Defi TVL Climbs Higher, Optimism Use Rises, 270K BTC on ETH, Lending on ETH Taps $44 Billion

Publikováno: 18.9.2021

In mid-September, the total-value locked (TVL) in decentralized finance (defi) continues to climb higher, as the value held on Ethereum, Binance Smart Chain, Avalanche, Solana, and more blockchains has risen dramatically to $171 billion today. On the Ethereum network, there’s 270,783 bitcoin held in TVL worth more than $13 billion and $15 billion has been […]

In mid-September, the total-value locked (TVL) in decentralized finance (defi) continues to climb higher, as the value held on Ethereum, Binance Smart Chain, Avalanche, Solana, and more blockchains has risen dramatically to $171 billion today. On the Ethereum network, there’s 270,783 bitcoin held in TVL worth more than $13 billion and $15 billion has been […]

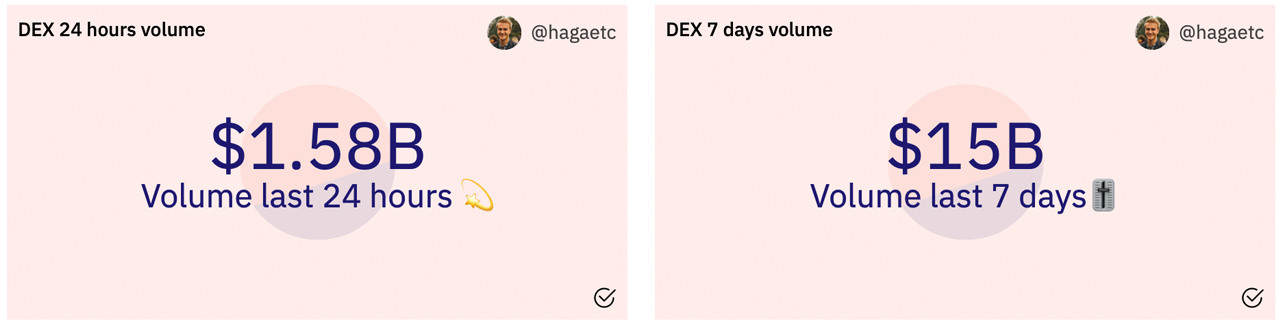

In mid-September, the total-value locked (TVL) in decentralized finance (defi) continues to climb higher, as the value held on Ethereum, Binance Smart Chain, Avalanche, Solana, and more blockchains has risen dramatically to $171 billion today. On the Ethereum network, there’s 270,783 bitcoin held in TVL worth more than $13 billion and $15 billion has been swapped across 14 different Ethereum-based decentralized exchange (dex) platforms. $23.8 billion has been swapped across a variety of blockchain protocols, according to a recently published defi weekly report.

Defi Growth Remains Exponential

A number of crypto assets like bitcoin (BTC) and ethereum (ETH) have increased in value during the last month, but for the most part, crypto-assets like solana (SOL) and avalanche (AVAX) stole the show during the last 30 days.

