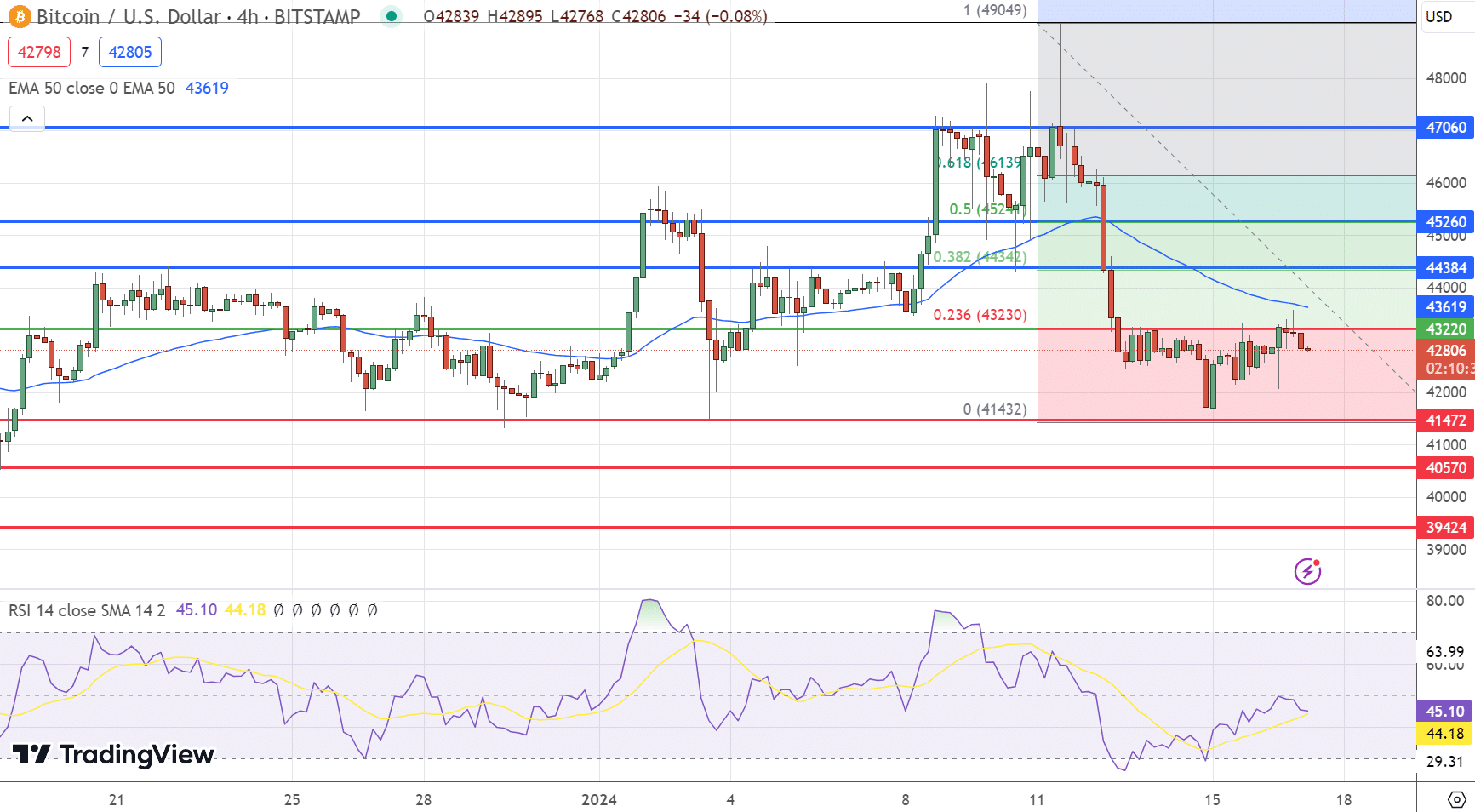

In a dynamic week for the cryptocurrency market, Bitcoin price prediction is neutral as BTC is trading at $42,870 with a modest increase of less than 0.25% as of Wednesday. This uptick comes amidst a flurry of significant developments. Core Scientific, a prominent Bitcoin mining entity, has announced plans to file for bankruptcy and relist its shares, a move that has sent ripples across the crypto industry.

