Dex Platforms Trade Over $2.4 Billion in 7 Days, Defi Swaps up 68% Since Last Week

Publikováno: 16.8.2020

Years ago the cryptocurrency community did not have access to a plethora of decentralized exchanges (dex). In 2020 with the rise of Ethereum, dex platforms have grown exponentially with trading applications like Uniswap, 0x, Kyber, and more. Dex trading growth has spiked over 68% this week alone and during the last seven days, $2.4 billion […]

Years ago the cryptocurrency community did not have access to a plethora of decentralized exchanges (dex). In 2020 with the rise of Ethereum, dex platforms have grown exponentially with trading applications like Uniswap, 0x, Kyber, and more. Dex trading growth has spiked over 68% this week alone and during the last seven days, $2.4 billion […]

The post Dex Platforms Trade Over $2.4 Billion in 7 Days, Defi Swaps up 68% Since Last Week appeared first on Bitcoin News.

Years ago the cryptocurrency community did not have access to a plethora of decentralized exchanges (dex). In 2020 with the rise of Ethereum, dex platforms have grown exponentially with trading applications like Uniswap, 0x, Kyber, and more.

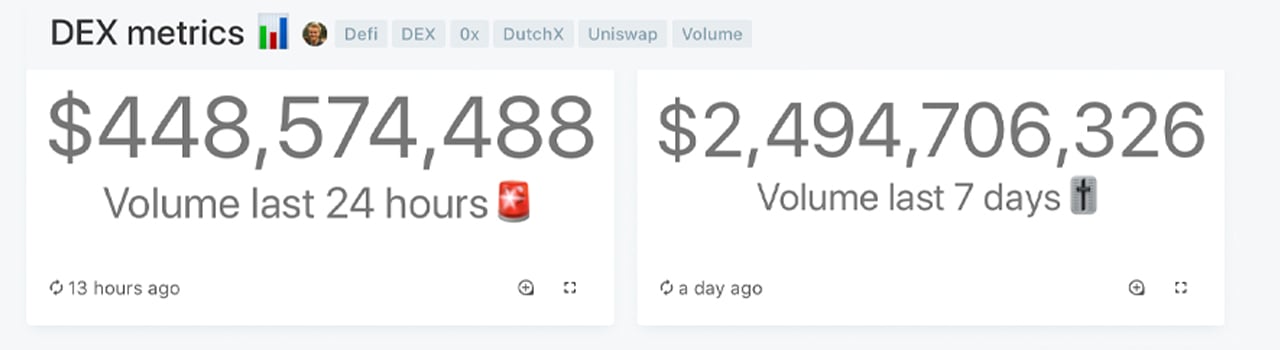

Dex trading growth has spiked over 68% this week alone and during the last seven days, $2.4 billion was swapped on these exchanges.

Onchain data from Dune analytics shows that more than $2.4 billion in decentralized exchange (dex) swaps took place last week and $448 million worth during the last 24 hours.

