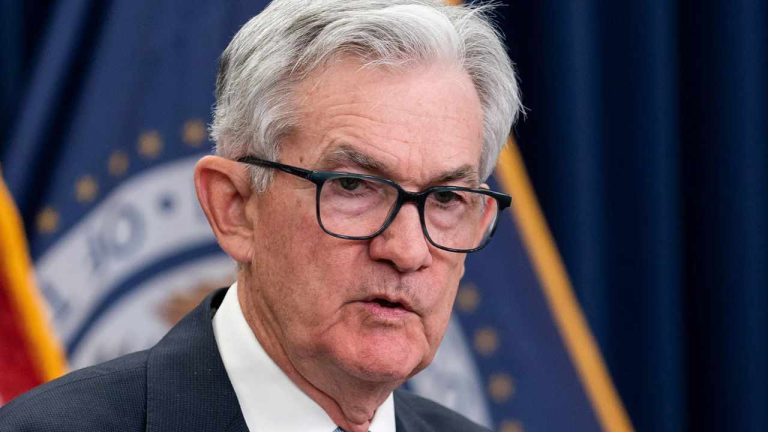

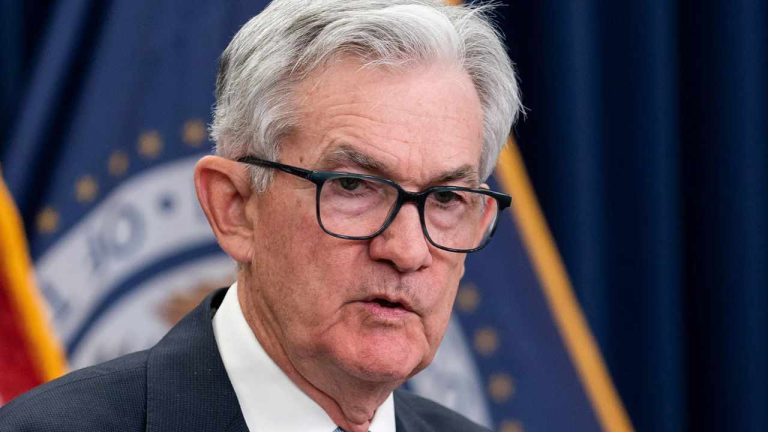

Fed Chair Powell Signals More Rate Hikes This Year as Taming Inflation Has ‘Long Way to Go’

Publikováno: 21.6.2023

Federal Reserve Chairman Jerome Powell has signaled more interest rate hikes this year. “Given how far we’ve come, it may make sense to move rates higher but to do so at a more moderate pace,” the Fed chair told U.S. lawmakers. “Inflation pressures continue to run high, and the process of getting inflation back down […]

Federal Reserve Chairman Jerome Powell has signaled more interest rate hikes this year. “Given how far we’ve come, it may make sense to move rates higher but to do so at a more moderate pace,” the Fed chair told U.S. lawmakers. “Inflation pressures continue to run high, and the process of getting inflation back down […]

Federal Reserve Chairman Jerome Powell has signaled more interest rate hikes this year. “Given how far we’ve come, it may make sense to move rates higher but to do so at a more moderate pace,” the Fed chair told U.S. lawmakers. “Inflation pressures continue to run high, and the process of getting inflation back down to 2 percent has a long way to go,” he stressed.

Fed Chair Powell on Future Rate Hikes and Inflation

Federal Reserve Chairman Jerome Powell signaled more interest rate hikes this year in his prepared remarks before the House Financial Services Committee Wednesday. His speech was part of his appearance on Capitol Hill to present the Federal Reserve’s semiannual Monetary Policy Report. During the Federal Open Market Committee (FOMC) meeting last week, Fed officials decided to pause raising interest rates after 10 consecutive rate hikes.

“In light of how far we have come in tightening policy, the uncertain lags with which monetary policy affects the economy, and potential headwinds from credit tightening, the FOMC decided last week to maintain the target range for the federal funds rate at 5 to 5-1/4 percent and to continue the process of significantly reducing our securities holdings,” the Fed chair detailed, elaborating:

Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.

“Given how far we’ve come, it may make sense to move rates higher but to do so at a more moderate pace,” Powell clarified during the question-and-answer session with committee members.

The Fed chair also noted: “The economy is facing headwinds from tighter credit conditions for households and businesses, which are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain.”

Twelve of the 18 Fed policymakers indicated last week that they expect at least two more rate hikes this year while four projected a single rate hike. Only two officials expect the Fed to keep its key rate at its current level through year’s end.

Regarding inflation, Powell stressed that it remains well above the Fed’s goal of 2%. While noting that “Inflation has moderated somewhat since the middle of last year,” he emphasized:

Inflation pressures continue to run high, and the process of getting inflation back down to 2 percent has a long way to go.

When considering the necessary measures to achieve a 2% inflation rate over time, Powell affirmed that the Fed will continue to make its decisions meeting by meeting, taking into account “the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Last week, the Fed chairman rejected the possibility of a rate cut in the near future, stating that while “it will be appropriate to cut rates at a time when inflation is coming down really significantly, we’re talking about a couple of years out.”

What do you think about the statements by Fed Chair Jerome Powell about future rate hikes and inflation? Let us know in the comments section below.