Bitcoin Price Prediction: Market Trends, CEO Insights & New Ventures in BTC

Publikováno: 17.11.2023

In the dynamic world of cryptocurrency, Bitcoin’s latest market movements have caught significant attention as it trades at $36,530, marking a around 2.50% decline on Friday. Amidst these fluctuations, Brazil’s evolving cryptocurrency regulatory landscape is spurring a competitive environment, as noted by the CEO of Coinext. Furthermore, the innovative strides of Jane Street-backed ZetaChain are […]

The post Bitcoin Price Prediction: Market Trends, CEO Insights & New Ventures in BTC appeared first on Cryptonews.

In the dynamic world of cryptocurrency, Bitcoin’s latest market movements have caught significant attention as it trades at $36,530, marking a around 2.50% decline on Friday. Amidst these fluctuations, Brazil’s evolving cryptocurrency regulatory landscape is spurring a competitive environment, as noted by the CEO of Coinext.

Furthermore, the innovative strides of Jane Street-backed ZetaChain are poised to expand Bitcoin’s applications, signaling a potential shift in its utilization. In another notable development, Tether is reportedly planning a substantial investment of $500 million in Bitcoin mining, highlighting the growing interest and diverse investments in the cryptocurrency sector.

This update delves into these crucial trends, CEO insights, and new ventures shaping the Bitcoin ecosystem.

Brazil’s Evolving Crypto Regulations: Coinext CEO’s Perspective

In the vibrant setting of the Web Summit, José Ribeiro, the visionary CEO of Coinext, delved into the dynamic cryptocurrency ecosystem of Brazil. He brought to light the burgeoning appeal of Bitcoin in emerging markets, with a special focus on Brazil.

The advent of global exchange giants like Binance, OKX, and Coinbase into the Brazilian arena is redefining the competition in the payment sector. Ribeiro forecasts an unprecedented surge in Bitcoin transactions by 2023, signaling a new chapter in Brazil’s financial narrative.

Rising From Inflation: Brazil’s Leap Towards Crypto Adoption

With Brazil’s turbulent history of inflation, Ribeiro emphasizes that the escalating competitive landscape is not just a trend but a necessity for the widespread adoption of cryptocurrencies. He envisions a new boom cycle in the wake of anticipated rate cuts next year.

Brazil’s crypto regulatory environment is driving competitiveness — Coinext CEO

Bitcoin maximalist José Ribeiro, CEO of crypto exchange Coinext, spoke with Cointelegraph at the Web Summit about Brazil’s cryptocurrency landscape.

Cryptocurrency may be “out of fashion,” but it… pic.twitter.com/XeXcgqXd2K— Brian Arnold (@havizkolesi) November 17, 2023

Currently pegged at 12.25%, Brazil’s benchmark interest rate is on track to fall to 9.25% by December 2024, a shift that could redefine Brazil’s economic contours.

Beyond the Price: A Call for Crypto Fundamentals

Ribeiro steers the conversation to the global stage, pointing out key influences like the potential launch of a Bitcoin ETF in the U.S. and the impending Bitcoin halving. However, his advice to investors is clear and resonant: Look beyond the ephemeral world of price fluctuations and anchor your strategies in the solid bedrock of cryptocurrency fundamentals.

He underscores the critical role of regulatory frameworks, praising Brazil’s advanced tax compliance measures, including rigorous monthly reporting protocols to local tax authorities.

Brazil’s Crypto Market Ushering Global Optimism

Brazil stands at the forefront of a transformative era, with its progressive regulatory stance, burgeoning usage, and escalating market competition. These factors, Ribeiro believes, are the catalysts that could revive positive sentiments in the global cryptocurrency market, potentially ushering Bitcoin into a new phase of resurgence.

Expanding Bitcoin’s Reach: The Role of Jane Street and ZetaChain

ZetaChain, a California-based firm, wants to expand Bitcoin’s utility by incorporating it into the decentralized finance (DeFi) ecosystem. Bitcoin’s application scope has been limited in comparison to blockchains such as Ethereum, with slightly under 1,000 monthly developers.

This integration is being facilitated by ZetaChain, a Layer 1 blockchain, which allows developers to create smart contracts on its platform that interact with native Bitcoin, basically adding a smart contract layer to Bitcoin.

Jane Street-backed ZetaChain wants to bring more use cases to Bitcoin https://t.co/UJNlpKfK5p by @ritacyliao

— TechCrunch (@TechCrunch) November 16, 2023

ZetaChain recently collaborated with decentralized exchange Sushi to bring native Bitcoin functionality, allowing users to exchange Bitcoin across 30 networks without leaving the Bitcoin network.

This move improves liquidity and represents an important step toward greater interoperability in the DeFi market. The integration may have a favorable impact on Bitcoin’s market dynamics, encouraging wider acceptance and utilization in the growing decentralized financial landscape.

Tether’s Strategic Move: A $500 Million Investment in Bitcoin Mining

Tether, led by incoming CEO Paolo Ardoino, is planning a significant foray into Bitcoin mining, with the goal of capturing 1% of BTC mining processing power. Tether is to invest $500 million in mining facilities in South American countries including as Uruguay, Paraguay, and El Salvador during the next six months.

We're quite close to add another extremely powerful piece of the puzzle for @Tether_to ecosystem.

Total of 5 mind-blowing projects (and counting) for 2024.

Couple of these could obliterate some popular Web2 centralized services for good.Pure Real World Ecosystem aka "Things…

— Paolo Ardoino

(@paoloardoino) November 12, 2023

The move is part of an expansion strategy backed in part by a $610 million loan financing facility offered to Northern Data Group, a German miner. Ardoino expects direct mining activities to reach 120 MW by the end of the year, with a goal of 450 MW by the end of 2025.

