Ether (ETH) Set for 55% Surge After Key Technical Breakout, as Supply Turns Deflationary, Says This Well-Known Analyst

Publikováno: 7.11.2023

Famous crypto data analytics firm Matrixport’s head of research Markus Thielen argued in a recent report that Ether (ETH) could be set for a more than 55% surge to $3,000. Ether is the second most valuable cryptocurrency in the world by market capitalization after Bitcoin (BTC) and powers the Ethereum layer-1 smart-contract-enabled blockchain, which remains […]

The post Ether (ETH) Set for 55% Surge After Key Technical Breakout, as Supply Turns Deflationary, Says This Well-Known Analyst appeared first on Cryptonews.

Famous crypto data analytics firm Matrixport’s head of research Markus Thielen argued in a recent report that Ether (ETH) could be set for a more than 55% surge to $3,000.

Ether is the second most valuable cryptocurrency in the world by market capitalization after Bitcoin (BTC) and powers the Ethereum layer-1 smart-contract-enabled blockchain, which remains the most widely used blockchain in the DeFi, NFT and broader web3 industry.

In a recently published note on defiontarget.com, Thielen pointed out that Ether appears to have now broken to the north of its downtrend from the yearly highs, and also pointed out that Ethereum network activity has improved in recent weeks, leading to the Ether supply turning deflationary once again.

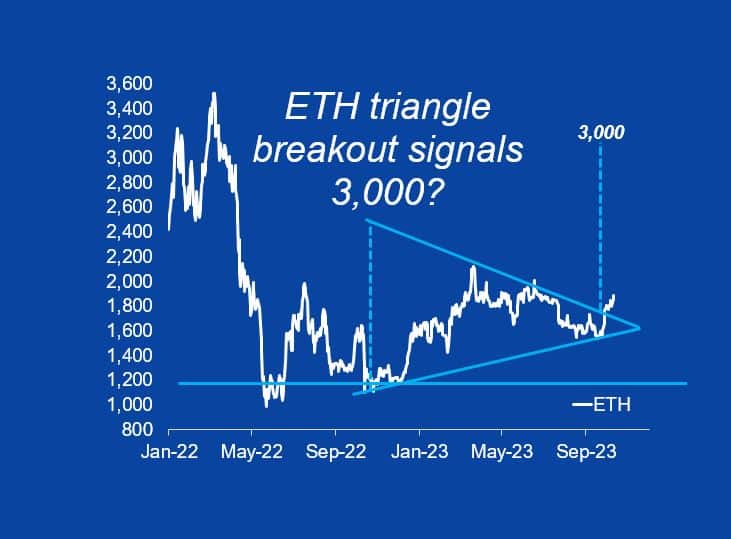

Thielen’s analysis included a chart showing that Ether appears to have broken to the north of a pennant structure that it had been in the throws of forming since late 2022.

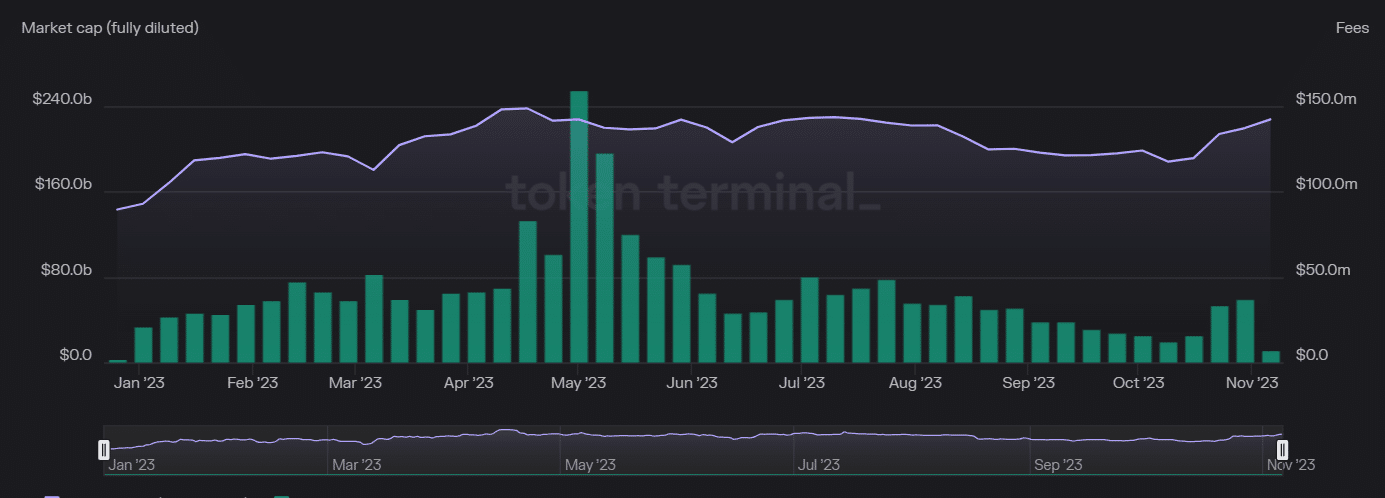

Moreover, he argued that “revenues for the Ethereum ecosystem are bottoming out from depressed levels… (which) this could signal a tradeable bottom for ETH”.

