Bitcoin Price Prediction: Surge to $52,250 Amid Coinbase Shift & VC Funding Boost; BTC to Target $55,000?

Publikováno: 19.2.2024

In the During the Asian session, Bitcoin is trading near $52,250, marking a modest increase of approximately 0.50% on Monday, the cryptocurrency landscape is undergoing significant shifts. Notably, Coinbase’s recent decision to halt native Bitcoin payments for merchants, opting instead for a Coinbase account requirement, has sparked a vibrant dialogue regarding Bitcoin’s scalability and practicality […]

The post Bitcoin Price Prediction: Surge to $52,250 Amid Coinbase Shift & VC Funding Boost; BTC to Target $55,000? appeared first on Cryptonews.

In the During the Asian session, Bitcoin is trading near $52,250, marking a modest increase of approximately 0.50% on Monday, the cryptocurrency landscape is undergoing significant shifts. Notably, Coinbase’s recent decision to halt native Bitcoin payments for merchants, opting instead for a Coinbase account requirement, has sparked a vibrant dialogue regarding Bitcoin’s scalability and practicality for everyday transactions.

In the During the Asian session, Bitcoin is trading near $52,250, marking a modest increase of approximately 0.50% on Monday, the cryptocurrency landscape is undergoing significant shifts. Notably, Coinbase’s recent decision to halt native Bitcoin payments for merchants, opting instead for a Coinbase account requirement, has sparked a vibrant dialogue regarding Bitcoin’s scalability and practicality for everyday transactions.

Amid these discussions, venture capital funding in the blockchain and cryptocurrency sectors witnessed a surge in Q4 2023, highlighting a growing confidence in the digital currency’s future. This backdrop sets the stage for a nuanced Bitcoin price prediction, as investors and enthusiasts alike scrutinize market dynamics, regulatory developments, and technological advancements to gauge Bitcoin’s trajectory in a rapidly evolving financial ecosystem.

Coinbase Shifts Bitcoin Payment Strategy, Sparks Debate on Crypto Accessibility

Coinbase has recently updated its payment system, impacting how merchants accept Bitcoin. The platform, Coinbase Commerce, has stopped supporting direct Bitcoin and UTXO coin payments. This move, aimed at overcoming challenges in updating its Ethereum Virtual Machine (EVM) payment system, means customers must now use a Coinbase account to transact with Bitcoin. CEO Brian Armstrong hinted at future payments possibly leveraging the Lightning Network, a solution designed to enhance Bitcoin’s transaction speed and cost.

This decision has stirred concerns among the crypto community:

- Customer Accessibility: There’s worry that requiring a Coinbase account may restrict ease of access for users wanting to make Bitcoin transactions.

- Bitcoin’s Growth: Critics argue that this could hinder Bitcoin’s expansion by limiting its use in everyday transactions.

Moreover, this change highlights the broader issue of Bitcoin’s scalability and its role in regular commerce. The adoption of technologies like the Lightning Network becomes crucial in addressing these challenges, suggesting a pivotal moment for Bitcoin’s journey towards becoming a mainstream payment method.

Venture Capital Flows into Crypto and Blockchain Surge in Q4 2023 Amid ETF Launches

The last quarter of 2023 witnessed a notable increase in venture capital investments within the blockchain and cryptocurrency sectors, reaching $1.9 billion, a 2.5% rise from the preceding quarter. This uptick is largely attributed to the introduction of spot Bitcoin Exchange-Traded Funds (ETFs), sparking heightened interest among investors. The funds were primarily directed towards innovative financial and technological solutions, including decentralized infrastructure and the tokenization of real-world assets.

Key investment rounds in the sector:

- Blockchain.com secured $165 million.

- Swan Bitcoin raised $100 million.

- Wormhole received $225 million, boosting its valuation to $2.5 billion.

The advent of spot Bitcoin ETFs in the United States has notably increased financial institutions’ engagement with cryptocurrencies. By the first quarter of 2024, the momentum continued as crypto firms amassed $2.6 billion across 353 funding rounds, despite a downturn in overall deal value and volume. This shift reflects the growing interest from established financial entities like BlackRock in the cryptocurrency space.

The surge in venture funding not only underscores the growing confidence in the crypto industry but also signals a broader acceptance of digital currencies like Bitcoin. The involvement of major financial institutions could significantly bolster Bitcoin’s legitimacy and adoption, potentially influencing its market price and public perception positively.

