Bitcoin Price Prediction: Dips, CBDC Threats, $1.5B Investment & Kiyosaki’s Advice

Publikováno: 28.11.2023

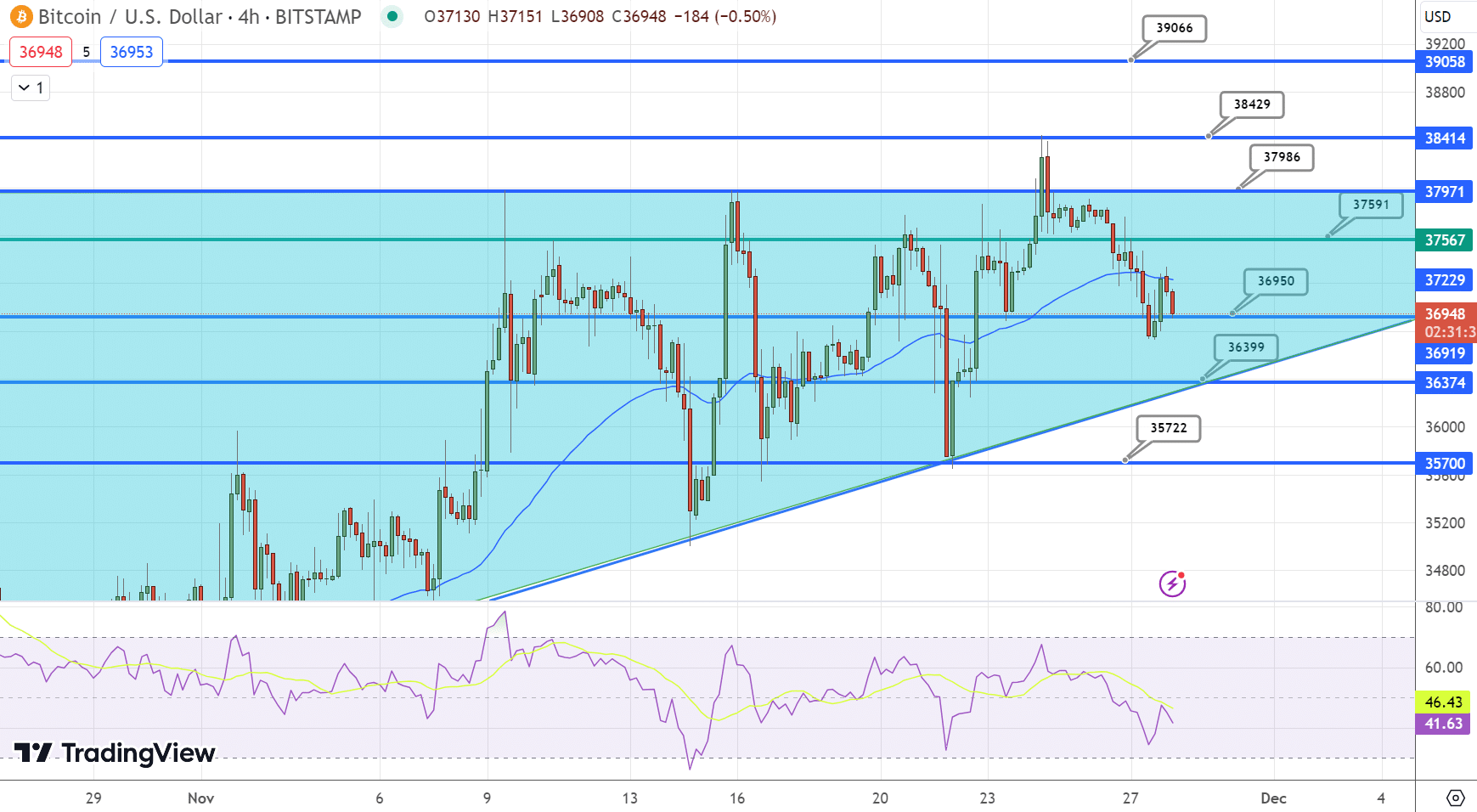

In the ever-shifting landscape of cryptocurrencies, Bitcoin, the pioneering digital asset, is currently trading at $37,182, experiencing a slight downturn of around 1% on Tuesday. Amidst this fluctuation, Bitcoin continues to offer unparalleled transactional independence, a quality not without its challenges as Kennedy voices concerns over the potential threats posed by Central Bank Digital Currencies […]

The post Bitcoin Price Prediction: Dips, CBDC Threats, $1.5B Investment & Kiyosaki’s Advice appeared first on Cryptonews.

In the ever-shifting landscape of cryptocurrencies, Bitcoin, the pioneering digital asset, is currently trading at $37,182, experiencing a slight downturn of around 1% on Tuesday. Amidst this fluctuation, Bitcoin continues to offer unparalleled transactional independence, a quality not without its challenges as Kennedy voices concerns over the potential threats posed by Central Bank Digital Currencies (CBDCs).

Despite these complexities, the confidence in Bitcoin remains robust, with a staggering $1.5 billion already invested in Bitcoin-related investment products this year alone.

Echoing this sentiment, renowned financial expert Robert Kiyosaki emphasizes the timeliness of investing in Bitcoin, alongside traditional safe havens like gold and silver, advising to make these moves “before it’s too late,” underscoring a sense of urgency in the evolving financial landscape.