“While revenues have only climbed back into the summer 2023 range of $30 million in weekly fees, the shocking number of just $12.1 million during the week of October 9 might be behind us”.

“A tactical bullish trade could have merit for as long as weekly Ethereum fees stay above $30 million,” he added.

As per TokenTerminal, the Ethereum network generated fees of around $36 million last week.

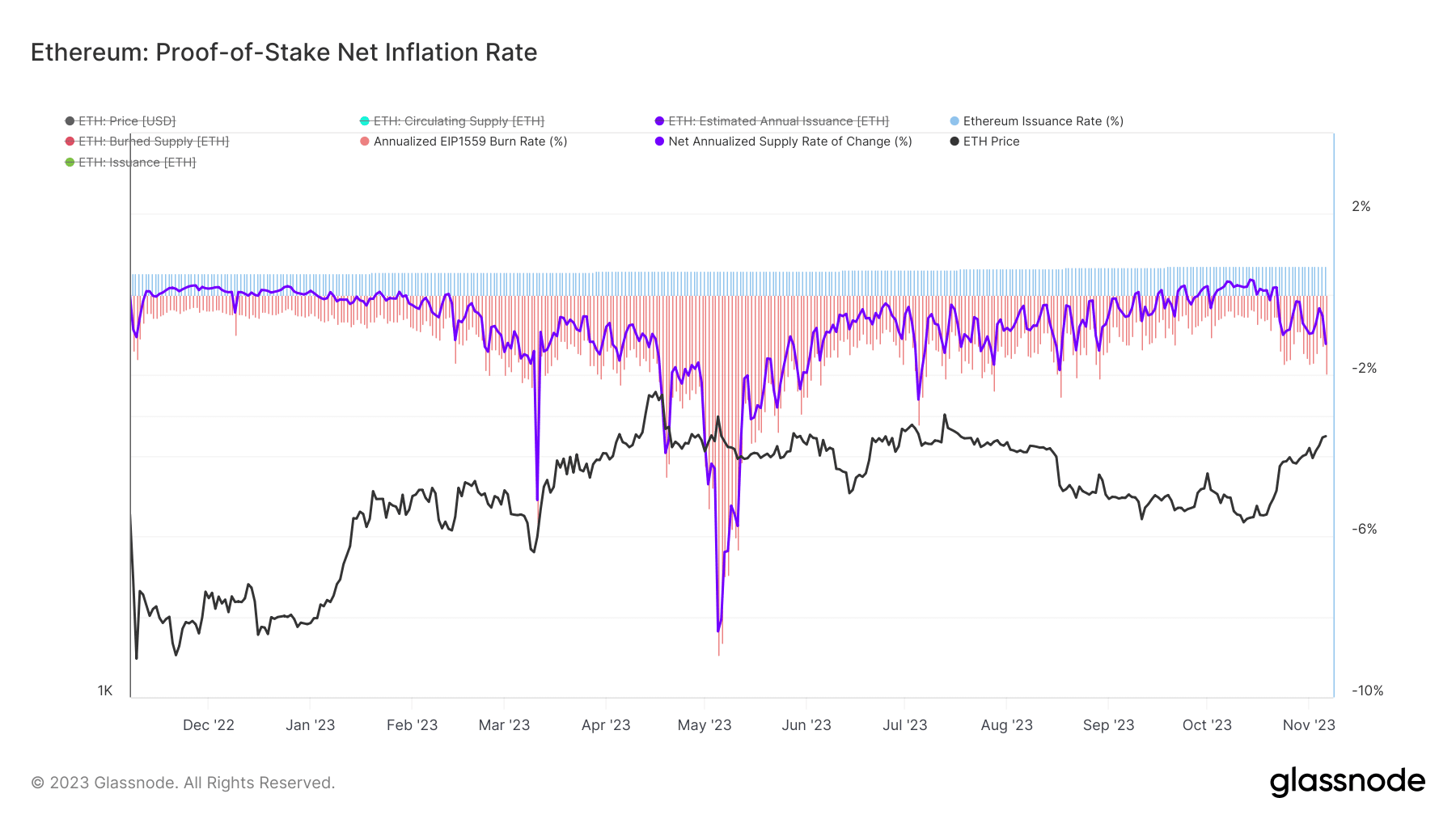

This recovery in network fees means a higher ETH burn rate (the majority of Ethereum network fees are burnt).

Indeed, as per Glassnode, the Ether inflation rate recently hit its lowest level since August of -1.2%, having recently been as high as 0.3% in early October.

