Cardano Price Prediction as ADA’s Social Dominance Reaches 6-Month High – Can ADA Reach $10?

Publikováno: 11.12.2023

Amidst the dynamic cryptocurrency market, Cardano (ADA) has become a prominent topic of discussion, witnessing its social dominance climb to a six-month high. As of now, the live Cardano price stands at $0.55310, with a trading volume of $1.2 billion over the past 24 hours. Despite a 6% decline in the same period, Cardano maintains […]

The post Cardano Price Prediction as ADA’s Social Dominance Reaches 6-Month High – Can ADA Reach $10? appeared first on Cryptonews.

Amidst the dynamic cryptocurrency market, Cardano (ADA) has become a prominent topic of discussion, witnessing its social dominance climb to a six-month high. As of now, the live Cardano price stands at $0.55310, with a trading volume of $1.2 billion over the past 24 hours.

Despite a 6% decline in the same period, Cardano maintains its position as the 8th largest cryptocurrency by market capitalization, currently valued at $19.5 billion. The circulating supply of ADA coins has reached 35,327,693,686, with a maximum cap set at 45,000,000,000 ADA coins.

This surge in social dominance and market activity brings forth the question: can Cardano (ADA) escalate to the $10 mark?

Cardano Price Prediction

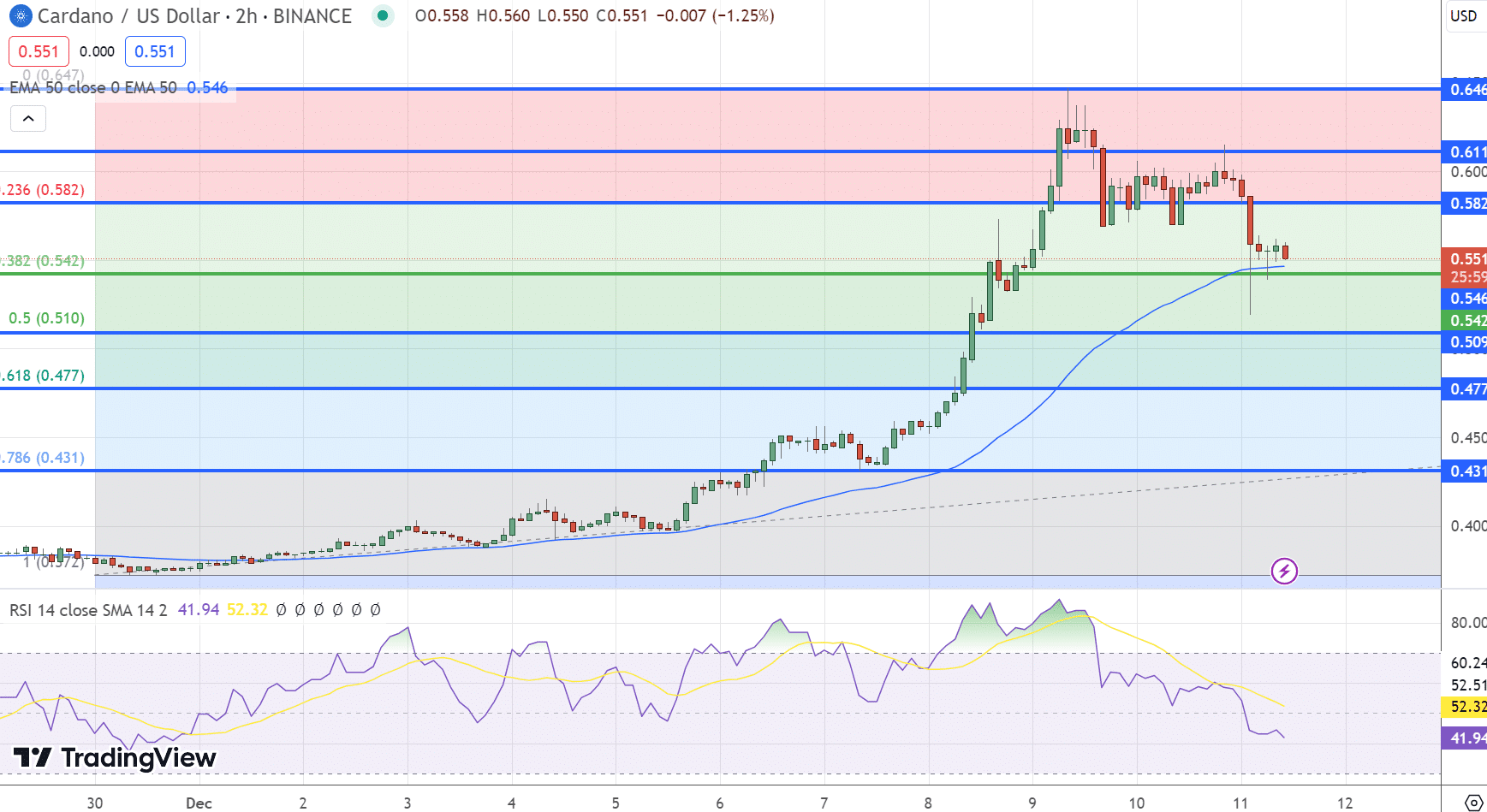

The current trading scenario for ADA, now at $0.551. Cardano’s current trajectory is defined by critical technical levels. The immediate pivot point, set at $0.542, aligns with the 38.2% Fibonacci retracement level.

This point acts as a threshold, determining the asset’s short-term direction. Resistance levels are observed at $0.5820, $0.6110, and $0.6460, which could cap upward movements.

Conversely, support levels are crucial at $0.509 (50% Fibonacci level), $0.477 (61.8% Fibonacci level), and further down at $0.4310. These levels will play a pivotal role in cushioning ADA against potential declines.

Technical Indicators and Implications

The Relative Strength Index (RSI) stands at 41, indicating a bearish sentiment as it stays below the neutral 50 mark. Meanwhile, the Moving Average Convergence Divergence (MACD) is -0.010, trailing below its signal line at 0.026, further suggesting a potential bearish momentum.

Another key indicator, the 50-day Exponential Moving Average (EMA) at 0.5460, is crucial as ADA has recently crossed below this mark. This crossover might signal an onset of selling pressure, posing a risk of further decline.

ADA’s recent completion of the 38.2% Fibonacci retracement at $0.532 highlights a critical juncture. If ADA sustains above this level, it could indicate a potential for recovery and a test of higher resistance levels.

However, a break below this pivot could expose ADA to further decline towards the 50% or 61.8% Fibonacci levels, emphasizing the precarious nature of its current market position.

Summing Up

