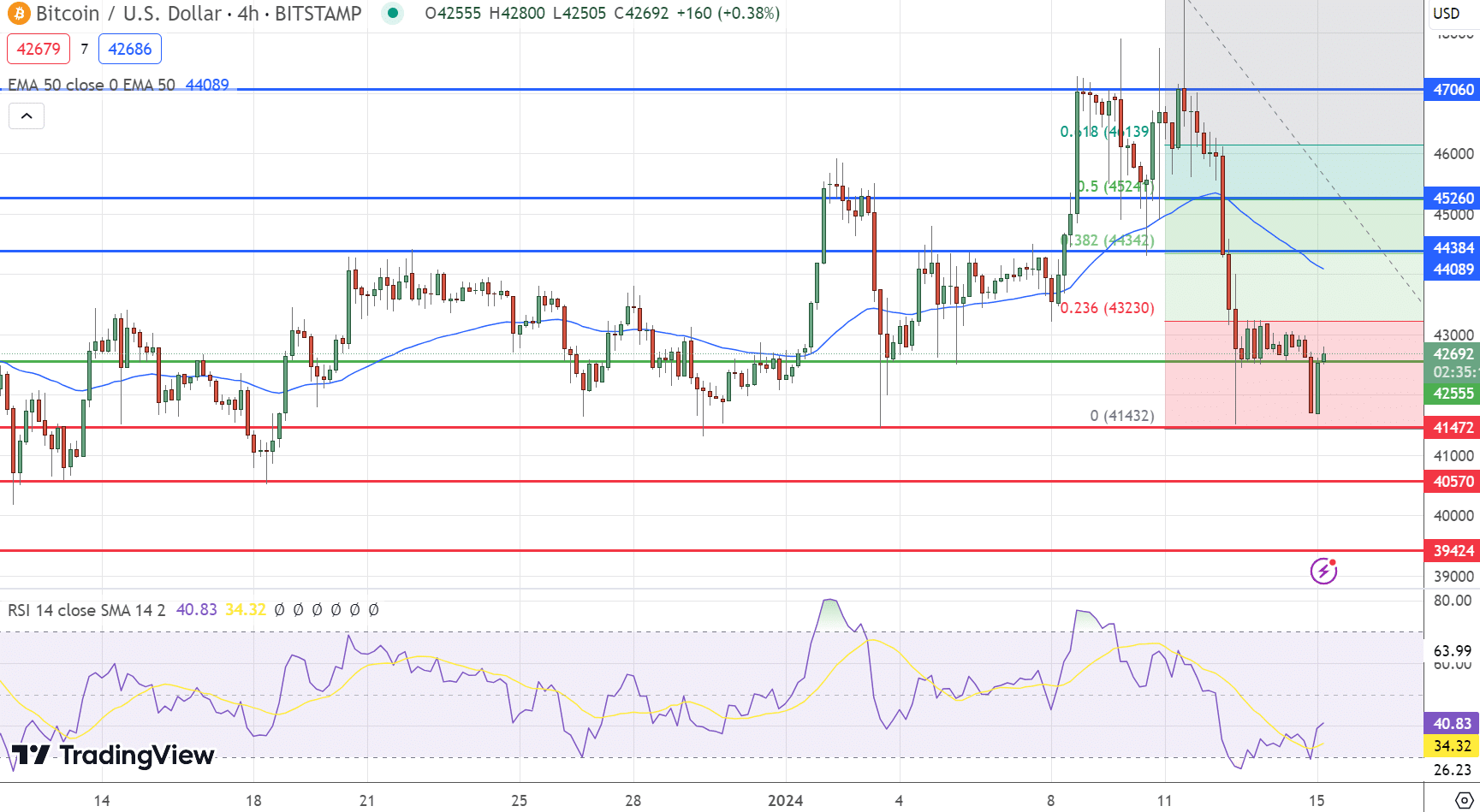

Bitcoin Price Prediction: BTC Choppy Near $42,600, Ark & BlackRock Stir Buzz

Publikováno: 15.1.2024

As the trading week begins, Bitcoin exhibits a choppy pattern, marginally up by 0.06% and hovering around $42,635. The cryptocurrency landscape is buzzing with notable developments that could shape its short-term trajectory. Ark Invest’s Cathie Wood, a known advocate for Bitcoin, continues to hold a strong belief in its potential, further influencing market sentiment. In […]

The post Bitcoin Price Prediction: BTC Choppy Near $42,600, Ark & BlackRock Stir Buzz appeared first on Cryptonews.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction: BTC Choppy Near $42,600, Ark & BlackRock Stir Buzz appeared first on Cryptonews.