Canadians Support Cash Payments Over CBDCs: Report

Publikováno: 30.11.2023

Source: Jason Hafso / Pexels Canadians are less enthusiastic about a Central Bank Digital Currency (CBDC) opting for traditional payment methods despite wider awareness, a new survey shows. The Digital Canadian Dollar Public Consultation Report published by the Bank of Canada highlighted the overall sentiments of consumers towards a CBDC in light of recent blockchain […]

The post Canadians Support Cash Payments Over CBDCs: Report appeared first on Cryptonews.

Canadians are less enthusiastic about a Central Bank Digital Currency (CBDC) opting for traditional payment methods despite wider awareness, a new survey shows.

The Digital Canadian Dollar Public Consultation Report published by the Bank of Canada highlighted the overall sentiments of consumers towards a CBDC in light of recent blockchain activities and future payment initiatives.

Generally, Canadians do not embrace the technology, as anticipated by pro-CBDC experts casting negative light on the current state of the technology.

According to the survey that took responses from 89,423 participants, 95% have heard about the CBDC or possess sufficient information on how the technology worked showing massive public awareness.

In most cases, massive public awareness of 95% is expected to trickle into a larger adoption but that might not be the case for a Canadian CBDC as consumers want other options.

Participants want laws to protect cash as a payment option

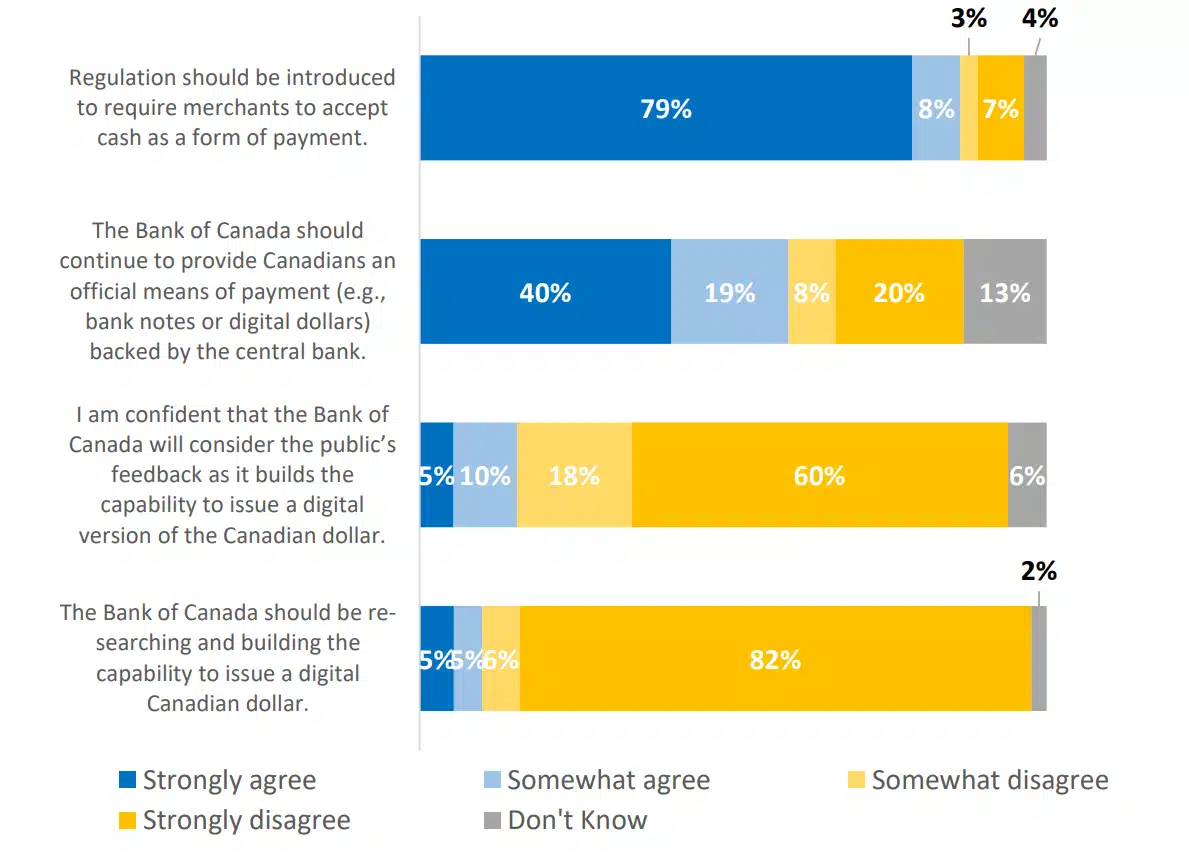

Per the study, a large portion of participants prefer cash transactions and push for laws to mandate merchants to accept cash during transactions despite the growing popularity of digital payments.

This sentiment has also been shared in the United Kingdom where the public consultation also revealed that users fear that digital payment systems may replace cash calling on authorities to protect the payment option.

However, financial authorities explained that a potential digital pound will not replace cash as a payment option but complement it as the jurisdiction seeks ways for faster and seamless cross-border settlements.

Over 82% of respondents said that the Bank of Canada should not research the capabilities of the CBDC as they chose their current payment methods. The respondents also noted that they didn’t expect the public survey to sway the bank’s drive toward the CBDC.

On the country’s cryptocurrency usage, 15% of the respondents hold digital assets with that demographic more open to support a state-backed digital currency.

Participants express their hope for widely accepted CBDC to benefit and lean towards privacy and security in the utility of the currency.

Consumers flagging privacy concerns has been the norm in recent weeks with users saying central banks should not gather additional details of their transactions in a bid to monitor their behaviour. Authorities have also dismissed this fear assuring users of anonymity.

Mixed feelings for the future

Although the reports of the survey show low expectations, pro-CBDC experts view the technology as a potential game changer in finance with a wider reach to disadvantaged users.

Furthermore, opinion surveys suggest that the government will do more to educate on the utility of the technology and not just a replacement for private cryptocurrencies. Canadian authorities have issued several regulations on the stablecoins and the larger crypto ecosystem citing investor protection concerns.

In August, a Bank of Canada report showed that citizens were not incentivized to use a CBDC as the majority of the population had good access to financial services.

The post Canadians Support Cash Payments Over CBDCs: Report appeared first on Cryptonews.