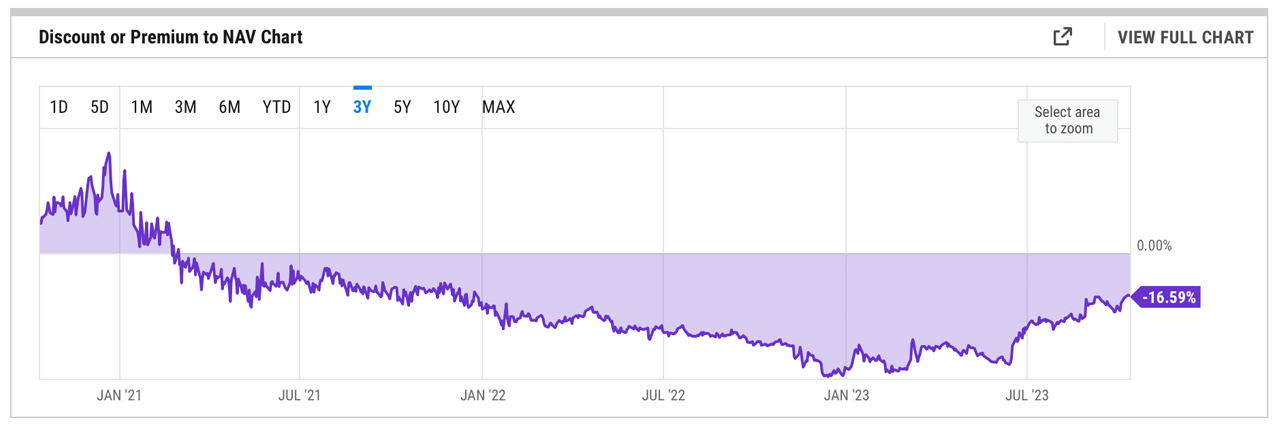

Grayscale’s Bitcoin Trust Discount to NAV Narrows Sharply to a 16.59% Gap

Publikováno: 13.10.2023

Grayscale’s Bitcoin Trust, known as GBTC, has witnessed a significant shift in its market dynamics. In January 2023, GBTC traded at a significant 48.31% discount to its net asset value (NAV). Today, that gap has narrowed to 16.59%, indicating changes in market sentiment and presenting potential implications for investors. End of 2023 Sees GBTC’s Discount […]

Grayscale’s Bitcoin Trust, known as GBTC, has witnessed a significant shift in its market dynamics. In January 2023, GBTC traded at a significant 48.31% discount to its net asset value (NAV). Today, that gap has narrowed to 16.59%, indicating changes in market sentiment and presenting potential implications for investors. End of 2023 Sees GBTC’s Discount […]

Grayscale’s Bitcoin Trust, known as GBTC, has witnessed a significant shift in its market dynamics. In January 2023, GBTC traded at a significant 48.31% discount to its net asset value (NAV). Today, that gap has narrowed to 16.59%, indicating changes in market sentiment and presenting potential implications for investors.

End of 2023 Sees GBTC’s Discount to NAV Tighten

The largest bitcoin (BTC) trust known as GBTC has seen a significant improvement in terms of its previous discount to NAV. Essentially, net asset value (NAV) serves as a financial barometer, indicating the per-share value of a fund’s underlying assets. In the context of GBTC, the NAV represents the value of BTC it holds, adjusted for liabilities, and divided by its outstanding shares. Simply put, it’s a measure of what each GBTC share should theoretically be worth based on bitcoin’s market value.

GBTC’s market price can deviate from its NAV, leading to either a discount or premium status. When GBTC trades at a higher price than its NAV, it’s at a premium. Conversely, if it trades lower than its NAV, it’s at a discount. This percentage difference provides insights into market perceptions and investor sentiment around GBTC. Since the end of February 2021, GBTC has traded at a discount to its NAV. Unlike traditional stocks, GBTC doesn’t offer an easy way to redeem shares for actual bitcoin, and shares are traded over-the-counter (OTC).

This structure can cause its market price to diverge from the underlying BTC value. External factors, such as investor sentiment, market speculation, regulatory news, and liquidity considerations, can further influence this price disparity. A 48.31% discount in January 2023 meant GBTC shares were trading significantly below the value of the bitcoin they represented. Investors could have been acquiring bitcoin exposure via GBTC at a bargain.

Fast forward to the present, and the discount has reduced to 16.59%, suggesting a change in market dynamics and a potential increase in demand for GBTC shares. The shrinking discount implies a potential positive shift in GBTC’s market sentiment. For investors, buying GBTC at a discount might seem like a lucrative deal, as they gain exposure to BTC at a reduced price. However, the future remains uncertain, and there’s no guarantee that the discount will continue to narrow at the same pace or even flip to a premium.

At the moment, Grayscale is fervently working to persuade the U.S. Securities and Exchange Commission (SEC) to transform GBTC into an exchange-traded fund (ETF). With a nudge from the judiciary, Grayscale has carved out a bit of wiggle room in this endeavor, but the outcome is still hanging in the balance. Simultaneously, the SEC is sifting through more than half a dozen spot bitcoin ETF proposals from industry giants such as Fidelity, Blackrock, and Franklin Templeton.

What do you think about GBTC’s discount tightening? Share your thoughts and opinions about this subject in the comments section below.