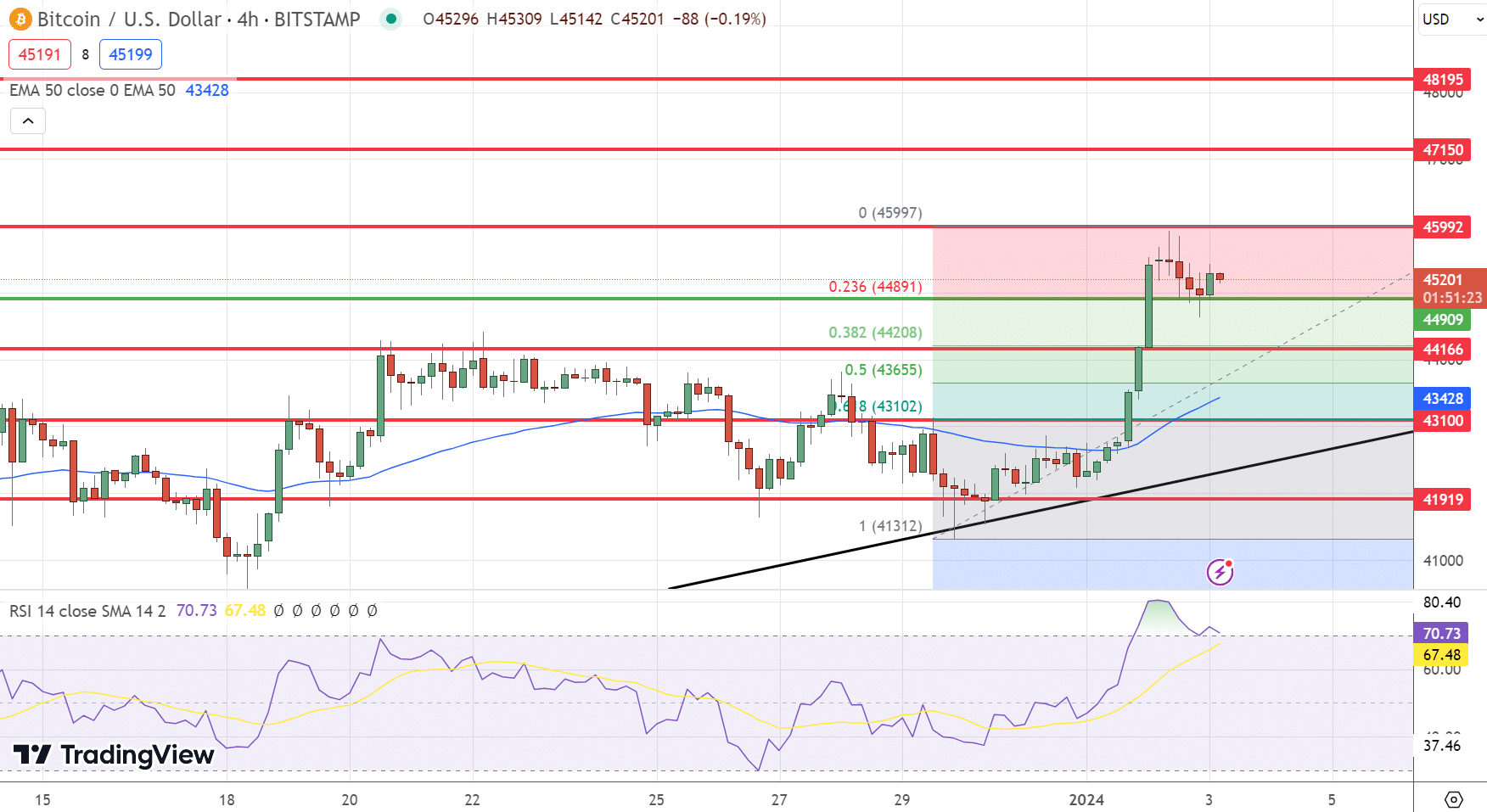

In the dynamic world of cryptocurrencies, Bitcoin currently trades at $45,224, marking a slight decrease of less than 0.50% on Wednesday. In a significant move, Michael Saylor has initiated the sale of $216 million in MicroStrategy stocks, opting to invest further in Bitcoin.

Meanwhile, CleanSpark, a prominent Bitcoin mining company, is advancing its operations by establishing an in-house trading desk.

Adding to the market’s anticipation, the U.S. Securities and Exchange Commission (SEC) continues its careful examination of the paperwork for a spot Bitcoin Exchange-Traded Fund (ETF), a decision eagerly awaited by crypto enthusiasts and investors.

Let’s look further into this.

Michael Saylor Sells $216M MicroStrategy Stocks for Bitcoin

According to a filing with the US Securities and Exchange Commission, MicroStrategy’s Executive Chairman, Michael Saylor, has begun selling $216 million in MicroStrategy shares over a four-month period, starting with the first tranche of 5,000 shares on January 2.

Saylor previously announced plans to sell up to 5,000 MSTR shares daily over four months to meet personal obligations and increase his Bitcoin holdings.

Following MicroStrategy’s substantial Bitcoin acquisitions, including purchasing an additional 14,620 Bitcoin for $615 million on December 27, the company’s total holdings reached approximately 189,150 Bitcoin, valued at nearly $8.5 billion.

Despite his personal sales, Saylor continues to emphasize the importance of maintaining a significant stake in the company. While the direct impact on BTC prices remains speculative, further Bitcoin investments by high-profile individuals might enhance market sentiment.

CleanSpark Launches In-House Bitcoin Trading Desk

CleanSpark Inc., a U.S.-based Bitcoin mining company, has announced plans to establish an in-house trading desk in 2024 to enhance earnings from its substantial Bitcoin assets.

The company’s CEO, Zachary Bradford, highlighted the strategic benefits of internal trading, leveraging its significant Bitcoin holdings, which included 2,575 BTC valued at around $116 million as of December.

CleanSpark intends to focus on regulated cryptocurrency products, particularly option contracts on the Chicago Mercantile Exchange.

Bradford anticipates other Bitcoin miners might follow suit, setting up their own trading desks to manage risks and capitalize on market opportunities, potentially increasing market stability.

SEC Continues Review of Bitcoin ETF Paperwork

The United States Securities and Exchange Commission (SEC) continues to review applications for spot Bitcoin ETFs as Bitcoin’s price exceeds $45,000.

Bloomberg analyst James Seyffart shared insights on 11 pending Bitcoin ETF applications, with decisions expected between January 8 and 10.

Despite reports from Reuters and CNBC anticipating an announcement this week, Fox Business suggests a possible delay due to extensive paperwork.

Ark Invest and 21Shares face a decision deadline of January 10. The ongoing speculation about ETF approvals is stirring market excitement, potentially leading to heightened volatility in Bitcoin prices as investors await regulatory outcomes.