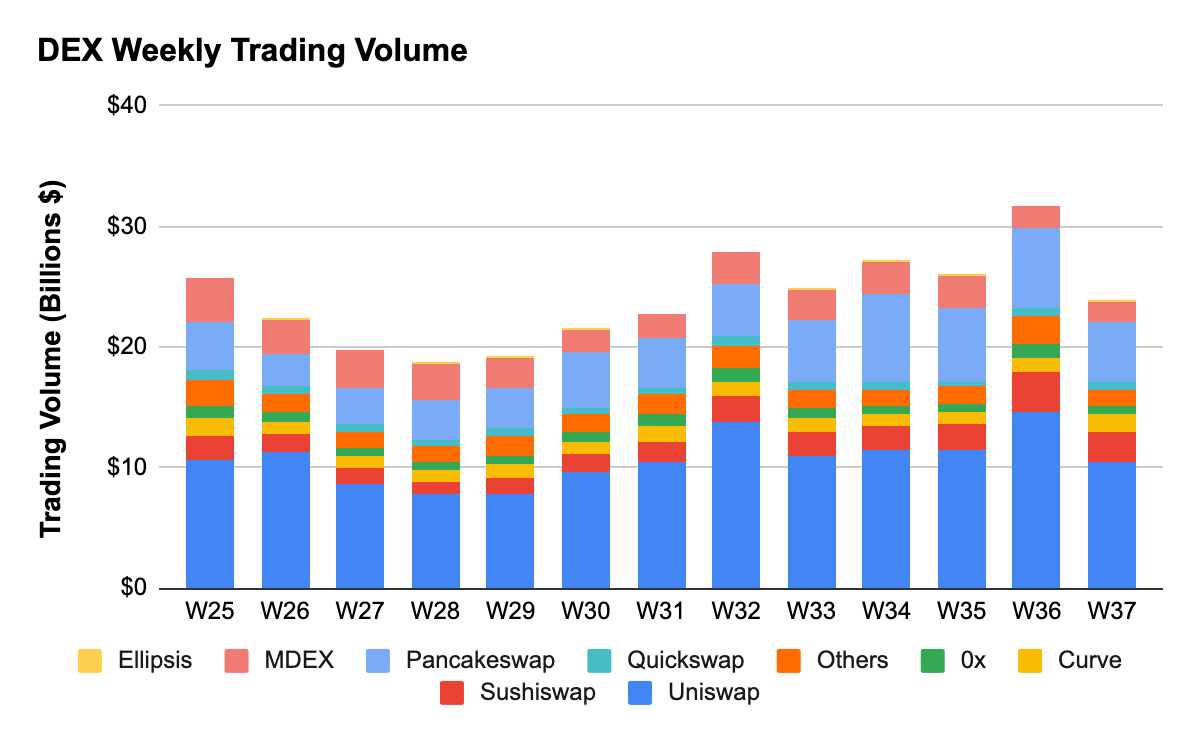

Decentralized finance (defi) solutions continue to grow exponentially and statistics from Dune Analytics indicate that $15 billion has been swapped on 14 Ethereum-based dex platforms. Uniswap captured more than 62% of that $15 billion worth of global trade volume by commanding $9,620,102,739 in swaps during the last week.

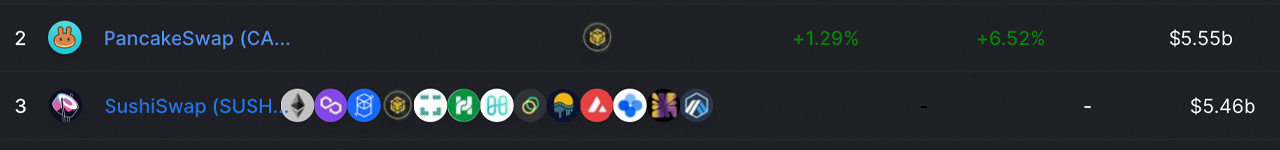

While Uniswap has a lot of volume, the Binance Smart Chain dex Pancakeswap has a TVL of around $5.55 billion according to metrics recorded on Saturday. Sushiswap has $5.46 billion and it has far more connections than just the BSC network. The total dex weekly trade volume across a number of blockchains according to Coin98 Analytics is $23.8 billion.

Metrics show that there’s $171 billion in TVL stretched across a myriad of blockchains. Ethereum still dominates the TVL by a long shot but a number of other chains have been moving up the ladder in terms of activity during the last month.

Data from Coin98 Analytics’ latest defi report indicates that the total number of Polygon wallets has surpassed 68.3 million. Coin98 Analytics findings also show that “Optimism and Arbitrum addresses increased by 2 and 6 times, respectively.”

“Although the number of Optimism addresses [has] far exceeded that of Arbitrum, the past week signifies a strong rise of Arbitrum against Optimism,” Coin98 Analytics said. “Specifically, the total number of Arbitrum addresses reached 121,000, while the number of Optimism addresses fell behind at 103,000,” the report adds.

Over $7 Billion Across Bridges, Lending TVL on Ethereum Reaches $44 Billion, Large Quantity of Bitcoin Is Leveraged on Ethereum

Dune Analytics’ “Bridge Away (L1 Ethereum)” statistics show that there’s $7.71 billion TVL on Harmony Bridges, Near Rainbow Bridge, Optimism ERC20 Bridges, Arbitrum Bridges, Solana Wormhole, Fantom Anyswap Bridge, Polygon ERC20 Bridge, and the Avalanche Bridge. On Friday, the project Wormhole announced that its ETH – SOL token bridge is now live.