That should boost optimism that, assuming network activity remains healthy, Ether should remain a deflationary asset, boosting its long-term value proposition to investors.

If Ether was to hit Thielen’s target of $3,000 per token, that would mark a surge of more than 55% from the current price just below $1,900.

Ether (ETH) to Outperform Bitcoin (BTC)?

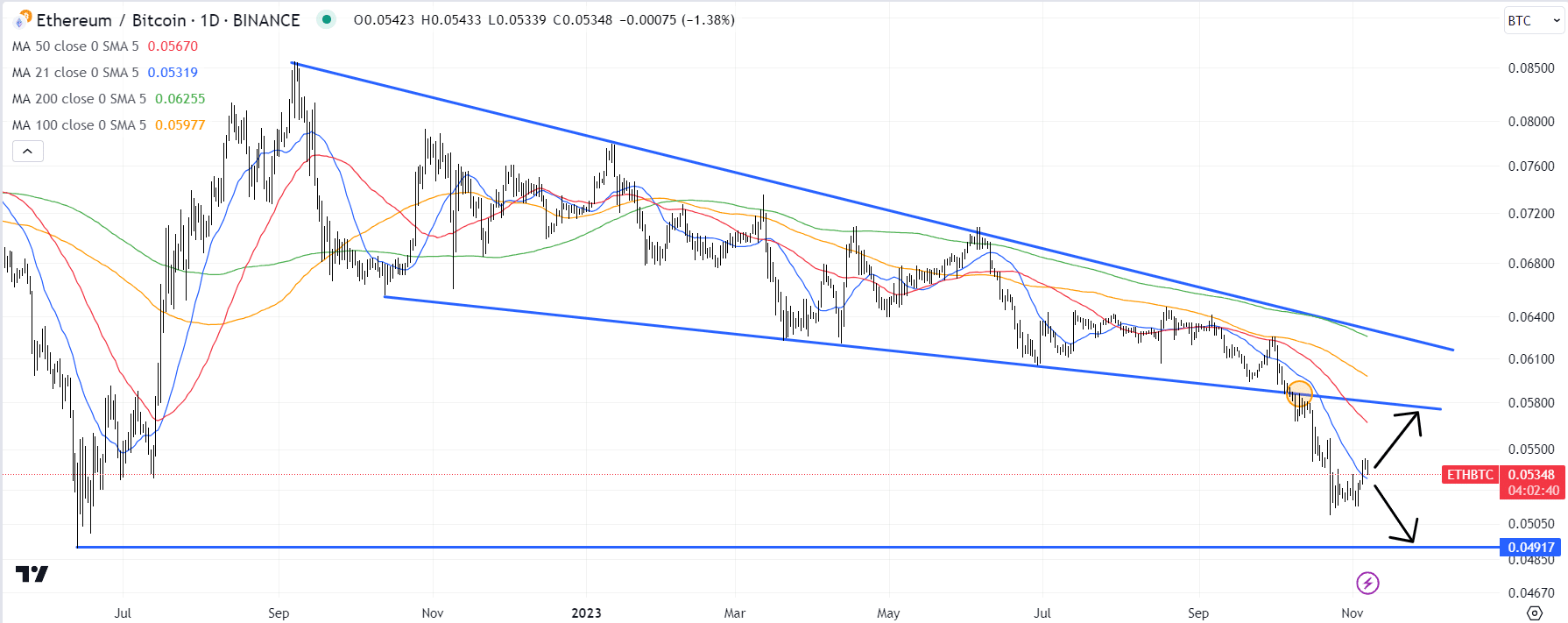

Bitcoin has increased its market dominance over Ether in the last few weeks amid optimism about potential near-term approvals of spot Bitcoin Exchange Traded Funds (ETFs) on the US, which are anticipated to attract substantial capital inflows from the traditional finance industry.

After trending lower for most of 2023, with Bitcoin also benefiting from safe-haven demand given its status as crypto’s oldest, most trusted and (arguably) most decentralized cryptocurrency, the ETH/BTC exchange rate fell rapidly in October to hit its lowest levels since June 2022.

But this exchange rate recently rallied back to the north of its 21DMA, a sign of a potential turn around.

Thielen argued in his latest note that Ether trading volumes are also catching up to Bitcoin, which potentially “supports the view that altcoins could outperform”.

“While Bitcoin traded as much as 3x the volume of ETH in mid-October, this ratio has also dropped to just 2x”.

If Thielen is right about a possible near-term surge in the ETH price to $3,000, then ETH/BTC could very well rise back towards resistance in 0.058 area in the near future.

But if Bitcoin continues to lead the broader market rally amid optimism about upcoming spot Bitcoin ETFs, and Ethereum network activity once again falls back, then a retest of the 2022 lows under 0.05. remains on the cards.

The post Ether (ETH) Set for 55% Surge After Key Technical Breakout, as Supply Turns Deflationary, Says This Well-Known Analyst appeared first on Cryptonews.