BlackRock Ethereum ETF Plans Spur On Bitcoin ETF Token Investors to Take Last Chance to Buy at Low $0.005 Price

Publikováno: 10.11.2023

Bitcoin ETF Token Website Friday, November 10, 2023 – The emergence of BlackRock’s Ethereum ETF plans has sent the ETH price surging through the $2,000 mark and has injected even more FOMO into the race to invest in the Bitcoin ETF Token ($BTCETF). Meanwhile, Bitcoin is trading at $37,400 with bulls targeting $40,000 well before […]

The post BlackRock Ethereum ETF Plans Spur On Bitcoin ETF Token Investors to Take Last Chance to Buy at Low $0.005 Price appeared first on Cryptonews.

Friday, November 10, 2023 – The emergence of BlackRock’s Ethereum ETF plans has sent the ETH price surging through the $2,000 mark and has injected even more FOMO into the race to invest in the Bitcoin ETF Token ($BTCETF).

Meanwhile, Bitcoin is trading at $37,400 with bulls targeting $40,000 well before the month is out, while the Bitcoin ETF Token has already attracted $271,000 from eager investors.

BlackRock is the largest asset manager in the financial industry and where it goes others follow. The financial giant has already laid down the gauntlet with its application for a spot Bitcoin ETF. Now it has emerged, following its registration of a corporation in Delaware called the iShares Ethereum Trust, that it wants to bring a spot Ethereum ETF to market too.

Late yesterday Nasdaq filed a listing for the iShares Ethereum Trust, confirming the BlackRock news. iShares is the brand of the BlackRock ETF business.

To get an idea about why everyone in crypto is so excited about the possibility of a spot ETF, be it Bitcoin or Ethereum, the US ETF market is valued at around $7 trillion. By comparison, the total US equity market is sized at $44 trillion.

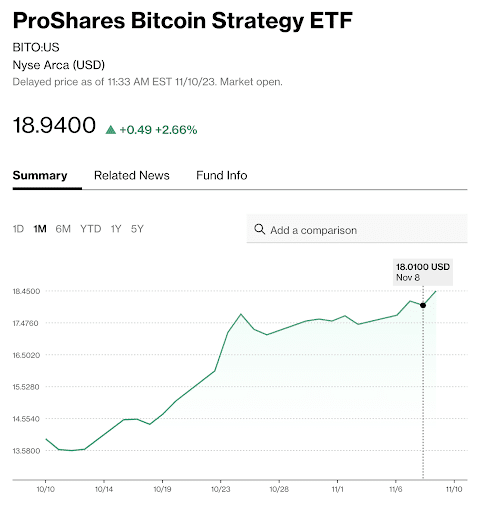

Exchange-traded funds already exist for crypto assets but in the US they are confined to the regulated futures market, where funds such as the ProShares Bitcoin Strategy ETF (BITO) dominate.

A spot product would provide retail and institutional investors with direct exposure to Bitcoin in a way that futures do not. ETFs will provide all types of investors with cheap and easy exposure to Bitcoin (and Ethereum) using a regulated vehicle. Analysts expect the approval of ETFs to open the floodgates of new money coming into the asset class.

Bitcoin ETF Token buyers are getting FOMO

Bitcoin ETF Token’s raise rate for the ICO is speeding up against the backdrop of growing excitement and anticipation for the launch of the first fund on January 10th, or possibly even sooner after an eight-day window for application approval was opened earlier this week.

The US Securities and Exchange Commission could choose to approve all 12 spot Bitcoin ETFs that have submitted applications, although that is probably unlikely.

Nevertheless, analysts at Bloomberg Intelligence believe there is a 90% probability of a spot Bitcoin ETF being approved by the January 10 deadline for the ARK 21 Shares Bitcoin ETF. No wonder the Bitcoin ETF FOMO is reaching a frenzied pitch.

