Cake DeFi: A One-Stop Shop for Generating Yield

Publikováno: 29.7.2020

Cake DeFi, a platform that allows users to generate cash flow through pooled masternode staking and options lending, has created a platform with a clean user interface that allows anyone from the novice to the time-starved investor, to start earning interest on their cryptocurrency with a couple of simple clicks of a button. Cake was […]

Cake DeFi, a platform that allows users to generate cash flow through pooled masternode staking and options lending, has created a platform with a clean user interface that allows anyone from the novice to the time-starved investor, to start earning interest on their cryptocurrency with a couple of simple clicks of a button. Cake was […]

The post Cake DeFi: A One-Stop Shop for Generating Yield appeared first on Bitcoin News.

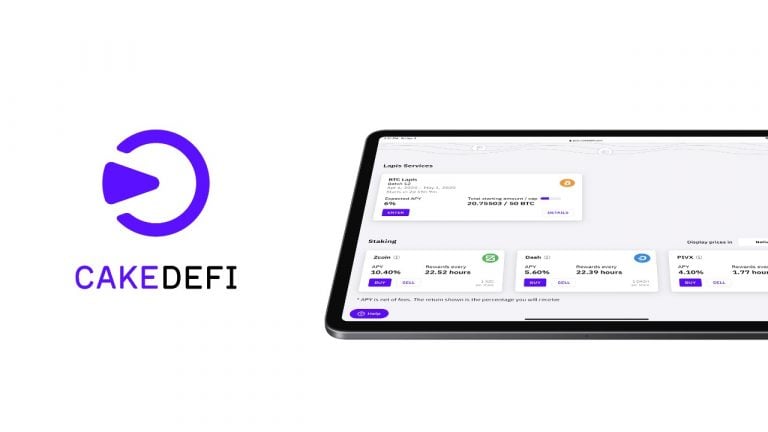

Cake DeFi, a platform that allows users to generate cash flow through pooled masternode staking and options lending, has created a platform with a clean user interface that allows anyone from the novice to the time-starved investor, to start earning interest on their cryptocurrency with a couple of simple clicks of a button.

Cake was founded in early 2019 by Dr. Julian Hosp and U-Zyn Chua as a way to bring the benefits of passive income into the mainstream through a simple user interface. Dr. Hosp is CEO and Co-Founder and a serial entrepreneur, international blockchain expert, medical doctor, and ex-professional athlete. U-Zyn Chua is CTO and Co-Founder and has served as one of the early contributors to Bitcoin, Ethereum, and Dash, and a current blockchain adviser to the Singapore Ministry of Defense. The company is distributed across Europe and Asia and has Mandarin and German localization options.

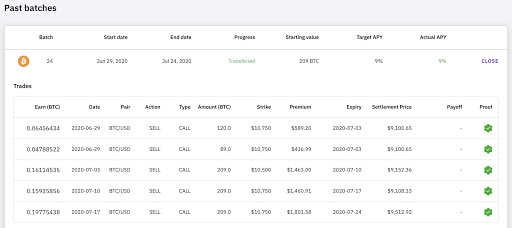

The company’s Lapis Service makes it easy for users to generate high returns on assets that are not currently proof of stake such as Bitcoin and Ethereum. The company presently achieves 8-9% interest for its users via weekly batches that lock for four weeks.

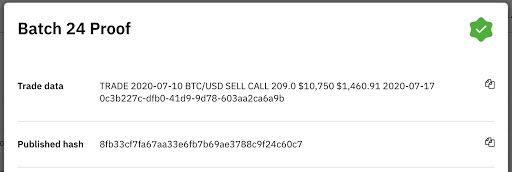

Interestingly, Cake does not take “DeFi” to mean lack of compliance oversight. The company leverages the best aspects of blockchain technology by providing full transparency on both its Pool and Lapis Service.

To balance between security and transparency, the trades within each Lapis Service batch are hashed and later publicly revealed at the end of the batch. This allows batch participants and even the public to review the specific details of each trade – including the strike price, premium, and settlement price.

Cake plans on beefing up its product portfolio by launching USD lending in Q3 2020 as well as other fiat integrations. Cake’s fiat support will signal the company’s shift in strategy toward offering a blend of CeFi and DeFi solutions all in one platform.

One of the company’s unique offerings is being the first staking provider for DeFiChain (DFI) – a fully decentralized blockchain designed specifically for high speed DeFi transactions. Users earn 25% APR on Cake’s DFI Pool, with block rewards paid every 26 seconds.

The fact that Cake offers a way for users to earn interest not only through staking with DASH, PIVX, Zcoin, DeFiChain (DFI) but also through Bitcoin and Ethereum options presents another unique use case of CeFi meeting DeFi. For this reason the company recently surpassed ten percent week-on-week growth for new users and deposits.

Cake presents users the convenience and flexibility of pooling tokens with no lower limit. The company also offers weekly statement reports, and processes for real-time compounding – allowing users to take advantage of the wonders of compounding interest in a single click.

Overall, Cake DeFi’s name may mislead those who think that DeFi always translates into products that are hard to use. Cake combines the best elements of DeFi and CeFi for users to take advantage of some of the highest rates that staking and centralized finance can offer, all in a simple way through a Singapore registered and licensed entity.

This is a sponsored post. Learn more on how to reach our audience here. Read disclaimer below.

The post Cake DeFi: A One-Stop Shop for Generating Yield appeared first on Bitcoin News.