Bitcoin Price Prediction

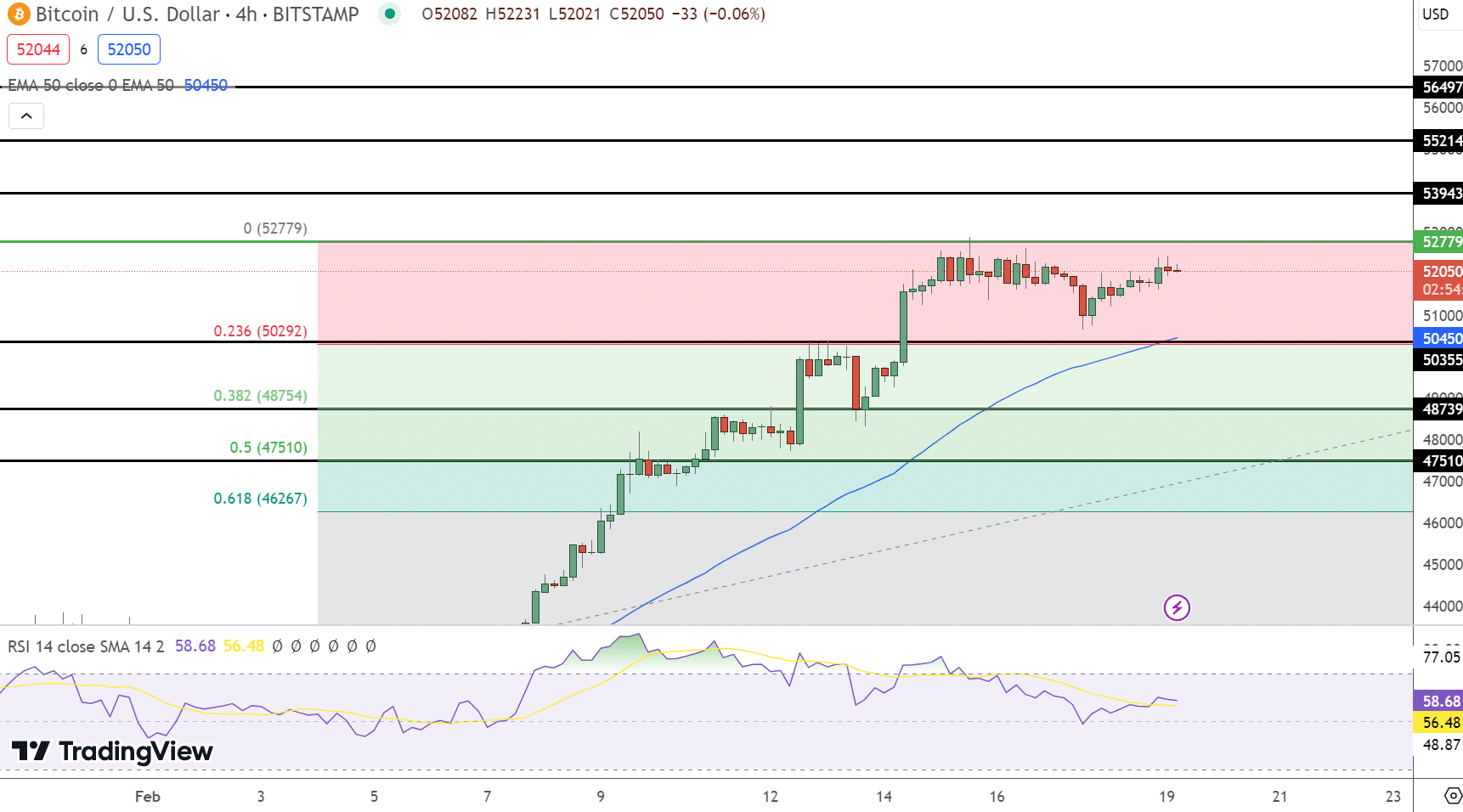

In the current session, Bitcoin (BTC/USD) demonstrates resilience, navigating the 4-hour chart with a pivot point at $52,779. The cryptocurrency confronts immediate resistance at $53,943, with further barriers at $55,214 and $56,497. On the downside, support emerges at $50,355, extending to $48,739 and $47,510.

#BitcoinPricePrediction: BTC's pivot at $52,100 signals a bullish vs bearish momentum threshold.

Key resistances set at $53,600, $55,165, $56,870, a break above could signal further climbs.

Support at $50,285 underpins the bullish outlook. Stay tuned for potential highs!pic.twitter.com/8IS89ViW00

— Arslan Ali (@forex_arslan) February 14, 2024

The Relative Strength Index (RSI) stands at 58, indicating a tilt towards bullish momentum yet cautioning of potential overextension. The 50-Day Exponential Moving Average (EMA) is positioned at $50,450, reinforcing the significance of current price levels in determining the market’s direction.

Conclusively, Bitcoin’s market stance is bullish above $52,780. However, a descent below this pivot could signal a shift to bearish territory. Investors are advised to monitor these critical levels and indicators to navigate the BTC/USD’s next movements effectively.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

The post Bitcoin Price Prediction: Surge to $52,250 Amid Coinbase Shift & VC Funding Boost; BTC to Target $55,000? appeared first on Cryptonews.