Bitcoin Price Pumps Above $43,000 as BTC Bulls Regain Control – Here’s What to Watch This Week

Publikováno: 29.1.2024

The Bitcoin price pumped back to the north of the $43,000 level for the first time in two weeks on Monday as the BTC bulls regained control, with sentiment strengthening due to easing concerns about Grayscale sell pressure, and as new bullish bets come in. Grayscale’s GBTC has been hit by heavy sell pressure since […]

The post Bitcoin Price Pumps Above $43,000 as BTC Bulls Regain Control – Here’s What to Watch This Week appeared first on Cryptonews.

The Bitcoin price pumped back to the north of the $43,000 level for the first time in two weeks on Monday as the BTC bulls regained control, with sentiment strengthening due to easing concerns about Grayscale sell pressure, and as new bullish bets come in.

Grayscale’s GBTC has been hit by heavy sell pressure since converting to an ETF earlier this month.

This weighed heavily on the Bitcoin price, helping to pressure BTC back to the $38,000s last week from earlier monthly highs above $49,000.

But Grayscale transferred just 6,500 BTC tokens to exchanges to sell on Monday.

That’s way down from the near 20K BTC token per day it was dumping in recent weeks.

Indeed, JP Morgan argued last week that post-ETF approval profit-taking from GBTC has likely nearly run its course.

Meanwhile, 10X Research analyst Marcus Thielen argued in a client note on Monday that new longs could enter above $43,000.

Thielen cited Elliot Wave analysis, and that “wave 5” to new yearly highs above $50,000 has begun.

He added that fundamental catalysts such as subsiding GBTC sales, US stocks pushing to new record highs and Google allowing Bitcoin & Crypto ETF ads to commence from Monday could act as Bitcoin price tailwinds.

Bitcoin Price Catalysts to Watch This Week

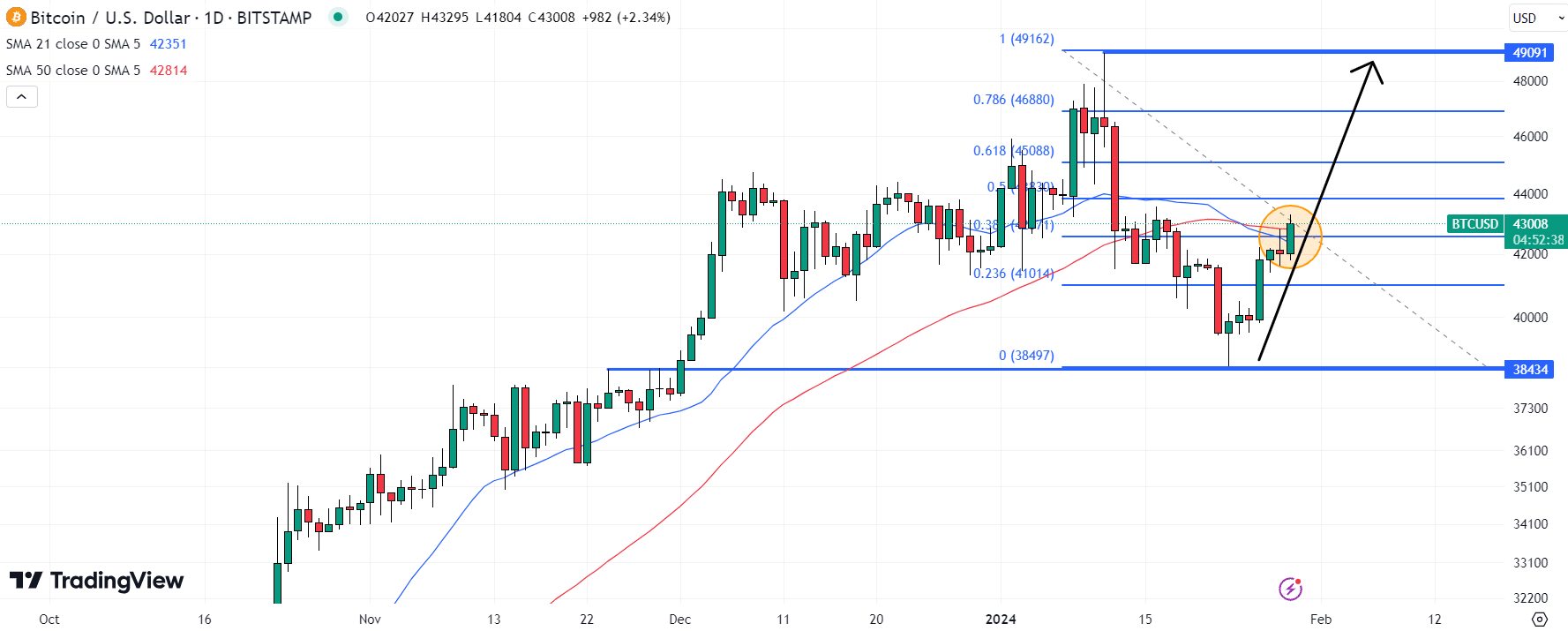

The Bitcoin price is at an important crossroads given it is probing its 21 and 50DMAs.

A sustained break above here and the 50% Fibonacci retracement of the Bitcoin price’s recent pullback could confirm bullish momentum.

BTC absorbing selling like a chad

One of my favorite indicators of strength— DonAlt (@CryptoDonAlt) January 29, 2024

But Wednesday’s Fed meeting could spoil the party for BTC.

The Fed is likely to push back against market bets that interest rate cuts could begin as soon as March.

That’s because recent US economic data has largely been stronger than expected, raising risks that US inflation remains sticky above the Fed’s 2% inflation target.

A further unwinding of these rate-cut bets could push up the US dollar and US yields, weighing on crypto.

While Fed rate cuts may not come by March, they are still widely at some point expected this year.

That’s especially true if US regional banks find themselves in trouble again when a key liquidity program announced by the Fed to stave off a bank crisis in March 2023 expires in March.

Indeed, this is a wild card for the Bitcoin market that has been going largely under the radar.

Another US bank crisis, especially if it accelerates Fed policy easing, could be a major tailwind for the Bitcoin price in 2024.

Elsewhere, BTC traders will be keeping one eye on spot Bitcoin ETF flows.

CoinShares said that, at over $2.2 billion, GBTC outflows outweighed inflows into the other recently launched ETFs last week.

Traders will be monitoring the extent to which GBTC outflows have slowed this week, as well as the pace of inflows into other ETFs.

The post Bitcoin Price Pumps Above $43,000 as BTC Bulls Regain Control – Here’s What to Watch This Week appeared first on Cryptonews.