Bitcoin’s Independence vs. CBDC Threats: Kennedy’s Concerns

Robert F. Kennedy Jr. expressed concerns about central bank digital currencies (CBDCs) on a recent episode of the What Bitcoin Did podcast. Kennedy highlighted the potential impact of CBDCs on individual financial autonomy and privacy.

Known for his advocacy for individual rights, he contrasted Bitcoin’s decentralized nature with the programmable aspects of CBDCs. Kennedy praised Bitcoin as an “elegant solution” for safeguarding transactional privacy, while warning that CBDCs could give governments unprecedented oversight capabilities.

Read "An Interview With Robert F. Kennedy Jr." on #Bitcoin, inflation, CBDCs, and the imperative of individual freedom for a healthy society.

"The Primary Issue" by @BitcoinMagazine Cover Story: https://t.co/4Q5ZbjUZOp

— The Bitcoin Magazine (@thebtcmag) November 27, 2023

This includes real-time taxation and the potential integration with social credit systems, which could restrict financial access based on behavior. His comments reflect ongoing debates about government-backed digital currencies and privacy issues, where Bitcoin’s decentralized framework stands as a safeguard against privacy infringement.

Kennedy’s critique of CBDCs, underscoring Bitcoin’s merits, might positively influence Bitcoin’s market value by bolstering the enthusiasm of cryptocurrency advocates.

Thanks @BitcoinMagazine for a great interview on CBDCs. My primary concern is that the Fed's proposed digital cash could be used as an instrument of control — similar to China’s oppressive social credit system — rather than as a tool of empowerment. #Kennedy24pic.twitter.com/oPMRphd3Ui

— Robert F. Kennedy Jr (@RobertKennedyJr) November 21, 2023

As awareness of Bitcoin’s role in preserving financial independence grows, interest and investment in it could see an uptick. However, currently, the price trend seems to be heading in the opposite direction.

2023 Sees $1.5 Billion Flow into Bitcoin Investments

The exchange-traded products (ETPs) sector has experienced a significant influx of investments, with $312 million flowing in during the week ending November 24, as reported by CoinShares.

This year, ETP inflows have reached approximately $1.5 billion, marking a continuous nine-week stretch of positive net flows in the broader cryptocurrency market, with an average of $346 million per week.

The week ending November 24 recorded the highest inflows throughout this period. A substantial 87% of these weekly inflows were from Canadian and German ETPs, contrasting with the modest $30 million from the US.

New record of inflows with US$346m this week, the highest total observed in the past 9 weeks of inflows.

– #Bitcoin –

$BTC: US$312m inflows (year-to-date inflows US$1.5bn)

Short Bitcoin: US$0.9m outflows

ETP volumes as a percentage of total spot Bitcoin volumes… pic.twitter.com/gMUPzTy0q4

— CoinShares (@CoinSharesCo) November 27, 2023

The total assets managed by cryptocurrency funds have soared to their highest in 18 months, currently standing at $45.4 billion. This surge in investment interest could be partly attributed to the buzz generated by recent discussions involving BlackRock, Grayscale, and the U.S. Securities and Exchange Commission on November 22, centering around the potential approval of a U.S. spot Bitcoin ETF.

Despite this institutional interest fostering a positive market sentiment, it has yet to translate into a sustained upward price trend for Bitcoin.

Robert Kiyosaki Urges Timely Investment in Bitcoin, Gold, and Silver

Robert Kiyosaki, the esteemed author of “Rich Dad Poor Dad,” is actively advising his substantial following of 2.4 million people to invest in Bitcoin (BTC), gold, and silver, particularly in the face of intensifying global inflation.

Known for his critical views on traditional financial systems, Kiyosaki is vocal in his skepticism of fiat currencies, advocating for a shift towards alternative assets.

His financial insights, previously foreseeing a surge in gold prices to $2,100 – a prediction that has since materialized – and projecting a further increase to $3,700, are rooted in concerns over what he terms a “woke government” and the ongoing inflationary trend.

Great News Gold reaches new high. Bad News: Workers and savers are losers. Bad News: been saying the same for 25- years. Don’t be a loser. Get out of FAKE money system. Get into gold, silver, Bitcoin now…. Before it’s too late.

— Robert Kiyosaki (@theRealKiyosaki) November 26, 2023

Kiyosaki’s strong support for Bitcoin, along with gold and silver, aligns with his broader strategy of moving away from fiat-based assets.

This stance, coupled with his track record of accurate predictions, might significantly sway market sentiment and foster increased interest in BTC, especially during these economically volatile times.

I am shocked at the rising prices of INFLATION. Thank God I have plenty of money. Yet I feel for those who struggle paycheck to payeck. I feel for people who cannot afford food, rent, & fuel and cannot afford to invest in Gold, Silver, and Bitcoin as I suggest. Our “Woke”…

— Robert Kiyosaki (@theRealKiyosaki) November 23, 2023

Despite this, the prevailing bearish sentiment in the cryptocurrency market continues to exert pressure on Bitcoin, the largest cryptocurrency by market capitalization.

Bitcoin Price Prediction

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction: Dips, CBDC Threats, $1.5B Investment & Kiyosaki’s Advice appeared first on Cryptonews.