Grayscale Investments Launches Defi Fund — Now Offers 15 Crypto Investment Products

Publikováno: 20.7.2021

Grayscale Investments has launched a decentralized finance (defi) fund. The new defi fund is the crypto asset manager’s 15th investment product and its second diversified product. “The emergence of decentralized finance protocols provide clear examples of technologies that can redefine the future of the financial services industry,” said the Grayscale CEO. Grayscale Debuts Decentralized Finance […]

Grayscale Investments has launched a decentralized finance (defi) fund. The new defi fund is the crypto asset manager’s 15th investment product and its second diversified product. “The emergence of decentralized finance protocols provide clear examples of technologies that can redefine the future of the financial services industry,” said the Grayscale CEO. Grayscale Debuts Decentralized Finance […]

Grayscale Investments has launched a decentralized finance (defi) fund. The new defi fund is the crypto asset manager’s 15th investment product and its second diversified product. “The emergence of decentralized finance protocols provide clear examples of technologies that can redefine the future of the financial services industry,” said the Grayscale CEO.

Grayscale Debuts Decentralized Finance Fund

Grayscale Investments, the world’s largest digital currency asset manager, announced Monday the launch of its newest diversified investment product, the Grayscale Decentralized Finance Fund.

The announcement explains that the Grayscale Defi Fund “provides investors with exposure to a selection of industry-leading defi protocols,” adding:

The Grayscale Defi Fund is Grayscale’s fifteenth investment product, and its second diversified fund offering.

Its other diversified fund, the Grayscale Large Cap Fund, recently became a reporting company with the U.S. Securities and Exchange Commission (SEC). The fund also recently added cryptocurrency cardano (ADA) as its third biggest component.

The newly launched defi fund has a market capitalization-weighted portfolio designed to track the Coindesk Defi Index, also launched Monday. The index’s “methodology includes liquid defi assets on a market cap-weighted basis,” the announcement notes. The fund is now open for daily subscription by eligible individual and institutional accredited investors.

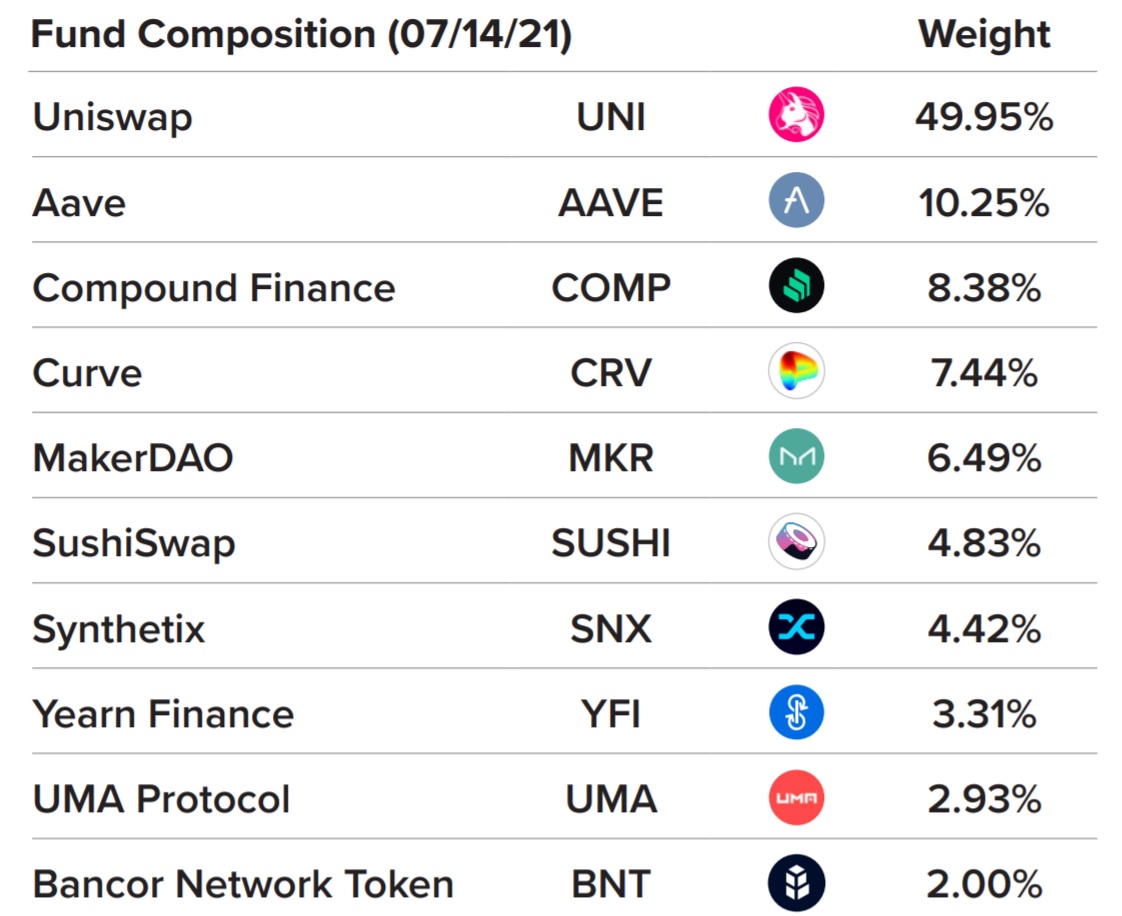

As of July 14, the fund consisted of uniswap (UNI), 49.95%; aave (AAVE), 10.25%; compound (COMP), 8.38%; curve (CRV), 7.44%; makerdao (MKR), 6.49%; sushiswap (SUSHI), 4.83%; synthetix (SNX), 4.42%; yearn finance (YFI), 3.31%; UMA protocol (UMA), 2.93%; and bancor network token (BNT), 2.00%.

Grayscale Investments CEO Michael Sonnenshein commented:

The emergence of decentralized finance protocols provide clear examples of technologies that can redefine the future of the financial services industry.

The company currently has nearly $30 billion in assets under management. It is currently considering 31 crypto assets for investment products.

Besides the new defi fund, Grayscale’s 14 other investment products are the Bitcoin Trust, Basic Attention Token Trust, Bitcoin Cash Trust, Chainlink Trust, Decentraland Trust, Ethereum Trust, Ethereum Classic Trust, Filecoin Trust, Horizen Trust, Litecoin Trust, Livepeer Trust, Stellar Lumens Trust, Zcash Trust, and the Digital Large Cap Fund.

Last week, the asset manager announced that the oldest bank in the U.S., BNY Mellon, will provide its flagship product, the Grayscale Bitcoin Trust (GBTC), with asset servicing and exchange-traded fund (ETF) services.

What do you think about Grayscale launching a defi fund? Let us know in the comments section below.