Spot Bitcoin ETF approval will be a thunderbolt signaling new highs ahead for crypto assets – which is why investors want to buy the Bitcoin ETF Token

The entrance of a spot crypto collective investment vehicle will unleash a torrent of billions of dollars flooding into the market. The US ETF market is currently valued in the region of $7 trillion when equities and fixed income are combined.

The first asset class to get the ETF treatment was commodities such as gold. Before ETFs came along, gold was a difficult asset for retail investors to get exposure to. There were liquidity and custody issues to navigate, which meant the bullion market remained the preserve of institutions and government.

The first gold ETF was launched in 2003 and the exchange-traded fund industry has not looked back ever since.

A Bitcoin ETF and an Ethereum ETF could have an equally consequential effect on financial markets, and that’s why investors are flocking to buy the Bitcoin ETF Token. If the launch of a gold ETF was anything to go by, a spot Bitcoin ETF will be transformational.

Spot crypto ETFs will at a stroke provide retail and institutional market participants with a regulated way to gain exposure to the asset class without having to directly hold Bitcoin or Ethereum.

The SEC's closing approval window prompts a 90% chance by Jan 10, 2024, per #Bloomberg.

As #BTC nears $36K, the #CryptoCommunity anticipates a potential game-changer.

In addition to that #BitcoinETF has also hit another milestone, raising over $200K!

pic.twitter.com/KWoDWm5pF1

— BTCETF_Token (@BTCETF_Token) November 10, 2023

With only a limited number of Bitcoin in circulation and demand set to rocket, the sky’s the limit on how high the price of crypto assets could go.

Add into the ETF theme the Bitcoin halving of block rewards that takes place in April 2024, and we could be on the threshold of the biggest Bitcoin bull run ever.

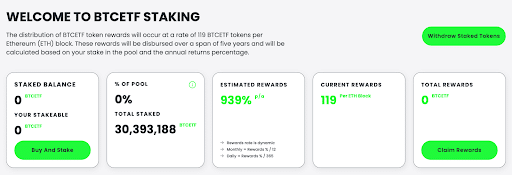

Along with the ETF tailwind, Bitcoin ETF Token facilitates staking, making it an attractive proposition in the hunt for yield. Although it is true that yields are on the rise in the fixed-income world of bonds, they do not match the heady brew on offer from Bitcoin ETF Token, where APY is still in the hundreds of percent.

What is more, the risks associated with yield farming are not present in the Bitcoin ETF Token ecosystem, as the source of the yield is the tokens allocated from supply specifically for distributing rewards.

$BTCETF has a deflationary burn mechanism yield to real-world Bitcoin ETF approval, launch and performance milestones

Bitcoin ETF Token is deflationary – it has a burn mechanism that is price-supportive because it reduces the total token supply.

At launch, the Bitcoin ETF Token will have a 5% burn on all transactions, while up to 25% of the total token supply is eligible to be burned.

All the burn mechanism events are triggered by real-world events related to spot Bitcoin ETF milestones, such as the first approval and launch dates, among other things.

There are also triggers related to the performance of the $BTCETF token. For example, when the trading volume of $BTCETF hits $100 million the transaction tax is reduced from 5% to 4%. Other milestones include the approval date of the first spot Bitcoin ETF, at which point the sales tax is reduced from 4% to 3%.

Crypto YouTuber Micheal Wrubel with 310,000 subscribers is supper bullish on $BTCETF, as he explains in his day-old video which has already amassed 20,000 views:

Austin Hilton with 235k subscribers on YouTube is another $BTCETF fan. He tells his audience that $BTCETF is “like nothing you have ever seen,” as he encourages his viewers to find out more.

Thoughtful design decisions are crafted with the intention of maximizing FOMO and tokenholder returns as the crypto ETF frenzy builds.

If you are looking to position your investment portfolio to profit from the coming price explosion in crypto before the rest of the crowd, then buying Bitcoin ETF Token is the best opportunity on the market today.

The post BlackRock Ethereum ETF Plans Spur On Bitcoin ETF Token Investors to Take Last Chance to Buy at Low $0.005 Price appeared first on Cryptonews.