Ethereum Price Prediction as JPMorgan Says ETH Will Outperform BTC in 2024 – Can ETH Reach $100,000?

Publikováno: 14.12.2023

The Ethereum price has surged by 5.5% today, with the coin moving to $2,298 in the context of a market that has gained by the same percentage in the past 24 hours. ETH’s performance today also comes as JPMorgan analysts predict that the altcoin could outperform Bitcoin (BTC) next year, helped along by the incoming […]

The post Ethereum Price Prediction as JPMorgan Says ETH Will Outperform BTC in 2024 – Can ETH Reach $100,000? appeared first on Cryptonews.

The Ethereum price has surged by 5.5% today, with the coin moving to $2,298 in the context of a market that has gained by the same percentage in the past 24 hours.

ETH’s performance today also comes as JPMorgan analysts predict that the altcoin could outperform Bitcoin (BTC) next year, helped along by the incoming EIP-4844 upgrade that will enable Protodanksharding and its scaling upgrades for layer-two networks.

ETH is also up by 13% in the last 30 days, with the altcoin sitting on a 73% rise in the past year.

And with most analysts predicting a fully fledged bull market in 2024, today’s gains may be only the tip of a very large iceberg.

Ethereum Price Prediction as JPMorgan Says ETH Will Outperform BTC in 2024 – Can ETH Reach $100,000?