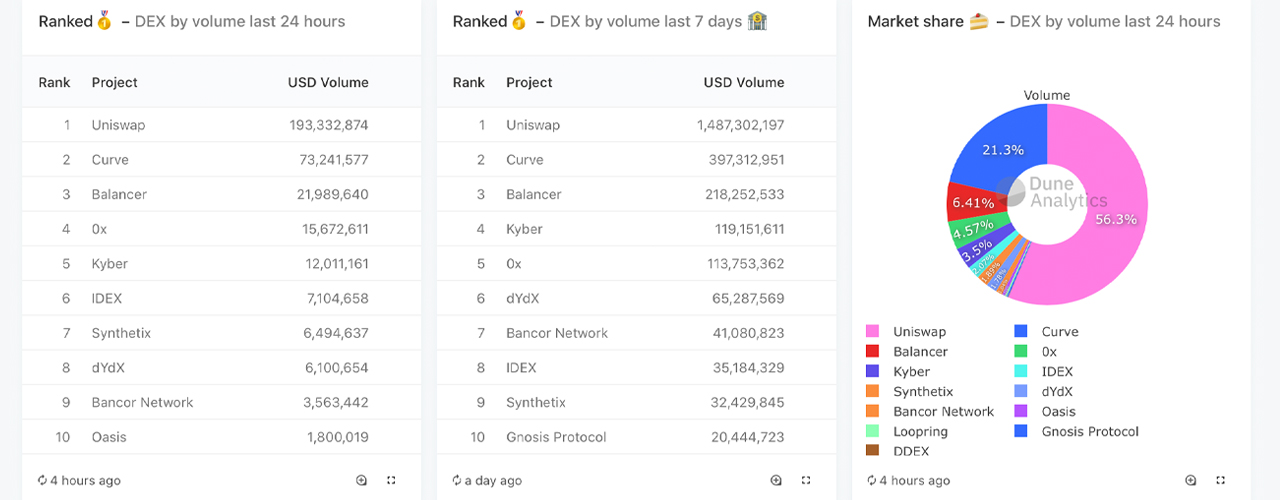

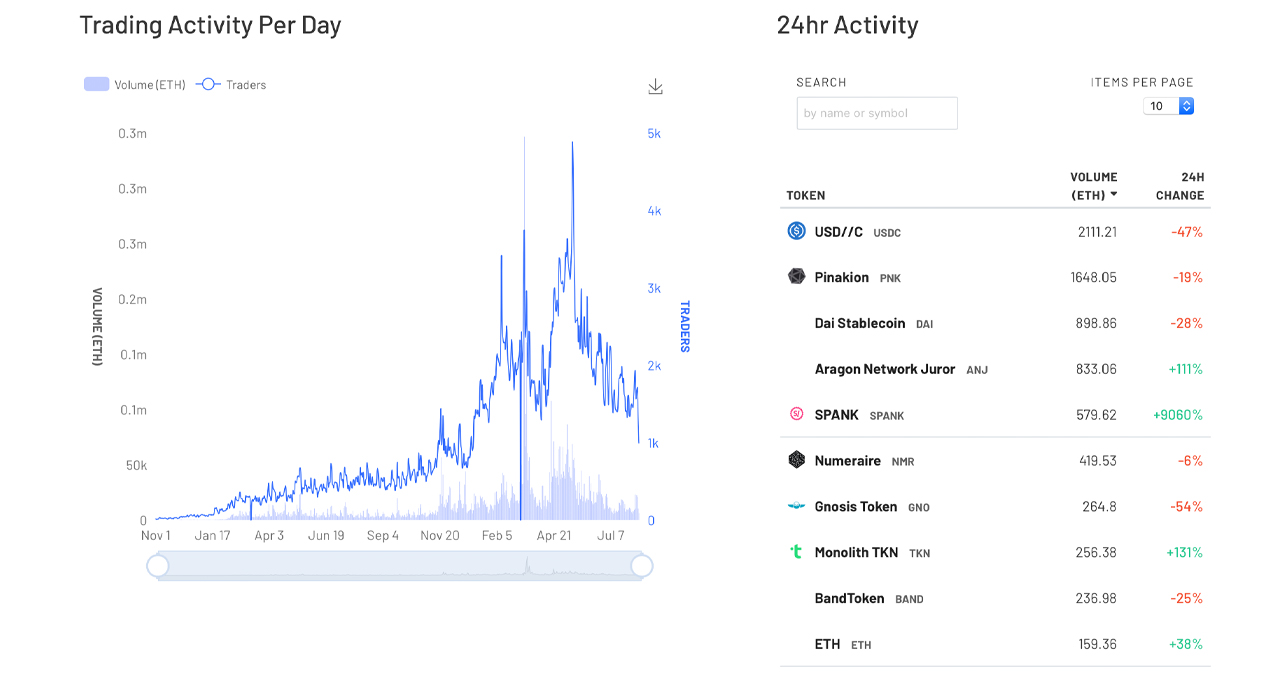

Dex platforms on Ethereum have exploded with demand and every week dex trade volumes have swelled higher and higher. Today according to statistics, the billions of weekly trade volume stems from defi exchanges like Uniswap, Balancer, Kyber, Synthetix, Bancor, Loopring, Ddex, Curve, 0x, Idex, Dydx, Oasis, and Gnosis.

