Ciphertrace Says Banks Unknowingly Process $2 Billion in Crypto per Year

Publikováno: 17.12.2019

According to the blockchain analysis firm Ciphertrace, major U.S. banks process roughly $2 billion in digital currency transactions that go undetected every year. Ciphertrace disclosed a slew of financial institutions have not deployed the right KYC/AML infrastructure to detect unregistered cryptocurrency transfers. Also read: US to Strictly Enforce Crypto Rules Similar to FATF Guidelines All […]

According to the blockchain analysis firm Ciphertrace, major U.S. banks process roughly $2 billion in digital currency transactions that go undetected every year. Ciphertrace disclosed a slew of financial institutions have not deployed the right KYC/AML infrastructure to detect unregistered cryptocurrency transfers. Also read: US to Strictly Enforce Crypto Rules Similar to FATF Guidelines All […]

The post Ciphertrace Says Banks Unknowingly Process $2 Billion in Crypto per Year appeared first on Bitcoin News.

According to the blockchain analysis firm Ciphertrace, major U.S. banks process roughly $2 billion in digital currency transactions that go undetected every year. Ciphertrace disclosed a slew of financial institutions have not deployed the right KYC/AML infrastructure to detect unregistered cryptocurrency transfers.

Also read: US to Strictly Enforce Crypto Rules Similar to FATF Guidelines

All Top 10 US Banks Have Unwittingly Processed Crypto Transactions

Ciphertace offers cryptocurrency intelligence solutions for more than 87% of the virtual assets in existence. It monitors blockchains and transactions in order to detect non-compliant behavior and money laundering. On December 16, the firm revealed that out of the top 10 banks in the U.S., every financial institution has processed digital currency transactions unknowingly. Ciphertrace claims that banks are processing around $2 billion in undetected crypto transactions per year. The blockchain analysis firm says that the funds stem from money service businesses (MSBs) that deal with cryptocurrencies like exchanges and brokerage services.

According to Ciphertrace, the financial institutions that unknowingly process these crypto transactions are not equipped with the latest technology to detect such transfers. Typically banks must identify MSB-derived transactions and report the transfers to the Financial Action Task Force (FATF). However, in the near future, Ciphertrace believes banks will need to comply with the identification and compliance requirements that deal with cryptocurrencies according to the latest FATF regulatory policy. In November, the U.S. regulator reaffirmed digital currencies like bitcoin apply to to the agency’s “Travel” rule.

“Financial institutions are exposed to cryptocurrency-related risks because they have no way to detect underlying threats,” said Dave Jevans, CEO of Ciphertrace.

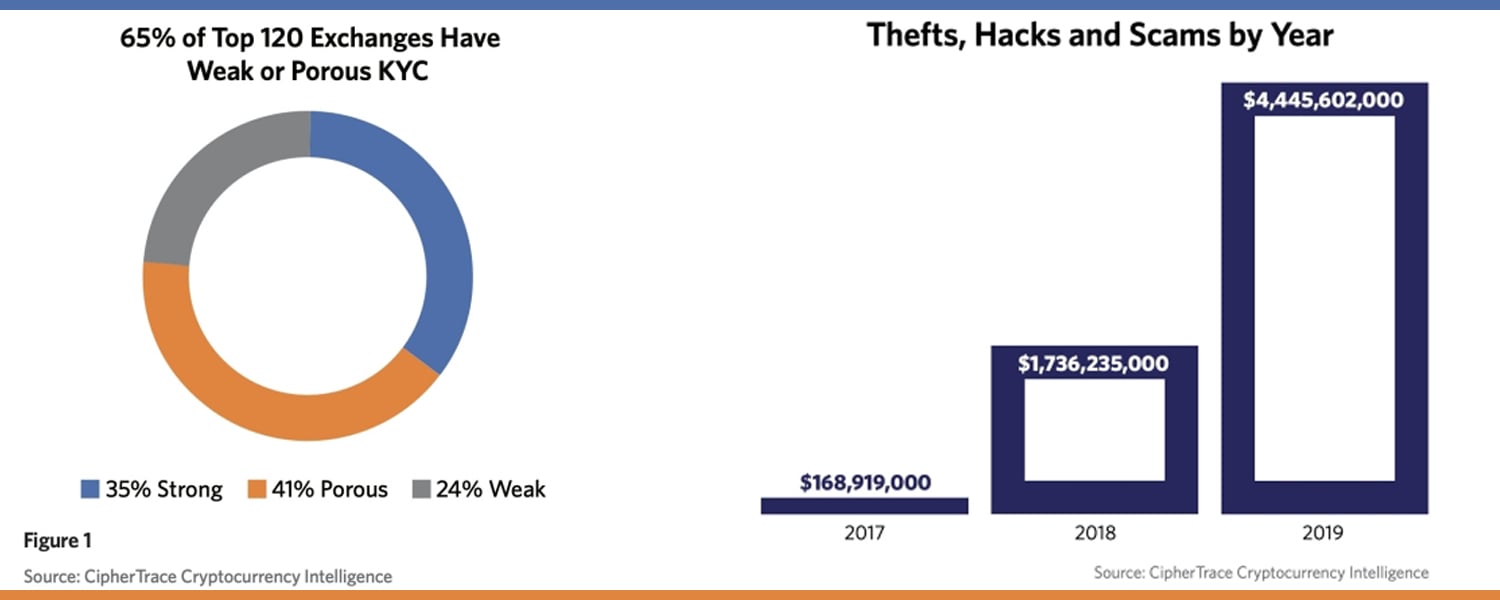

Anticipating the New FATF AML Regulations

The Ciphertrace report follows the firm’s latest research that detailed two-thirds of the top crypto exchanges have “weak [know-your-customer] KYC” procedures. An exchange that has “weak KYC” allowed Ciphertrace researchers to withdraw roughly 0.25 BTC per day with no questions asked. In the study, Ciphertrace highlights that “a majority of exchanges are not equipped to handle basic KYC, let alone comply with the stringent new funds ‘Travel Rule’ included in the updated FATF guidance.” Ciphertrace’s research does underline the fact there’s been a significant reduction in cryptocurrency crime this year. However, 2019 still had a host of exchange casualties and hacks costing investors more than $4.4 billion to date. Ciphertrace also notes that many exchanges have removed privacy-centric cryptocurrencies in order to prepare for the latest FATF guidance. The research states:

In anticipation of the new FATF AML regulations, many cryptocurrency exchanges have preemptively jettisoned their privacy coins; yet, 32 percent of exchanges, including those determined to have weak KYC, still have privacy coins listed.

Over the last two years, regulations tied to cryptocurrencies have increased dramatically and blockchain analysis startups are monitoring most of the popular public blockchain networks. The decline in cryptocurrency crime was skewed by the Quadrigacx loss and Plustoken frauds but overall Ciphertrace believes regulation is curbing nefarious crypto activities. “Ciphertrace had previously speculated that the shift from outright thefts to exit scams and other frauds perpetrated by insiders indicated that crypto exchanges had begun to adequately invest in hardening their IT infrastructures,” the study concludes.

What do you think about Ciphertrace disclosing that $2 billion crypto transactions per year are processed by banks unknowingly? Let us know in the comments section below.

Image credits: Shutterstock, Ciphertrace, Wiki Commons, Fair Use, and Pixabay.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Ciphertrace Says Banks Unknowingly Process $2 Billion in Crypto per Year appeared first on Bitcoin News.