Bitcoin Price Prediction as BTC’s Monthly Volume in January Hit Highest Level Since September 2022 – Bull Market Starting?

Publikováno: 5.2.2024

In a remarkable turn of events, Bitcoin‘s 24-hour trading volume surged 15.30% to $16.01 billion, indicating a significant uptick in investor engagement and marking the highest volume since September 2022. This increase, over 10% for Bitcoin, pushing its value beyond the $43,000 threshold, was partly driven by Grayscale’s decreased Bitcoin sales and a strong US […]

The post Bitcoin Price Prediction as BTC’s Monthly Volume in January Hit Highest Level Since September 2022 – Bull Market Starting? appeared first on Cryptonews.

In a remarkable turn of events, Bitcoin‘s 24-hour trading volume surged 15.30% to $16.01 billion, indicating a significant uptick in investor engagement and marking the highest volume since September 2022.

This increase, over 10% for Bitcoin, pushing its value beyond the $43,000 threshold, was partly driven by Grayscale’s decreased Bitcoin sales and a strong US stock market.

Upcoming events like the US Federal Reserve meeting and January’s job reports may influence market trends.

Despite potential uncertainties, Bitcoin’s market capitalization grew by 2% to $1.66 trillion within 24 hours, highlighting the impact of increased trading activity on its market valuation.

Federal Reserve’s 2024 Interest Rate Strategy

Jerome Powell, the Federal Reserve Chair, has confirmed plans to reduce interest rates three times in 2024. This strategic decision is aimed at leveraging the robust U.S. economy and controlling inflation, with an objective to lower the benchmark interest rate to 4.6% from its current 23-year peak.

Powell’s optimism about the U.S. economy is evident as he highlights a strong job market and minimizes recession risks.

Despite acknowledging the Fed’s initial slow response to inflation, he anticipates an improvement in 2024, driven by the resolution of supply chain issues and the effects of previous rate increases.

Jerome Powell said in an interview broadcast Sunday night that the Federal Reserve remains on track to cut interest rates three times this year, a move that's expected to begin as early as May. https://t.co/v3V5xCSj3Spic.twitter.com/Th2MplNIkV

— NEWSMAX (@NEWSMAX) February 5, 2024

Powell’s commitment to carefully phased interest rate reductions has bolstered confidence in the U.S. economy, which could alleviate concerns within the crypto market.

This approach is expected to foster a positive outlook, benefiting Bitcoin and the broader cryptocurrency landscape.

DonAlt’s Bitcoin Forecast: Hitting $60K?

Crypto analyst DonAlt predicts Bitcoin could reach $60,000 if it surpasses significant barriers. He identifies $38,000 and a critical range between $44,000 and $45,000 as initial hurdles.

Surpassing $45,000 is pivotal for aiming at $60,000, as it would signify overcoming major resistance levels.

Bitcoin Could Soar to $60,000, Says Crypto Analysthttps://t.co/jtp4wPKv3T

— BH NEWS (@bhnewsnet) February 5, 2024

Despite potential challenges, such as the introduction of spot Bitcoin ETFs, DonAlt remains positive about Bitcoin’s prospects, downplaying the likelihood of a decline to $30,000.

He advocates for a bullish outlook should Bitcoin maintain its position above $44,000.

Despite inherent risks, his optimistic stance suggests that Bitcoin’s trajectory is keenly watched by investors, with the anticipation that adhering to his forecast could drive buying momentum and positively influence Bitcoin’s market value.