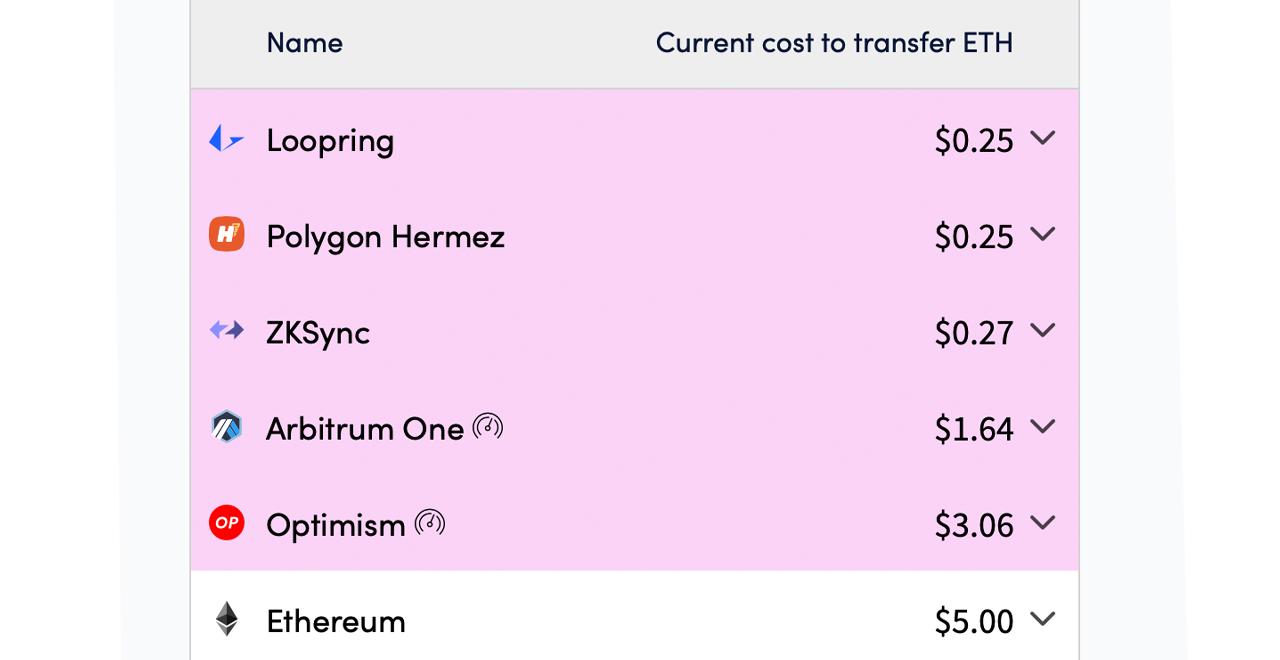

L2fees.info indicates that an ether transfer using Loopring is $0.25, a transfer across Polygon Hermez is also $0.25, Zksync is $0.27, Arbitrum One costs $1.64 and Optimism costs around $3.06 on Saturday. Meanwhile, L2fees.info shows that the median fee to send ethereum (ETH) on September 18 is over $5 per transfer.

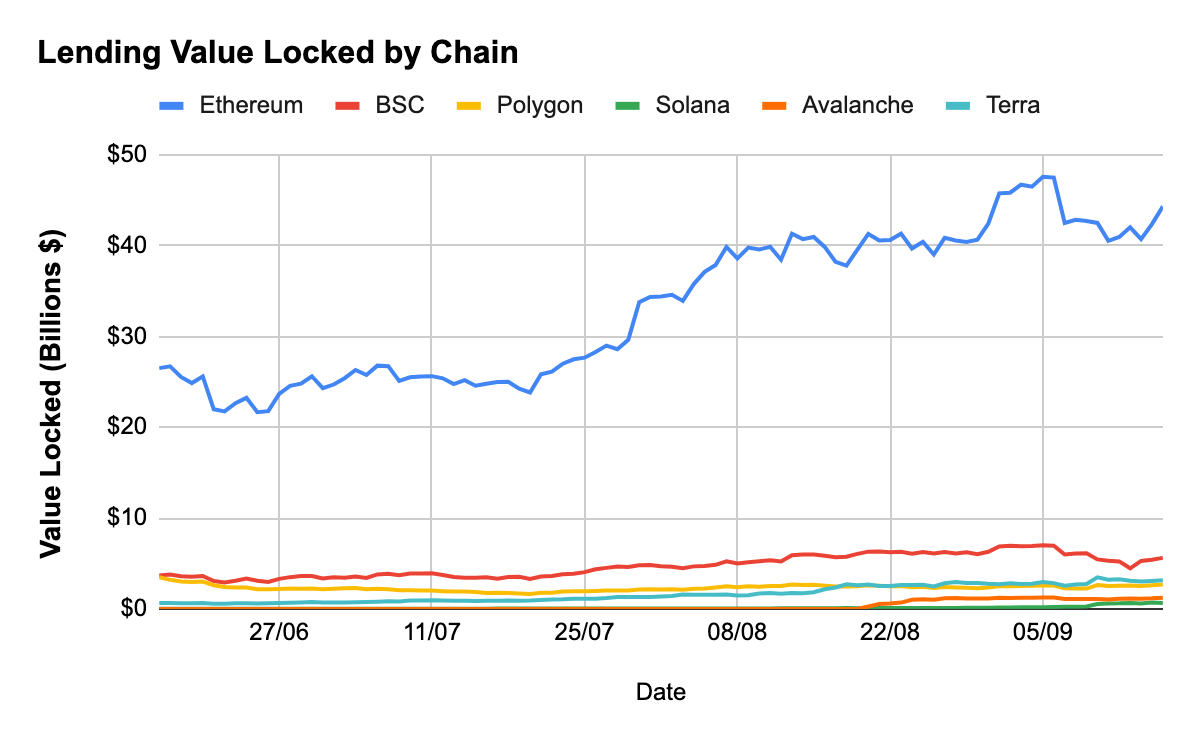

Another interesting stat for defi this week discovered by Coin98 Analytics, is the lending total-value locked on Ethereum today is roughly $44 billion. Also, out of seven different bitcoin (BTC) projects that use the Ethereum network, there’s 270,783 bitcoin held in TVL worth more than $13 billion today.

This measurement includes projects like WBTC, TBTC, SBTC, IMBTC, PBTC, HBTC, and RENBTC. 76% of the 270K bitcoin or $13 billion worth of wrapped or synthetic BTC is used by the Wrapped Bitcoin (BTC) project and its participants.

What do you think about the growing activities tied to the decentralized finance (defi) space? Do you envision defi slowing down any time soon? Let us know what you think about this subject in the comments section below.