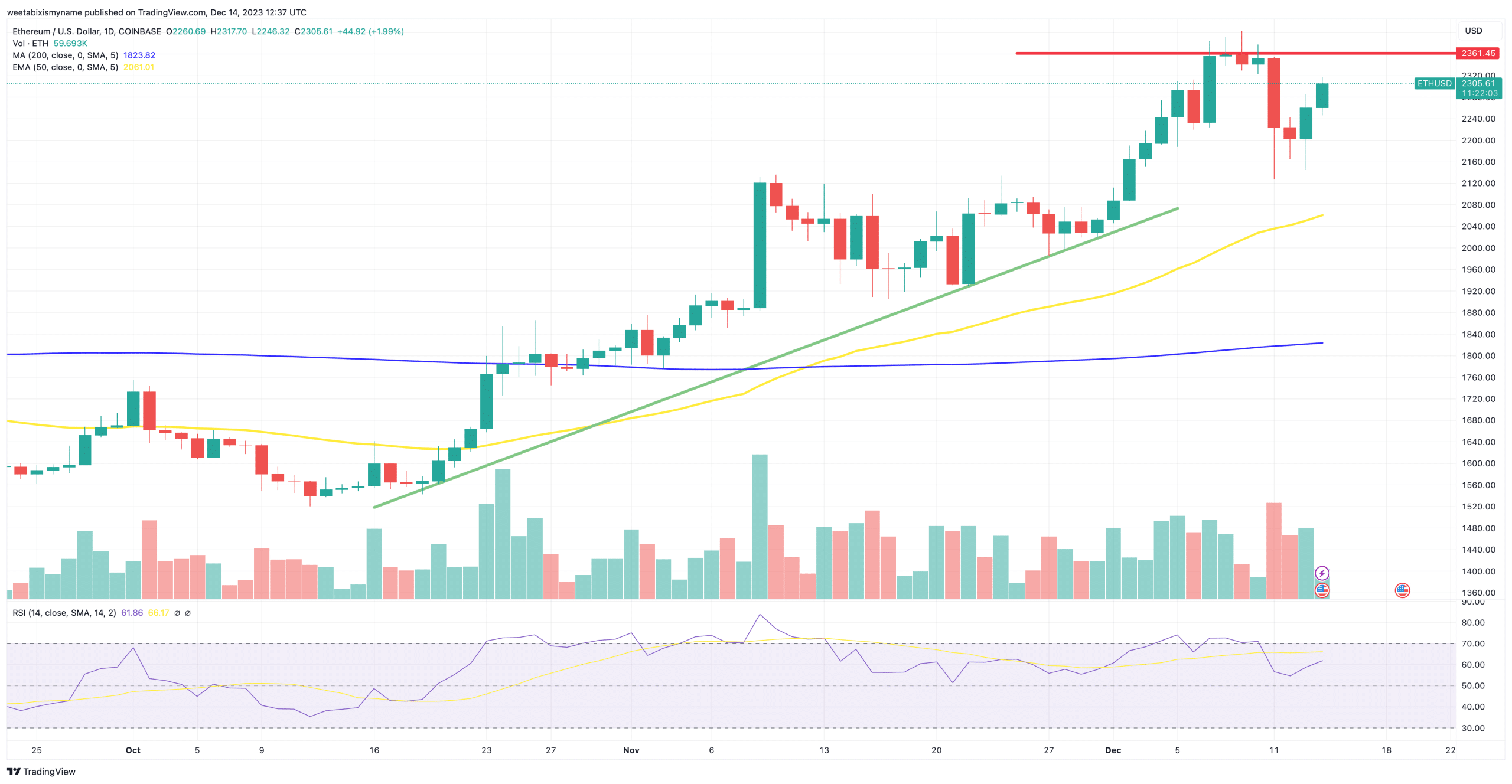

Now looks like a very good time to reenter the ETH market, given that the coin’s indicators point towards incoming gains.

Not only is its 30-day average (yellow) rising well beyond its 200-day (blue), but the coin’s RSI (purple) has just past the 60 level, signalling rising buying pressure.

As such, ETH not only has growing momentum, but also has space for further gains in the coming weeks, before it enters overbought territory.

It’s also worth pointing out that the alt’s support level (green) has risen consistently in the past couple of months, resisting all but the most minor of losses.

This sits well with ETH’s trading volume, which at $19 billion makes it the most heavily traded non-stablecoin cryptocurrency save for Bitcoin (BTC).

And as noted above, some analysts suspect that ETH could post bigger percentage gains in 2024 than even BTC, with JPMorgan’s Nikolaos Panigirtzoglou writing in a note to investors yesterday that the arrival of Protodanksharding could be a big factor in improving the strength of ETH’s fundamentals.

JP Morgan: Ether has the potential to outperform Bitcoin and other cryptocurrencies in 2024 due to the EIP-4844 upgrade "Protodanksharding."

JP Morgan believes the likelihood of a Bitcoin ETF being approved and the halving event has already been factored into Bitcoin's price

— 0xNgaos (@0xNgaos) December 14, 2023

Such fundamentals remain very strong as they already are, with the Ethereum blockchain accounting for more than 50% of the entire sector’s total value locked in.

Ethereum has also enjoyed some bullish adoption news this year, with PayPal launching an Ethereum-based stablecoin and Coinbase launch its own layer-two network for Ethereum.

This means that the arrival of Protodanksharding – which will allow layer-two networks to process multiple transactions in parallel – will only boost the Ethereum price even further.

It could reach $3,000 by the first few months of the year, before topping its current ATH – at $4,878 – during the second half of 2024.

Other Fundamentally Strong Altcoins

Because ETH is such an established coin, many traders may also be inclined to diversify some of their portfolios into smaller cap alts, which may have the potential to outpace the market next year.

Presale tokens have been a good source of such outsized gains this year, with the biggest often creating momentum before they list on exchanges.

And one ongoing presale with good momentum right now is Bitcoin Minetrix (BTCMTX), a stake-to-mine platform that has raised over $5.2 million in its sale.

#Tether freezes 41 wallets linked to OFAC's SDN List, taking precautionary measures.

CEO Paolo Ardoino emphasizes a safer #Stablecoin ecosystem.

How do you think such actions impact the stability and trust in stablecoin technology?#BitcoinMinetrix attains another… pic.twitter.com/EOIjneI5f3

— Bitcoinminetrix (@bitcoinminetrix) December 12, 2023

Making use of the Ethereum blockchain, Bitcoin Minetrix is a stake-to-mine platform in that it will enable users to mine Bitcoin (BTC) by staking its native token, BTCMTX.

Staking provides users with tokenized mining credits, which they can then spend to pay for Bitcoin mining to take place on their behalf.

This can earn them newly mined BTC, while staking will also provide fresh BTCMTX tokens, with the latter having a total max supply of four billion.

Given these two sources of income, Bitcoin Minetrix could therefore end up a highly lucrative platform for investors.

Just as importantly, its streamlined interface and cloud-based system aims to make Bitcoin mining more accessible than ever before.

The fact that it has already raised over $5 million suggests that its native token could have a big listing next year, with investors still able to join the sale by visiting the Bitcoin Minetrix official website.

1 BTCMTX costs $0.0122, although this will rise to $0.0124 in just under three days, meaning interested traders should act sooner rather than later.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Ethereum Price Prediction as JPMorgan Says ETH Will Outperform BTC in 2024 – Can ETH Reach $100,000? appeared first on Cryptonews.