Fear Grips Stock Market Traders While Cryptocurrency Investors Become Greedy

Publikováno: 4.2.2020

The clash of two emotions, fear and greed, is said to determine investors’ sentiment. This ratio draws a historical picture of the market and it’s also an indicator of its future state. As an established trend, traditional investments such as stocks and digital assets like cryptocurrencies often move in opposite directions. The beginning of 2020 […]

The clash of two emotions, fear and greed, is said to determine investors’ sentiment. This ratio draws a historical picture of the market and it’s also an indicator of its future state. As an established trend, traditional investments such as stocks and digital assets like cryptocurrencies often move in opposite directions. The beginning of 2020 […]

The post Fear Grips Stock Market Traders While Cryptocurrency Investors Become Greedy appeared first on Bitcoin News.

The clash of two emotions, fear and greed, is said to determine investors’ sentiment. This ratio draws a historical picture of the market and it’s also an indicator of its future state. As an established trend, traditional investments such as stocks and digital assets like cryptocurrencies often move in opposite directions. The beginning of 2020 has provided another example of that.

Also read: China Stocks Plummet Despite 1.2 Trillion Yuan Injection to Mitigate Effects of Epidemic

S&P 500 Fear and Greed Index Slides Into Fear Territory

Economic crises and financial meltdowns, geopolitical tensions, trade wars, and epidemics, such as the coronavirus outbreak in Asia, affect traditional investments and cryptos, often in different ways. Stocks, for example, tend to fall when investors see risks for the traditional economic and financial systems, while decentralized digital currencies usually gain value in this type of situation.

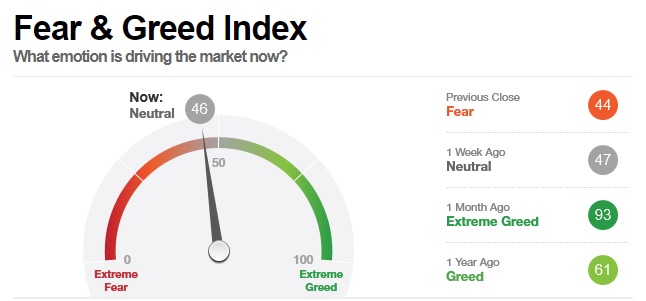

The CNN Fear and Greed Index, which gauges emotions of stock investors, looks at seven indicators such as stock price momentum, or the S&P 500 Index versus its 125-day moving average. The observed diversion from the average of each indicator is compared to their normal diversion and the combined result for all indicators provides the final index reading, from 0 to 100. The higher it is, the greedier investors are at a certain moment in time.

In early January, the index was in “Extreme Greed” territory with readings over 90 in the first days of 2020, up from around 60 points a year ago. Since then, responding to dipping stock prices due to the expanding coronavirus outbreak in China, it moved away from the high levels, dropping to below 70 around two weeks ago. Investors remained relatively bullish but changes in some of the index’s components indicated their fears were growing.

The latest update puts the index in the range between “Neutral” and “Fear.” It’s at 46 at the time of writing, with the previous close at 44. Its current rating reflects the S&P 500 slide from the end of January which came after a new case of the deadly infection was confirmed in the United States.

Chinese stocks also plummeted on market reopen this past Monday, Feb. 3, after the Lunar New Year holidays. The majority of almost 4,000 shares dropped by the daily limit very quickly. The coronavirus death toll in the country has already exceeded 360, with 17,000 confirmed cases so far.

Crypto Fear and Greed Index Scores Monthly High

Monday’s massive sell-off of Chinese shares provoked а reaction from crypto markets too. The prices of major cryptocurrencies such as BTC and BCH briefly jumped right after stock trading resumed in the People’s Republic, following the extended break that lasted more than a week. The sudden spike confirmed a frequently observed phenomenon: traditional stocks and digital asset markets are often negatively correlated.

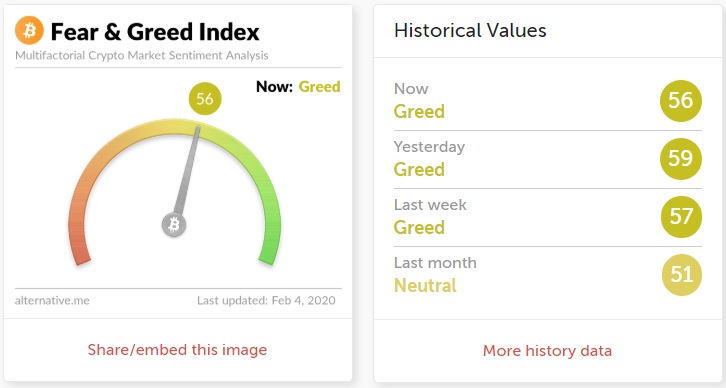

A Crypto Fear and Greed Index developed by Alternative.me, a platform that tracks multiple indicators in the crypto space, helps to better understand the mood of cryptocurrency investors and compare their behavior with that of traditional investors. Alternative.me analyzes emotions and sentiments from different sources on a daily basis and compiles the data to produce its index which is valid for BTC and other large cryptocurrencies, the website details. It tracks volatility (25%), market momentum and volume (25%), social media (15%), surveys (15%), BTC dominance (10%), and Google Trends data (10%). The index’s creators note:

The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO. Also, people often sell their coins in irrational reaction of seeing red numbers.

The Crypto Fear and Greed Index uses the same 0 – 100 scale, where zero means “Extreme Fear” while readings closer to the hundred mark indicate “Extreme Greed.” In the past couple of days, the index has been between 56 and 59, which is in “Greed” territory. A similar reading was registered last week, 57. About a month ago, the index was “Neutral” at 51 points. It has been rising from a recent low of 15 on Dec. 18, 2019 to a monthly high of 59 on Feb. 3, when China’s stock market opened with sliding indicators.

Do you consider fear and greed indices a reliable source of information about stock and crypto markets? Share your thoughts on the subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock, CNN, Alternative.me.

Do you want to keep an eye on moving cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time price updates, and head over to our Blockchain Explorer tool to view all previous BCH and BTC transactions.

The post Fear Grips Stock Market Traders While Cryptocurrency Investors Become Greedy appeared first on Bitcoin News.