In the political arena, El Salvador’s President Nayib Bukele, known for his bullish stance on Bitcoin, seems on track for a controversial reelection, further intertwining the nation’s political narrative with the fate of cryptocurrencies.

Adding to the mix, the Grayscale Bitcoin Trust ETF has made a substantial move by transferring an additional $376 million in Bitcoin, a decision that could have far-reaching implications on the market’s liquidity and investor sentiment. These events collectively paint a complex picture for Bitcoin’s price trajectory in the near term.

Core Scientific’s Share Relisting Imminent

Approved for its Chapter 11 restructuring, Core Scientific—once one of the biggest casualties of the crypto winter—plans to relist its shares on Nasdaq by the end of January. The plan involves paying off all outstanding debt and granting current stockholders approximately 60% of the shares in the newly restructured company. Before the 2022 bear market, Core Scientific was the largest publicly traded Bitcoin miner. The company filed for Chapter 11 when prices plummeted to $16,000 in December 2022.

With Bitcoin currently trading at around $43,000, Core Scientific’s resurgence is reflective of growing industry interest, especially following the SEC’s approval of spot Bitcoin ETFs. The rising price of Bitcoin and these developments contribute to a renewed sense of optimism in the cryptocurrency industry.

President Bukele’s Controversial Path to Reelection in El Salvador

According to a poll by Francisco Gavidia University, President Nayib Bukele of El Salvador holds a commanding lead—71%—in the 2024 presidential reelection race. With opponents from traditional political parties polling at or around 3%, Bukele’s lead is substantial, bolstered by his reputation for implementing strict security measures.

The 42-year-old Bitcoin advocate took a temporary leave of absence to run for a second term, a move made possible by Supreme Court judges who upheld his human right to seek office, despite constitutional limitations on consecutive terms.

The poll also indicates that Bukele’s New Ideas Party is poised to strengthen its position, potentially winning 57 of the 60 seats in the legislature. While his anti-gang policies have significantly reduced crime, they have also raised concerns about authoritarianism.

Despite these controversies, Bukele’s endorsement of Bitcoin has been instrumental in portraying El Salvador as a forward-thinking nation in the cryptocurrency sphere, especially as Bitcoin prices continue to rise.

Grayscale Bitcoin Trust ETF Moves $376 Million in Bitcoin Amidst Market Settling

On January 16, the Grayscale Bitcoin Trust (GBTC) transferred 8,730 Bitcoin (BTC), valued at approximately $376 million, to Coinbase Prime deposit addresses. This move indicates potential selling pressure following a drop in the fund’s share price. Analysts suggest that recent declines in Bitcoin’s price may be linked to GBTC’s outflows. GBTC, one of the world’s largest Bitcoin holders, has restructured to become an exchange-traded fund (ETF).

This change allows authorized users to redeem their shares for the cash equivalent of Bitcoin. In recent days, the trust has experienced significant withdrawals, with critics highlighting its management fee (1.5%) as higher than those of its competitors. Nonetheless, Bitcoin’s price remained stable during midday U.S. trading hours, despite the selling activity associated with GBTC.

EL SALVADOR'S BUKELE LOOKS SET TO CRUISE TO CONTROVERSIAL PRESIDENTIAL REELECTION -POLL (Reuters)

EL SALVADOR'S BUKELE LOOKS SET TO CRUISE TO CONTROVERSIAL PRESIDENTIAL REELECTION -POLL (Reuters)

On January 16, the Grayscale Bitcoin Trust (GBTC) moved 8,730 Bitcoin (worth…

On January 16, the Grayscale Bitcoin Trust (GBTC) moved 8,730 Bitcoin (worth…