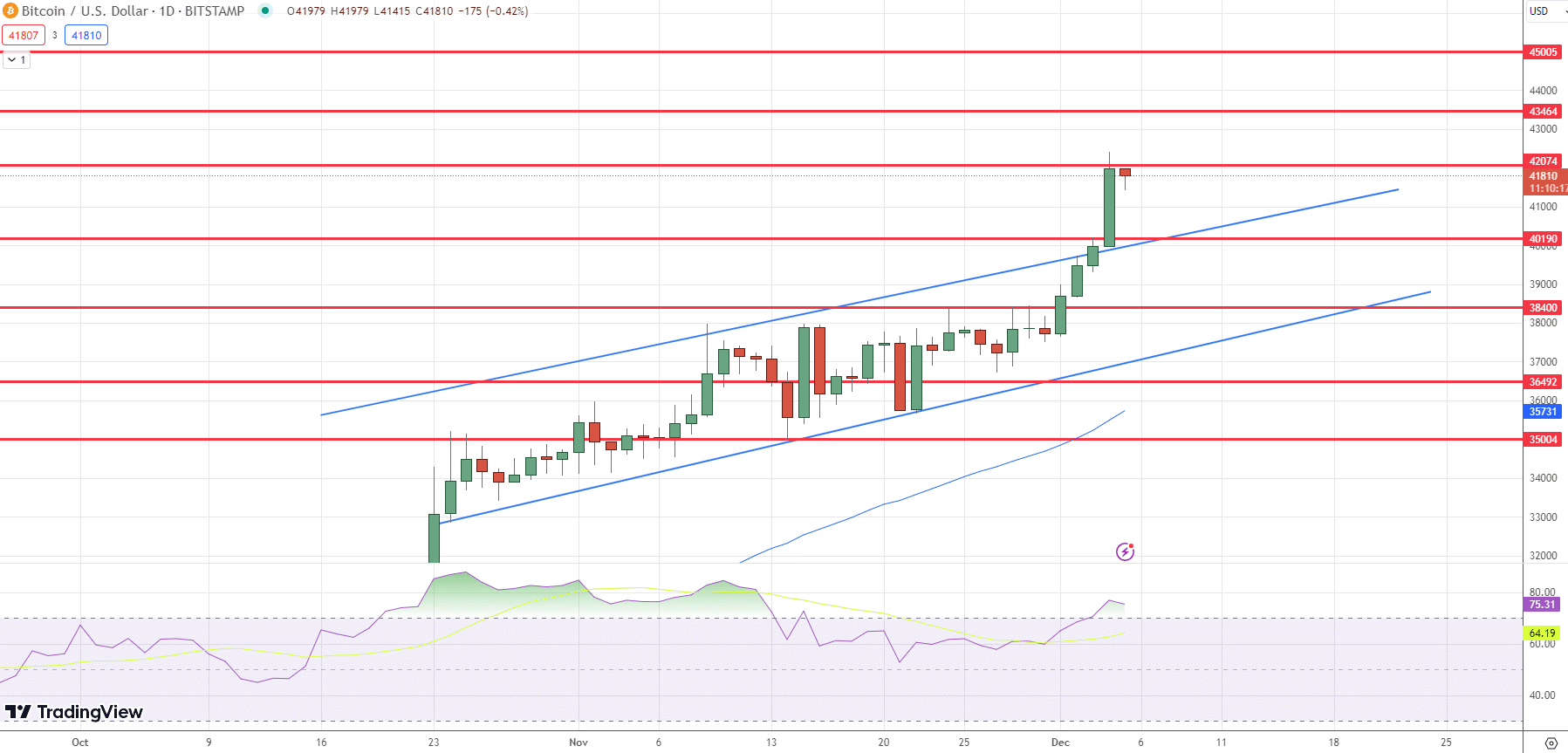

Bitcoin, currently standing as the premier cryptocurrency, has witnessed a remarkable surge, pushing its price to a striking $41,765. Accompanied by a substantial 24-hour trading volume of $27 billion, Bitcoin has experienced an impressive upswing of nearly 6% in the last day alone.

This notable ascent solidifies its position at the top of CoinMarketCap rankings, boasting a live market capitalization of $816 billion. With a circulating supply of 19,560,793 BTC out of the maximum 21,000,000 BTC coins, the market eagerly anticipates Bitcoin’s next significant move.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction as BTC Pulls Back From $42,000 – When is the Next Leg Up? appeared first on Cryptonews.

With an RSI hinting at overbought conditions, will

With an RSI hinting at overbought conditions, will