For weeks now and today, statistics show that Uniswap is the most popular dex out there in terms of trade volume.

The top five dex platforms include Uniswap, Curve, Balancer, Kyber Network, and 0x. Essentially these exchanges allow people to trade value whether it be synthetic bitcoin like WBTC, stablecoins like DAI, or any Ethereum token standard.

The platform Uniswap is a dex that runs on the Ethereum blockchain and it allows permissionless swaps between ETH and over 200 ETH-based tokens. Instead of leveraging the typical order book model, Uniswap utilizes smart contracts and liquidity pools. On Saturday, 56% or $193 million out of the $448 million of 24-hour trades happened on Uniswap.

21.3% of today’s dex trades are taking place on Curve a decentralized exchange liquidity pool that’s also built on Ethereum. Curve just recently launched in January 2020 and it allows low slippage trades, and a low fee algorithm.

Balancer is a dex aggregator that provides traders with swapping abilities between sourced liquidity. The project says it’s an “n-dimensional automated market-maker built on Ethereum.” $21 million or 6.4% out of all 13 dex platform trades are executed on the Balancer system. 0x is the fourth most used dex on Ethereum today with 4.5% or $15 million in global trade volume.

The fifth most popular dex today is Kyber Network, which is an onchain liquidity protocol. Essentially, users pledge liquidity to the Kyber Network which allows anyone to swap their tokens in a single transaction. Kyber captures 3.5% of the market share of trades which adds up to a hair over $12 million in trade volume on Saturday,

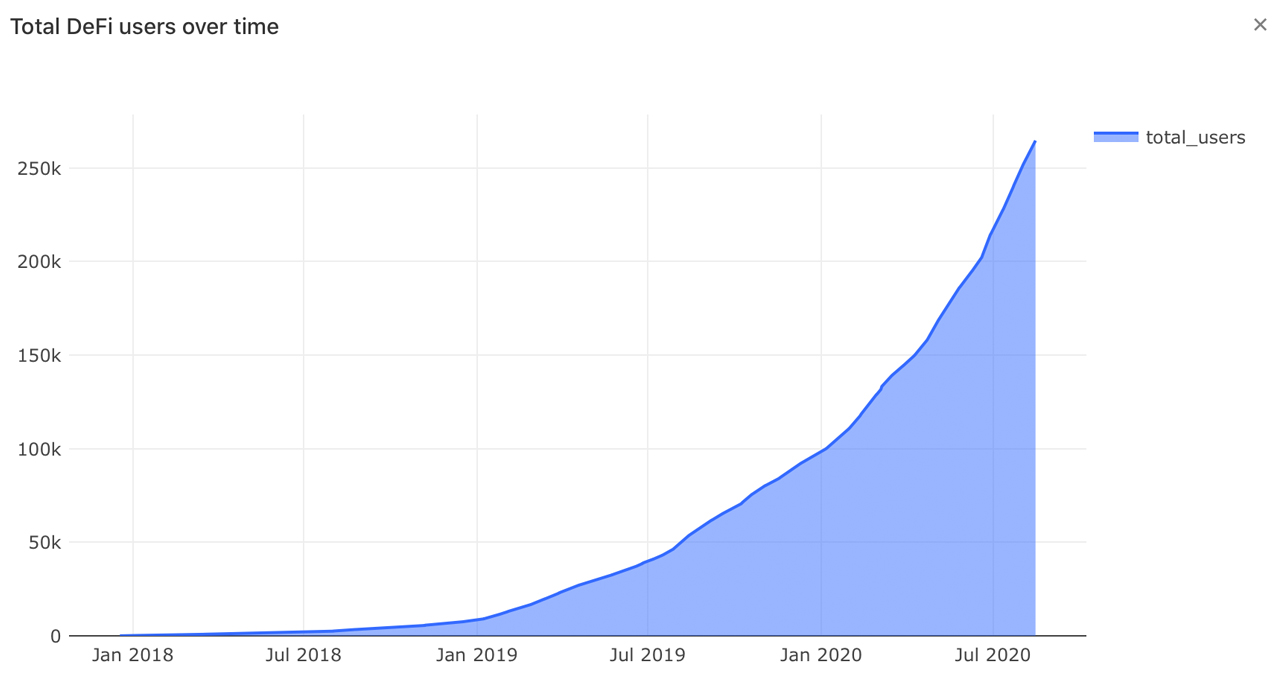

August 15. All five of these exchanges have seen explosive trade volume increasing month over month. Dune Analytics data and charts from Richard Chen also shows that defi users have increased drastically as well in 2020.

