Bitcoin Price Prediction: BTC Drops to $41,000 Amid $4B ETF Surge and USD Dominance Concerns

Publikováno: 22.1.2024

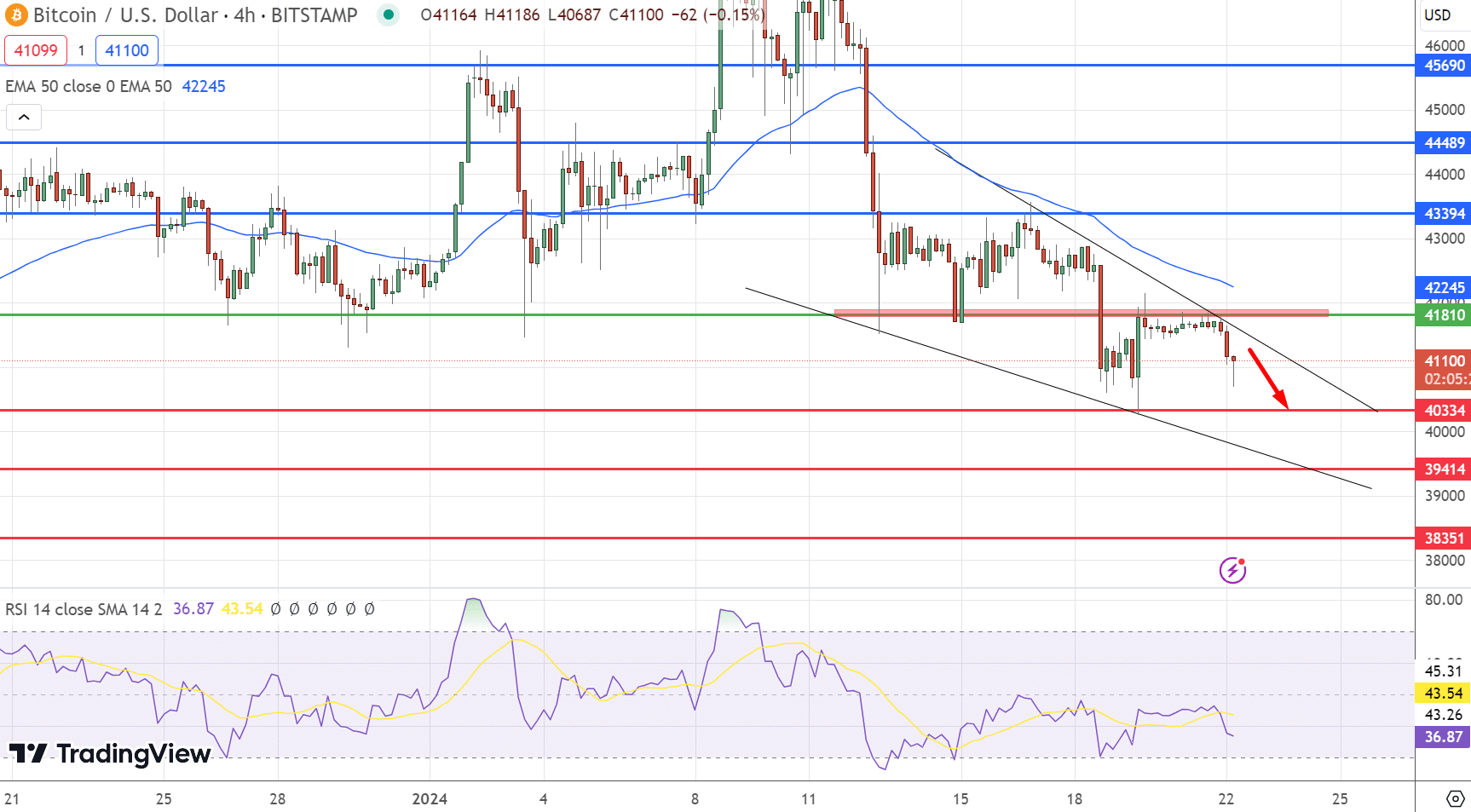

In the dynamic realm of cryptocurrency, Bitcoin (BTC) has experienced a notable shift, currently trading at $41,068, marking a 1.70% decrease on Monday. This change occurs amidst significant developments in the crypto landscape, including the remarkable growth of Bitcoin ETFs, which have swiftly reached $4 billion in assets under management (AUM) by accumulating an impressive […]

The post Bitcoin Price Prediction: BTC Drops to $41,000 Amid $4B ETF Surge and USD Dominance Concerns appeared first on Cryptonews.