Overall, Cardano’s trend appears bullish above the $0.542 mark. The immediate future for ADA hinges on whether it can maintain its position above this crucial Fibonacci level. Should it break below, the asset may witness further downward movement, testing lower support levels.

Bitcoin ETF Token – Newer High-Potential Altcoin

Cardano (ADA), already a significant player in the cryptocurrency market, is not the only altcoin on the brink of potential major rallies. The crypto space is buzzing with newer altcoins, many of which are currently in the presale stage, gaining considerable momentum.

A prime example of such an altcoin is Bitcoin ETF Token (BTCETF), an ERC-20 cryptocurrency. It has successfully raised an impressive $3.5 million out of its $3.8 million target in its token offering. This substantial fundraising effort underlines growing investor confidence in the potential of Bitcoin ETF Token.

@conio teams up with @coinbase to expand digital asset offerings for Italian banks, with plans to support up to 50 #Tokens by 2023.

Europe's embracing #Crypto with initiatives like Markets in crypto assets regulation.

What digital assets do you think will gain traction next… pic.twitter.com/DPg0m5yJQB

— BTCETF_Token (@BTCETF_Token) December 11, 2023

Bitcoin ETF Token stands out with its unique and bullish deflationary tokenomics. The plan is to systematically burn 5% of its total supply at five distinct milestones, each linked to the performance of Bitcoin ETFs or Bitcoin’s market price.

The first burn is scheduled when an SEC-approved Bitcoin ETF attains a trading volume of $100 million, and the final one when Bitcoin’s price hits the $100,000 mark. This gradual reduction of 25% of its total supply is strategically designed to amplify demand for the token, potentially elevating its market value.

Unveiling how #BTCETF not only readies for the #Bitcoin#ETF influx but also grants staking incentives, bolstering network resilience and reliability.

pic.twitter.com/SpJX1QYLtT

— BTCETF_Token (@BTCETF_Token) December 8, 2023

The token’s allure is further enhanced by the opportunity it presents for holders to stake their tokens and earn passive income. This feature, coupled with the deflationary strategy, has garnered the interest of numerous traders.

For those interested in participating in this emerging opportunity, Bitcoin ETF Token is currently available for purchase at $0.0066 per token. However, this price is set to increase in just 02 days, 08 hours, and 44 minutes, making it a time-sensitive opportunity for new investors. Post-listing, the price of BTCETF is projected to climb significantly, especially with the planned token supply burn.

To join this promising venture, investors can visit the official Bitcoin ETF Token website and become part of its growing community.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Cardano Price Prediction as ADA’s Social Dominance Reaches 6-Month High – Can ADA Reach $10? appeared first on Cryptonews.