While the impact of Tether’s significant entry into Bitcoin mining on BTC pricing is unknown, such a move may potentially influence market dynamics, with greater mining activity potentially impacting Bitcoin’s supply and demand dynamics.

Bitcoin Price Prediction

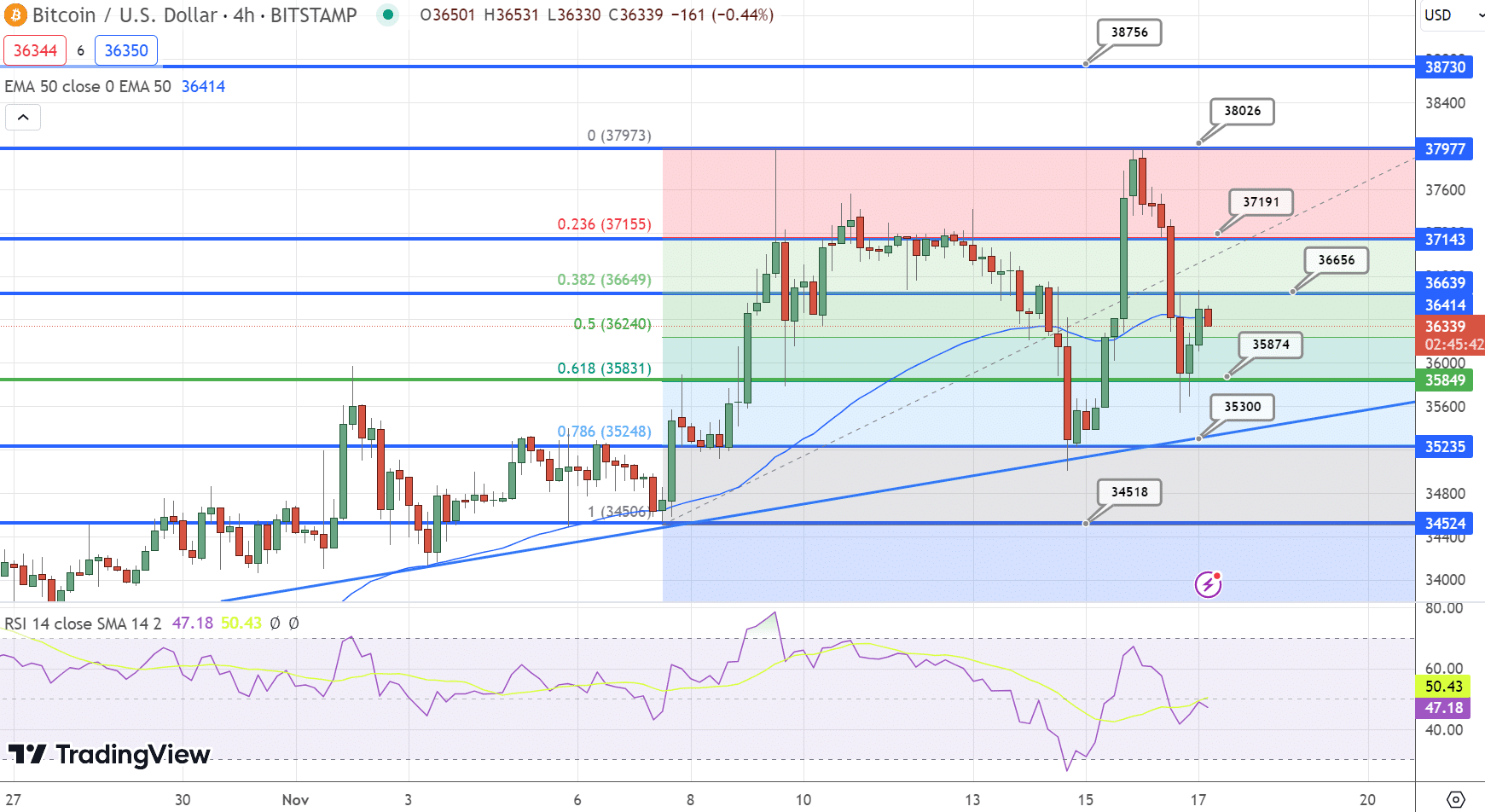

As of November 17, the leading digital currency, Bitcoin, hovers around $36,450, reflecting a slight retreat of 2.50% within the last 24 hours, a common sight in its volatile trading landscape.

Despite this dip, Bitcoin’s dominance is unshaken, with a live market capitalization towering at over $712 billion, asserting its prominence over the market’s fluctuating tides.

The 4-hour chart reveals Bitcoin grappling with pivotal price levels, seeking direction. The immediate resistance stands at $36,571, a breach of which could propel the digital asset towards more robust barriers at $38,611 and subsequently at $40,084.

Conversely, should the bears tighten their grip, Bitcoin may retreat towards immediate support at $33,096, with further fallback positions waiting at $31,622 and $30,149.

Bitcoin’s technical indicators offer a mixed narrative; the Relative Strength Index (RSI) lingers just below the neutral 50 mark, signaling neither an overbought nor an oversold condition—a reflection of the market’s indecision.

Price action analysis shows Bitcoin consolidating in a narrow range between $35,875 and $36,650, with traders keenly watching for a breakout to gauge the next significant move.

In conclusion, while Bitcoin’s recent performance indicates a holding pattern, the digital asset’s resilience above the $35,875 level suggests an underlying bullish sentiment.

Should it maintain this crucial support, the forecast appears optimistic, with an anticipation that Bitcoin may soon retest resistance levels in the days ahead.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

The post Bitcoin Price Prediction: Market Trends, CEO Insights & New Ventures in BTC appeared first on Cryptonews.