In the dynamic realm of cryptocurrency, Bitcoin (BTC) has experienced a notable shift, currently trading at $41,068, marking a 1.70% decrease on Monday. This change occurs amidst significant developments in the crypto landscape, including the remarkable growth of Bitcoin ETFs, which have swiftly reached $4 billion in assets under management (AUM) by accumulating an impressive 95,000 BTC in a mere six days.

These movements signal a growing investor confidence and a shift in the traditional investment strategies towards digital assets. Amidst these shifts, Morgan Stanley has raised concerns about the enduring dominance of the US Dollar, suggesting that the rise of cryptocurrencies could substantially reshape the global currency landscape.

Adding to the discourse, the CEO of Grayscale has cast doubt on the future of most approved spot Bitcoin ETFs, indicating a challenging path ahead for these financial instruments. These factors combined paint a complex picture for Bitcoin’s future, balancing the surge in ETF interest against broader market and regulatory uncertainties.

Bitcoin ETFs’ Rapid Accumulation: $4B AUM with 95,000 BTC in Six Days

In just six days, Bitcoin Exchange-Traded Funds (ETFs)—including Fidelity’s FBTC and BlackRock’s iShares Bitcoin Trust (IBIT)—have accumulated 95,000 BTC, elevating their total assets under management (AUM) to nearly $4 billion.

During the same period, Grayscale Bitcoin Trust (GBTC) experienced a $2.8 billion drop in AUM. This significant growth in AUM was propelled by inflows exceeding $1.2 billion into the ETFs from Fidelity and BlackRock.

LATEST: Despite $GBTC seeing a -$590m outflow gash friday, The Nine overwhelmed it w/ +$623m (3rd best day), $IBIT & $FBTC both >$200m while $BTCO & $HODL had their best hauls to date. TOT NET FLOWS stand at +$1.2b as Nine's aum hit $4b vs GBTC's -$2.8b, upping aum share to 14%. pic.twitter.com/nB57H8Ro8s

— Eric Balchunas (@EricBalchunas) January 20, 2024

The rising AUM and daily trading volumes of Bitcoin ETFs reflect a shift in investor preferences, signaling enhanced interest and confidence in cryptocurrencies from institutional players. This trend could potentially underpin a sustained upward price movement for Bitcoin.

Morgan Stanley’s Warning: Crypto’s Potential to Upend US Dollar Dominance

Morgan Stanley highlights the growing traction of digital assets like Bitcoin and raises concerns over the potential decline in U.S. dollar dominance. The investment bank points out that America’s increasing twin deficits and shifting geopolitical landscapes are putting the dollar’s leading role in the global financial system into question.

The surge in interest in digital assets, including stablecoins, Bitcoin, and central bank digital currencies (CBDCs), could significantly transform the currency landscape. The report also notes China’s efforts to promote the yuan in global trade and the European Union’s initiatives to strengthen the euro’s position.

This emerging trend towards reducing dependence on the dollar could potentially amplify interest in virtual currencies like Bitcoin. Such assets are increasingly viewed as safeguards against exchange rate volatility and geopolitical uncertainties.

Grayscale’s CEO Skeptical: Many Spot Bitcoin ETFs Unlikely to Succeed

Grayscale CEO Michael Sonnenshein recently expressed skepticism about the long-term success of many spot Bitcoin ETFs. Speaking at the World Economic Forum event, he highlighted Grayscale’s comparatively higher management fee of 1.5%, in contrast to competitors’ fees ranging from 0.2% to 0.4%.

Sonnenshein justified Grayscale’s fees by referencing its decade-long track record and status as the largest Bitcoin fund. He noted that while competitors attract new clients with lower fees, Grayscale remains committed to Bitcoin.

Grayscale CEO says most of the 11 approved bitcoin ETFs won’t survive, defends highest fees in industry

Grayscale Investments CEO Michael Sonnenshein told CNBC that most of the approved bitcoin exchange-traded funds won’t survive, while defending the highest fees in the…

— *Walter Bloomberg (@DeItaone) January 19, 2024

Despite recent withdrawals of $2.2 billion from Grayscale’s Bitcoin Trust, inflows into spot Bitcoin ETFs have surpassed $1.2 billion in the last five days. Sonnenshein predicts that only a few major Bitcoin ETFs will survive in the long run, potentially influencing both market sentiment and Bitcoin’s price.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction: BTC Drops to $41,000 Amid $4B ETF Surge and USD Dominance Concerns appeared first on Cryptonews.