There are 264,638 defi users over time and the platforms with the most users include Uniswap, Kyber Network, alongside other defi services like lending from Compound and NFTs from Opensea.

2020 stats clearly show that dex platforms are sustainable and permissionless trading can bring a lot of funds into the ecosystem.

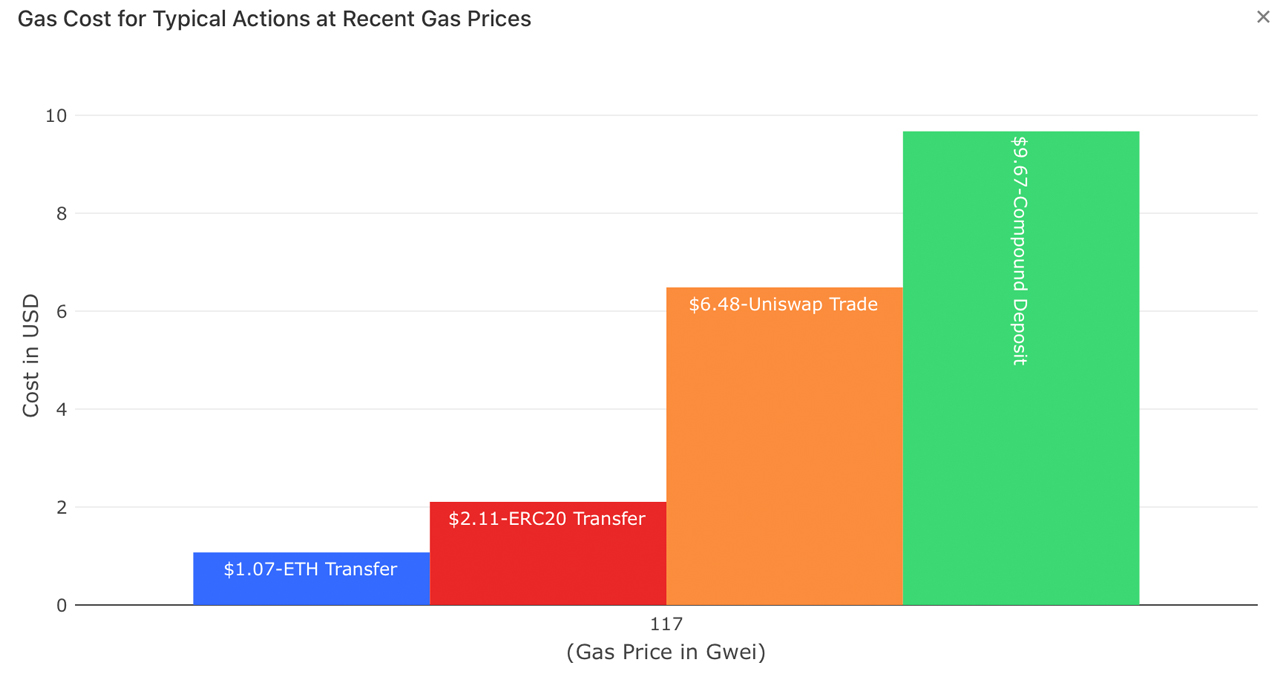

One of the clearest issues right now for defi is the exasperating ETH network fees. Uniswap is the second largest contributor to added gas costs for typical actions within the ETH ecosystem. A Dune Analytics chart that shows “Gas Cost for Typical Actions at Recent Gas Prices” indicates that a Uniswap trade can be around $6.48 today.

What do you think about the rise of decentralized exchanges (dex) on Ethereum today? Let us know what you think about this subject in the comments section below.

The post Dex Platforms Trade Over $2.4 Billion in 7 Days, Defi Swaps up 68% Since Last Week appeared first on Bitcoin News.