Bitcoin Price Prediction

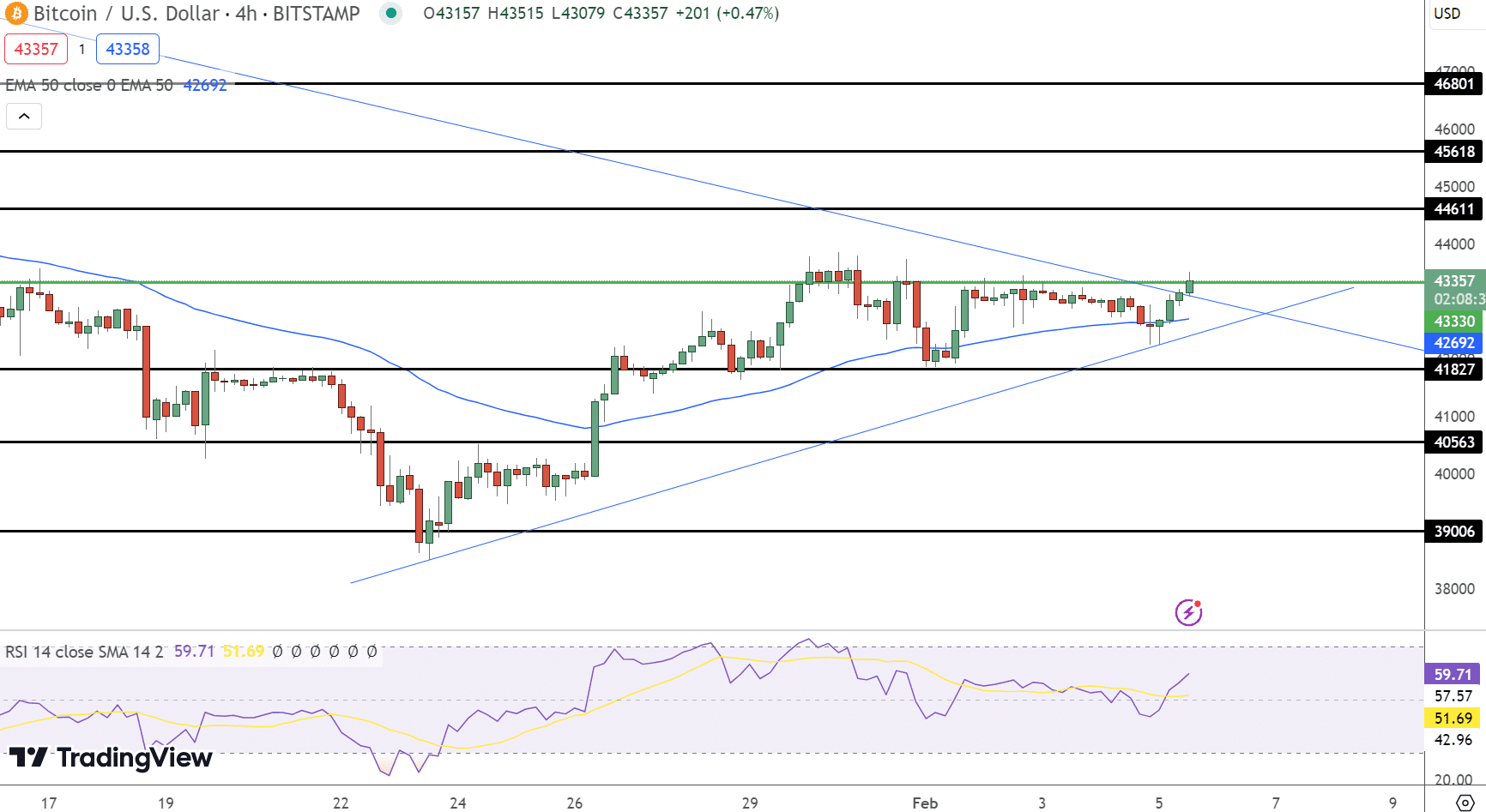

Bitcoin (BTC/USD) reflecting a slight uptick with its current price at $43,362, marking a nearly 1.85% increase. On the 4-hour chart the pivot point stands at $43,330, signaling a delicate balance in market sentiment.

Resistance levels are identified at $44,611, $45,618, and $46,801, hinting at potential hurdles for upward movements. Conversely, support levels at $41,827, $40,563, and $39,006 offer a cushion against downward pressure.

The RSI at 59 tilts towards a moderately bullish sentiment, while the 50 EMA at $42,692 provides a backdrop of underlying strength. The chart reveals a double top pattern, signaling resistance around the pivot point.

This formation, coupled with a closing candlestick below this threshold, suggests a critical juncture for Bitcoin’s trajectory.

In conclusion, the trend oscillates between bearish below $43,330 and bullish above, indicating a market at a crossroads, awaiting clearer signals for direction.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction as BTC’s Monthly Volume in January Hit Highest Level Since September 2022 – Bull Market Starting? appeared first on Cryptonews.