Canada Market Favors Crypto and Blockchain Investments Over Others in 2023

Publikováno: 7.2.2024

Although investments in Canadian fintechs slowed down in 2023, crypto and blockchain-related investments dominated the scene. KPMG’s global Pulse of Fintech report published Tuesday found that VC-backed investments comprised over three-quarters of all deals, totaling 83 transactions valued at $711m. Among these, over two-thirds were early-stage or seed investments. For the second consecutive year, crypto […]

The post Canada Market Favors Crypto and Blockchain Investments Over Others in 2023 appeared first on Cryptonews.

Although investments in Canadian fintechs slowed down in 2023, crypto and blockchain-related investments dominated the scene.

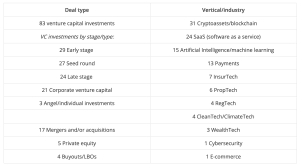

KPMG’s global Pulse of Fintech report published Tuesday found that VC-backed investments comprised over three-quarters of all deals, totaling 83 transactions valued at $711m. Among these, over two-thirds were early-stage or seed investments.

For the second consecutive year, crypto and blockchain led the pack with a total of 31 deals. Meanwhile, software-as-a-service fintechs followed closely behind with 24 investments. Artificial intelligence and machine learning secured 15 investments.

Investor interest in cryptoasset fintechs may have been fueled by expectations of the US SEC approving a spot bitcoin ETF, according to KPMG advisory services partner Edith Hitt. The SEC approved 11 such ETFs in January, signaling a significant milestone and broader industry acceptance.

“The approval of a Bitcoin ETF in the United States could help boost investment in Canadian fintechs and help drive new technological advancements in the digital assets space,” she said.

Blockstream Funding Reflects Canada’s Growing Crypto Interest

Hitt noted that one of the notable Canadian investments last year was in a blockchain infrastructure company, indicating increasing interest in the technology. She referred to Blockstream, a digital asset firm based in Victoria, Canada, which secured $125m in funding to expand its bitcoin mining operations.

“Notable investment in blockchain infrastructure suggests that investors could be thinking ahead to the future, where a central bank digital currency or ‘digital dollar’ might one day become a reality in Canada,” she added.

“If that happens, blockchain could potentially be the infrastructure that’s used to underpin that system, and that could be another growth catalyst for Canada’s fintech ecosystem.”

However, reports indicate that Canadians show less enthusiasm for a CBDC. Instead, a significant portion appears to favor cash transactions and advocate for legislation requiring merchants to accept cash during transactions.

Global Trend for VC Funding in Crypto

KPMG suggested that a mix of factors like market cycles, slower growth, market ups and downs, higher costs, and global tensions all contributed to the subdued investment scene.

The decline in Canada’s fintech investment reflects a global trend in VC funding for the crypto sector.

Galaxy Digital reported a 70% decrease in VC funding in 2023, totaling around $10b in deal value compared to nearly $32b in 2022.

The post Canada Market Favors Crypto and Blockchain Investments Over Others in 2023 appeared first on Cryptonews.